How Leonardo will go according to Leonardo

The Italian aerospace and defense group reported results from January 1 to December 31, 2022 together with 2023 guidance. Here's what Leonardo predicts for Leonardo's future

Leonardo is optimistic about the 2023 guidance, but not too much according to some analysts.

Last week, the Italian aerospace and defense group reported the results from January 1 to December 31, 2022, approved by the board chaired by Luciano Carta. In particular, Leonardo recorded a net result up by 58.5% to 932 million. Revenues also increased by 4.8% to 14.7 billion, as did orders, equal to 17.3 billion (+21%).

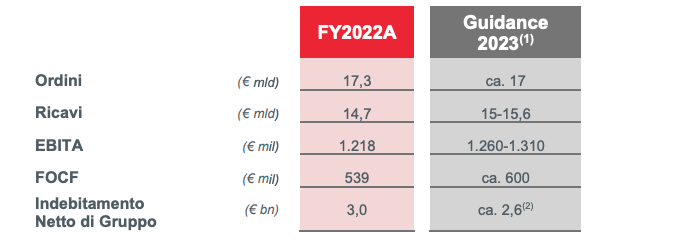

Furthermore, the management of the company led by Alessandro Profumo has communicated financial estimates for 2023. The guidance for the current year foresees: orders at approximately 17 billion, revenues at 15-15.6 billion, ebitat at 1.26- 1.31 million, debt of about 2.6 billion.

Leonardo sees a positive outlook in the main defense markets because "due to growing geopolitical tensions, governments are re-evaluating their need for security with consequent increases in defense spending" and "the main markets will record sustained growth in demand with a Overall market Cagr expected to be around 6%”. In this scenario, "we are very well positioned to benefit from this increase in defense budgets in all our main markets" observed Lucio Valerio Cioffi, general manager of Leonardo, during the presentation of the 2022 results to analysts.

All the details.

LEONARDO'S GUIDANCE 2023

As the company's note explains, “the expected trend in 2023 confirms the path of sustainable growth accompanied by an increase in profitability and cash generation, albeit in a context characterized by high volatility at the macroeconomic and geopolitical level. The actions promptly implemented by the Group made it possible to mitigate the effects generated by inflationary pressures as a result of the Russia-Ukraine conflict".

Based on current assessments – continues the group – of the impacts of the geopolitical situation on the supply chain, on inflationary levels and on the global economy, subject to any further significant aggravations, Leonardo forecasts for 2023: high levels of new orders for approx. €17 billion, confirming the good positioning of the Group's products and solutions and the ability to effectively control key markets.

REVENUES, EBITA AND CASH FLOW

As regards revenues, the company estimates “€ 15.0 – 15.6 billion, up on 2022 thanks to the contribution of new orders and the development of assets in the portfolio on defense and government programmes; increasing profitability, with EBITA of € 1,260 – 1,310 million, supported by the growth in volumes and the confirmation of excellent levels of industrial profitability in the main business areas, despite the presence of a business mix still characterized by programs under development and significant share of revenues generated as prime contractor; the forecast reflects, albeit gradually improving, the difficulties in civil aeronautics, in particular aerostructures. On the FOCF, the group expects a figure of 600 million euros, with the defense and government business guaranteeing solid cash generation while the cash absorption in Aerostructures continues, albeit to a lesser extent than in 2022.

Furthermore, Leonardo estimates a Net Debt of the Group of approximately 2.6 billion euros "thanks to the generation of cash and net of the expected payment of dividends of € 0.14 per share and new leasing contracts for approximately 100 million". Below is the summary table.

THE WORDS OF DG CIOFFI

“In our domestic markets, we are seeing rising levels of spending with Italy expected to reach NATO's spending target of 2% of GDP by 2028, the UK increasing spending towards 3% by 2030 and the Poland towards 4% in 2023” explained the general director Lucio Valerio Cioffi. To this, he continues, “must be added a strong level of spending in the United States and we are also seeing growing levels in geographical areas such as the Middle East and North Africa where we have built stronger positions to create new opportunities”. To sum up, he concludes, “we are confident that our current positioning will allow us to benefit enormously from higher overall defense spending, customers expediting orders, and also expenses for replacing or upgrading equipment and systems that have become obsolete.” .

THE COMMENT OF THE ANALYST

Yet according to some analysts, the guidance provided by Leonardo's management is "shy".

“Profitability is growing and net debt is falling, offering Leonardo the main ingredients an investor would like, but the projections remain slightly timid for 2023, with revenues growing by 2% – 6%, compared to a + 5% in 2021 and +4% in 2022)” is the immediate comment by Gabriel Debach, market analyst at eToro, quoted by MF . "With many investors betting on the defense sector, in a context of higher international spending, the expectations are likely to be higher".

"The guidance on 2023 is judged in the expectations by UBS which adds how instead the long-term guidance has been updated by forecasting cumulative orders in the period 2022-26 for 90 billion which is higher than the 85 billion of the consensus" notes Radiocor . For Citi, "which continues to consider the Leonardo stock undervalued (buy), the consensus is already projected towards the highest range of the 2023 guidance".

Finally, for Akros the messages coming from results and outlook are positive both in the short and medium term and furthermore the 2023 guidance has good upside potential.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-andra-leonardo-secondo-leonardo-guidance-2023/ on Mon, 13 Mar 2023 09:48:59 +0000.