How and why gold gushes

All challenges won by gold. Analysis by Simone Di Biase, Head of Relationship Management at BG SAXO

Gold continues to defy the gravitational pull of rising US Treasury yields and a stronger dollar which has gained further momentum after the US Federal Reserve paused its rate hike campaign, while at the same time time forecast considerably higher rates in 2024 and 2025 due to a resilient U.S. economy, a strong job market and sticky inflation, recently exacerbated by an OPEC-backed rise in energy prices.

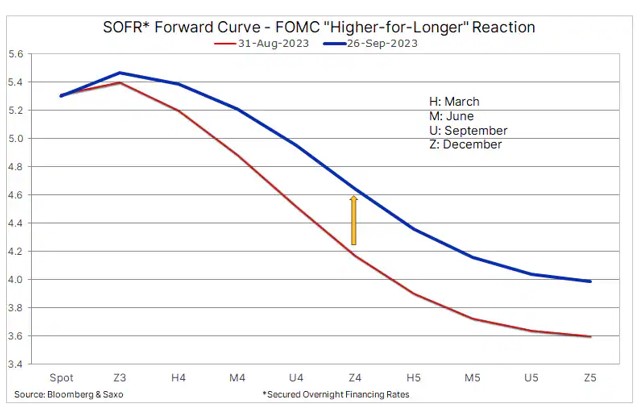

Following the FOMC announcement, the dollar hit a new 11-month high against a broad basket of major currencies, while the 10-year US Treasury yield hit a 16-year high above 4.5%. The short-term interest rate futures market has reduced bets on the number of 25 basis point rate cuts by the end of 2024 to less than three from the current level, with the risk of another hike before the end of the 'year.

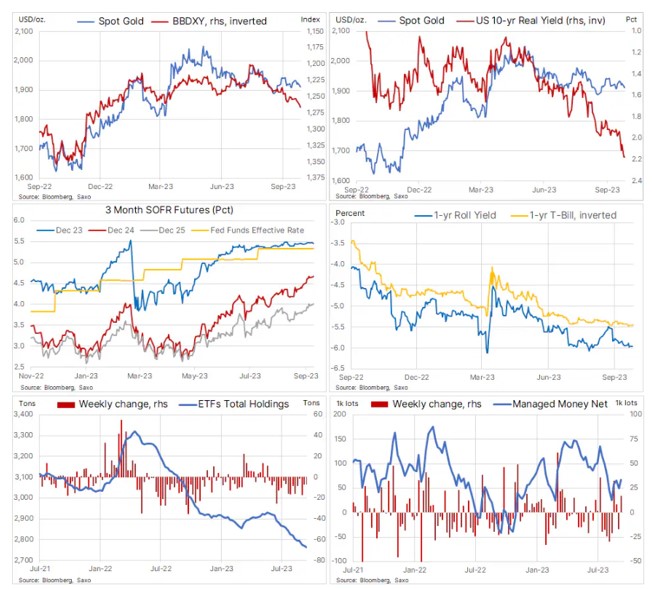

Looking at our chart below, it is difficult to construct a bullish scenario for Gold if current developments were the only driver for the yellow metal. With the dollar and bond yields rising, the inverse correlation to a relatively stable Gold has deteriorated, a development that has reduced selling pressure from algorithmic trading strategies, normally a major contributor to daily trading volumes.

Furthermore, as mentioned, the tailwind from future rate cuts has also weakened. A development that for now continues to see some asset managers being cautious when it comes to investing in Gold through ETFs due to the high opportunity cost of holding a non-interest bearing position compared to short-term government bonds. The current cost of holding a Gold position for 12 months is close to 6%, most of this is the cost of borrowing dollars for a year, and until we see a clear trend towards lower rates and/or an upward breakout that forces a response, short-term investors will look for opportunities elsewhere.

ETF investors that include the latter group have trimmed holdings over the past four months, leaving the total down 172.4 tons during this period to 2757.8 tons, a 3-1/2-year low. The net bullish position meanwhile continues to hover around 60k contracts (6 million ounces), about 35k below the one-year average.

BECAUSE GOLD RESISTS WELL

As mentioned in some previous reports, the reason why Gold, in our opinion, has held up well despite the headwinds mentioned, is based on the search for a hedge against the current negative market sentiment and, also due to the belief that the FOMC will fail to provide a soft landing for monetary policy. A hard landing or stagflation can occur if the Fed keeps the funds rate too high for too long or in the unlikely event that the economy becomes too hot to handle.

Other drivers may be rising energy prices that keep inflation high while hurting economic activity or the outbreak of a geopolitical financial crisis.

The demand for gold as a hedge is unlikely to disappear, as the US economic outlook in the coming months looks increasingly challenging. That's why we maintain a moderately bullish view on Gold, while questioning whether the yellow metal will continue to be able to withstand additional yields and dollar strength in the near term.

Gold, in a downtrend channel since May, is currently stuck in a range between $1900 and $1950 with additional dollar and yield strength increasing the risk of a near-term break below which it could see $1885 challenged.

A close above the 200-day moving average, around $1927, will likely coincide with a break in the downtrend, opening for a fresh attempt to challenge the resistance at the $1950 area.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutte-sfide-vinte-oro/ on Sun, 01 Oct 2023 05:05:46 +0000.