How are investments and savings going with the pandemic. A company report

The pandemic has halted consumption and investments, causing household savings and company reserves to grow by almost 100 billion overall. The liquidity of investment funds collapsed, down by more than 8%. The analysis of a company

Consumption at stake and zero investments, in the last 12 months, due to the pandemic: with almost 60 billion additional billions accumulated by families and almost 53 billion in the coffers of companies, the mass of Italian savings is running towards 2,000 billion euros. During the last year, in full Covid emergency, the reserves of Italians increased by almost 100 billion (+ 5%), from 1.898 billion in May 2020 to 1.996 billion in May 2021. The surge would have been even more striking if we had not witnessed the collapse of the liquidity of investment funds, which fell by more than 30 billion (-8%).

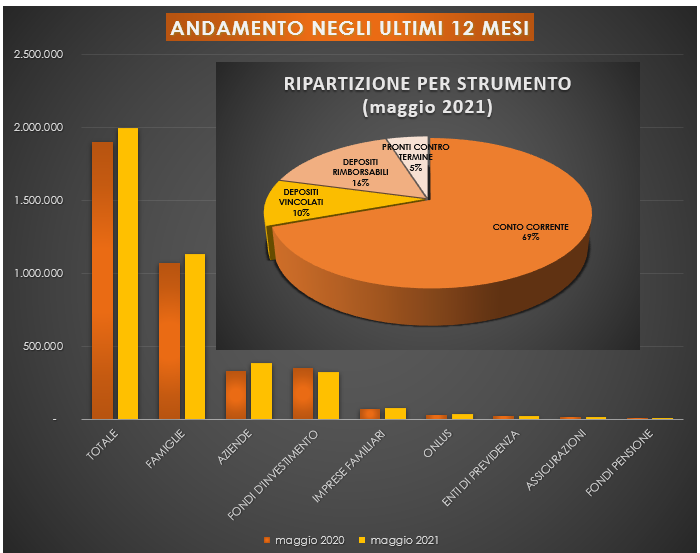

Liquidity on current accounts increased, with the total balance reaching 1,384 billion, up by more than 147 billion (+ 12%) in 12 months. Companies have essentially stopped investments and thus accumulated huge resources: their piggy banks have risen by almost 54 billion (+ 16%), reaching over 387 billion; while those of households grew by approximately 54 billion (+ 5%), reaching 1,130 billion and those of family businesses recorded a positive balance of 7 billion (+ 10%), up to 78 billion.

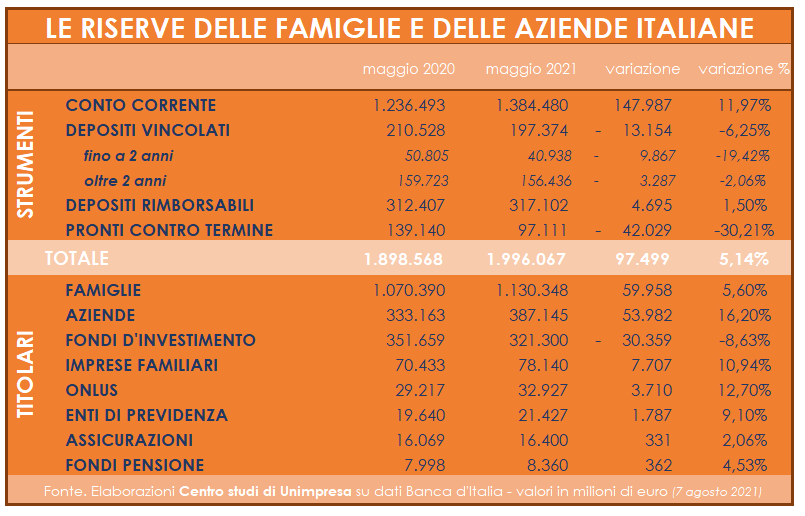

These are the main data of an analysis by the Unimpresa Study Center on the reserves of Italian households and companies, according to which there are 13 billion less (-6%) on term deposits, while repurchase agreements have fallen by 42 billion. (-30%) at 97 billion: two signs that show how families and companies prefer to have financial resources always available, abandoning less liquid forms of savings.

THE COMMENT OF LONGOBARDI (UNIMPRESA)

«For the future of the country, an imperceptible but fundamental ingredient will be decisive: trust, essential to restart consumption and investments. We need to have a lot of it and believe in the potential of our business activities, focus on the goodness of projects every day. It is necessary to continue to invest, to look intelligently at the opportunities offered by new technologies, which must not represent a mere opportunity to reduce company costs, must not be shortcuts for easy profits; innovation, technologies and digital must be opportunities to develop new products and services or to improve what we already do; they must be opportunities to be exploited in order to always look forward with a prospect of growth and progress »comments the honorary president of Unimpresa, Paolo Longobardi. "The European funds of the Recovery fund should not be wasted and the government will have to ensure that there is no waste and that the underworld stays away from this game," adds Longobardi.

HOW MUCH THE RESERVES OF FAMILIES AND COMPANIES ARE GROWING

According to the analysis of Unimpresa, which processed data from the Bank of Italy, from May 2020 to May 2021 the total reserves of Italian households and companies went from 1,898.5 billion to 1,996.1 billion, an increase of 97 , 4 billion (+ 5.14%) on an annual basis. In detail, household savings rose by 59.9 billion (+ 5.60%) from 1,070.3 billion to 1,130.3 billion, while those of companies rose by 53.9 billion (+ 16.20%) , from 333.1 to 387.1 billion, deposits of family businesses increased by 7.7 billion (+ 10.94%), from 70.4 to 78.1 billion. Out of 3.7 billion (+ 12.70%) the piggy banks of non-profit organizations, which rose from 29.2 billion in spring 2020 to 32.9 billion in May 2021, while they increased by 1.7 billion (+ 9.10% ) deposits from social security institutions (from 19.6 billion to 21.4 billion), 331 million (+ 2.06%) those of insurance companies (from 16.1 billion to 16.4 billion) and 362 million ( + 4.53%) those of pension funds (from 7.9 billion to 8.3 billion). The overall increase would have been even more marked if the reserves of investment funds had not fallen, which fell by 30.3 billion (-8.63%) from 351.6 billion to 321.3 billion.

As for the analysis by instrument, the growth in reserves is almost entirely due to the additional 147.9 billion (+ 11.97%) left on current accounts, which went from 1,236.4 billion in May 2020 to 1,384.4 billion. last May. The other instrument with the positive balance is that of repayable deposits, which rose by 4.6 billion (+ 1.50%) from 312.4 billion to 317.1 billion. On the other hand, term deposits fell by 13.1 billion (-6.25%) from 210.5 billion to 197.3 billion: in detail, those with a maturity of up to 2 years decreased by 9.8 billion (-19.42%) went from 50.8 billion to 40.9 billion, while those with maturities over two years fell by 3.2 billion (-2.06%) from 159.7 billion to 156.4 billion . Exposure to repurchase agreements also fell sharply by 42.1 billion (-30.21%) from 139.1 billion to 97.1 billion.

«The behavior of families and businesses, which can be photographed from the analysis by instrument, highlights an attitude oriented above all to the utmost prudence. If citizens do not spend, companies respond by freezing any short and medium-term investment. Not only that: the choices made by companies and families also bring to light the desire to accumulate money with particularly liquid forms of deposit and, at the same time, highlight the significant reduction in banking services with duration constraints (deposits up to 2 years or more) or in any case not immediately available (repurchase agreements) »observe the analysts of the Unimpresa Study Center.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/pandemia-consumi-investimenti-unimpresa/ on Sat, 14 Aug 2021 06:00:25 +0000.