How Poste Italiane’s 2023 accounts will close

Net profit and revenues will increase for Poste Italiane in the first nine months of 2023. The company led by Matteo Del Fante has thus revised its operating profit guidance upwards. Here are the growing sectors and those in retreat

Financial results growing in the first nine months of 2023 for Poste Italiane which raises its guidance.

The group led by Matteo Del Fante closes the accounts for the first nine months of 2023 with a net profit of 1.5 billion euros, +5.8% compared to the same period of the previous year despite a decreasing third quarter net profit by 15.9% to 382 million. In the nine months, with revenues growing by 6.8% to 8.9 billion and an operating result (Ebit) growing by 1%, the company revised its operating result guidance upwards "driven by an exceptional financial performance ” and sees 2023 Ebit at 2.6 billion (from the original target of 2.5 billion euros).

“The results of the first nine months of 2023 go beyond our strategic plan”, comments CEO Del Fante, who among other things announces the break even at the operating profit level already in the 2023 financial year for the 'mail, parcels' sector and distribution with a result "above guidance".

There is also a reward coming for shareholders: the interim dividend of 24 cents per share will also be paid on November 22nd.

All the details.

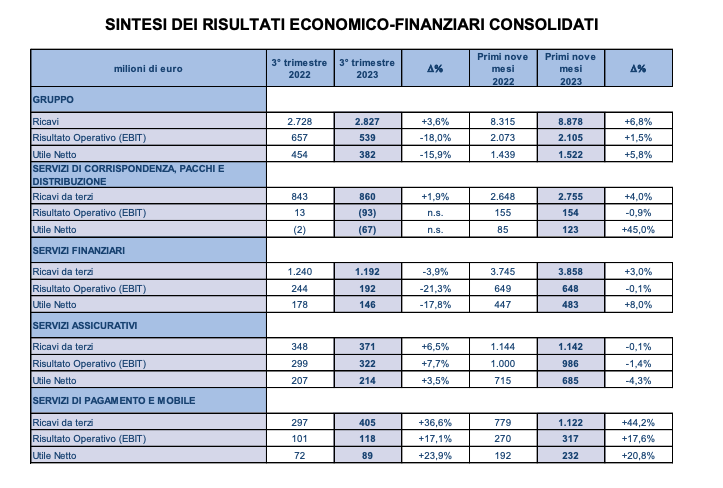

POSTE ITALIANE'S RESULTS IN SUMMARY

In the third quarter, Poste Italiane achieved revenues of 2.8 billion, up 3.6% on year, while in the nine months turnover stood at 8.9 billion, up 6.8%.

The operating result amounted to 539 million in the third quarter, down 18%; in the nine months it amounted to 2.1 billion, up by 1.5%, including a one-off budget bonus for employees amounting to 90 million. Net profit for the third quarter stood at 382 million, down 15.9%; in the nine months it amounted to 1.5 billion, up 5.8%.

PARCEL MAIL SECTOR BREAK-BREAK IN 2023

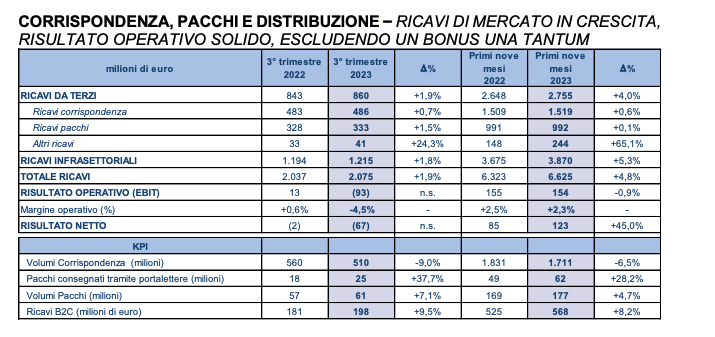

Revenues from mail, parcels and distribution increased by 1.9% to 860 million (2.8 billion in the nine months of 2023, up 4%), thanks to increasing parcel volumes, repricing actions on rates and a better mix of products in correspondence.

In particular, the company expects that the 'traditional' mail, parcel and distribution sector of Poste Italiane, in terms of operating profit, will reach break even in the 2023 financial year, earlier than expected, driven by the still growing parcel shipping sector which compensates for the physiological decline in volumes of traditional correspondence (supported in revenues by the revision of tariffs).

“All segments contributed to the division's revenue growth thanks to revised postal rates and a favorable business mix, as well as growth in parcel volumes. In light of these excellent results, we expect that the operating result (Ebit) for the full year 2023 of 'Mail, Parcels and Distribution' will be higher than our guidance and break-even", explained Del Fante presenting the results achieved by company in the first nine months of the year.

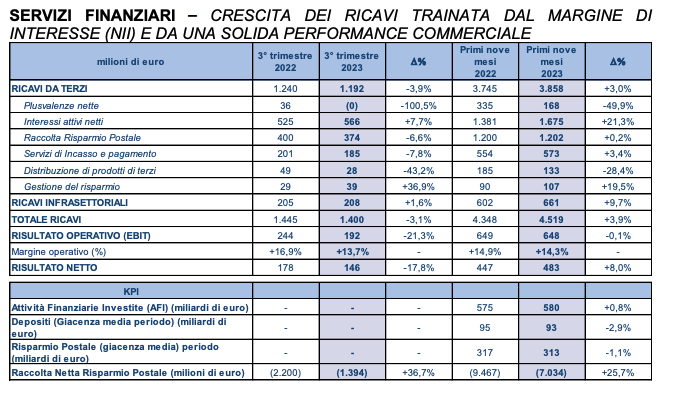

FINANCIAL SERVICES DOWN

Total financial services revenue was $1.4 billion in the third quarter, down 3.1% year over year.

GROWTH FOR INSURANCE SERVICES

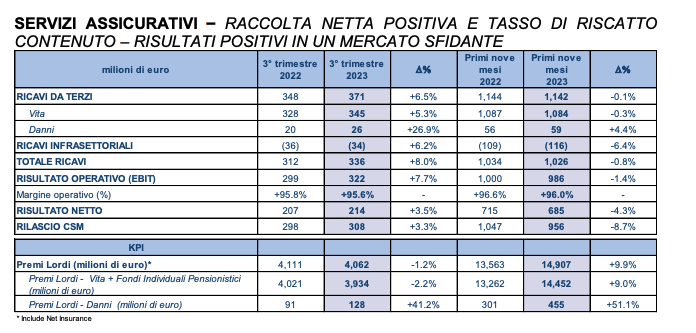

Revenues from insurance services stood, again in the third quarter, at 371 million, up 6.5%. Specifically, non-life insurance net revenues increased 27% in the quarter, supported by higher gross premiums in the protection business and the consolidation of Net Insurance.

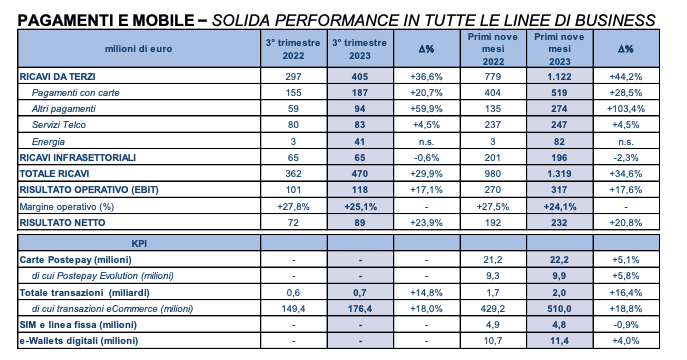

THE PAYMENTS AND POSTEPAY SECTOR

Revenues from payments and mobile stood at €405 million in the third quarter, up 36.6% year-on-year (+44.2% in the nine months), driven by solid performance across all business lines and benefiting from Lis consolidation .

COSTS INCREASE IN THE QUARTER WITH A ONE-OFF GRANT TO EMPLOYEES OF A THOUSAND EUROS

Total costs for the third quarter amounted to 2.3 billion, up 10.5% on an annual basis compared to the third quarter of 2022 (+8.5% in the nine months), including a one-off bonus for employees from 90 million, with a continued focus on rationalization in the current inflationary context.

Poste Italiane will in fact pay the one-off sum of one thousand euros to all employees agreed last August in November.

The "solid results" achieved in the first nine months of the year – explains CEO Matteo Del Fante – "were possible thanks to the dedication and resilience of our people, who work tirelessly to meet the needs of Italians, with particular attention constantly innovating and improving the customer experience. We are therefore pleased to be able to pay all our employees a one-off bonus of one thousand euros, agreed in August and payable in November. This bonus also has the aim of mitigating the inflationary dynamics during the period of validity of this agreement. In the meantime, negotiations are underway for the new collective agreement for the period 2024-26."

PLUS SIGN FOR FINANCIAL ACTIVITIES

Furthermore, Poste also saw the increase in financial assets which amounted to 580 billion, up by 4 billion compared to December 2022, supported by a positive market effect of 5.7 billion. Positive net collections on savings and investment products amounted to 0.8 billion in the nine months of 2023, thanks to significant flows from 'Target maturity fixed income' funds and positive collections in the insurance sector, in a challenging context, mitigating the lower activity in savings. As for the capital position, the total capital ratio of Bancoposta is equal to 24.2% (of which Cet1 Ratio equal to 20.7%), the leverage ratio equal to 3.2% and the Solvency II Ratio of the Poste Vita insurance group equal to 252%, above managerial ambition.

THE WORDS OF DEL FANTE

“The favorable interest rate environment supported the recurring interest margin (NII), helping to support the resilience of the revenue trend of our financial services” commented CEO Matteo Del Fante.

“The positive net collection in the insurance sector is above the market level – continues the number one of Poste – and is combined with an early redemption rate lower than half the market rate, contributing to the success of our insurance business in a challenging market context. The 'non-life' insurance sector continues to grow, also thanks to the consolidation of Net Insurance, which represents a factor capable of accelerating the growth of the Protection business”. The payments and mobile area continues "to record double-digit growth, thanks to our leadership in e-commerce, the greater use of our cards due to the structural migration from cash to electronic payments, as well as the consolidation of Lis", he said. added.

“Thanks to our proven business model which leverages diversification – continues the CEO of Poste Italiane – we consistently achieve financial results above our objectives, driven by commercial performance and cost rationalization”.

POSTE ITALIANE'S 2023 GUIDANCE REVISED UPWARDS

Therefore, continues the CEO of Poste Italiane, “Based on these solid results, we are pleased to revise our guidance on operating profit (Ebit) for 2023 upwards, from the original target of 2.5 billion to 2.6 billion."

“We continue to invest, further enhancing our capabilities in technology, products and people, diversifying our businesses, while preserving our strong balance sheet.”

THE NEW STRATEGIC PLAN COMING IN 2024

Meanwhile, the CEO is "working on the new strategic plan which we will present – he explains – next year together with the results for the entire 2023 financial year. With the new plan we will outline the strategy underlying the transformation of our logistics business and evolution of our service model, aimed at maximizing the value of our platform". “We are proud – concluded Del Fante – to be able to once again affirm our ability to generate positive results in different market contexts, a factor that will continue to be among the strong points of our business model”.

FROM NOVEMBER 22nd PAYMENT OF INTERNAL DIVIDEND

Approving the results of the first nine months, the board of directors of Poste Italiane resolved the distribution of an interim dividend expected for 2023 of 0.237 euros per share, "for a total of 307 million, which is an increase of 13% compared to to last year" specified Del Fante. It will be paid from November 22nd with ex-dividend date on the 20th and record date on the 21st.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-si-chiuderanno-i-conti-2023-di-poste-italiane/ on Tue, 07 Nov 2023 10:51:03 +0000.