How the budgets of state-owned companies celebrate. Report Comar

All the details on the "Report on the financial statements of state-owned companies 2017-2021" prepared by the CoMar study center, comparing the end of 2021 and 2020, with the forecasts for 2022

Excellent state of health and good prospects for state-owned or controlled companies.

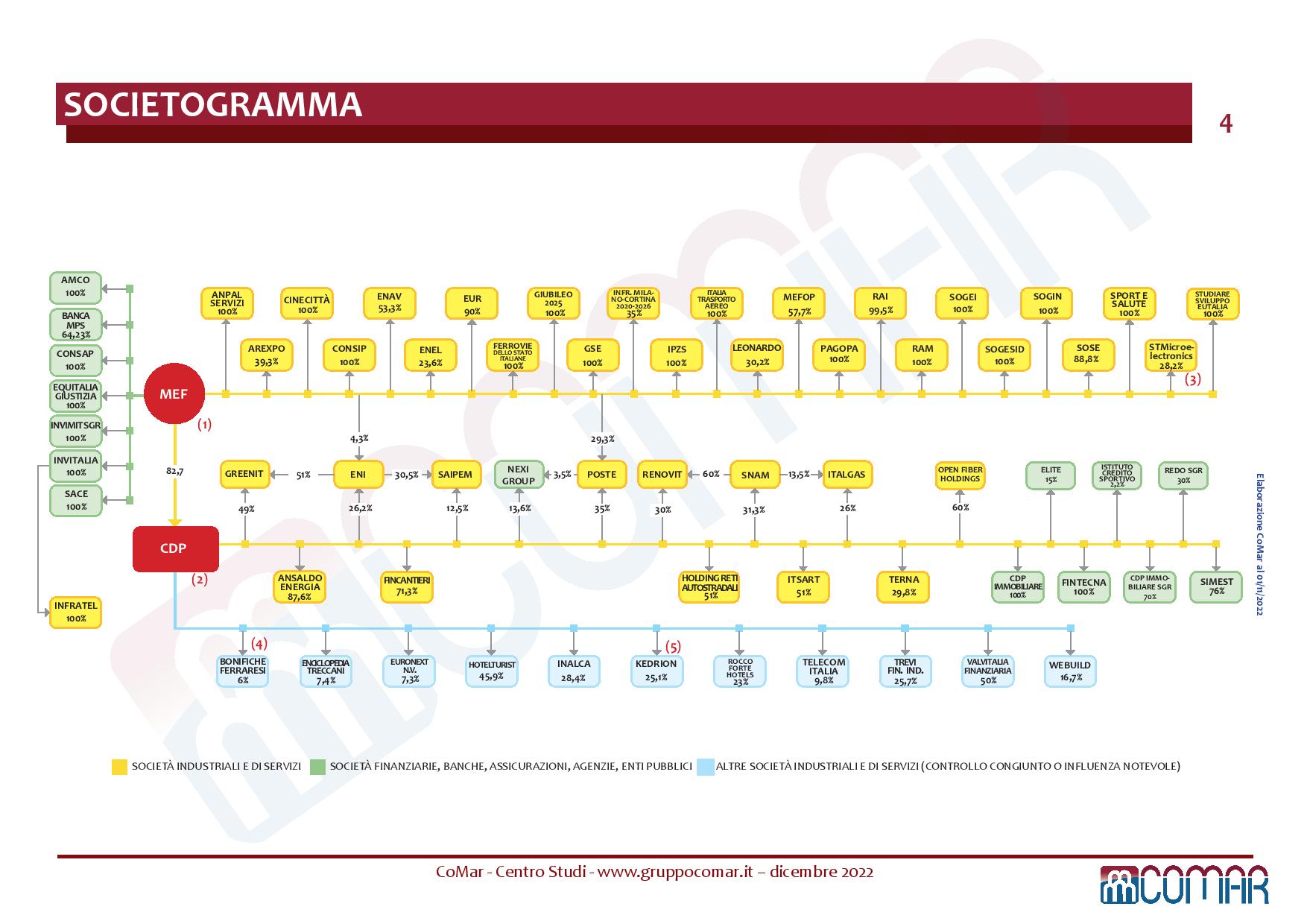

The 34 industrial and service companies controlled by the State, through the Ministry of Economy and Finance, show that they have overcome the difficult period of the pandemic and face with good prospects the uncertainties deriving from the growth in raw material costs, from inflation at the top, by the rise in interest rates, by a slowdown in consumption.

This is essentially what emerges from the latest report of the Comar study center: the fourth edition of the "Report on the financial statements of the state-owned companies 2017-2021" in the comparison between the end of 2021 and 2020, with the forecasts for 2022.

CoMar's analysis also evaluated the trend for 2022, based on the data for the first 9 months that 11 listed companies communicated to the markets, comparing them with similar data for the first 9 months of 2020. These 11 companies represent among the 75 and 80% of the total turnover and profits of the State Subsidiaries examined. Therefore, in the 12 months September 2021 – September 2022:

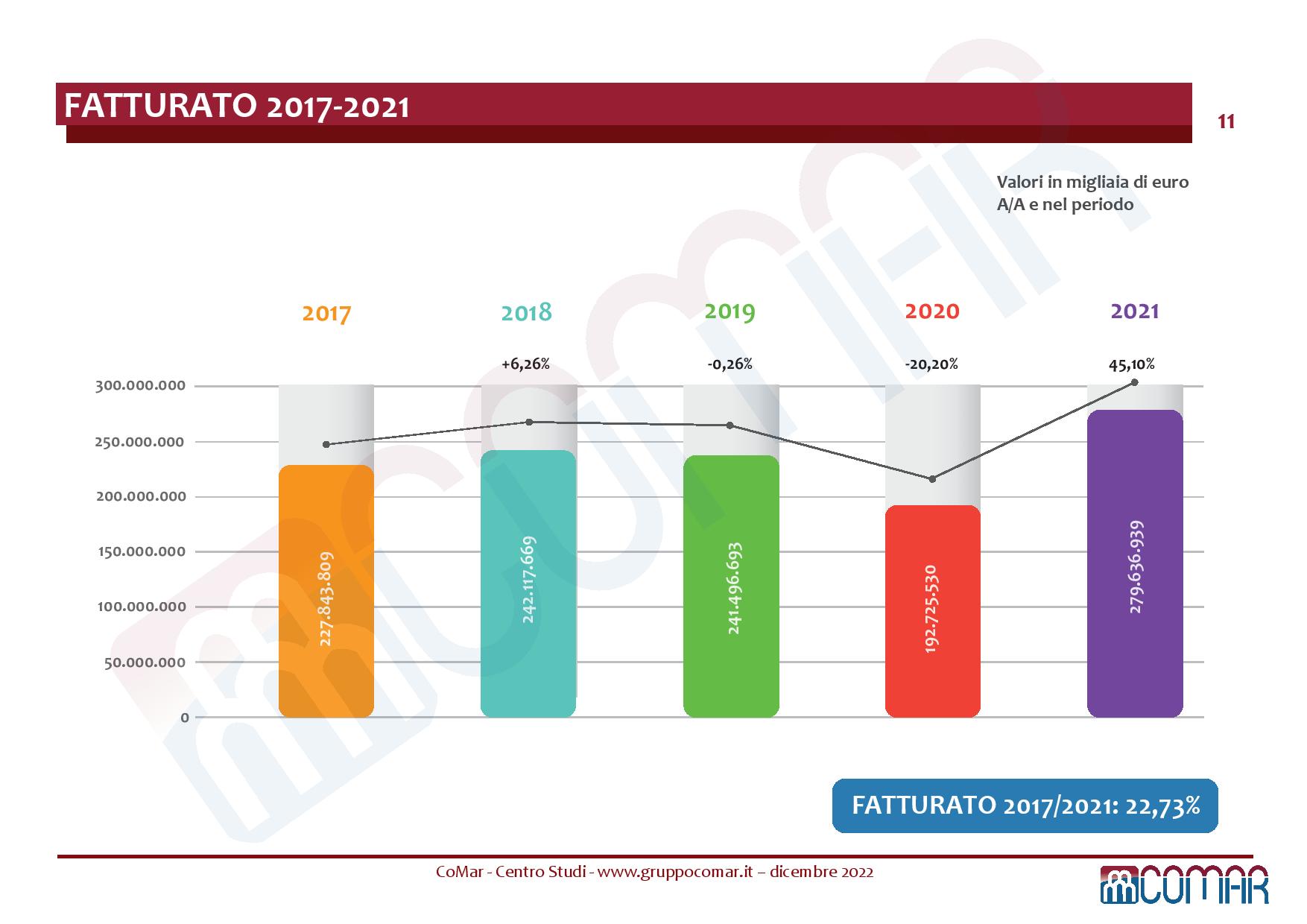

The total turnover of state-owned companies was 279.6 billion, an increase of 86.9 billion euro (+45.1%); profits amounted to 11.4 billion, an improvement of 15.6 billion euro on previous losses; debts amounted to 182.8 billion, up by 18.6 billion (+11.3%); employees are 462,880 (+1.13%).

In the analysis, more specifically, it is highlighted that:

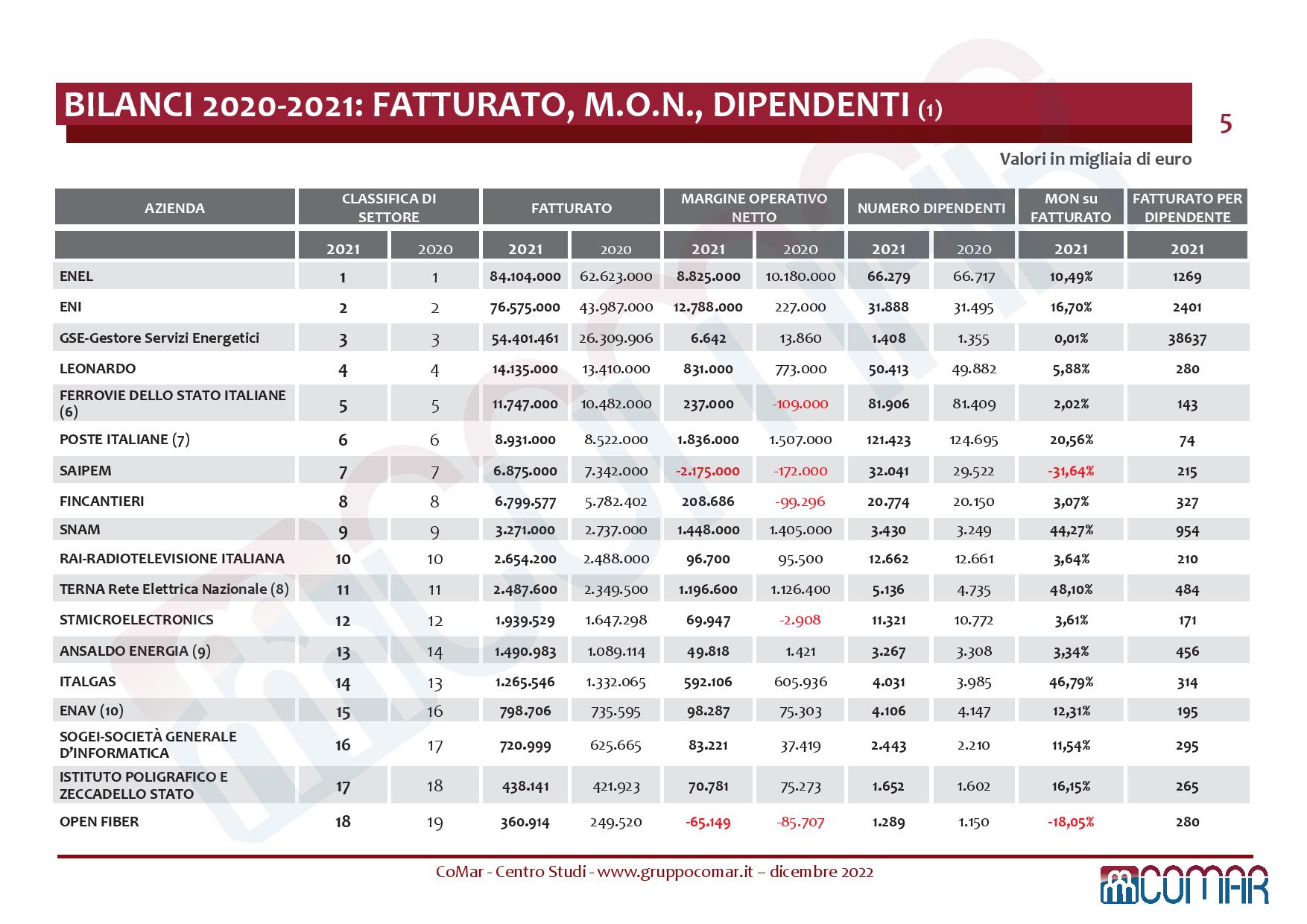

- the total turnover was 279.6 billion euros, up on the 192.7 billion in 2020; even more in comparison with 2017, for an increase of 51.7 billion euro;

- considering the breakdown of turnover by individual business sectors in 2021, 87.2% is achieved in networks and infrastructures, divided between 79.5% of energy and 7.7% of transport and telecommunications; 10.4% is attributable to mechanics; shares slightly above 1% for publishing, entertainment, sport and ICT; residual quotas, close to 0, by environment and territory or for services to the PA;

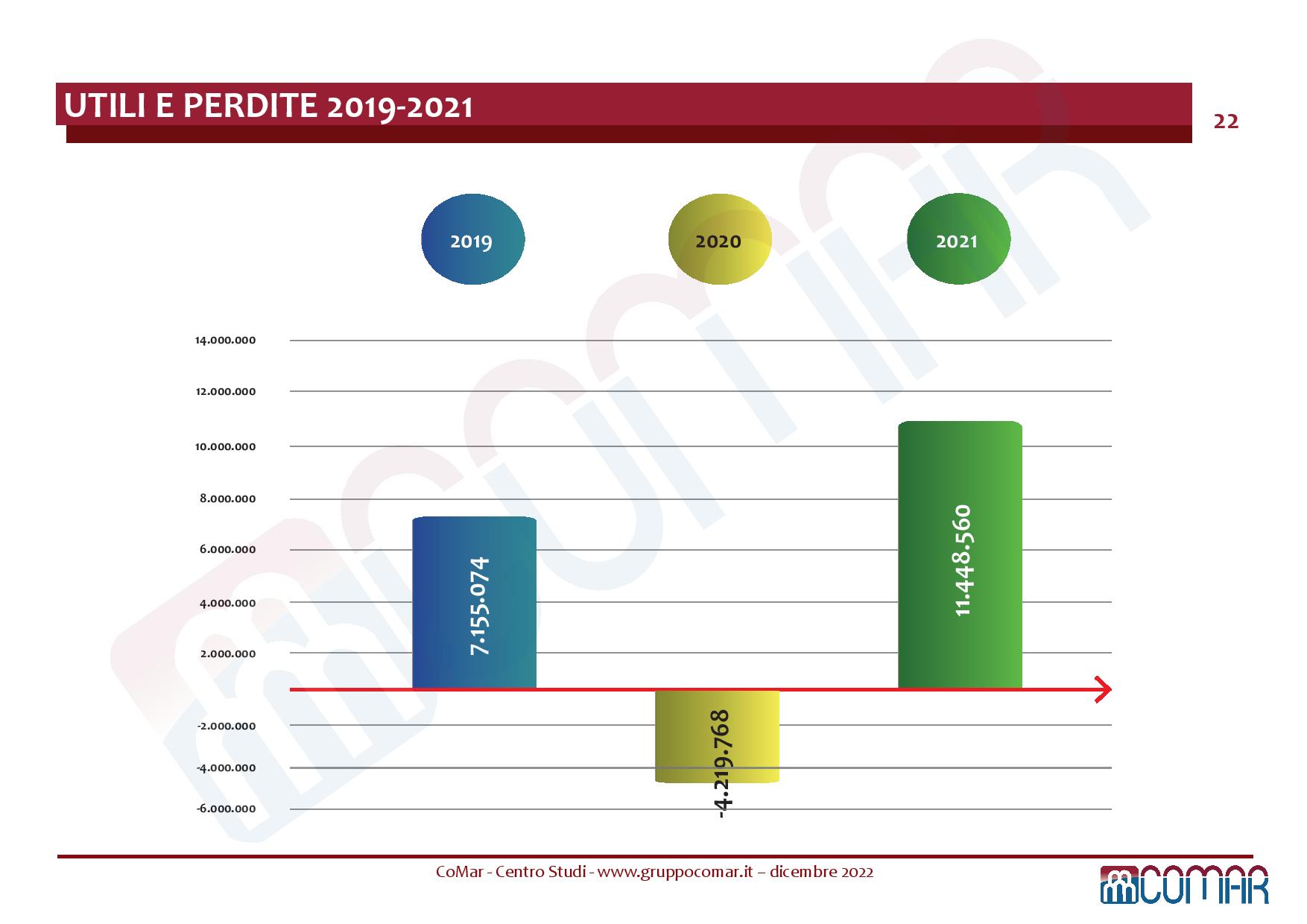

- the accrued result recorded profits of €11.4 billion, against losses of €4.2 billion in 2020; bringing in a positive balance of 14.3 billion in the three-year period 2019-2021;

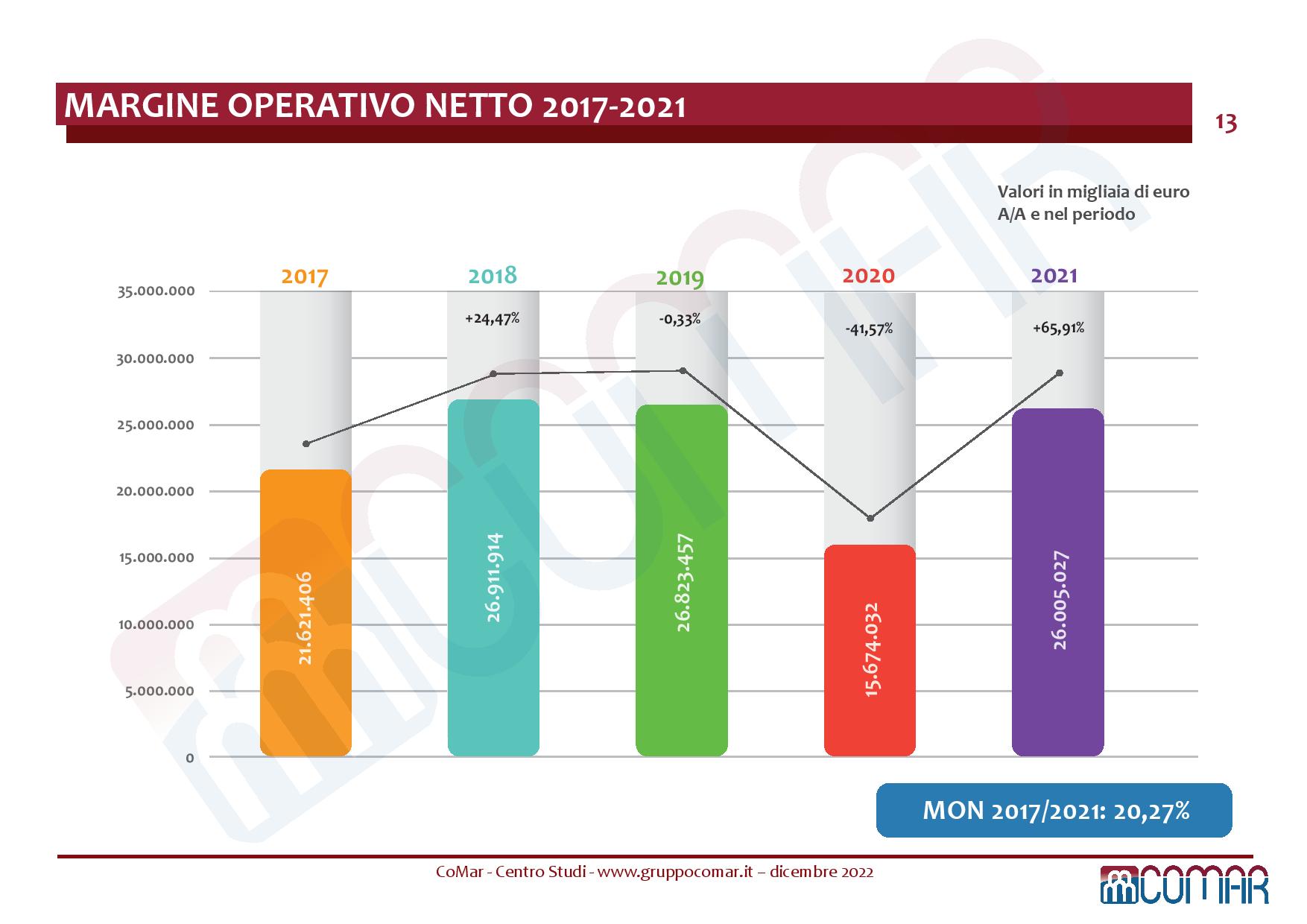

- EBIT was 26 billion euros, a significant improvement (+10.3 billion; +65.9%) on the 15.6 billion of 2020, but also on the 21.6 of 2017 (+20.2% );

- the trend of the aforementioned values determined the ratio between net operating margin and turnover, which rose to 9.3% between 2020 and 2021, which was lower than the 11% of the two-year period 2018-2019;

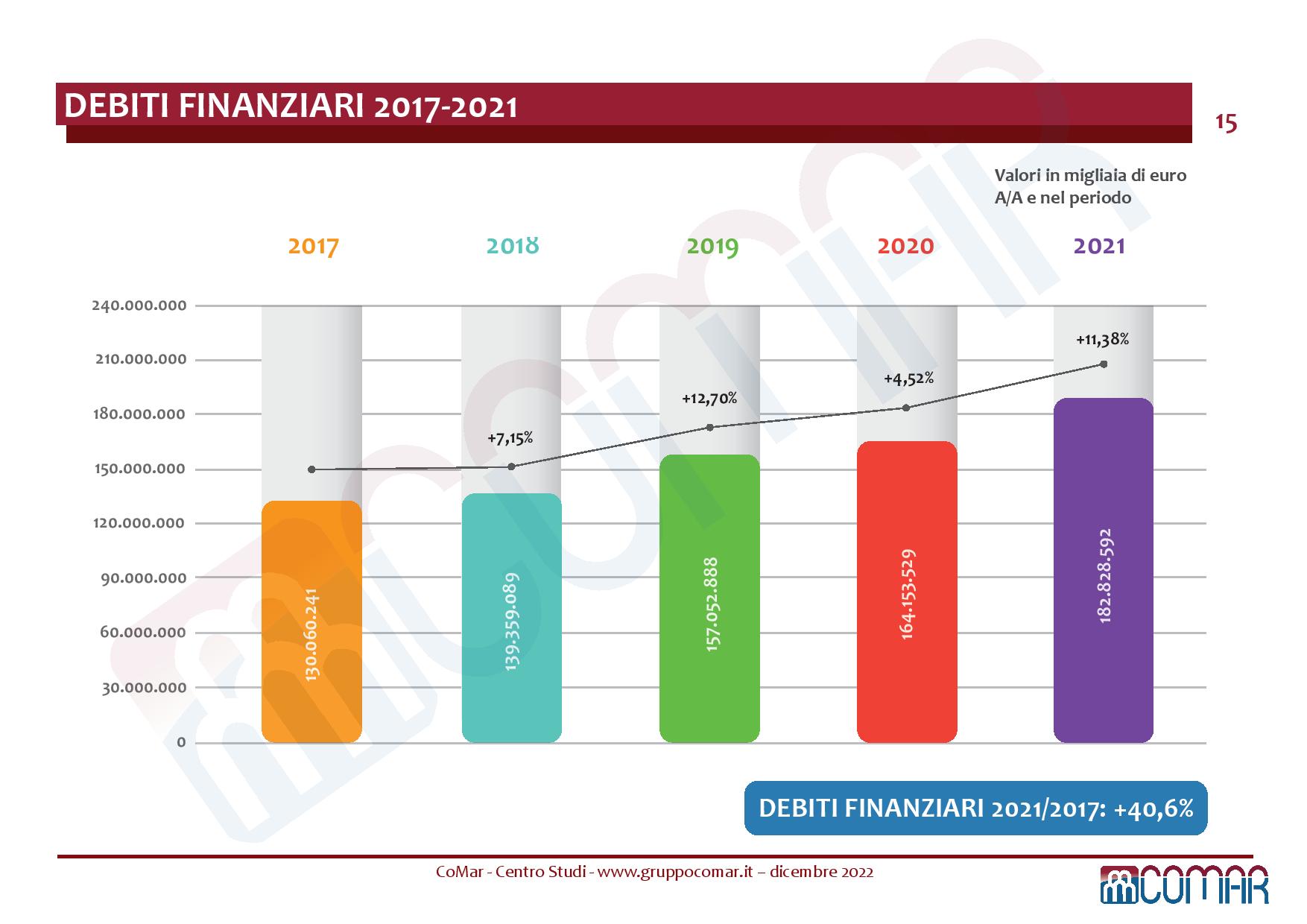

- financial debts, between 2020 and 2021, increased from 164.1 billion euros to 182.8 billion; increase of over 52 billion on 2017 (+40.6% in the five-year period);

- the ratio between financial payables and turnover stands at 65.3%, when it was 57% in 2017;

- with regard to employees, these oscillate, in the five-year period 2017-2021, around 460,000 (from a minimum of 457,648 in 2017 to the current 462,880;

- the turnover per employee was 604 thousand euros in 2021, up from 498 thousand in 2017.

As regards the rankings of the individual companies, even considering the diversity of the respective sectors to which they belong, with reference to the 2021 financial statements:

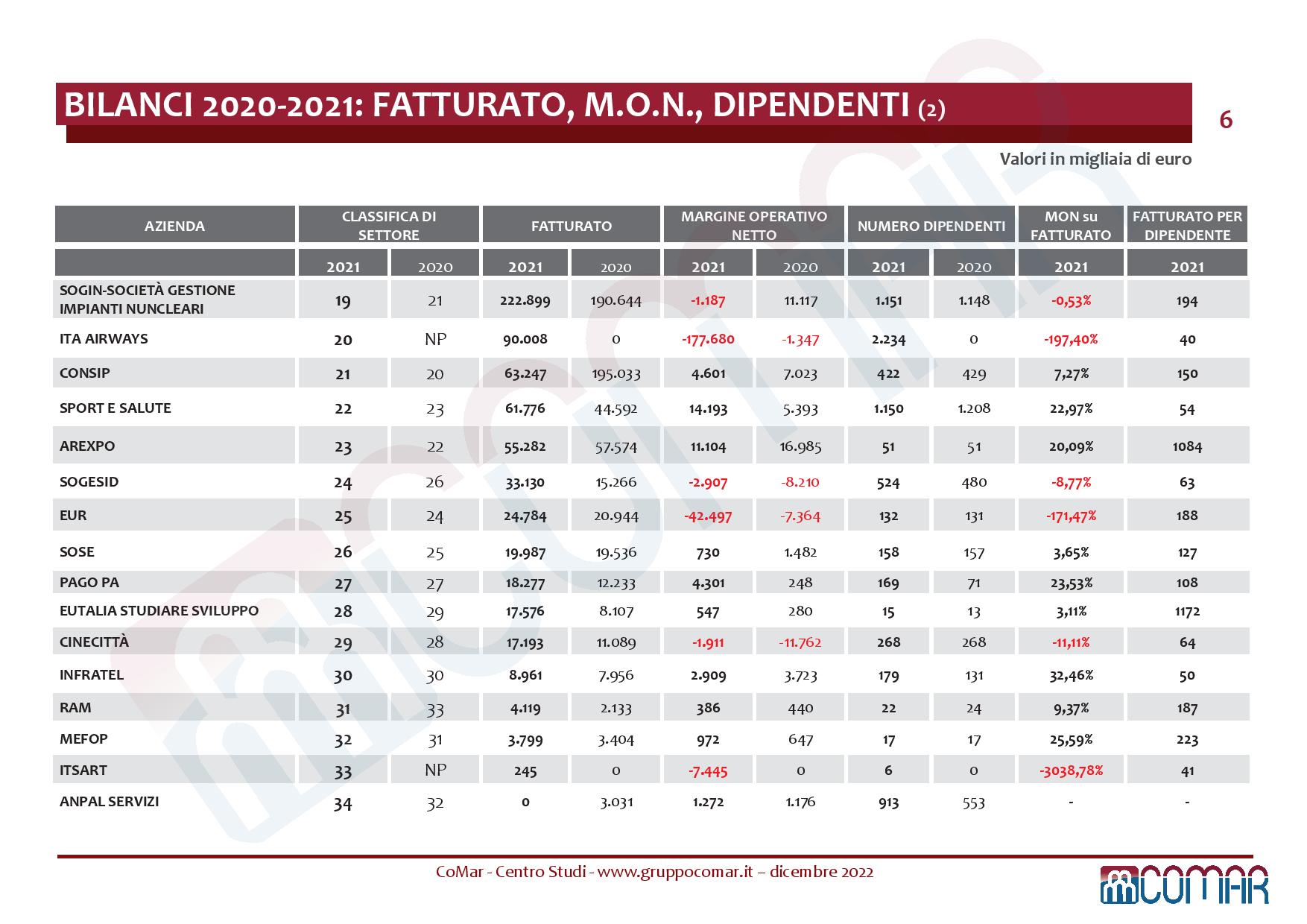

- the companies with the best “results on turnover” ratio are Snam (+45.7%), Terna (+31.7%), Italgas (+28.6%), Infratel (+27.3%), Sport and Health (+20.6%), Post (+17.6%); the worst were Itsart (-3,039.5%), Eur (-173.4%), Ita Airways (-164.3%), Open Fiber (-58.1%), Saipem (-35.8%);

- the companies with the best “mon on turnover” ratio are, in order, Terna, Italgas, Snam, Infratel and Mefop; less well: Itsart, Ita Airways, Eur, Saipem, Open Fiber;

- 8 have both mon and negative results: Cinecittà, Eur, Ita Airways, Itsart, Open Fiber, Saipem, Sogesid, Sogin;

- the major employers are, in order: Poste, Ferrovie, Enel, Leonardo, Eni, Saipem;

- the companies with the best “turnover per employee” ratio are, in order: Gse, Eni, Enel, Eutalia Studiare Sviluppo, Arexpo; the worst: Ita Airways, Itsart, Infratel, Sport e Salute, Sogesid;

- the companies with the best “financial debts to turnover” ratio are, in order: Eutalia Studiare Sviluppo, Sogei, IPZS, Gse, Sogin; less well: Infratel, Open Fiber, Itsart, Sport and Health, Italgas.

Of the 34 companies, some have had very negative results for years, which have not been remedied. Others, more recently established, already show situations of serious problems.

CoMar's analysis also evaluated the trend for 2022, based on the data for the first 9 months that 11 listed companies communicated to the markets, comparing them with similar data for the first 9 months of 2020. These 11 companies represent among the 75 and 80% of the total turnover and profits of the State Subsidiaries examined. Therefore, in the 12 months September 2021 – September 2022:

• turnover increased from 142.4 billion euros to 247.4; it therefore increased, in one year, by 105 billion, with a +73.7%. In the increase, the following stand out: Enav (+106%), Eni (+100%), Enel (+84%), Saipem (+46%); the smallest increases, from 10% down, are by Snam, Italgas, Terna Leonardo and Poste;

• profit varied from 7 billion euros to 18.9 billion; it therefore increased, in one year, by 11.9 billion, more than doubling, with a +170.9%. Eni (+472%), Saipem and Leonardo (+189%); very limited profit increases for Italgas and Terna; if not in reduction, as for Enel.

In 2021, the public perimeter expanded, with the establishment and operational launch of new companies: Italia Trasporto Aereo (Ita Airways, from mid-October 2021) and Itsart. The enlargement continued in 2022, so that the new companies Jubilee 2025 and Infrastrutture Milano-Cortina 2020/2026 (SIMiCo) will also be taken into account in the next aggregates; as well as those, already existing, but recently repurchased by the State (Autostrade per l'Italia).

To the 34 companies already considered in this document, another 11 companies could be added, still industrial and service companies, where the MEF has non-controlling shares, although exercising influence (Telecom Italia, Webuild, etc.). The MEF's shareholdings in banks, insurance companies and agencies are also not included, which comply with different, non-comparable accounting standards, but which would make the role of the state in the economy even more evident (Amco, Banca MPS, Istituto Credito Sportivo, Sace, etc.).

In the ranking by turnover of all Italian companies, the entire podium is occupied by investee companies, like half of the top 10 positions (and 7 of the top 20). Their weight is also significant considering their presence on the Stock Exchange: 12 listed, with Eni and Enel in first and third place overall by capitalisation.

There are 12 listed companies: Enav, Enel, Eni, Fincantieri, Leonardo, Italgas, Poste Italiane, Raiway, Saipem, Snam, STMicroelectronics, Terna. For 4 of them, the percentage shareholding of the State (also considering CDP) is more than 50%: Enav (53.3%), Fincantieri (71.32%), Poste Italiane (64.26%), Raiway (65 %). The minor holdings are Enel (23.6%), Terna (29.85%), Eni (30.62%), Leonardo (30.2%), Snam (31.35%). In addition to these 12 listed companies, for listed financial instruments, Ferrovie dello Stato Italiane and Rai.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/bilanci-delle-partecipate-dello-stato-report-comar/ on Wed, 21 Dec 2022 08:43:16 +0000.