Here’s how the taxman presses real estate. Report

What emerges from the "Report on real estate wealth and its role for the Italian economy" edited by the economist Gualtiero Tamburini and presented by Confedilizia. On the land registry "this is not the time to intervene, the priority is another: to reduce the Imu", according to the president Spaziani Testa

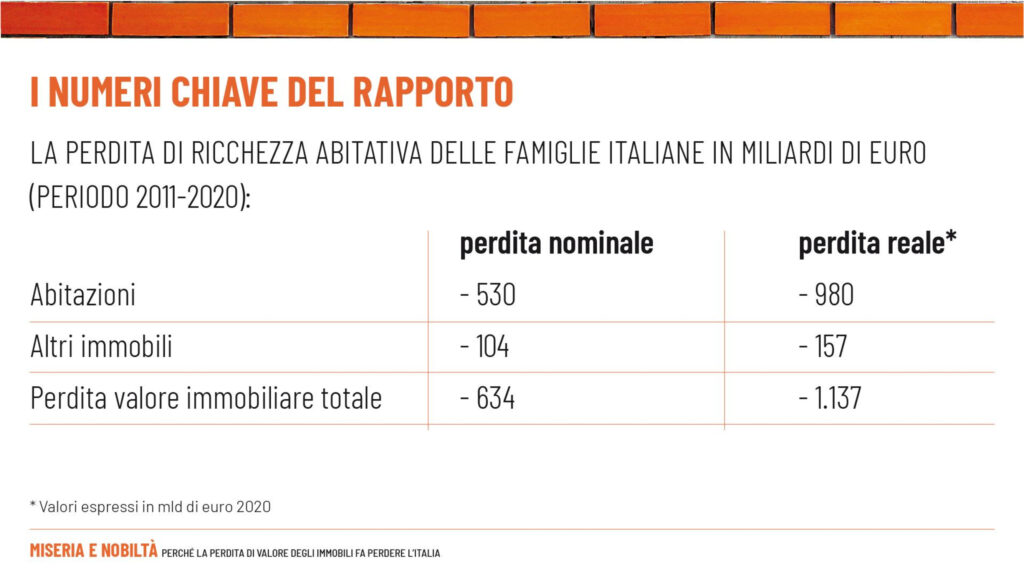

In the period between 2011 and 2020 in Italy, the nominal loss of the total real estate value is estimated at 634 billion euros, while the real loss instead amounts to 1,137 billion euros.

This is what emerges from the report “Real estate wealth and its role for the Italian economy”, presented by Confedilizia and Aspesi.

More specifically, for homes there is a nominal loss of 530 billion and a real loss of 980 billion. For other properties, the nominal loss is 104 billion, the real one 157 billion.

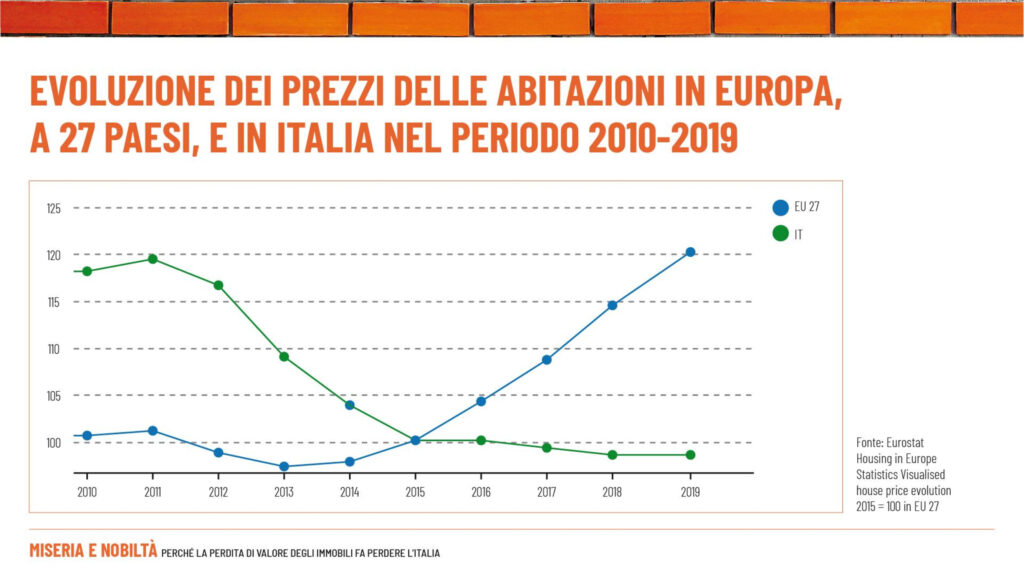

Comparing the evolution of house prices in Italy and in the EU, in the period 2010-2019, there is a decline in our country starting from 2011, on the contrary in Europe the price curve tends to rise starting from 2013.

In Italy, underlines the study by the economist Gualtiero Tamburini, real estate services and construction are worth about 30% of GDP, for a total of 7.3 million employees: 3.6 million in real estate services and 3.7 million in construction.

“The 6.1% growth of Italian GDP in 2021 – it says – is largely due to the real estate and construction sectors, which together with businesses and industrial production were the driving branches. Cresme estimates that almost half of the growth is attributable to the sector ".

Here are some of the salient details of the study:

Faced with a total direct production of 424.121 billion euros in 2020, the two Construction-Real estate branches have generated together, on the entire economy, a total direct and indirect impact of 708.936 billion euros of production, to which others can be added. 211.083 billion euro of related activities, for a final production amount of 920 billion euro.

It constitutes – reads the Confedilizia note – 30.2% of the value of all Italian production at basic prices; we can observe a similar percentage of impact of the two branches together with reference to the other measured variables, namely: employment with 29.7%, value added with 30% and GDP with 27.09%. It can be concluded that 30% is the order of magnitude of the size of real estate assets in the country's economy.

The data, however, which now emerges as more relevant is that this patrimonial and economic wealth – comments the confederation chaired by Giorgio Spaziani Testa – “dropped drastically in the period 2011-2020. A series of factors have contributed to this, mainly ranging from the increase in taxation, to the reduction of investments, to the decrease in property prices ".

The loss, for the housing stock alone, is over 530 billion euros nominal which, in 2020 currency, are equivalent to 980 billion euros, the economist Tamburini calculated in the report presented today: "The figure rises to 1,137 billion euros also considering properties other than homes (but the loss would even double if only the variations in prices were taken as a reference) ".

This negative figure affects both the added value, due to the lower rental income that properties produce, and the lower propensity to consume of families, according to the report. Furthermore, since real estate assets of all kinds constitute the physical infrastructure that hosts the activities of families and businesses, if this is not continuously managed, renewed and maintained, the consequences are then seen in terms of lower productivity and general well-being ( think of the ecological footprint determined by the energy consumption of buildings), is clear from the study by the economist, former president of Assoimmobiliare.

This is how the theme of relaunching real estate investment and in particular that of families arises – historically, three quarters of investments in construction are made by private individuals, the majority of which directly by families. "This can only happen by restoring trust to the same families (often cracked by contrary choices) so that they can be induced to return to investing in real estate the huge liquidity accumulated even during the current phase", remarks Spaziani Testa.

On the land registry, “this is not the time to intervene, the priority is another: to reduce the IMU. on the Imu, but also on the first houses, both in the purchase and sale, with the registration tax, and as regards social benefits, with the Isee which is influenced by the cadastral asset value ", underlined Spaziani Testa during the presentation of the report; "Real estate wealth and its role for the Italian economy". “The reason – he explained – with which the land registry reform is justified, ie to overcome inequalities, is partly unfounded. There are already tools not used by a large majority of the municipalities to correct distortions ”.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/valore-immobili-economia-italia/ on Thu, 18 Nov 2021 14:44:10 +0000.