How are the Italian banks? Equita report

The aftermath of the Credit Suisse case. The words of Visco (Bank of Italy). And the Equita report on Italian bank stocks

Banks still in the spotlight of the markets after the Credit Suisse case. The Swiss systemic concert – with American consent – was not particularly appreciated by the European institutions, the ECB in primis. This is because Credit Suisse's subordinated bonds were more penalized than the Swiss bank's shareholders in the context of the acquisition by UBS. ( here what is said and feared in Switzerland after the Ubs-Credit Suisse operation ).

THE AFTERMATHUS OF THE CREDIT SUISSE CASE

The Credit Suisse case comes after the bankruptcy of two American banks such as Silicon Valley Bank and Signature Bank. In these two cases, the political and monetary authorities of the United States decided ad hoc to break through the ceiling of 250 thousand dollars, a limit beyond which there was no state guarantee which was prepared in a targeted manner in the case of the two banks.

PRAISE AND ALARMS OF VISCO (BANKITALIA)

An intervention that was appreciated by the governor of the Bank of Italy. “In the event of a banking crisis in Europe “there is no immediate intervention tool like in the United States”, Ignazio Visco said today in a hearing before the Finance Commission of the Chamber. Visco recalled the events of the last two weeks with the crisis in the US banks and Credit Suisse and especially notes the speed of response in the US. "The important lesson of these days is a vigilance that has had defects but a very rapid intervention capacity in the United States while in Europe we do not have the tools to intervene quickly". Visco added that in the US "there is the FDIC, essential for the speed of response". “If we had a crisis” adds Visco in Europe “we don't have an immediate intervention tool”. It is an alarm bell, the governor remarked, "that has sounded" in European countries.

HOW BANKS ARE DOING IN PIAZZA AFFARI

Not only for this reason – i.e. for the implicit alarm for Europe launched by Visco – bank stocks still in the spotlight in Piazza Affari – and not only in Piazza Affari but throughout Europe, in addition to the USA – after the controversial bailout of Credit Suisse. On the Ftse Mib, the securities of the main lenders experienced a volatile morning and are now slowing down while maintaining a general increase. Finecobank scores +1.18%, Intesa Sanpaolo +0.89%, Mps +0.21% and Mediobanca +0.17%, while UniCredit is on par (-0.01%).

THE EQUITA REPORT ON ITALIAN BANKS

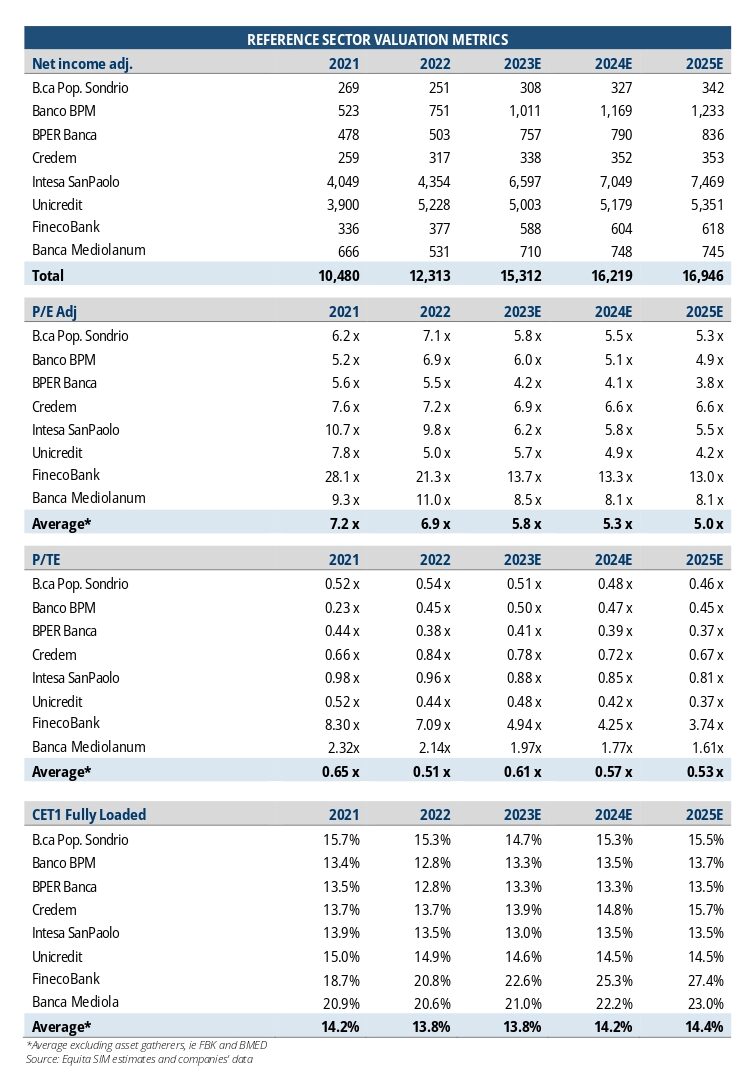

A report by Equita also tries to calm the climate on the sector: the analysts underline that "Italian banks are solid, liquid and well capitalised", albeit with increasing risks. «Despite the rapid resolution of the Credit Suisse problem, which is giving relief to the sector – warn the experts – we believe that our neutral stance is appropriate given the recent tensions on the market that have affected several credit institutions and the recent macro data suggesting that the economic slowdown could get worse. Elements, underlines Equita, which "will probably lead to an increase in the cost of capital of banks, at least in the short term".

UNICREDIT OK ACCORDING TO EQUITA

Among the commercial banks, Equita's favorite is UniCredit, thanks to «the improvement in operating performance, the solid capital position and the attractive and sustainable shareholder remuneration». All at "attractive valuations", reports Radiocor .

ORCEL'S SALARY

Equita also intervenes in the debate on the salary increase of CEO Andrea Orcel, which will be on the agenda of the meeting on 31 March. «The modification of the remuneration of the CEO it is justified by the company's intention to adopt a scheme that ensures greater alignment with the interests of the shareholders, through a system of incentives for exceeding the targets», writes Equita. Analysts recognize "the crucial role played by Orcel in the relaunch of the bank", which has "changed its strategic approach and its level of ambition, with tangible results in terms of profitability and capital generation". Consequently, they conclude, "we believe that any tension regarding the CEO and his eventual exit would be negative events for the title".

THE JUDGMENT OF EQUITY DRAWN FROM THEIR REPORT

“Italian banks are solid, liquid and well capitalised, but the marginal risks are higher,” reads a report on the banking sector by the independent investment bank Equita.

“We reiterate our opinion that

- the dynamics of the NII provides structural support to the profitability of the banks, which we expect to remain above the era of "negative rates";

- the Italian banking system has made significant strides in terms of efficiency, with consequent greater flexibility in operational management. Furthermore, the sector's capital position, liquidity and asset quality make it capable of coping with macroeconomic deterioration and is in no way comparable to the case of the United States.

While we welcome the swift resolution of the Credit Suisse issue, which is providing some relief to the sector, we believe our neutral stance on financials is appropriate for now in light of i) the recent market tensions which have hit hard various lenders, ii) recent macroeconomic data suggesting that the economic slowdown could get worse.

Indeed, these elements are likely to increase banks' cost of equity, at least in the short run.

Among commercial banks, our preferred name remains UniCredit due to its improved operational performance, strong capital position and attractive and sustainable shareholder remuneration at attractive valuations (P/TE < 0.5x). Among the asset gatherers, we confirm the BUY of Banca Mediolanum and FinecoBank, with the recent sell-off largely unjustified”.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-stanno-le-banche-italiane-report-equita/ on Wed, 22 Mar 2023 14:41:19 +0000.