How Fed and Putin will affect the stock exchanges

While Russia's war strategies in Ukraine contribute to the deepening food crisis, the latest US inflation data could force the Fed to run for cover to curb demand. The report by Peter Garnry, Head of Equity Strategy for BG SAXO

Equities must adjust to entrenched core inflation

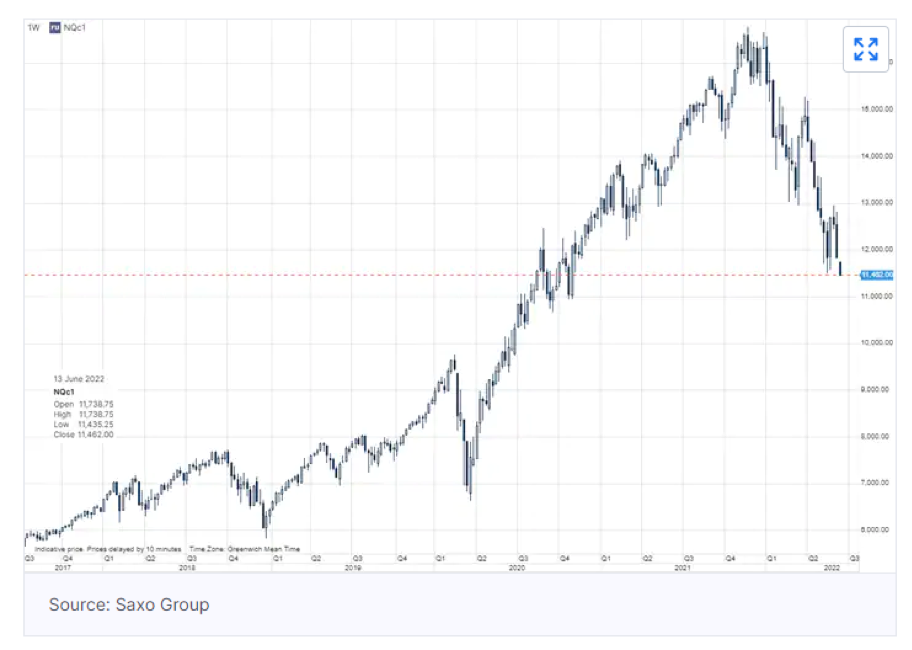

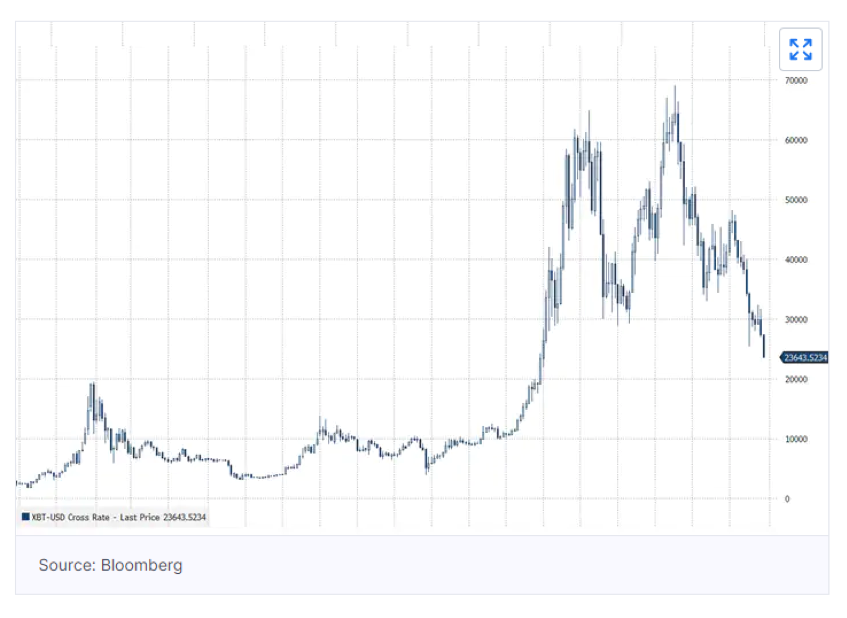

After the rebound that began on May 25, global equities have entered a consolidation phase that started last week. The selloff has extended and gradually worsened with Nasdaq 100 futures hitting cycle lows around 11,530, while Bitcoin is trading around 23,600 following the decision by Celsius (cryptocurrency lender) to stop. withdrawals.

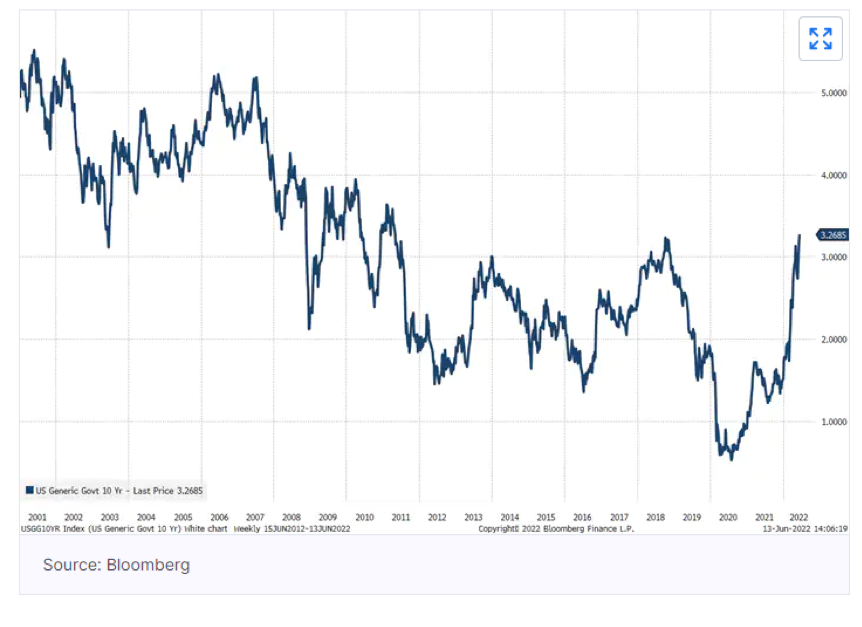

Interest rates are rising with the 10-year yield in the US now above 3.0% and Fed Funds forward rate futures suggest a significant increase in the US overnight interest rate over the next year. Finally, the US yield curve has reversed suggesting that the likelihood of a recession is growing. Furthermore, some polls show that long-term inflation expectations are rising.

The current bearish trend is due to a combination of negative dynamics that push the entire globe to gallop into crisis mode.

The data on US inflation showed a consumer price index, or core CPI m / m, of 0.6% and, if we exclude all the components that have some connection with energy prices, the inflation rate core is still high at 0.4% m / m, which brings the annualized figure to 5%. As a result, the market is realizing that the Fed will have to pull the brakes hard to stop inflation and the rate hike on Wednesday 15 June by 75 basis points is one example. In the latest reports that BG SAXO has released on historical stock drawdowns, it has been pointed out that this value could extend to around 30-35% and take more than a year to reach the minimum from the peak. The main hypothesis is that the current drawdown is a mix of the dynamics seen during the new economy bubble of the early 2000s (that of the dot-coms) and the energy crisis of the 1970s.

In addition to the inflation data in the United States, the world was also able to "see the cards" of Putin who, in a speech a few days ago, said that he considers himself the new Peter the Great, or that his current policy is, in reality, a crusade to "take back the Russian lands".

It is therefore clearer that Russia is using the war in Ukraine to stage a food crisis. In this regard, Yale history professor Timothy Snyder argues that Russia's deliberate strategy is to cause a crisis that will hit Africa hard and could cause disruptive flows of immigrants to Europe that will destabilize the continent.

Market participants are increasingly bracing themselves for an energy and food crisis that will extend into 2023, put upward pressure on inflation and cause an economic downturn in many emerging market countries.

As if that weren't enough, last weekend, he highlighted that China's return to post-pandemic normality is proving increasingly difficult. In some regions, the planned reopening of schools has been postponed and mass testing has been introduced in Shanghai after new cases of Covid. Unfortunately, it appears that China will be affected by new lockdowns for the rest of the year: this will cause continued and further disruptions in global supply chains.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-fed-e-putin-influenzeranno-le-borse/ on Sun, 19 Jun 2022 14:18:27 +0000.