How is industrial production going (and how it will go) in Italy

Industrial production: data, analysis and scenarios. The comment by Andrea Volpi, economist in the studies and research department of Intesa Sanpaolo

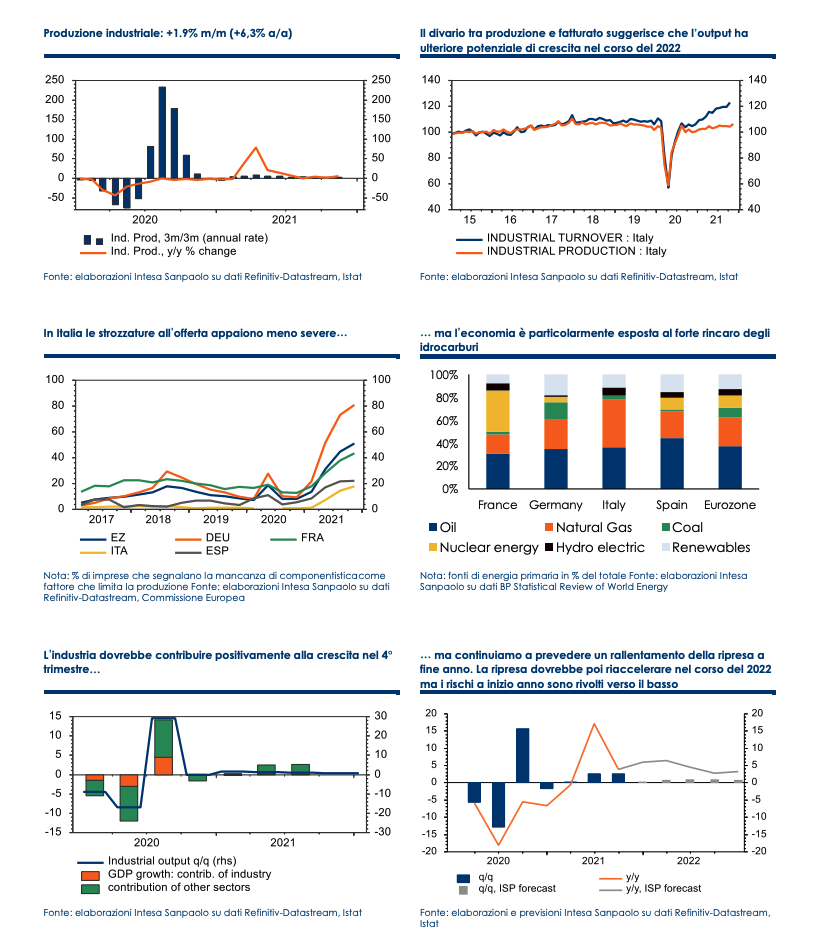

In Italy, industrial production grew by 1.9% mom in November after falling by 0.5% mom in the previous month (revised from -0.6%). The figure is well above our and consensus expectations, and represents the largest economic increase since October 2020. In trend terms and adjusted for working days, the change has risen to + 6.3% from a previous +1, 9%.

The monthly progress is driven by energy production (+ 4.6% m / m) but is in any case also spread to the other components with an increase in the output of capital goods (+ 2.0% m / m), intermediate (+ 0.8% m / m) and consumption (+ 1.7% m / m). In particular, there was an increase in the production of both durable (+ 1.2% m / m) and non-durable (+ 1.8% m / m) consumer goods.

If we exclude energy, production in manufacturing alone still grew by a solid + 1.7% m / m (+ 5.8% y / y). The largest increase was recorded by the typically volatile pharmaceutical industry (+ 6.0% m / m) but 11 macro-sectors out of 13 still reported an increase in output with encouraging signals also coming from the automotive sector (+3.4 % m / m, but still in largely negative territory in trend terms: -6.6%).

The industry is therefore on course for an expansion of around 0.8% qoq in the 4th quarter after having already grown by 1% qoq during the summer. The November data confirm the better relative performance of the Italian industry compared to that of the other main European economies, such as Germany and France, where however activity in the sector has not yet recovered the pre-Covid levels. It is no coincidence that in Italy the supply bottlenecks appear less severe than in other countries. However, the growth in infections and the sharp rise in energy prices could contribute to further tighten existing constraints and slow down activity at the beginning of 2022.

The record of infections could in fact be reflected in a reduction in hours worked (for the quarantines of infected workers) while companies that will have to cope with a sharp increase in energy tariffs could be forced to temporarily stop or postpone production activity.

The Italian industry is among those potentially most exposed to the energy shock and particularly energy-intensive sectors, with lower margins or unable to pass the higher costs to the end user, would be affected.

The risks for manufacturing in the first quarter of 2022 therefore appear to be mainly on the downside but we maintain a favorable scenario for the medium term. The presence of backlogs, the need to replenish inventories and the gap between real turnover and production figures are consistent with a large potential for further growth for manufacturing once supply tensions have been reabsorbed.

In the 4th quarter of 2021 we expect GDP growth of around 0.3% qoq: industrial data offer encouraging indications but we believe that the slowdown in the dynamics of services, especially in the sectors most exposed to health risk, will be decisive .

The recovery could accelerate modestly in early 2022: economic activity at the turn of the year should be weak, especially in January, but we expect a rebound once there is an improvement in the pandemic environment. In any case, the scenario still presents a large degree of uncertainty and the risks for the first quarter of 2022 are to the downside.

The recovery should then accelerate again in the central quarters of the year and we expect GDP growth on average to 4.3% in 2022 after the 6.2% estimated for 2021.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-va-e-come-andra-la-produzione-industriale-in-italia/ on Thu, 13 Jan 2022 11:59:45 +0000.