How car manufacturers move to grab batteries

There are those who look to China, those to the US and those to Australia. Europe also tries to have its say in terms of batteries. And there are those who are already sounding the alarm on the prices of materials to produce them, destined to explode

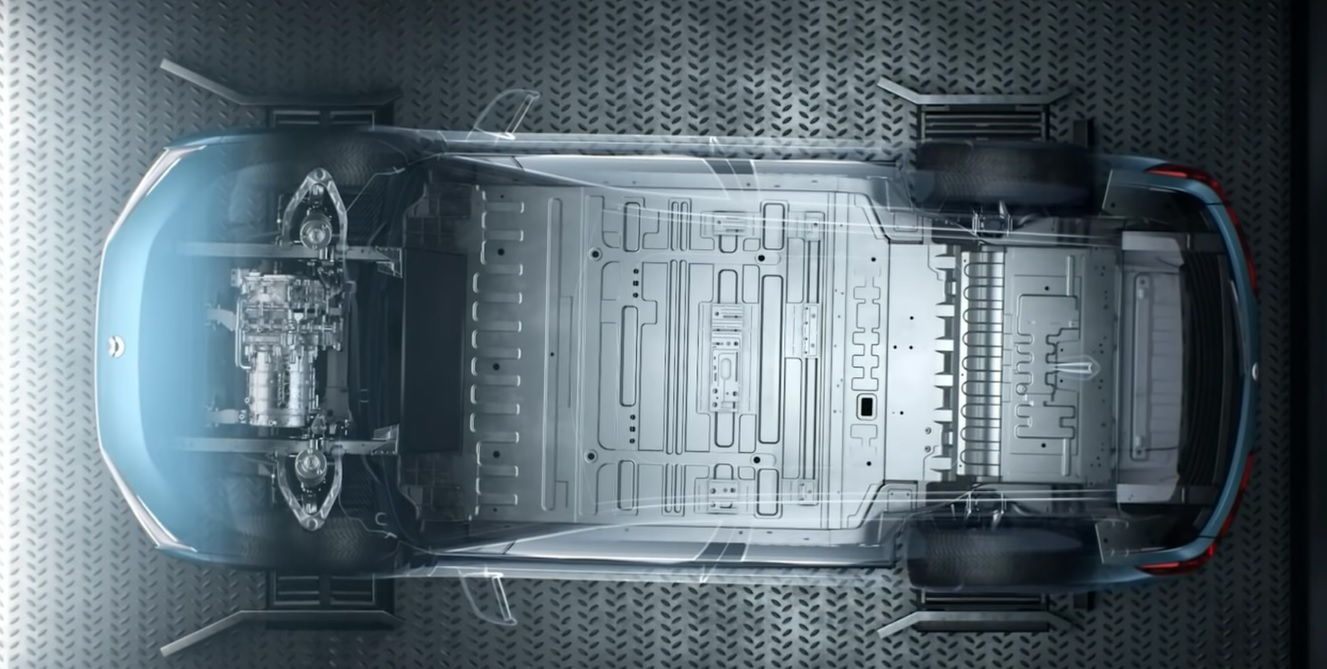

For those who were born electric, like Tesla or Lucid (which has even patented a proprietary technology, known as Lucid Space Concept), the problem does not even arise. All the other pre-existing houses, on the other hand, are investing billions to redesign their supply chain. On the fingers of one hand there are cases in which those who produced endothermic engines or in any case parts of these managed to convert in time. Also because today, as we have already written on other occasions and in any case we will see shortly, the battery market is firmly held in Chinese hands. And this is the reason why, as soon as we started talking about a possible ban on old vehicles with combustion engines in Europe, many brands, starting with the German ones, rushed to China to sign supply contracts.

A GLOBAL CHAIN

But, as we will see along our journey, the situation is much more complex than that, because if it is true that in Asia there are the most daring battery producers, it is in the USA that the most innovative solutions are being tested, while it is in Australia. (and obviously Africa and South America, not treated for space requirements) that the raw materials are found while in Europe gigafactories will rise to create the finished product, or at least to assemble it. With electricity, in short, the supply chains will seem intertwined and global. Which unfortunately will also mean that they will reveal themselves exposed to global crises, such as wars and pandemics, with domino effects that we have already seen with regard to commodity markets and the shortage of chips.

CHINA IN POLE POSITION

The undisputed protagonist of the negotiations is Catl , which, in addition to being the main player on the market, ensnares Western manufacturers with promises that today seem amazing: according to its technicians, thanks to the new Qilin accumulators it will be possible to travel over 1,000 km on a single charge. Two native Chinese electricians have already grabbed the new technology: Li Auto (Li Xiang) and Hozon New Energy Automobile . Until recently, in second place in the ranking there was, fixed, the South Korean LG Energy Solution , with a market share that was not even half that of Catl, to close with BYD . Until recently, in fact. In August, according to a report by SNE Research, a Seoul-based research firm, BYD performed a historic overtaking on the South Korean and now the first two steps of the podium are occupied by Chinese. And Tesla is relying on Asia, with important agreements with Catl and Panasonic. The latter will open a mega plant in De Soto, a city in the Kansas City metropolitan area, to build a new $ 4 billion, 4,000-job battery factory to supply Elon Musk's cars.

WHO WANTS TO EXPERIMENT, BUT LOOK AT THE USA

However, this does not mean that the Western houses do not also turn to other actors. BMW is also looking at solid state batteries with interest and has signed a partnership with the US startup Solid Power which has recently completed the installation of a pilot line for the production of new generation cells characterized by a high silicon content for anodes and sulfide electrolytes, in the hope that this technology will soon become accessible. BMW has also signed agreements for the lithium hydroxide of European Lithium and with another US startup Lilac Solutions which is trying to grab the rights to some Bolivian fields. And it is not the only one to go directly to the source, to procure raw materials, avoiding the "pre-prepared packages" produced mostly in China.

Mercedes-Benz also wants to experiment and has announced new developments in its collaboration with the American Sila to equip its cars with an optional battery pack with high silicon content anodes instead of carbon. There is also a Rock Tech Lithium agreement for 10,000 tons of lithium hydroxide per year starting from 2026. To close with the Germans, Volkswagen PowerCo has created a joint venture with the Belgian tech company Umicore del valore of three billion euros for the manufacture of chemical precursors and cathode materials for batteries in order to produce sufficient material for a total capacity of 160 GWh (gigawatt hour) by the end of the decade, setting a target of 60 GWh for 2026.

IN AUSTRALIA, MINES ARE MENTIONED BY MANY

Stellantis prefers to look to Australia, just like Toyota (which, in addition to Panasonic, has in fact entered into agreements with Bhp). A few days ago it announced the signing of a non-binding memorandum of understanding ("MOU") for the future sale of large quantities of cobalt and nickel sulphate products for batteries from the NiWest Nickel-Cobalt Project with the Australian GME Resources Limited , in Western Australia.

At the beginning of the year he had instead put 50 million euros on the plate to acquire 8% of the Australian startup, with an important office in Germany, Vulcan Energy (the same already chosen by Renault , which has also signed agreements with the Moroccan Managem for 5,000 tons of low-carbon cobalt sulphate and with the Finns of Terrafame for the supply of nickel sulphate), which allowed the company to become its second largest shareholder and secure lithium supplies for 10 years . On the US front, the Group moves by feeding the US supply chain, both for logistical reasons, given that part of the production takes place in America, and to avoid incurring the new regulatory links desired by Joe Biden . For this the contract with Controlled Thermal Resources which will supply up to 25,000 tons of lithium hydroxide per year for 10 years. The Stellantis group has signed an agreement with LG Energy Solutions for the construction of a new battery factory for electric cars in Canada.

Ford 's supply chain has also stars and stripes, which has chosen Ioneer's Australians for the Rhyolite Ridge project carried out in Nevada, has signed a joint venture with SK Battery America for three gigafactories in Tennessee and Kentucky and has investments in the Nevada startup. Redwood Materials. Outside of the States, it has agreements with Liontown Resources to supply spodumene concentrate from its Kathleen Valley project in Western Australia to obtain lithium from Lake Resources's Kachi project in northern Argentina. GM instead has agreements with the American Livent Corp with the Australian Controlled Thermal Resources and with the Anglo-Swiss mining company Glencore.

EUROPE HOUSE OF GIGAFACTORIES?

The EU will have no mines or even producers, but it is still moving. According to the latest report by Benchmark Minerals, projects for a total capacity of 789.2 GWh by 2030 have been started in the Old Continent, a level equal to just over 14% of the 5,452 GWh projected globally, sufficient to support the assembly of nearly 15 million pure electric vehicles and more than six times higher than what was indicated in 2018, when the "pipeline" had sites for 120 GWh (enough to supply 2.2 million EVs).

Thirty-six European industrial and academic realities, with the support of governments, public organizations and representative associations, will sign a pact to promote the European battery supply chain: the Upcell Alliance . Italian companies have also joined the alliance, such as Comau, the Turin-based robotics and industrial automation company of the Stellantis group, and the Milan Polytechnic. The companies that are part of the alliance deal with the three main stages of the battery manufacturing process: electrode manufacturing, battery cell assembly, module and battery pack assembly.

THE PRICES OF LITHIUM INTENDED TO EXPLODE?

This whole rush to electric seems destined to skyrocket raw materials. We are already seeing the increases, given that several manufacturers have begun to revise their price lists and could even worsen, as the Norwegian energy consultancy company Rystad Energy has been saying for some time. According to the analysis of the Norwegian company, there are two reasons behind the rise in prices: on the one hand the growing interest shown by the automotive sector in lithium-iron-phosphate batteries starting from the first months of 2021, on the other hand forecasts of limited supplies of lithium salts for the entire first half of 2022 due to production and logistical problems in China and South America. Having been published before the outbreak of the invasion of Ukraine by Moscow, the The report obviously does not take into account the changed geopolitical set-up so it could even be considered optimistic.

But more than the numbers themselves, which are now in danger of being "expired", the report is valuable because it takes a census of battery manufacturers and allows us to make order with respect to what has been listed so far with reference to the Old Continent. Within the next year, Europe should have seven companies, including LG Chem in Poland (32 GWh), Samsung Sdi in Hungary (20 GWh), Northvolt in Sweden (16 GWh), SK Innovation in Hungary (7.5 GWh) and Envision AESC in the UK (1.9 GWh). In 2030 we will have the entry into operation of 27 gigafactories from 18 different companies. As many as 17 plants with a minimum capacity of 1 GWh will be built by partnerships initiated by car manufacturers such as the Volkswagen, Stellantis or Renault groups.

According to Benchmark Minerals, the Tesla gigafactory in Berlin should reach, in 2026, a capacity of 75 GWh and, in 2030, of 125 GWh, thus becoming the second plant in the world after the one in Austin, Texas, also owned by Tesla, third the Northvolt, with 92 GWh of capacity, and the Chinese Catl, which has an 80 GWh project in Erfurt (Germany). The fourth position will be occupied by LG with 67 GWh and the fifth by Acc, the joint venture between Stellantis, Total and Mercedes, which has three plants in Germany, France and Italy for a minimum of 64 GWh.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/come-si-muovono-le-case-automobilistiche-per-accaparrarsi-le-batterie/ on Thu, 13 Oct 2022 09:19:01 +0000.