Here’s how Leonardo’s sectors are doing

All Leonardo's numbers in the main sectors of which the former Finmeccanica group is made up and the company's forecasts for the divisions in the 2024-2028 industrial plan

Defense and Security Electronics in Europe drives Leonardo's orders.

On March 12, the board of directors of the Italian aerospace and defense giant, meeting under the presidency of Stefano Pontecorvo, examined and unanimously approved the 2023 results. On the same day, CEO Roberto Cingolani presented the group's 2024 industrial plan -28 focused on cybersecurity and space .

Leonardo closed the 2023 financial statements with a net result of 695 million euros, down 25.4% compared to 2022 "the figure of which reflected the capital gain realized from the disposals of the Global Enterprise Solutions and Advanced Acoustic Concepts businesses of Leonardo Drs" . The ordinary net result is 742 million, up by +6.5%, "mainly reflects the EBIT trend", indicates the company, growing to 1 billion euros from 961 million in 2022 (+12.9 %).

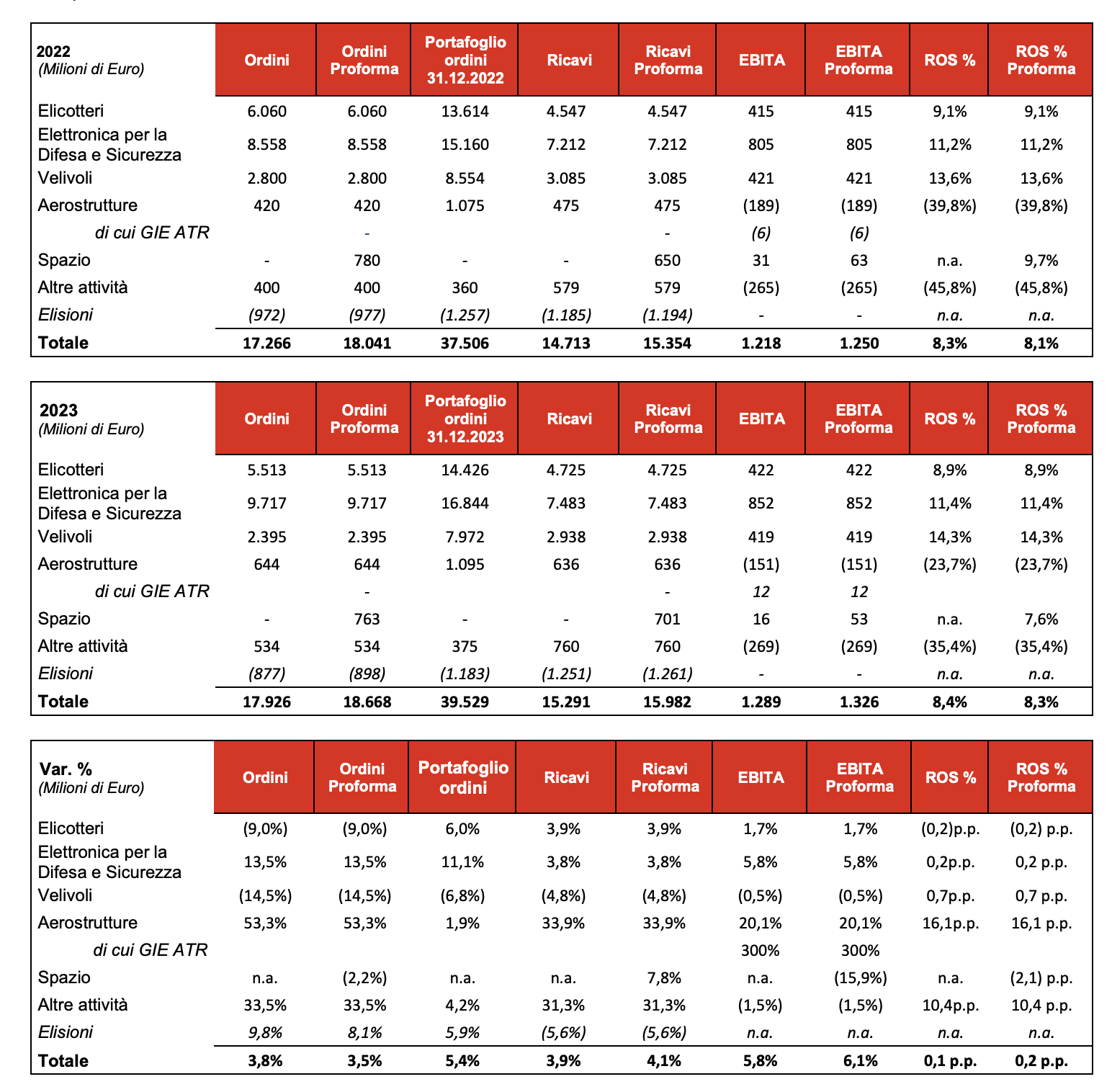

The definitive data confirm the economic indicators already communicated on February 29th : revenues at 15.29 billion, up by 3.9%, thanks also to the significant recovery of Aerostructures (+34%) and the performance of Defense Electronics and Security and Helicopters, the note continues, while the Orders "show continuous and structural growth, reaching close to the threshold of 18 billion with a particularly positive performance in the European component of Defense and Security Electronics".

The 2024 guidance sees revenues at approximately 16.8 billion from the 15.3 of 2023 already communicated in the preliminary results, with an Ebita growing from 1.29 to 1.44 billion.

Below are the details on the performance of the individual sectors as can be seen from the press release .

TREND BY LEONARDO BUSINESS SECTORS

Leonardo confirms its growth path in all core sectors of its business. As indicated previously, this Report provides some Key Performance Indicators which represent the performance of the business with the integral contribution of the Telespazio Group, in view of the next consolidation in 2024.

HELICOPTERS

The 2023 performance confirms the solidity of the business, with a positive performance in line with expectations, reports the note from the Piazza Monte Grappa group. Revenues and Ebita are growing compared to 2022, with a high level of new orders, albeit lower than the previous year. The 2022 Orders were – in fact – influenced by the acquisition of the contract for the supply of n. 32 AW149 helicopters to the Polish Ministry of Defense for 1.4 billion euros. 185 new helicopters were delivered in the period compared to 149 registered in 2022.

Orders stand at 5.5 billion euros and reflect the strong positioning of the AW Family with dual deployment, accompanied by significant contracts signed in the military segment. As regards revenues, these are growing due to increases on the dual use helicopter lines and on CS&T, attenuated by the lower contribution of the NH90 Qatar program. Ebita is also increasing due to higher revenues, with profitability substantially in line.

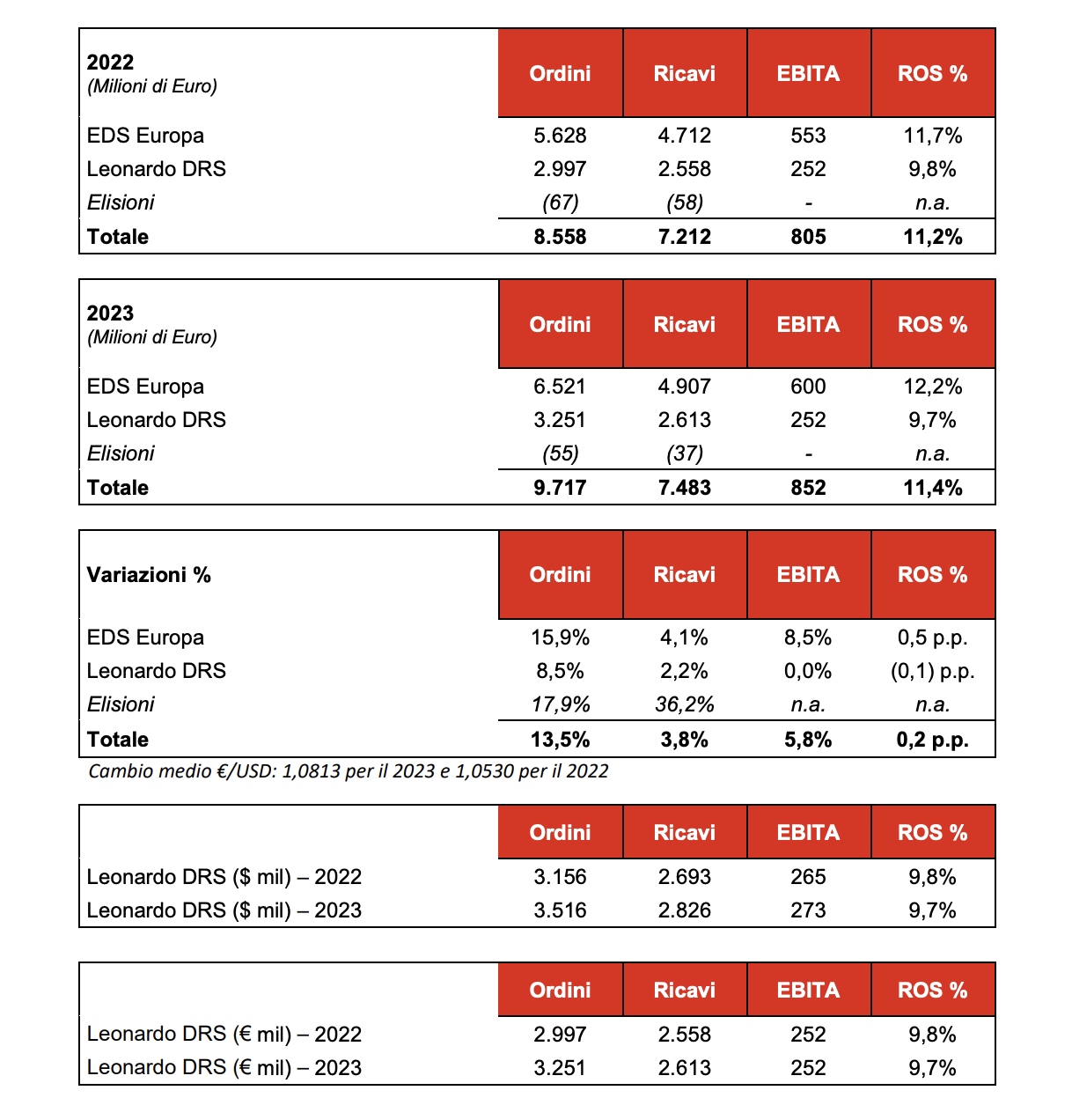

ELECTRONICS FOR DEFENSE AND SECURITY

According to Leonardo, the year just ended recorded a notable commercial performance with a book to bill greater than 1 in all the main business areas, and increasing volumes and profitability with particular reference to the European component. The subsidiary DRS records a level of acquisitions higher than 2022, with growing volumes and profitability, despite the unfavorable trend of the USD/€ exchange rate and the different scope (the 2022 figure benefited from the contribution of the GES business, sold on 1 August 2022)

+

+

Orders recorded a "definite growth in all business areas – of over 13% – despite the aforementioned different reference perimeter of the American component". Revenues also showed “volumes growing by 3.8%, in all the main business areas. The volumes of the subsidiary Leonardo DRS, sterilizing the unfavorable impact of the USD/€ exchange rate, increased by 4.9%”. Ebita is "growing in the main business areas of the European component, with particular reference to the Cyber Security Division and the greater contribution of the JVs. The profitability of the European component remains solid and in line with last year, despite the inflationary pressure. The profitability of Leonardo DRS also recorded growth compared to 2022, neutralizing the impact of the different perimeter and the unfavorable trend of the USD/€ exchange rate". With reference to Mbda, (the European missile consortium 25% owned by Leonardo), the company records improved profitability compared to 2022, confirming its operational and financial solidity.

AIRCRAFT

As regards the aircraft sector, this "confirms a high level of profitability, with a decline from a commercial point of view due to the postponement of some export orders" indicates the company press release. From a production point of view: for the military programs of the Aircraft division, n. 43 wings and n. 14 Final Assy for the program, in line with what was recorded in 2022; 9 deliveries of Typhoon aircraft were made to Kuwait, compared to the n. 4 registered in the same period of 2022, bringing the total number of aircraft delivered to 15 out of a total of 28 aircraft.

Looking at the orders, the sector "records a reduction in volume mainly due to the postponement of some export programs" indicates the note recalling that "in 2022 the first design phase of the Euromale remotely piloted aircraft system and the order for the avionics modernization of the C27J fleet for the Italian Air Force"

Looking instead at revenues, they stand at "volumes slightly lower than 2022, which had benefited from the production ramp-up of Kuwait's aircraft". However, the high levels of revenues for the Eurofighter, F-35 and proprietary platforms programs are confirmed. As regards EBITA, "the profitability of the Sector – despite the decline in volumes – is in line with 2022, confirming the double digit in terms of ROS" indicates the note.

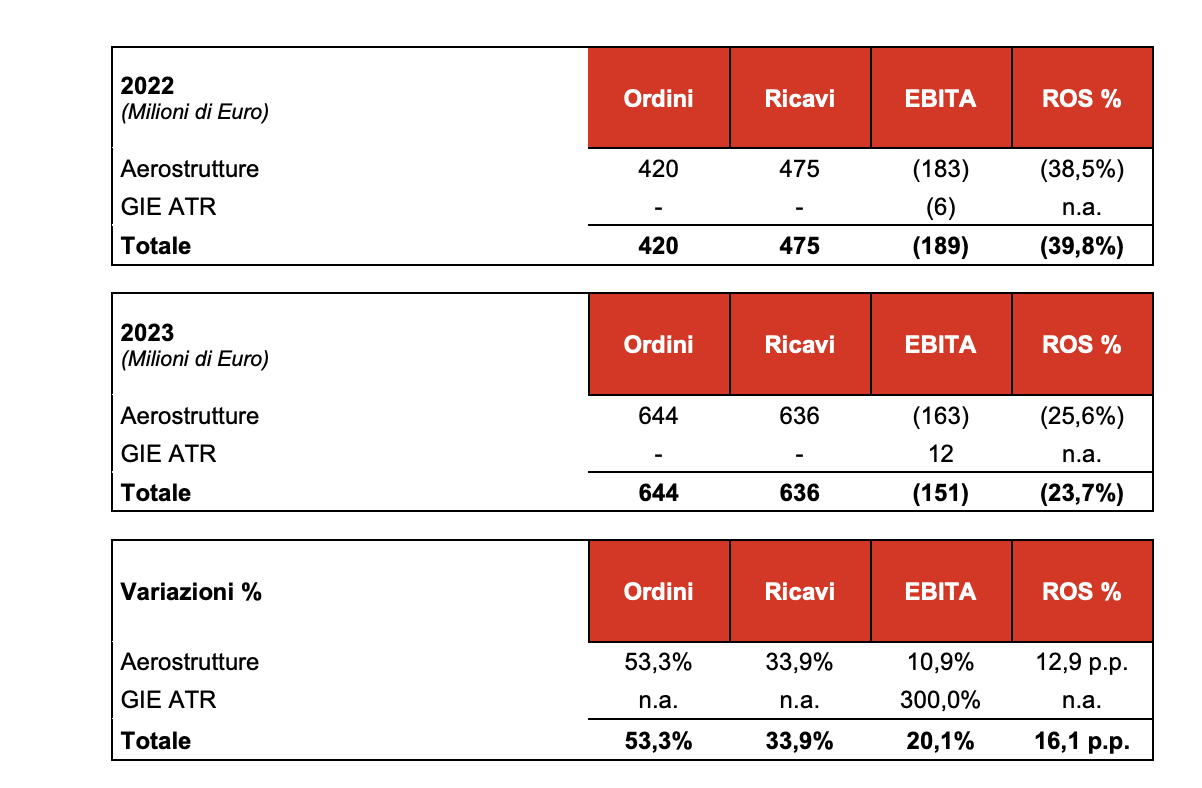

AEROSTRUCTURES

Moving on to the aerostructures division, the increase in deliveries following the greater demand from OEMs, associated with the progressive improvement in the saturation of the production sites (with particular reference to that of Grottaglie), confirms the continuous improvement in the performance of the Division supported by the recovery, also if not at pre-Covid levels, then the GIE ATR program.

From an industrial point of view: the company announces that it has delivered 39 fuselage sections and 32 stabilizers for the Boeing 787 program (22 fuselages and 13 stabilizers delivered in 2022) and 31 fuselage deliveries for the ATR program (24 in 2022 ); for the GIE ATR there were 36 deliveries compared to the 25 recorded in 2022, confirming the recovery trend in volume growth.

As regards orders, “there was a significant increase in commercial performance. In particular, orders were registered for the Boeing 787 and ATR series after the effect of the crisis due to the pandemic and new programs (Vertical and Boom)” indicates Leonardo's note.

For revenues, "2023 confirms the growth in volumes due to the increase in activities due to greater preparations on all lines". Profitability also significantly improved, thanks mainly to the increase in the saturation of industrial assets (in particular Grottaglie) and the workforce, with a consequent recovery of profitability. The GIE ATR also highlights a significant increase in the number of deliveries, improving all the performances recorded in 2022".

SPACE

After that, space. According to Leonardo, the sector "presents a decreasing result compared to the last financial year, attributable to the manufacturing segment which records significant costs linked to developments in the commercial telecommunications business. The satellite services segment records a growing operating result, confirming the positive trend underway, characterized by the solid performance of the production volumes of the Lob Satellite Systems and Operations, the better performance of the Lob GeoInformation, and the significant recovery in orders in the Satcom business . The growth in operating profit offsets the impact on net profit of the costs associated with the signing of the early retirement agreement pursuant to art. 4 of the so-called Fornero Law”.

With reference to the sector, the company recalls "that starting from 2024 the Leonardo Group will fully consolidate the contribution of the Telespazio Group, following the contractual changes that have changed its shareholding nature from a company subject to joint control to a subsidiary company".

THE FORECASTS OF LEONARDO'S 2024-2028 INDUSTRIAL PLAN FOR THE SECTORS

Finally, in the industrial plan presented by CEO Cingolani on 12 March, the group indicates that "for the Divisions, Leonardo's objective is to strengthen the core business and pave the way for the broader challenge in terms of safety".

Therefore, for Electronics the target is "to become a global player in the Defense Electronics sector through greater competitiveness, investments in technology, product rationalization by focusing on the basic offer and also leveraging international partnerships. Over the period of the Plan, the Electronics Division expects growth in orders, revenues and EBITA of 3%, 8% and 13% respectively”.

As regards the helicopter sector, the company aims to "strengthen its positioning as a global player in the civil segment and become a key player in the military, increasing the transformation of orders into revenues and enhancing product development to achieve a leading position in technology tilt-rotor, considered as the most viable and mature by the main military institutions. Over the period of the Plan, the Helicopter Division expects growth in orders, revenues and EBITA of 2%, 6% and 8% respectively”.

Moving on to aircraft, Leonardo intends to “ensure a leading role in the main international cooperation programmes, sustain high profitability and increase competitiveness through updating the product portfolio. Over the period of the Plan, the Aircraft Division expects growth in orders, revenues and EBITA of 11%, 7% and 4% respectively”.

On aerostructures, the group aims to “increase the profitability of supply, taking advantage of both operational excellence and market recovery, and increase the size of the business through strategic partnerships. Over the period of the Plan, the Aerostructures Division expects growth in orders and revenues of 16% and 17% respectively, with breakeven by the end of 2025”.

FOCUS ON THE GROWTH OF THE CYBER AND SPACE DIVISIONS

Afterwards, Cingolani confirmed that two of the pillars of the plan are cybersecurity and space. As regards the first, Leonardo intends to "exploit the opportunities for accelerating demand to increase size through organic and inorganic growth, acquiring distinctive skills with the aim of becoming a key European player. Over the period of the Plan, the Cyber Division expects growth in orders, revenues and EBITA of 16%, 13% and 33% respectively.” For the second, the company will proceed to "consolidate activities in a new Division and leverage existing capabilities to become a European leader in high value-added segments, following a path of organic growth to be integrated with inorganic levers. Over the period of the Plan, the Space Division expects growth in orders, revenues and EBITA of 10%, 11% and 16% respectively”.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-come-vanno-settori-di-leonardo/ on Mon, 18 Mar 2024 06:53:35 +0000.