How are Eni’s accounts going

Eni closes 2020 with a red of 742 million. All the details on the economic and financial results of the energy group

Covid-19 also infects Eni's accounts.

The energy giant, even if it has adopted a series of countermeasures to deal with the impact of the pandemic, is paying the price of a 2020 in which there was the largest ever recorded contraction in global oil demand.

Revenues drop and the group's profit drops, which closes the year with a red of 742 million. All the details.

ENI'S REVENUES IN 2020

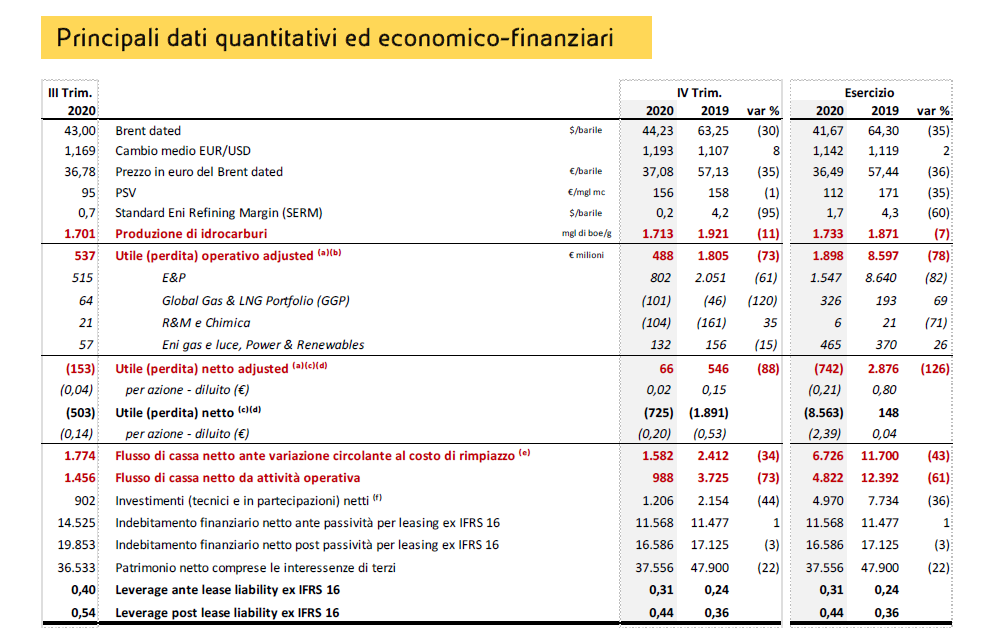

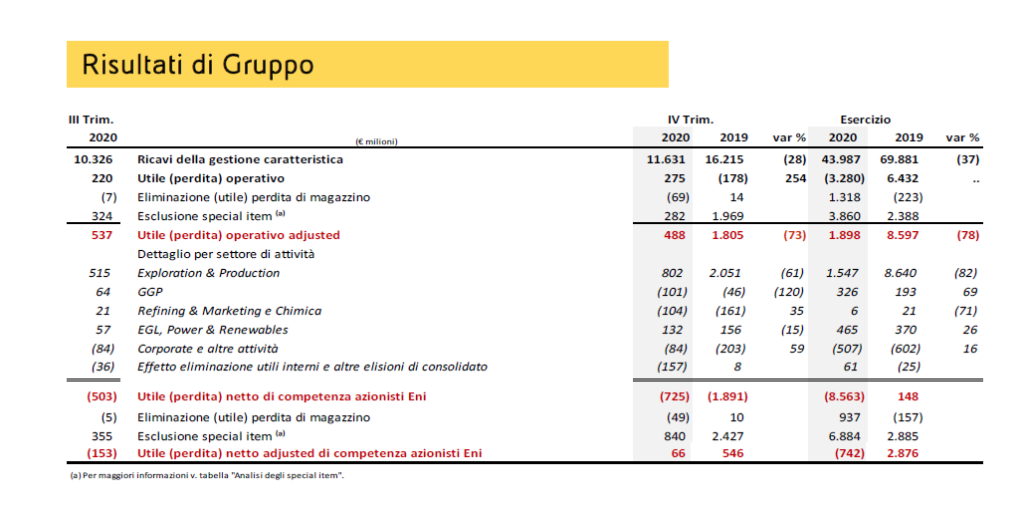

The oil giant, in full energy transition phase, closed the year of the pandemic with core business revenues of € 43.99 billion, down 37% compared to the 69.88 billion obtained in 2019, also thanks to the hydrocarbon production fell by 7% to 1.73 million boe / day.

Leading the energy transition is a journey and now more than ever it's going through a deep acceleration.

To find out more join us on https://t.co/2cq6tlLcWH for Strategy 2021 – 2024 & 2020 Results – Friday, 19 February 2021, at 14.00 CET – live video streaming

– eni (@eni) February 17, 2021

A RED OF 742 MILLION

Adjusted operating profit amounted to € 1.9 billion, down sharply compared to the € 8.6 billion obtained in the previous year. The company closed the year with a red of 742 million euros, against a profit of 2.88 billion recorded in 2019.

THE NUMBERS OF THE FOURTH QUARTER OF ENI

The six-legged dog returned to profit, however, in the fourth quarter of 2020, with a positive adjusted operating result of 488 million euros (compared to 1.81 billion in the corresponding period of the previous year) and a positive adjusted net result for 66 million euros, albeit significantly worse than the profit of 546 million recorded in the same period of 2019.

LIQUIDITY AND DEBT

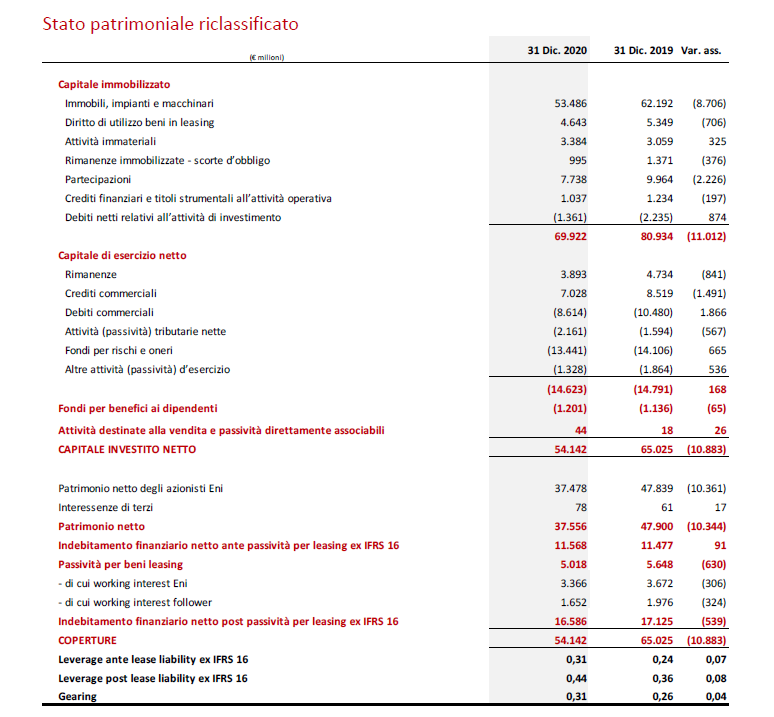

The coffers of Big Oil are resilient, which in any case boasts a liquidity reserve of approximately 20.4 billion euros, of which, the company note specifies , 9.4 billion treasury assets, 5.5 billion deriving from investments in liquid assets , 200 million from financial receivables and 3 billion from committed credit lines not yet used. The company's debt fell to 16.59 billion euros, compared to 17.13 billion at the beginning of the year.

THE DIVIDEND

The collapse of revenues and profits leads Eni to the distribution of a 2021 dividend, relating to the 2020 financial year, of € 0.36 per share, down compared to € 0.86 in 2019.

THE WORDS OF DESCALZI

“In the most difficult year in the history of the energy industry, Eni has shown great strength and flexibility, responding promptly to the extraordinary context of crisis and progressing in the irreversible process of energy transition. In a few months we have reviewed our spending program and minimized the impact on cash of the fall in the price of crude oil, increased our liquidity and defended our capital strength. The results of the fourth quarter, with a Brent price of 44 dollars a barrel, substantially stable compared to the previous quarter, exceed the expectations of the market in terms of operating profit and net profit, and confirm the generation of operating cash and effectiveness of our action to respond to the crisis ”, commented Eni's CEO, Claudio Descalzi.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/come-vanno-i-conti-di-eni/ on Fri, 19 Feb 2021 11:12:34 +0000.