How is industry in Italy compared to Germany. Analyses

This is why Italy is the only one of the four main economies of the Eurozone to have fully recovered the pre-pandemic levels of industrial production. The analysis by Paolo Mameli, senior economist of the Studies and Research Department of Intesa Sanpaolo

Italian industry more resilient than in other Eurozone countries.

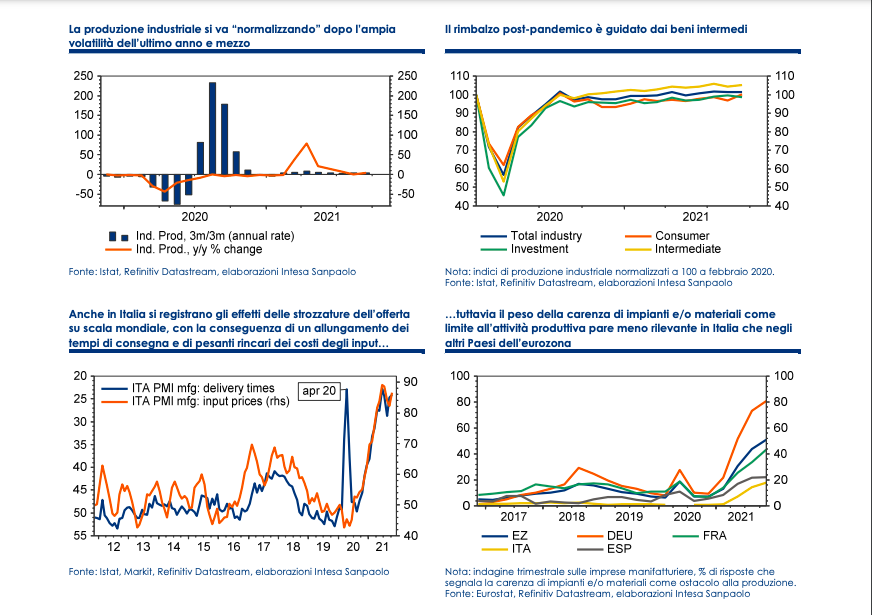

Industrial production unexpectedly increased in September, by 0.1% m / m, after falling by -0.3% m / m (revised down from -0.2% initially estimated) in August. The annual change (corrected for calendar effects) started to rise again, to 4.4% from -0.1% previously.

The seasonally adjusted index of industrial production remains 1.5% higher than the pre-pandemic level (this figure is stable compared to the estimate of a month ago). The recovery is entirely due to intermediate goods (+ 5.4% compared to February 2020), while the production of consumer goods is little changed and there is a decline in output for capital goods and energy (-1.4% and -4.6%, respectively).

The slight economic growth in production recorded in September is explained by the rebound in consumer goods (+ 3.3% m / m after -1.8% in August) and, to a lesser extent, in intermediate goods and energy (+ 0.9% from -1.4% previously, and + 1.3% from -2% m / m, respectively), while production of capital goods fell -1% m / m after climbing +0, 4% in August.

However, the one-tenth increase in the general index over the month is somewhat distorted by the "anomalous" jump (+ 19.3% mom) recorded by the pharmaceutical sector, net of which industrial production would have decreased by about half a percentage point in the month. Therefore, the breakdown by sector appears less reassuring than the summary data.

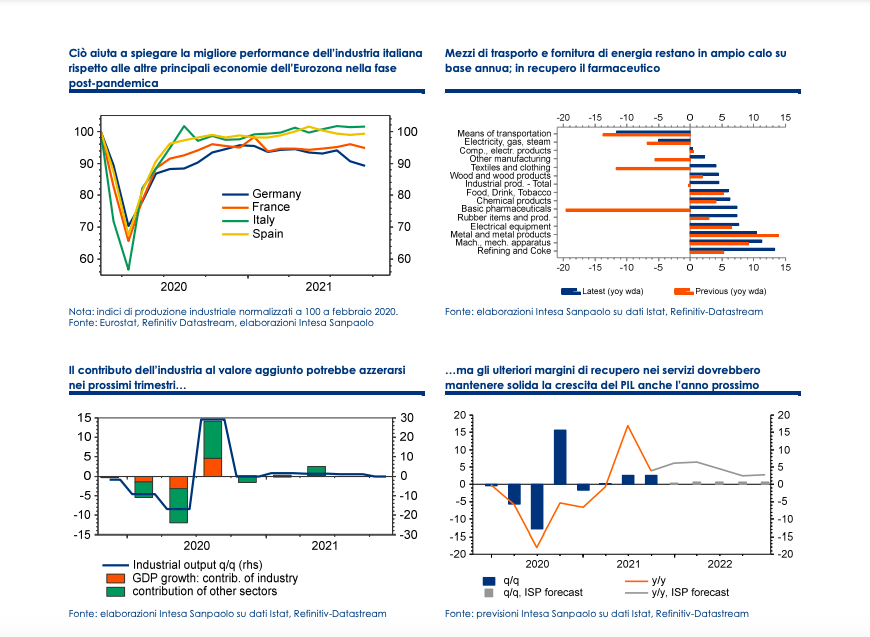

The performance on an annual basis (corrected for calendar effects) remains very varied by sector: there is a double-digit trend increase for refining (+ 13.3%), which however accounts for just 1% of total production , and above all for machinery and equipment (+ 11.4%), whose weight on the general index is much greater (13.6%); there is also considerable progress for the metallurgical sector (+ 9.6%) – the latter two sectors jointly contribute almost two thirds to the annual output growth.

Conversely, the only manufacturing sector that remains in large decline on an annual basis is that of means of transport (-11.7%, although an improvement compared to the previous month). Overall, production in the manufacturing sector alone is up by 5.6% compared to a year earlier.

After having risen by 1.5% qoq in the first three months of the year and by 1.2% qoq in the 2nd quarter, industrial production maintained a good pace of growth in the summer quarter, although slowing down. at 1% qoq. We expect a more marked deceleration in the current quarter, when industrial production could result in only a marginal increase compared to the previous three months.

Overall, in Italy as elsewhere, the industrial sector is held back by bottlenecks in international production chains, visible by the lengthening of delivery times and by the increases in input costs highlighted by business surveys.

This problem has acquired increasing importance in recent months, but appears less dramatic in Italy than in other Eurozone countries (in particular in Germany): this could be due to the lower weight of the transport sector as a percentage of the manufacturing sector in Italy. compared to the other main countries; moreover, compared to Italy, Germany has a greater share of the production chain which is delocalized, in particular towards Asia. These considerations help explain why Italy is the only one of the four main economies of the Eurozone to have fully recovered the pre-pandemic levels of industrial production (in September, the industrial output in Germany was lower than 10, 7% compared to February 2020 values).

In any case, a slowdown in manufacturing activity is already underway, and could continue in the coming months as supply bottlenecks could persist throughout the first half of next year. The contribution of the industry to the added value could be substantially zero in the current quarter, and it is unlikely that the sector will be a driving force for GDP even looking at the first half of next year.

In the next 6-9 months, the recovery margins for services seem large enough to compensate for the weakness of the industry, but this dynamic could become more uncertain as time passes: if the difficulties in the manufacturing sector persist beyond the middle of 2022 , serious downside risks for the entire economy could arise. This is not our central scenario: we confirm the idea that this brake factor may turn out to be of a transitory nature, and that the expansionary trend of GDP can continue next year, even if our current forecast for Italian GDP in 2022 is more cautious than that of consensus (4% against 4.3%, after an expected 6.2% this year).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-va-lindustria-in-italia-rispetto-alla-germania-report/ on Wed, 10 Nov 2021 14:52:17 +0000.