Here’s how Poste, Brt and Amazon share the parcel market. Agcom report

Revenues from the postal sector rose by 9.6% in the third quarter of 2021. All the details of the Communications Observatory of the Communications Regulatory Authority (Agcom)

The shipping sector in Italy is growing.

Specifically, the dynamics observed in the third quarter of 2021, compared to the corresponding quarter of 2020, see correspondence services up 4.1% and parcel delivery services up 11.6%. This is what emerges from the observatory on Communications released on December 29 by the Communications Authority (Agcom).

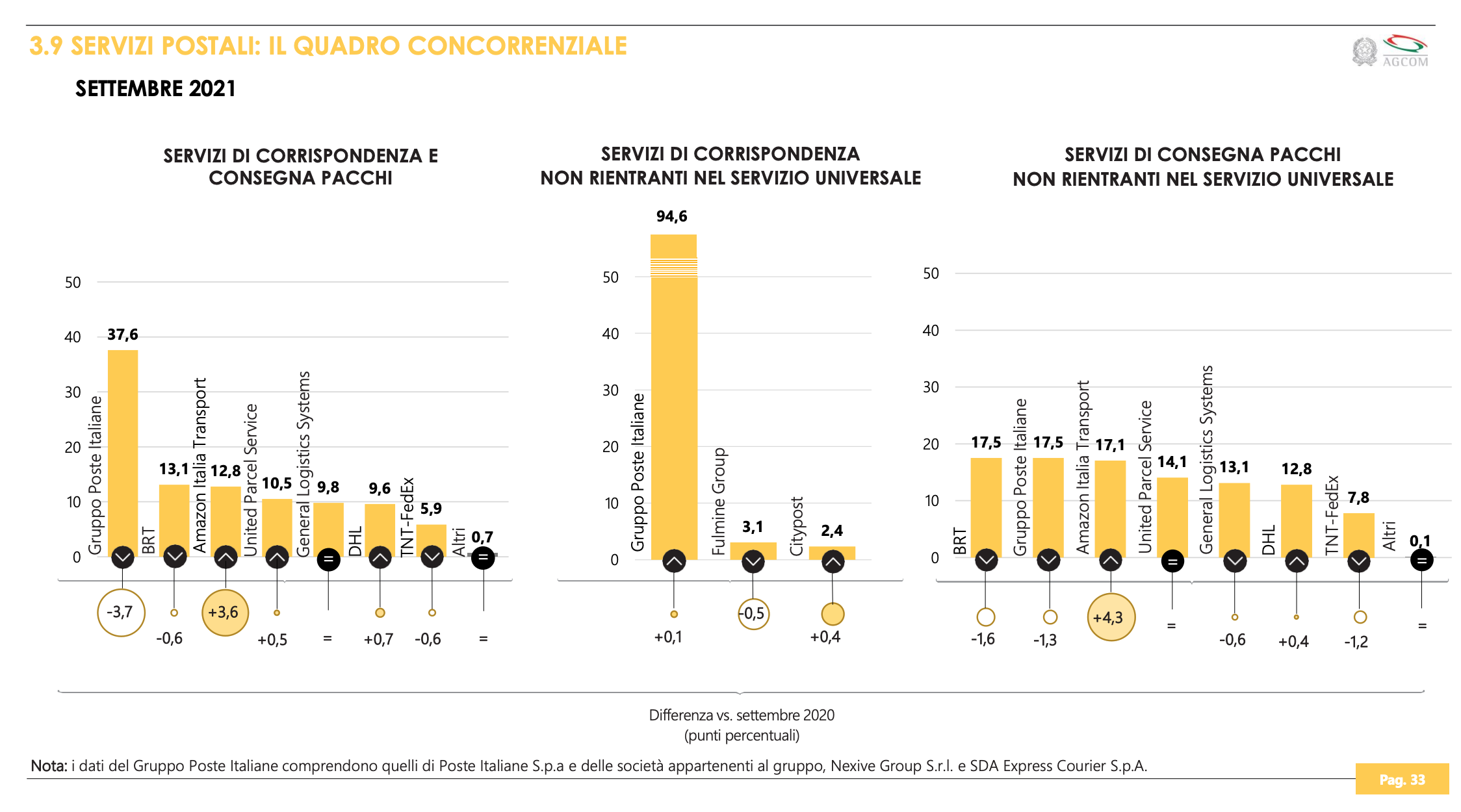

The Agcom observatory highlights how in the postal market as a whole (correspondence and parcel delivery services), the Poste Italiane Group is confirmed as the main operator with a 37.6% overall share (albeit down by 3.7 percentage points on an annual basis), followed by Brt (13.1%) and Amazon (12.8%), up 3.6 percentage points compared to September 2020.

All the details.

JUMP IN REVENUES IN THE SHIPPING SECTOR

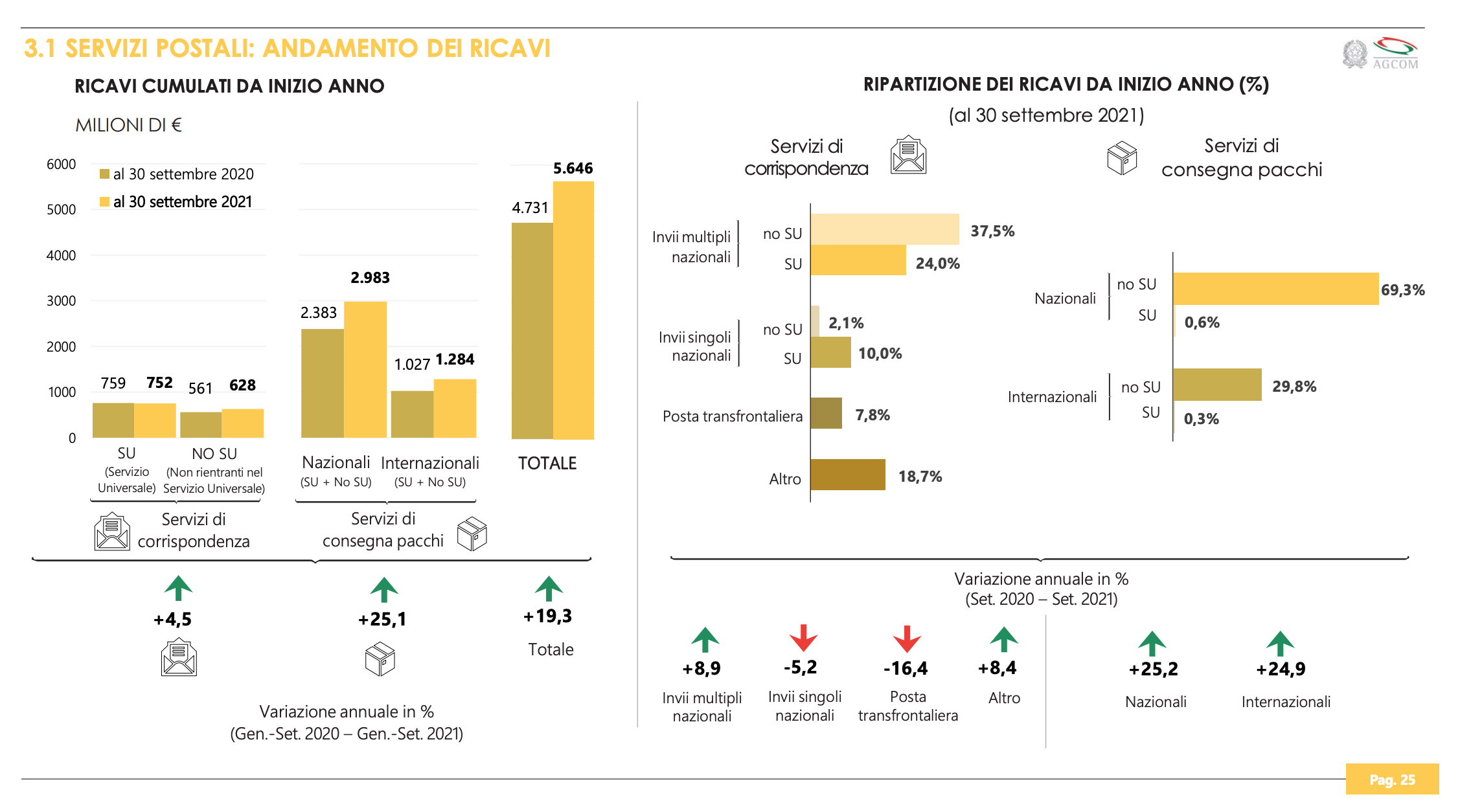

With reference to the first nine months of the year, the overall revenues recorded in the shipping sector grew on average, compared to the corresponding period of 2020, by 19.3% with significantly different results for the various market segments.

IN PARTICULAR, THE PARCEL DELIVERY SERVICES ARE INCREASING AGCOM SIGNALS

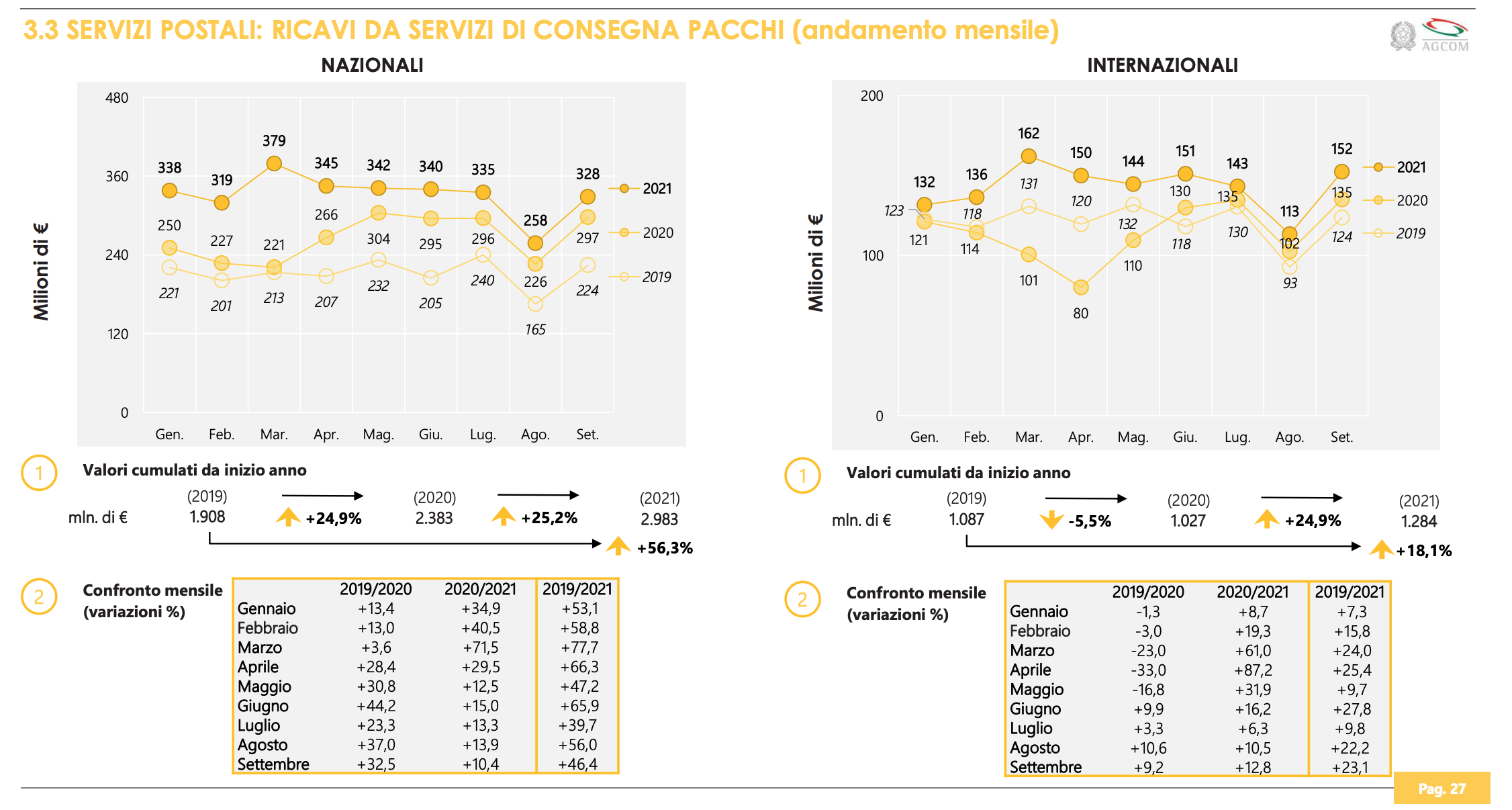

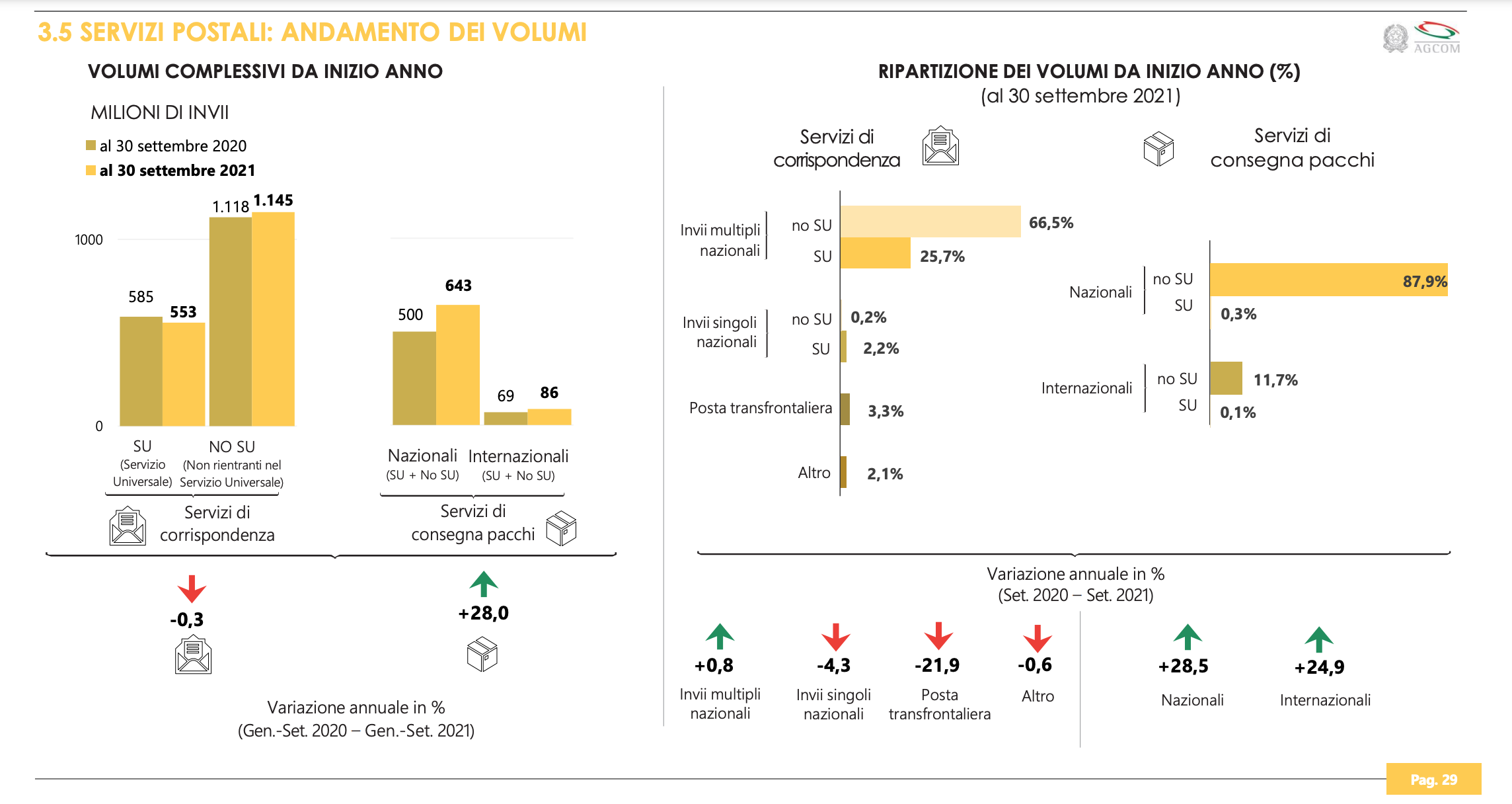

Specifically, the Observatory points out, revenues from parcel delivery services recorded an average growth of 25.1% (with equivalent results with distinct reference to national and international deliveries). If the corresponding period in 2019 (i.e. before the pandemic) is used as a comparison, the growth in revenues from domestic parcel services exceeds 56%. The corresponding dynamics on the volume side see an average growth of 28%, with 728 million packages delivered overall since the beginning of the year, of which 88% with national sender and recipient.

DUE TO THE USE OF ONLINE PURCHASES

Furthermore, Agcom would like to highlight how, compared to 2019, the delivery volumes of national parcels recorded an increase of 76.5%, testifying to how the use of online purchases is becoming more and more widespread as a normal mode of purchase. of Italians, not necessarily dictated by the restrictions of the health emergency.

MORE CONTENT THE INCREASE IN CORRESPONDENCE

From the beginning of the year, total revenues from correspondence services (i.e. those deriving from universal and non-universal services) show a limited increase (4.5%) compared to 2020.

Within them, however, opposite dynamics are observed: the services included in the Universal Service decreased by 1% compared to last year and by 32.1% compared to the period January-September 2019. At the same time, non-universal services show an annual growth of 11.9% and a decrease of 13.1% compared to 2019 (essentially the increase recorded in the first nine months of 2021 only partially recovered the reduction of 2020 due to the pandemic). Volumes show, on average, a marginal decline (-0.3%), attributable to two opposite trends for universal and non-universal services: the former decreased by 5.5% while the latter grew by 2.4% .

POSTE ITALIANE LEADER IN THE POSTAL SECTOR

The competitive framework of the postal sector, as a whole (correspondence and parcel delivery services), confirms the Poste Italiane Group as the main operator with a 37.6% overall share (albeit down by 3.7 percentage points on an annual basis ), followed by BRT (13.1%) and Amazon (12.8%), up 3.6 percentage points compared to September 2020.

MORE ACCENTUATED COMPETITIVE DYNAMICS IN THE PACKAGE SEGMENT

Looking at the competitive structure of the individual components of the market, the Poste Italiane group obviously dominates the correspondence services sector with over 90% of the market share, reports Agcom.

Unlike the parcel segment, the latter is in fact characterized by a more pronounced competitive dynamic: BRT, Poste Italiane and Amazon hold equivalent shares (around 17%), representing just over half of the market, and are followed by UPS. , GLS and DHL each with a share of around 13-14%.

Finally, Agcom underlines that on an annual basis, the average unit revenues of correspondence services show a growth of 1.2%, mainly determined by services not included in the Universal Service (+ 5.9%), those relating to services delivery of domestic parcels were substantially stable (+ 0.1%), while those relating to international deliveries fell by 2.2%.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/ecco-come-poste-italiane-brt-e-amazon-si-spartiscono-il-mercato-dei-pacchi-report-agcom/ on Sun, 09 Jan 2022 15:22:17 +0000.