Here’s what the Fed rate turnaround will look like

Fed: the march of the FOMC towards the turning point in rates will not be stopped by Omicron. The analysis by Giovanna Mossetti, economist of the Intesa Sanpaolo study center

The December FOMC meeting should take note of the increase in inflationary risks and pressures on the labor market, and prepare the ground for a possible anticipation of the rate turnaround. In a phase of persistent excess demand, the arrival of a new supply shock caused by the Omicron variant should help push the Committee into relatively more hawkish positions, to prevent second-round effects on prices and wages.

At its December meeting, the FOMC is expected to accelerate the march towards monetary policy normalization and signal that rising inflation and labor market risks are likely to require an anticipation of the rate turnaround. Even in a context of great uncertainty, we believe that the arrival of a new negative shock to the offer linked to the Omicron variant is read by the Committee as a further reason to raise the guard of monetary policy in the face of the risk of spread of second-party effects. joke about prices and wages.

The FOMC should note that inflation, which has been well above target for several months now, is expected to remain high for longer than expected, as the causes of the hike, albeit transitory, will persist into 2022 as well. , unused resources are shrinking amid significant excess demand and rising wages at a "rapid" pace. For now, reading the risks associated with the Omicron variant reinforces the Committee's concerns about the effects of supply shortages on prices and wages. As Powell said, "greater concerns about the virus could reduce people's willingness to work face-to-face, slowing progress on the labor market and intensifying blockages on supply chains."

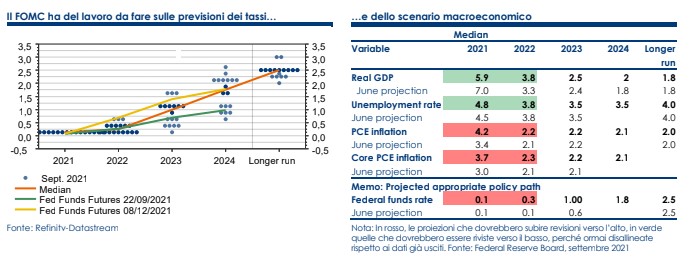

The forecast, although subject to uncertainty, is that the Committee will proceed with the announcement of an acceleration of the pace of tapering in December and January and signal the probable anticipation of the turn in rates through an upward shift in the point chart, with the median in line with 2 hikes in 2022. In the press conference, Powell should in any case indicate that the Fed will closely monitor the evolution of data and pandemic risks, indicating that the conditions for the turnaround in rates are not yet met and the he main objective at the moment is to be ready to react in the face of the evolution of data and the possible materialization of overheating risks. Our forecast is for 2 hikes in 2022, 3 hikes in 2023 and a rate arrival point between 1.75% and 2% in 2024. Risks are solidly oriented upwards.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/fomc-fed-tassi/ on Tue, 14 Dec 2021 06:15:56 +0000.