Here’s how much the digital euro will cost Intesa Sanpaolo, Unicredit and beyond

What will be the effects of the introduction of the digital euro for the major banks, not only in Italy? Numbers and scenarios from a Mediobanca report

Between 5 and 20% of profits. The impact of the digital euro on European banks should be included in this range, according to a study by Mediobanca which intervenes at a time when the ECB is about to close the study phase of the new currency. Following this, the Eurotower will begin the implementation phase for the next three years while the European Commission has already prepared a new legal framework to support the digital currency.

The introduction of this new currency, according to Piazzetta Cuccia, will be one of the two asteroids – together with digital transformation – that could enter on a collision course with the banking world, which is currently "losing the opportunity to collaborate in leading the process". “Investors and banks seem to be lagging behind on the digital euro (no three-year business plan foresees this) – we read in the Mediobanca report -, which has pushed us to write this report as yet another wake-up call”. Phrases that leave no doubts of interpretation.

I STUDY

Mediobanca experts underline that they made an estimate "to provide an indication of size, raise awareness and stimulate debate on digital euro models". Estimates, they highlight, which "precede any countermeasures by credit institutions". In particular, they took into consideration the effects on three items of the income statement (the interest margin, commissions and operating costs) for each of which three scenarios were considered: mild (minimum level in the adoption of digital currency, with few infrastructure and low recurring costs); adverse (high adoption and structure to support the digital euro; moderate (middle ground between the two previous ones). At risk there would be from a minimum of 5% to a maximum of 20% of the profits of European banks rising to 10% of the moderate scenario.

In general, in all three scenarios the impact on commissions for bank transfers is constant while the weight linked to the other accounting items increases, moving from the less complicated hypothesis to the more difficult one.

THE IMPACT OF THE DIGITAL EURO ON INTEREST MARGIN

Analyzing the impact with respect to the interest margin, the question of the potential outflow of bank deposits arises. Starting from the indications of the ECB, according to which the banked population is equal to approximately 302 million people, and assuming that they use the maximum allowed in digital format, i.e. 3,000 euros, we arrive at a decline in retail deposits of approximately 10%. To deal with this problem, according to analysts at Piazzetta Cuccia, banks could take three different paths (use excess liquidity, issue new bonds, cut loans). Depending on the scenario chosen, in the first case there would be a drop of between 1.4% and 6%, in the second case between 2% and 9%; finally, in the third case the decline in the interest margin would be between 1.4% and 6%.

THE IMPACT ON COMMISSIONS

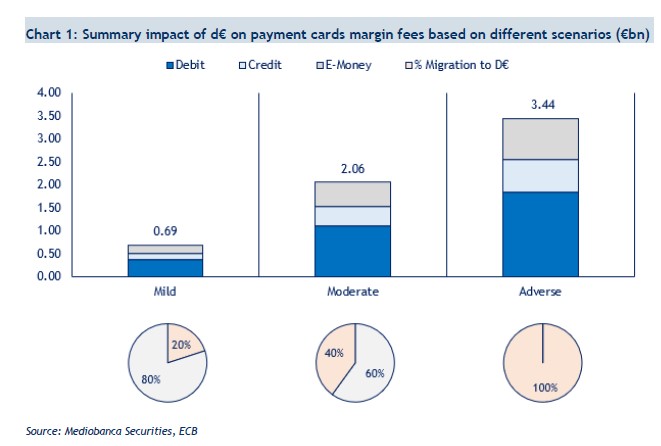

“Significant variability” in the impact of the digital euro on card payment transactions. They range from 0.7 billion euros to 3.4 billion euros. “It is important to underline – we read in the report – that this result depends on the transition from the traditional system to the platform for the digital euro. To ensure rapid and effective adoption by a broad customer base, the platform should introduce new and enticing features.” Mediobanca hypothesizes that, as banks develop “front-end functionality” and engage “in cross-selling products”, this could, on the one hand, lead to greater adoption and loyalty, but on the other, partially offset the losses arising from the sale of additional value-added services.

THE IMPACT ON THE COSTS OF INTESA SANPAOLO, UNICREDIT AND MORE

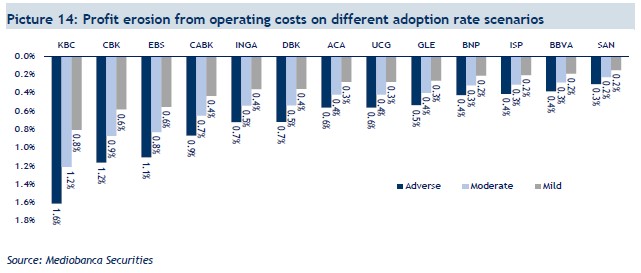

On the cost front, the Piazzetta Cuccia experts highlight that the ECB should pay for the development of the digital euro platform but – similarly to the interest margin and commissions – there could be a negative impact on the income statement for credit institutions . “Everything is still largely undefined, which makes it difficult to estimate,” they say, but they currently assume a profit erosion of up to 1.5% due to rising costs. The report specifies that the main variable depends on the number of countries in the euro area in which each bank operates. Therefore, if it is active in multiple countries, it will have to bear higher costs than an institution that operates in only one. The mild scenario considers around 20 million euros in annual costs for the largest countries and around 5 million euros for each additional country in which the bank operates. Under this scenario, many existing payment procedures can be seamlessly integrated with the digital euro. For the moderate and adverse scenarios, multipliers must instead be applied to estimate the potential increase in costs.

Overall, a modest erosion of profits of between 0.2% and 1.5% is assumed for the three scenarios. Unicredit would lose 0.6 percent in an adverse scenario, 0.4 percent in a moderate scenario and 0.3 percent in a mild scenario. The erosion of Intesa Sanpaolo's profits, however, would be 0.4 percent in an adverse scenario, 0.3 percent in a moderate scenario and 0.2 percent in a mild scenario.

MEDIOBANCA'S ADVICE

In conclusion, how should banks behave? In the meantime they must think about how to promote the digital euro and new paid products. “Betting on the failure of the project is short-sighted and risky – we read in the report -, given that the EU authorities are strongly motivated to get it off the ground”. Therefore "accepting that the digital euro will be a reality is the first step" together with "a complete analysis of its impact on businesses and the market".

We then need to collaborate to make the digital euro "a successful European system, capable of replacing existing ones and reducing costs, and then we need to introduce new value-added products to compensate for the lost revenue, which would complete the turning point. “The asteroid is coming, thinking about how to manage the impact is better than arguing with destiny” is the comment from Mediobanca which invites payment companies to expand to compensate for the probable compression of margins and competition.

As far as investors are concerned, the advice is to stop ignoring the digital euro and start asking questions.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/effetti-euro-digitale-banche/ on Sun, 12 Nov 2023 06:07:34 +0000.