How sparkling are the confidence indices of households and businesses

The data on the confidence of households and businesses communicated by Istat and relating to the month of July were once again stronger than expected. The comment by Paolo Mameli, senior economist of the Studies and Research Department of Intesa Sanpaolo

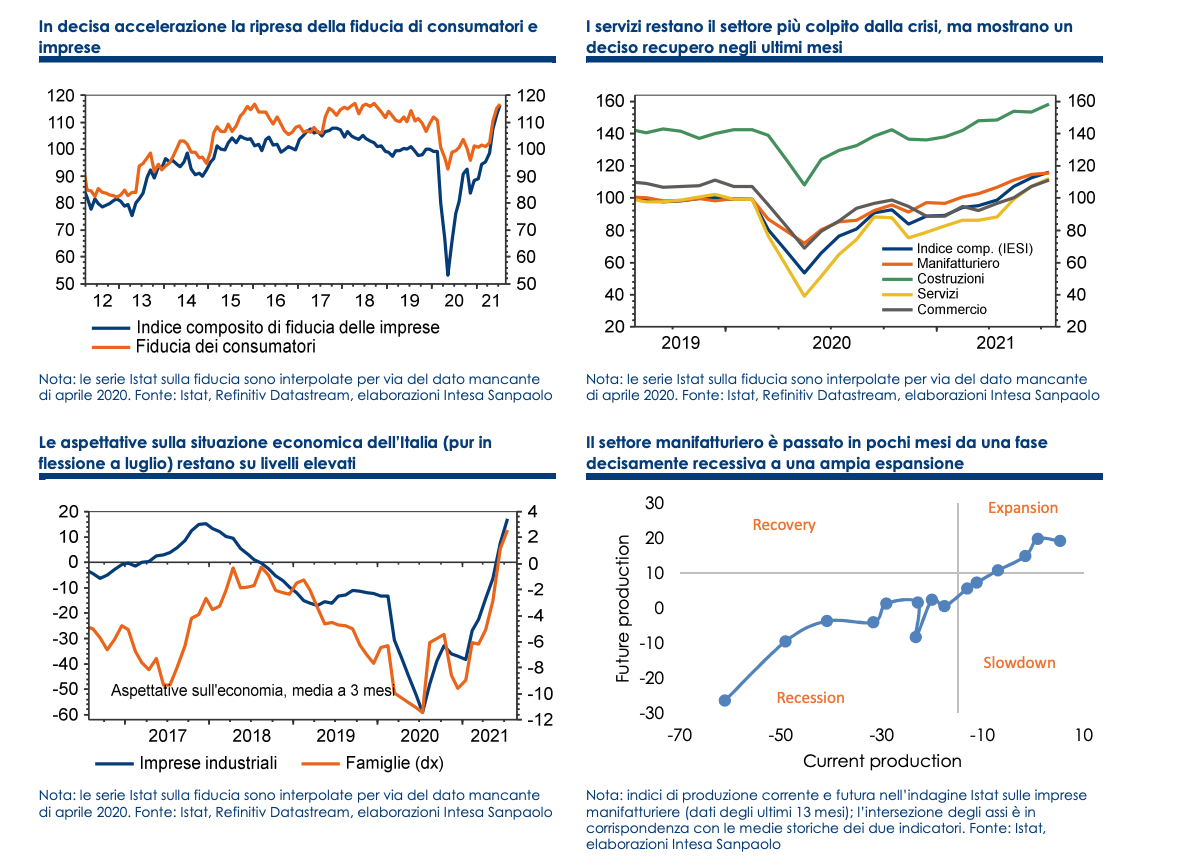

The data on the confidence of households and businesses communicated by Istat and relating to the month of July were once again stronger than expected: all the main indicators showed an improvement compared to the previous month (particularly large for the confidence of companies in the sector services), which brings the indices back to levels higher than those pre-Covid, or to new highs for two decades in the case of industry and construction.

Consumer confidence rose for a fourth consecutive month in July, to 116.6 from 115.1 last month. The data is stronger than the consensus estimates (which stood at 115.5) and brings the index to the highest since September 2018. The improvement is driven by the national economic climate, which improves more than the personal situation of the interviewees (which in any case reaches a new all-time high), and judgments on current conditions, while expectations for the future are less optimistic (but the correction appears physiological after last month a record was reached in the history of the series). Expectations on Italy's economic situation (which, moreover, had also reached an all-time high in June) also correct. Unemployment expectations rise for the second month: this is a sign that families are worried about the possible effects of the gradual end of the layoff freeze, consistent with our idea that a turning point for the labor market is not yet imminent.

The Istat composite index on business confidence rose for the eighth consecutive month, to 116.3 from a previous 112.8: this is an all-time high. All the main macro sectors recorded an improvement. The recovery is particularly strong for services (to 112.3 from 107), for the retail trade (to 111 from 107.2) – which recorded new highs respectively from June 2017 and from December 2019 – and for construction , where morale reached its highest level since January 2000 (158.6 from 153.6 previously).

In the manufacturing sector, business confidence once again rose more than expected, to 115.7 in July from 114.8 in June: this is a new record since November 2000. Progress is driven by current assessments on orders. (from the domestic market) and on production (and a drop in inventories), while current orders from abroad and expectations on orders and production (and the economy) are down compared to last month, when however they were touched of the maximum twenty years. Expectations on sales prices have risen to new records, a sign of the growing temptation of companies, at least in some industrial sectors, to pass inflationary pressures downstream in the production chain.

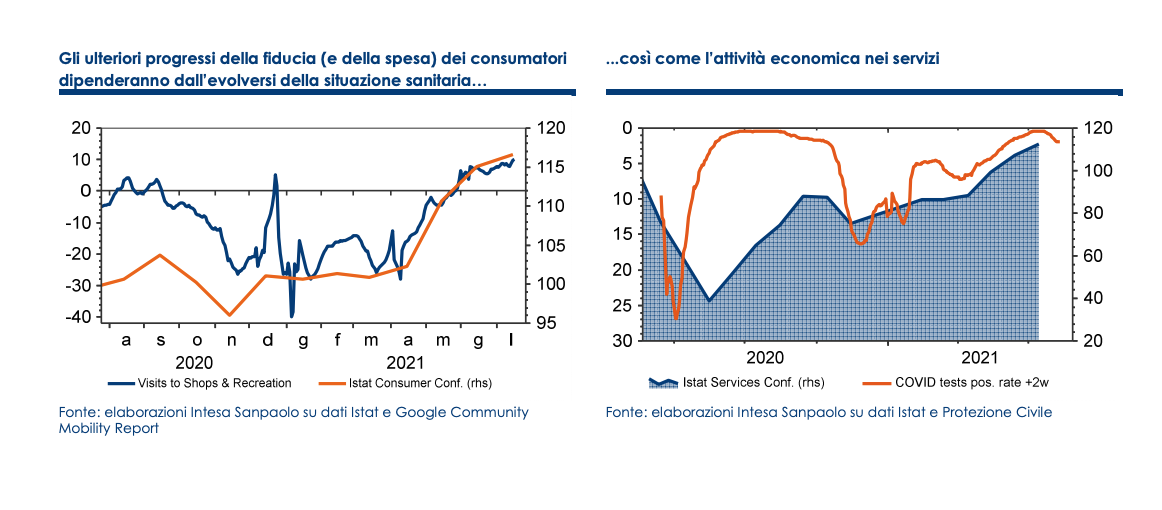

In summary, the round of confidence surveys in July was, as in the previous two months, much better than expected. The resumption of personal mobility following the "reopening" of the economy has been faster than expected, as can be seen from the fact that mobility towards shops and leisure activities (according to the indicators released by Google) is at its highest since the outbreak of COVID . This is benefiting above all from services and commerce, in the presence of a continuing expansion trend in manufacturing and construction.

Moreover, some signs of lesser vigor regarding future expectations also emerge from the investigations: the doubts of families and businesses about the continuation of the recovery at current rates could be linked to concerns about the rise in infections, also as a result of the spread of the "Delta ". If this trend continues, surveys may show a correction (from very high levels) in August.

Istat will release the preliminary data on GDP in the second quarter of the year the day after tomorrow. Our forecast is more optimistic than the consensus and sees an expansion of one and a half percentage points in the quarter. The July surveys indicate that the economy could maintain a very strong pace (between 1.5% and 2% qoq) also in the summer quarter, driven by consumption on the demand side and services on the supply side ( components that had slowed GDP the most during the most acute phase of the crisis). The ongoing rise in infections is unlikely to derail the recovery in the summer months (at least as long as hospitalizations remain at low levels); however, greater uncertainty could relate to the autumn quarter.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-sono-frizzanti-gli-indici-di-fiducia-di-famiglie-e-imprese/ on Wed, 28 Jul 2021 11:31:18 +0000.