How and why the ECB can campaign

On the eve of the upcoming elections, it is good for everyone to know that the ECB, even more than before, will follow the logic of rewarding the "good", only if they do the good. Giuseppe Liturri's analysis

From the afternoon of 2 August we have official confirmation that the ECB has divided the Eurozone, as if the existing divisions were not enough, between "donor" and "recipient" countries.

The data published by Frankfurt certified what market operators had already noted during the month: in July the ECB intervened significantly by purchasing Italian public bonds and making a decisive contribution to containing the spread between BTPs and the German Bund.

So far, nothing new. In fact, with various technical variations, the history of the ECB's interventions since 2015. The novelty is the fact that the two purchase programs – PSPP (started in 2015) and PEPP (started in March 2020) – ended respectively in June and March 2022. Since then, President Christine Lagarde has only committed to reinvesting the proceeds of the securities that progressively come to maturity.

However, these reinvestments will continue in a differentiated manner. The "pandemic" PEPP program – whose net purchases at the end of July amounted to 1,664 billion, of which 289 to the benefit of Italian securities – foresees that they continue at least until December 2024. The Pspp program – whose net purchases at the end of July were equal to 2,743 billion, of which 450 to the benefit of Italian bonds – will carry out the reinvestments for "a prolonged period of time after the start of the rate hike". The first program, unlike the second, however, provides for ample flexibility in reinvestments, both by type of securities and by beneficiary countries.

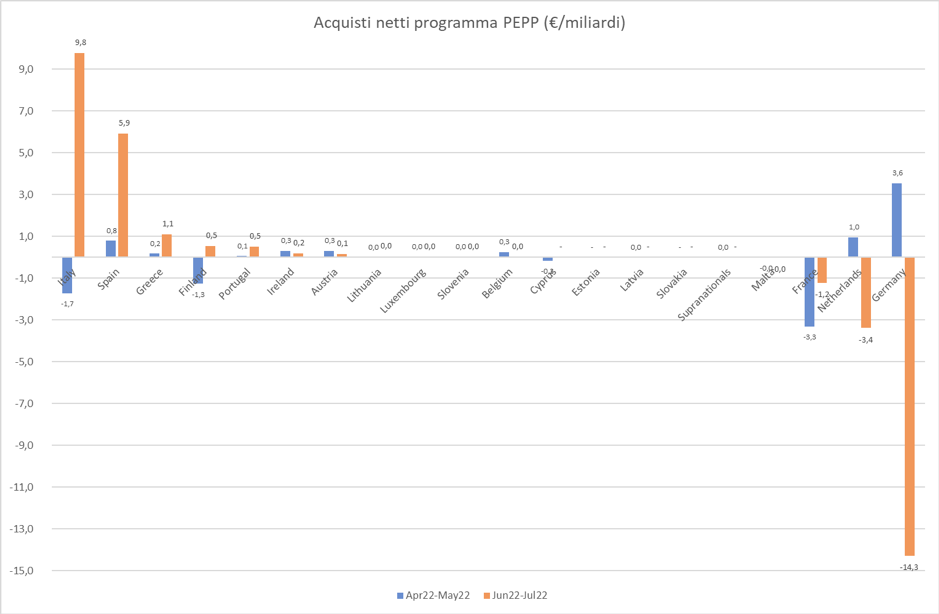

And this is precisely the key to understanding the importance of what happened in July and made known a few days ago. As already promised in the extraordinary board of directors on June 15, since the beginning of July the Eurotower has diverted the proceeds collected from German and Dutch bonds in maturity, towards the purchase of Italian and Spanish bonds, thus increasing their consistency. Overall, the ECB has kept its commitment not to increase net purchases, but has heavily maneuvered in the redistribution of proceeds, significantly moving away from the distribution base that should guide it. The final effect was to increase net purchases of Italian securities by approximately 10 billion and decrease net purchases of German securities by approximately 14 billion. Figures of absolute importance. Purchases in favor of Italy should be 17% of the total – reflecting the shareholding in the capital of the ECB – and have always been subject to moderate monthly fluctuations, understandable, considering the variability of the maturity calendars of the securities.

Since July we are no longer in the presence of normal flexibility, but of a deliberate maneuver whose significant contours emerge from the graph on the page, in execution of the decisions of the Frankfurt Governing Council. The cumulative deviation in favor of Italy with respect to the distribution base reached about 30 billion. In the last two months, the difference is even more evident when compared with the data of the previous two months, which did not register the significant deviations of July at all. To offer you an idea of the sensitivity of the markets towards the presence of the ECB, it is enough to remember that in October and November 2018, the Eurotower, in exercising that normal flexibility, "accidentally" touched the minimum monthly levels for the purchase of Italian securities and investors had an easy game in pushing the spread well beyond 300. Now this discretion is raised to the nth degree.

This – which Lagarde defined as “the first line of defense” to counter problems in the transmission of monetary policy due to the unwanted widening of spreads – is the definitive affirmation of a heavy and decisive mortgage on the fate of Italy. The ECB does not intend to generate new liquidity and that necessary to purchase Italian bonds and therefore prevent or mitigate unwanted increases in the spread, it can only derive from the liquidity drain operated towards holders of German, Dutch and French bonds. Thus a dangerous dependence is introduced in favor of these latter countries and a humiliating status of a needy country is given to Italy. The more humiliating the more the direct correlation between receivers and donors emerges every month. Where this is not enough, there are always reinvestments of the PSPP program, on which there is however less flexibility.

It is not difficult to imagine the devastating consequences of these operating methods on the political events of the country. Even more than in the past, every morning investors will check the ammunition with which the ECB will present itself on the securities market and will understand the assessment gained in Frankfurt on the economic policy choices of the current government. There will not even be a need to resort to the new TPI program, to send clear messages on the merit of purchases. In fact, the 1,664 billion Pepp, with an average duration of about 7.6 years, make about 220 billion renewals available per year. Far more than the emissions of the EU Next Generation and enough to scare anyone. We must not forget what happened on the morning of that Tuesday 29 May 2018 , when Carlo Cottarelli wandered between the Quirinale and Montecitorio to compose a botched technical government and the spread increased by 80 points in one day, with the yield of the two-year BTP practically out of control. . Last March, a Bank of Italy study dismissed that dramatic day as a "flash crash". But it was also the effect of a fugitive ECB and investors drew the consequences.

On the eve of the upcoming elections, it is good that everyone knows that the ECB, even more than before, will follow the aberrant logic of rewarding the "good", only if they do the good.

(Updated and expanded version of an article published in the newspaper La Verità)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-e-perche-la-bce-puo-fare-campagna-elettorale/ on Sun, 07 Aug 2022 06:28:22 +0000.