Here’s how the 737 Max makes Boeing fall again on the stock market

Shares of Boeing and its suppliers plummet after the temporary grounding and immediate inspection of dozens of 737 Max jets decided by the FAA, the US airline regulator, following the Alaska Airlines mid-flight crash

Turbulent start to the year for Boeing.

The shares of the American aerospace giant collapsed on the stock market on Monday after the Federal Aviation Administration (FAA) of the United States ordered the temporary grounding and immediate inspection of dozens of Boeing 737 Max jets. The measure is the consequence of the accident that an Alaska Airlines 737 Max 9 aircraft was involved on Friday 5 January .

Investors are weighing the financial fallout from Friday's in-flight crash that brings to light long-standing problems with Boeing's 737 Max.

As the Financial Times recalls, January 5 is just the latest blow for Boeing, which has struggled with manufacturing defects on the 737, and has continued to bear the consequences of a 20-month global ban imposed by regulators after a pair of fatal crashes five months apart in 2018 and 2019, in which a total of 346 people died. Airlines had resumed using planes of the same model only after they had undergone various modifications by Boeing.

All the details.

BOEING STOCKS PRECIPITATE

Boeing stock futures are down 8.4% at $228.02 on Wall Street, where Boeing has its main listing, while Alaska Airlines is down more than 5% in the premarket. The airline's shares recorded a drop of 7.48% to 208.5 euros also in Frankfurt. The stock of Spirit Aerosystems, the company that produces the jet's fuselage, lost 16% in the premarket.

Meanwhile, the stock of Airbus, the other giant in the aeronautical sector, is recording an increase of 1.60% in Frankfurt at 141.09 euros and is heading towards a gain of 1.76% at 142.20 euros in the premarket American, reports Radiocor .

If losses continue, the company would lose more than $12.5 billion in value, nearly the cost of developing a new plane, Reuters estimates.

THE ALASKA AIRLINES BOEING 737 MAX CRASH

On Friday evening, a piece of the fuselage of the plane, headed for California, broke off during takeoff from Portland, Oregon, forcing the pilots to turn back and make an emergency landing. There were no casualties neither among the 171 passengers on the flight nor among the 6 crew members. However, the event caused inconvenience to hundreds of passengers, who saw their departures postponed or cancelled.

US investigators announced Sunday that they had located the blown-out door of the Boeing 737 Max during the flight. The company has already grounded its entire Boeing 737-9 fleet, comprising 65 planes.

THE FAA'S DECISION

On Saturday the FAA, the American body that oversees civil flight, announced the decision to temporarily ground 171 Boeing 737 Max 9 aircraft in service with US airlines or on US territory. FAA administrator Mike Whitaker explained that the planes will have to be inspected before returning to the air. An emergency directive (Ead, Emergency Airworthiness Directive) will be issued shortly in this regard. An investigation into the incident was opened by the National Transport Safety Board (NTSB).

ANALYSTS COMMENT

“The spectacular crash will once again raise the question of Boeing's governance,” say Morningstar analysts, who point out that the manufacturer's reputation will suffer, Radiocor reports. Jefferies explains that the necessary inspections should be short, on the order of 4-8 hours per aircraft, which would allow grounded planes to resume flights within a few days and limit regulatory costs, Radiocor further notes. In a note, the broker estimates costs related to inspections at $1.7 million (1.55 million euros) and Boeing's payments to carriers at $18 million if the planes remain grounded for a week. For experts at Td Cowen, the impact of flight cancellations by US airlines should be limited, because there are fewer travelers in January.

If losses hold, the company would lose more than $12.5 billion in value, nearly the cost of developing a new plane.

BOEING'S COUNTERMOVE

Meanwhile, Boeing has called a company-wide safety meeting for Tuesday to discuss its response to the accident.

CEO David Calhoun, who will host the meeting from the factory in Renton, Washington, where the Max is assembled, said the meeting will strengthen the company's focus on safety.

“Safety is our top priority,” the aerospace group said on Jan. 6. “We agree with and fully support the FAA's decision to require immediate inspections of 737-9 aircraft with the same configuration as the affected aircraft.”

THE 737 MAXS IN THE WORLD

There are approximately 1,300 737 Max worldwide, taking into account all versions.

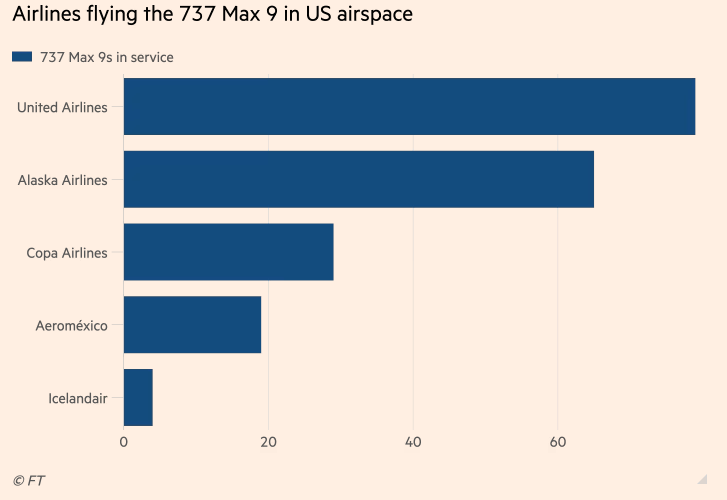

There are 215 Max 9 aircraft in service globally, according to data from the aeronautical consultancy Cirium, notes the Ft . The largest operators are United Airlines and Alaska Airlines in the United States, Turkish Airlines and Copa Airlines of Panama. Copa said it had temporarily suspended flights of 21 Boeing 737 Max 9 planes. Turkey said it had withdrawn its small fleet of five Max 9 planes.

EASA'S POSITION

EASA, the European Union Agency for Aviation Safety, has announced that currently no airline in the member countries of the European Union uses Max 9s with the same set-up as the Alaska Airlines flight.

WHAT HAPPENS TO THE TITLE OF THE AMERICAN AEROSPACE GIANT

Since the 737 MAX was grounded in March 2019, Boeing shares have fallen more than 40% while Airbus shares have risen 25%, Reuters recalls.

Finally, the turbulence of recent years is also reflected in the price of Boeing shares. The company's stock remains far from the record of $446 in March 2019. In terms of market value, however, Boeing is still ahead of Airbus. The American aerospace giant has a market capitalization estimated at around 127 billion euros, compared to around 112 billion for the European giant Airbus.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-come-il-737-max-fa-crollare-di-nuovo-boeing-in-borsa/ on Mon, 08 Jan 2024 15:28:40 +0000.