How the business of defense companies is flocking (including Leonardo and Fincantieri)

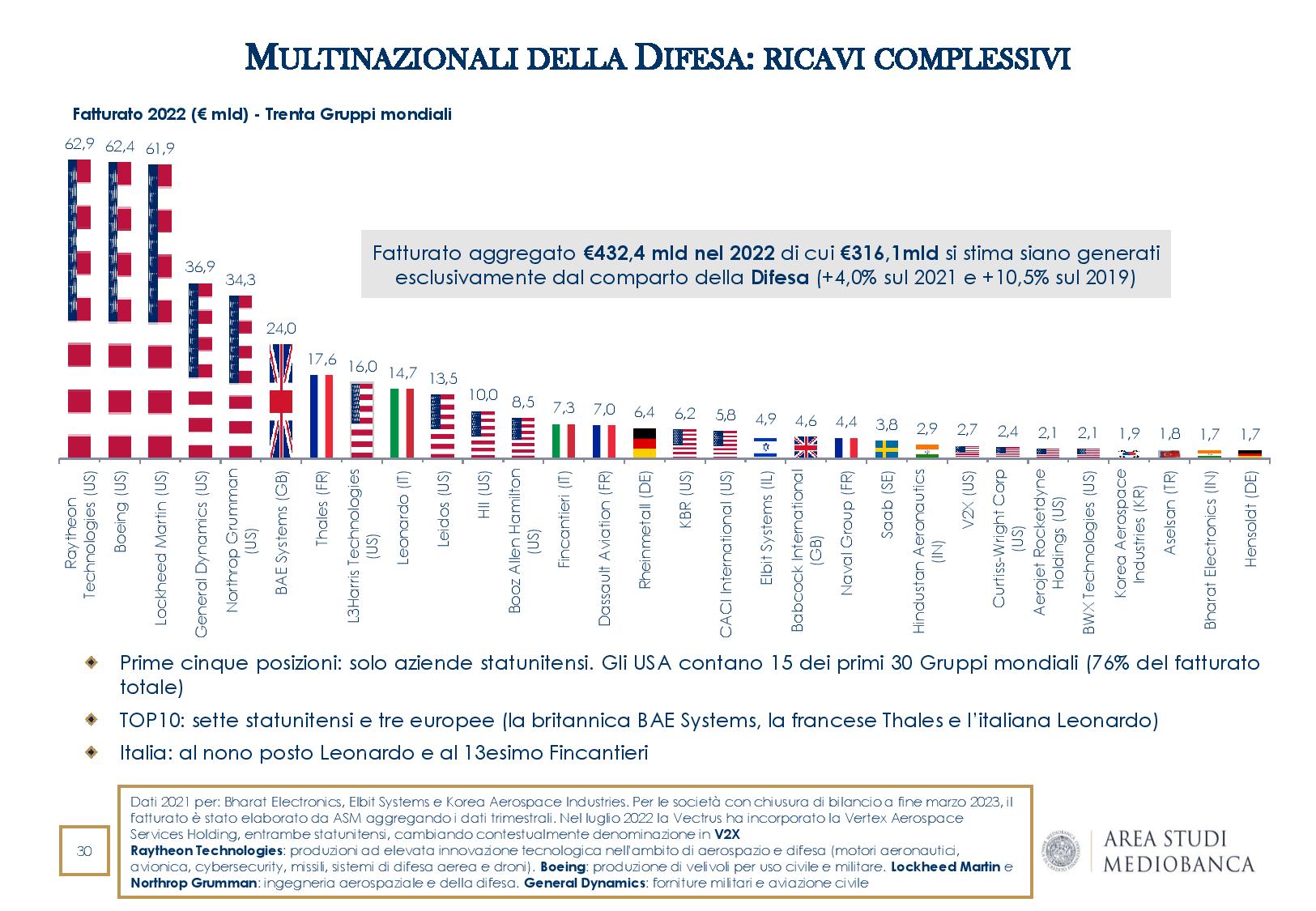

Leonardo is in ninth place in the top ten defense companies by turnover, while Fincantieri is thirteenth. This is what emerges from the focus of Mediobanca's research area on the 30 main global defense groups

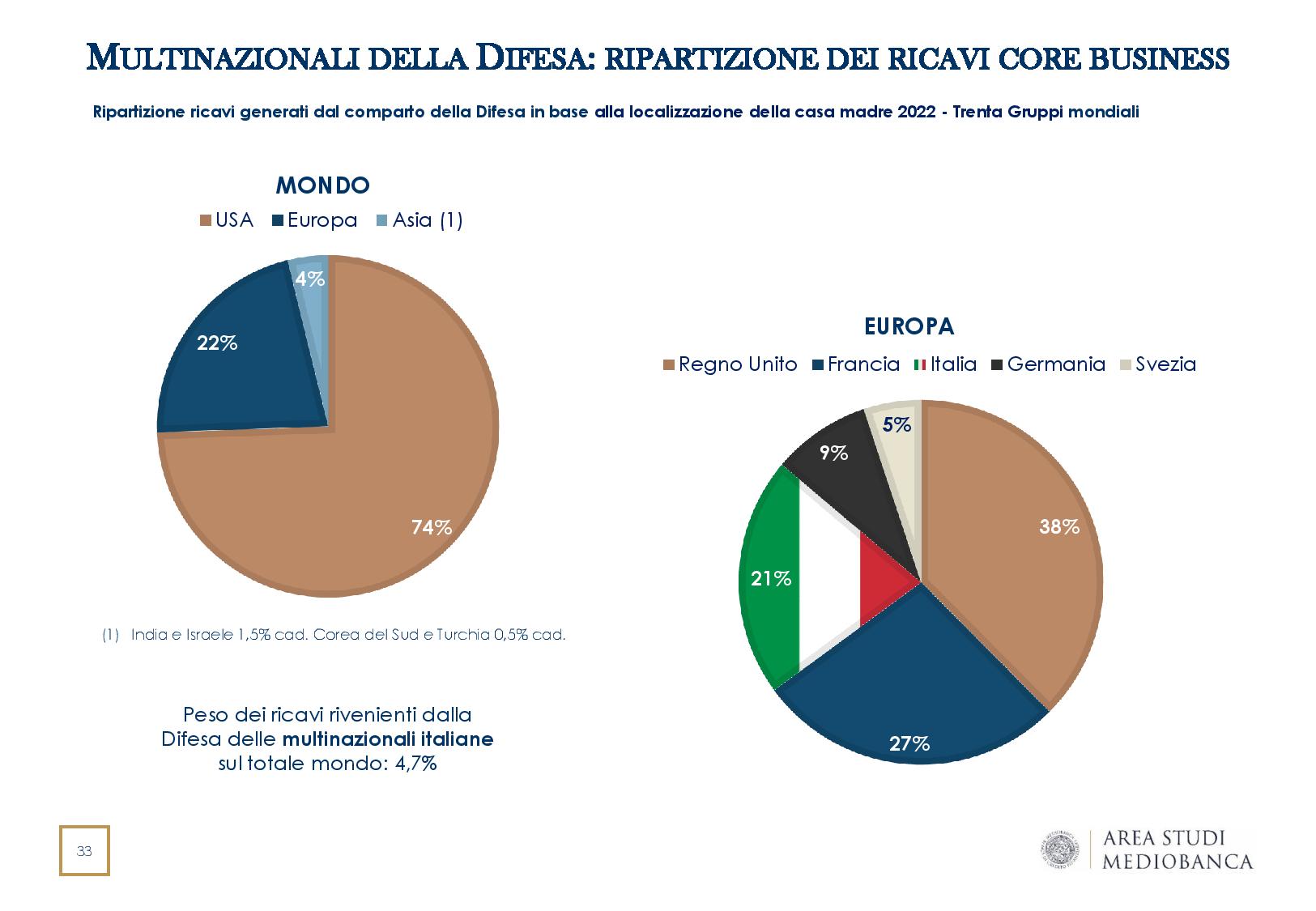

The Italian defense giants Leonardo and Fincantieri together account for 21% of European turnover and 4.7% of world turnover.

This is what emerges from the focus of Mediobanca's research area on the 30 main global defense groups with individual revenues exceeding 1.5 billion euros, of which 15 are based in the USA, 10 in Europe and five in Asia.

With the invasion of Ukraine and the war on the borders of Europe, the world scenario has changed, increasing the need for security.

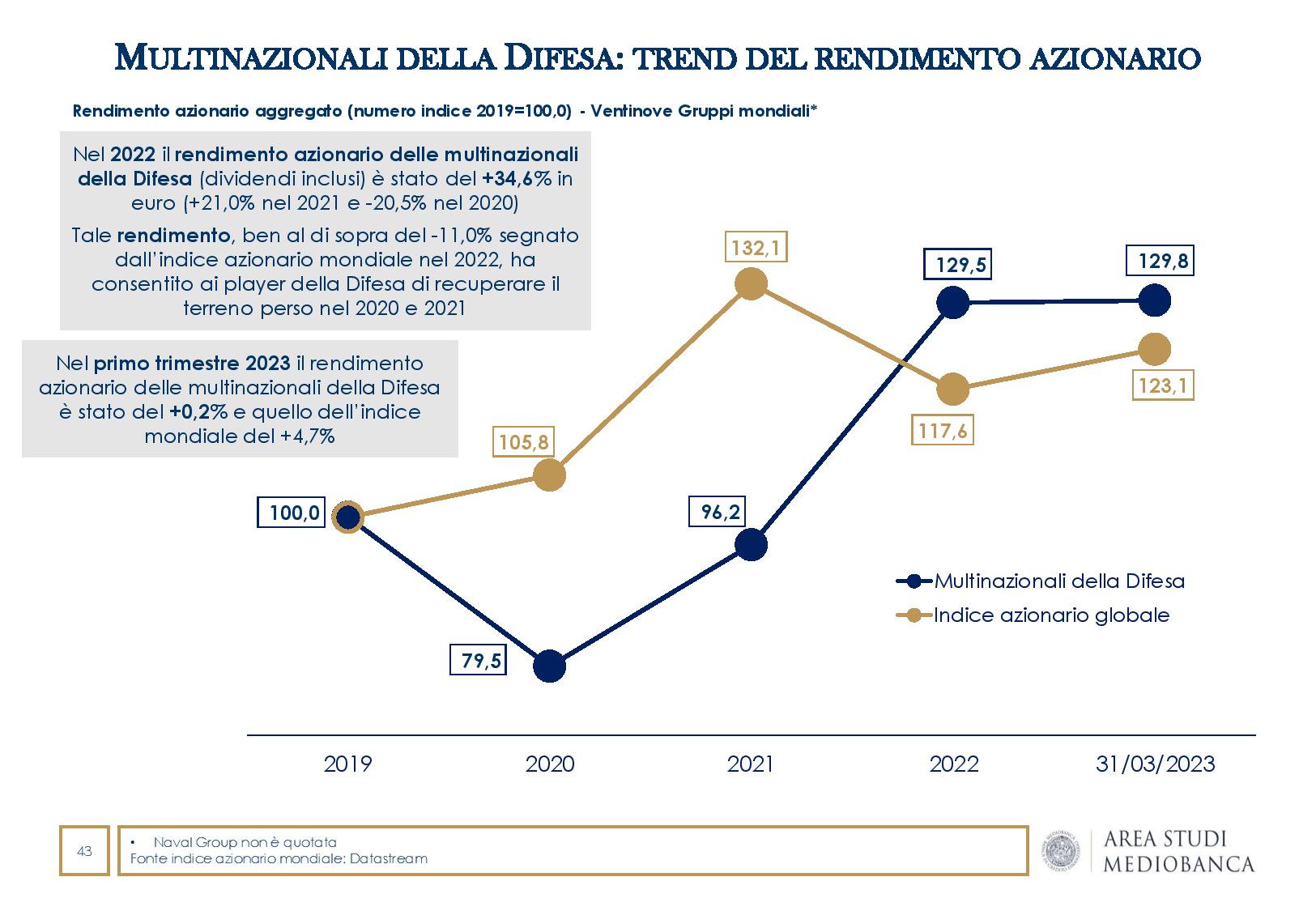

The effects of this changed perception are reflected in the financial statements of the defense multinationals considered and in their listings on the Stock Exchange: in 2022 investments grew more than three times faster than revenues and equities achieved the highest returns, the experts point out of Mediobanca.

All the details.

DEFENSE MULTINATIONALS GROWING

The invasion of Ukraine, bringing the war back to European borders, redefined the development and investment priorities for the countries of the old continent, but also for the rest of the world. The global scenario has profoundly changed and the need for security has become a priority, explains the note from the Mediobanca Research Department. The Russian aggression has changed the general perception of the need to strengthen the defensive tool, protect citizens, state borders and the economic system.

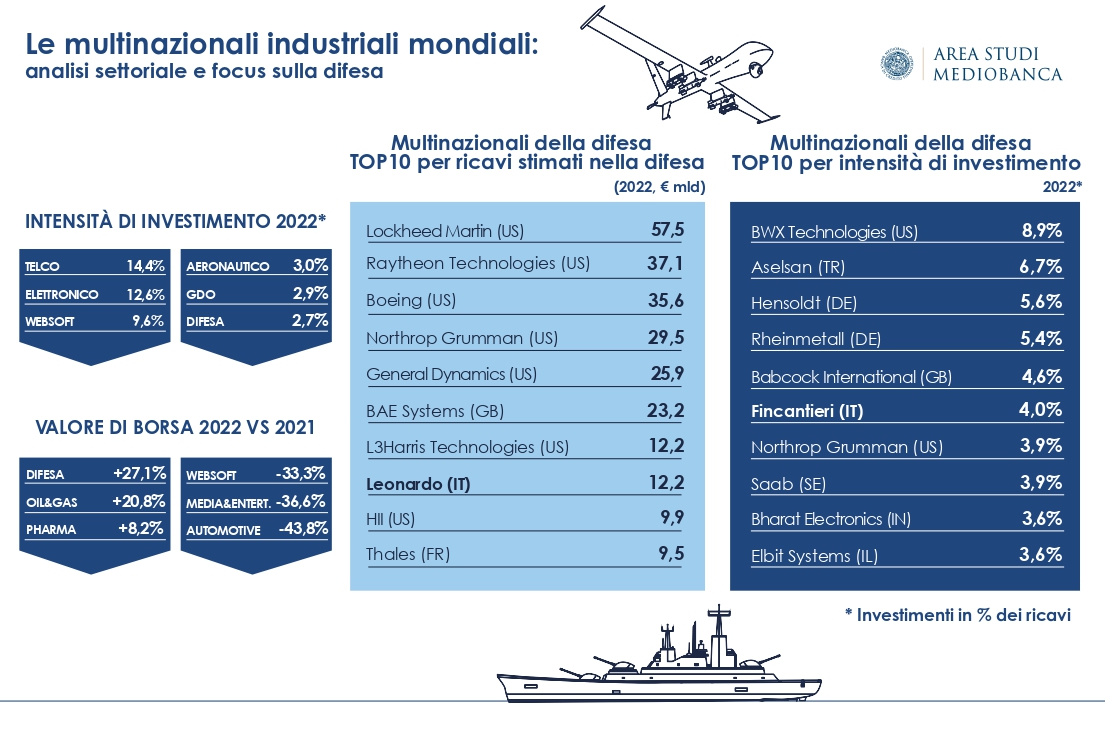

Many European countries, including Italy, have decided to raise expenditure to strengthen their defensive tools to 2% of GDP, as established by NATO. The effects of this changed perception can be seen both on the Stock Exchange, where the shares of defense multinationals achieved the best performances in 2022, and in the analysis of their investments, growing on average at more than three times the speed of revenues (+13 .2% vs +4.0% on 2021).

US COMPANIES LEAD THE RANKINGS BY REVENUE

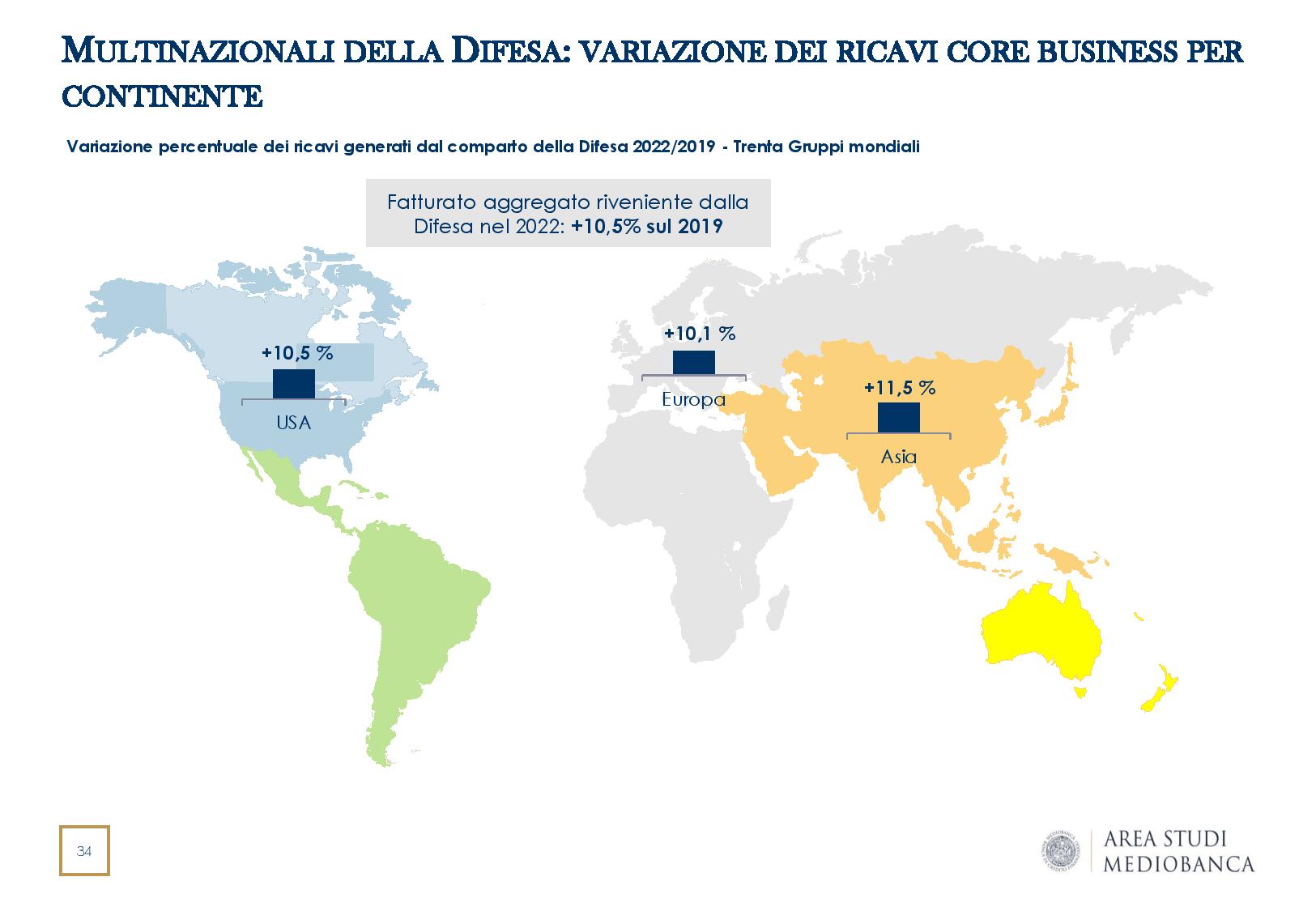

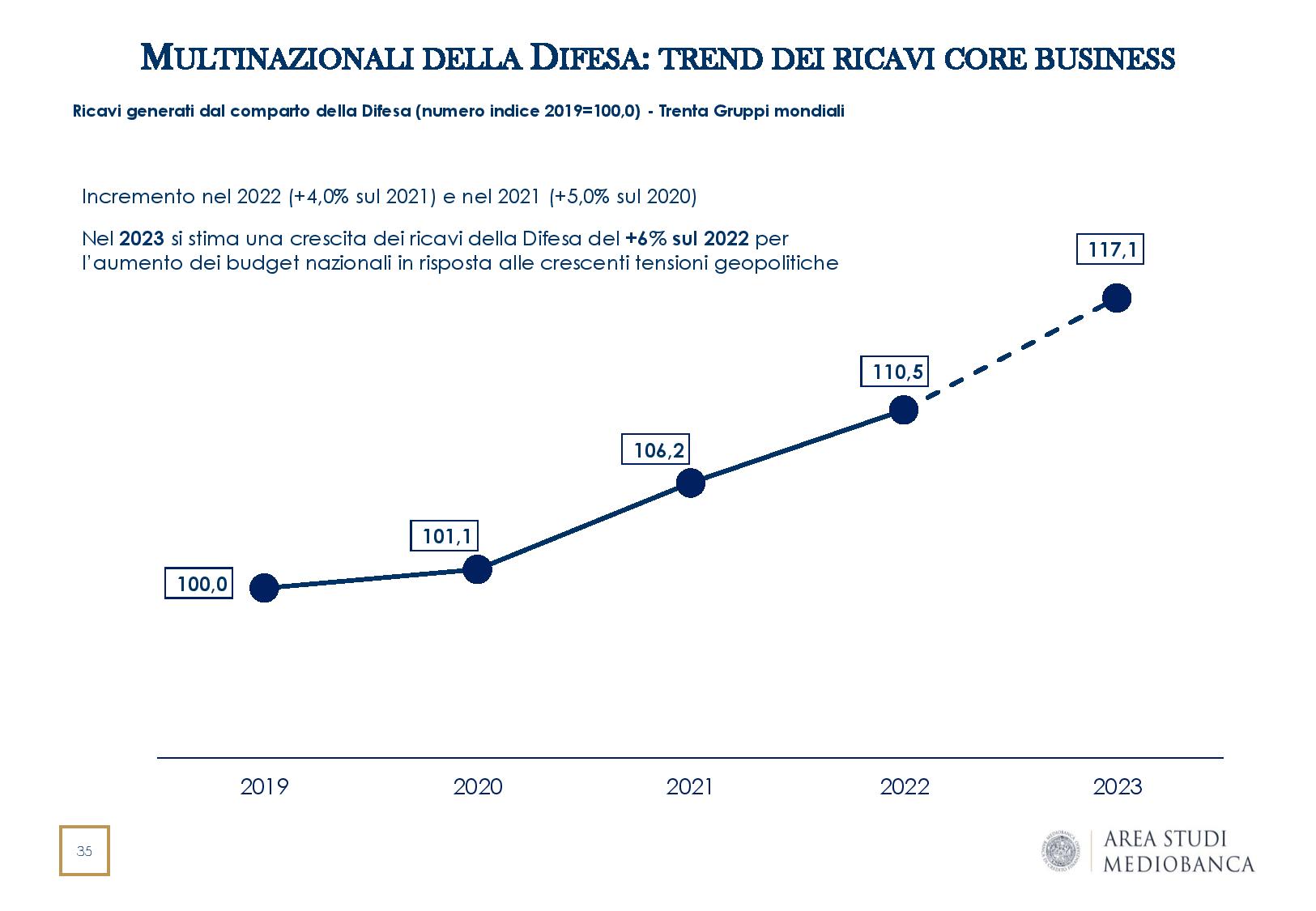

In 2022, the aggregate turnover of the thirty world groups mainly specializing in Defense was 432 billion dollars, of which 316 billion are estimated to be generated exclusively by the same sector (+4.0% on 2021 and +10.5 % on 2019).

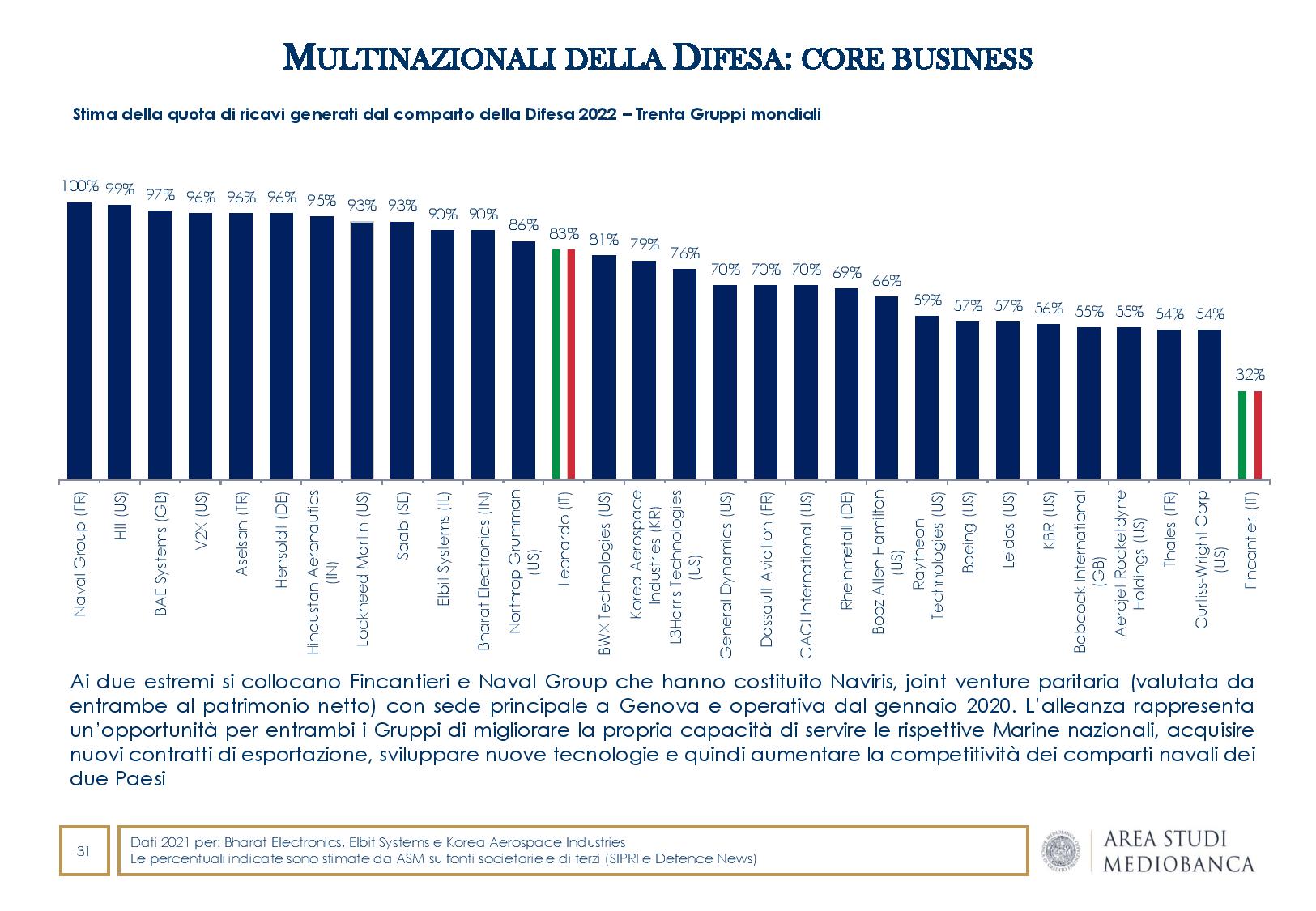

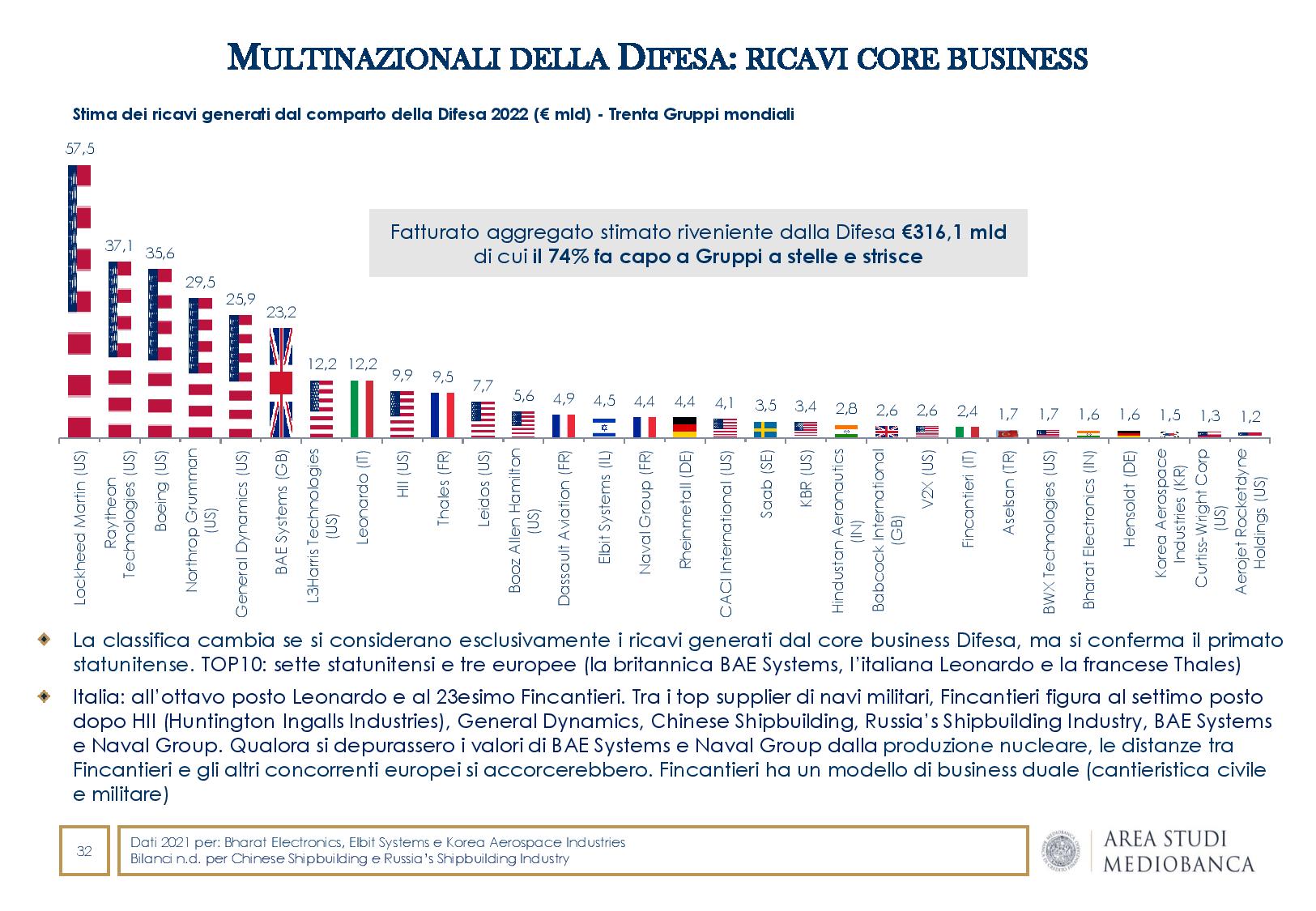

The landscape is dominated by US players with a 74% share of the total, followed by European groups with 22% and Asian ones with 4%. A further increase in revenues of +6% over 2022 is expected in 2023, due to the increase in national budgets in response to growing geopolitical tensions. The United States, with their 15 big players, also take the lead in terms of numbers ahead of France, separated by three companies; two groups each for Germany, Great Britain, India and Italy which, with Fincantieri and Leonardo, accounts for 21% of European turnover and 4.7% of world turnover.

LEONARDO IN NINTH PLACE AND FINCANTIERI IN THIRTEENTH FOR TURNOVER

The first five places for estimated revenues generated by the defense sector are occupied exclusively by US groups: Lockheed Martin (57.5 billion euros), Raytheon Technologies (37.1 billion), Boeing (35.6 billion euros), Northrop Grumman (€29.5 billion) and General Dynamics (€25.9 billion). In eighth position is Leonardo (€12.2 billion) and in 23rd Fincantieri (€2.4 billion).

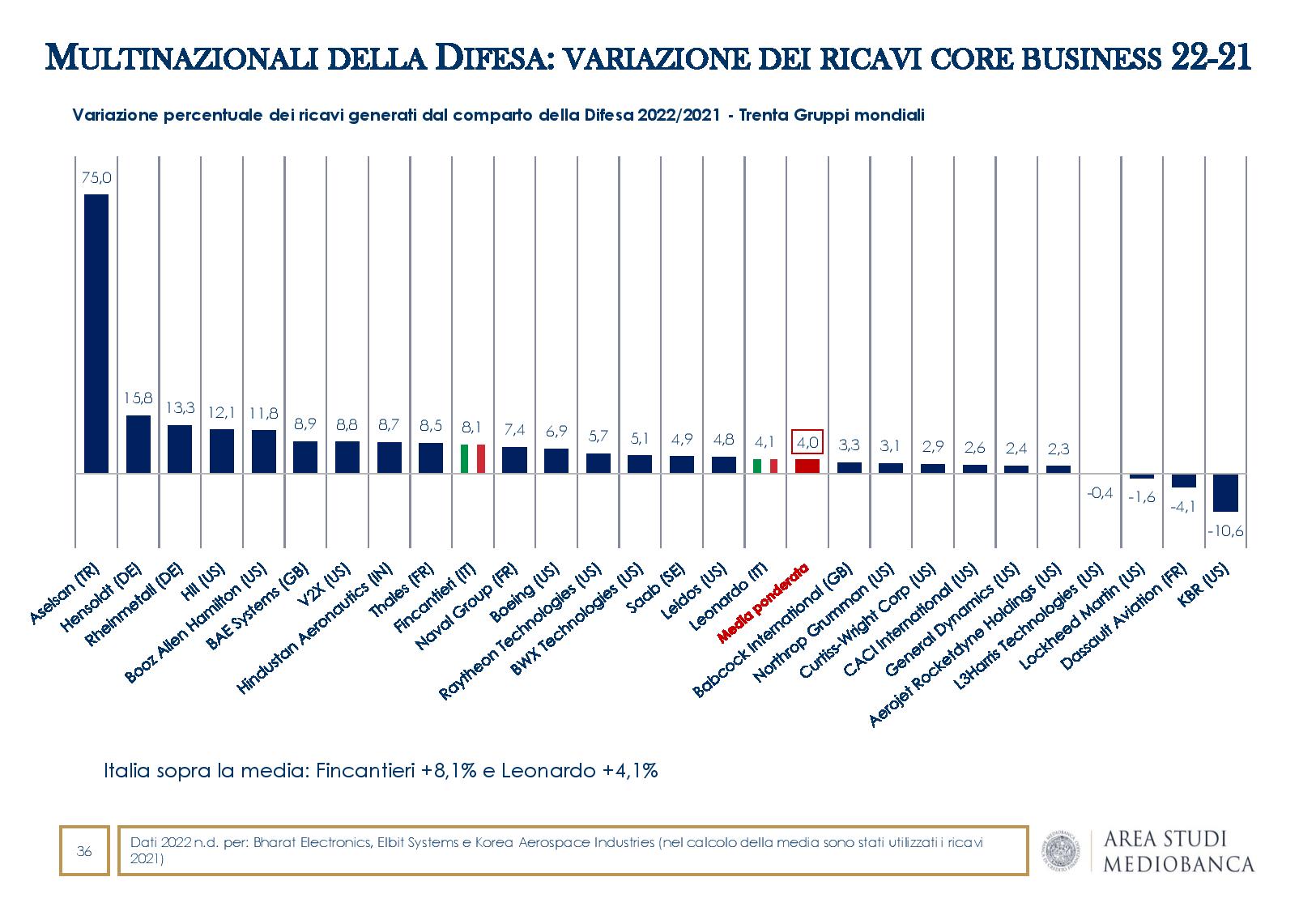

FINCANTIERI AND LEONARDO ABOVE AVERAGE IN REVENUE GROWTH

The increase in revenues sees the Turkish Aselsan excel (+75.0% on 2021), ahead of the German Hensoldt (+15.8%) and Rheinmetall (+13.3%) and the US HII-Huntington Ingalls Industries (+ 12.1%) and Booz Allen Hamilton (+11.8%), all with double-digit growth. Both Italian groups stand out for an above-average increase: Fincantieri with +8.1% and Leonardo with +4.1%.

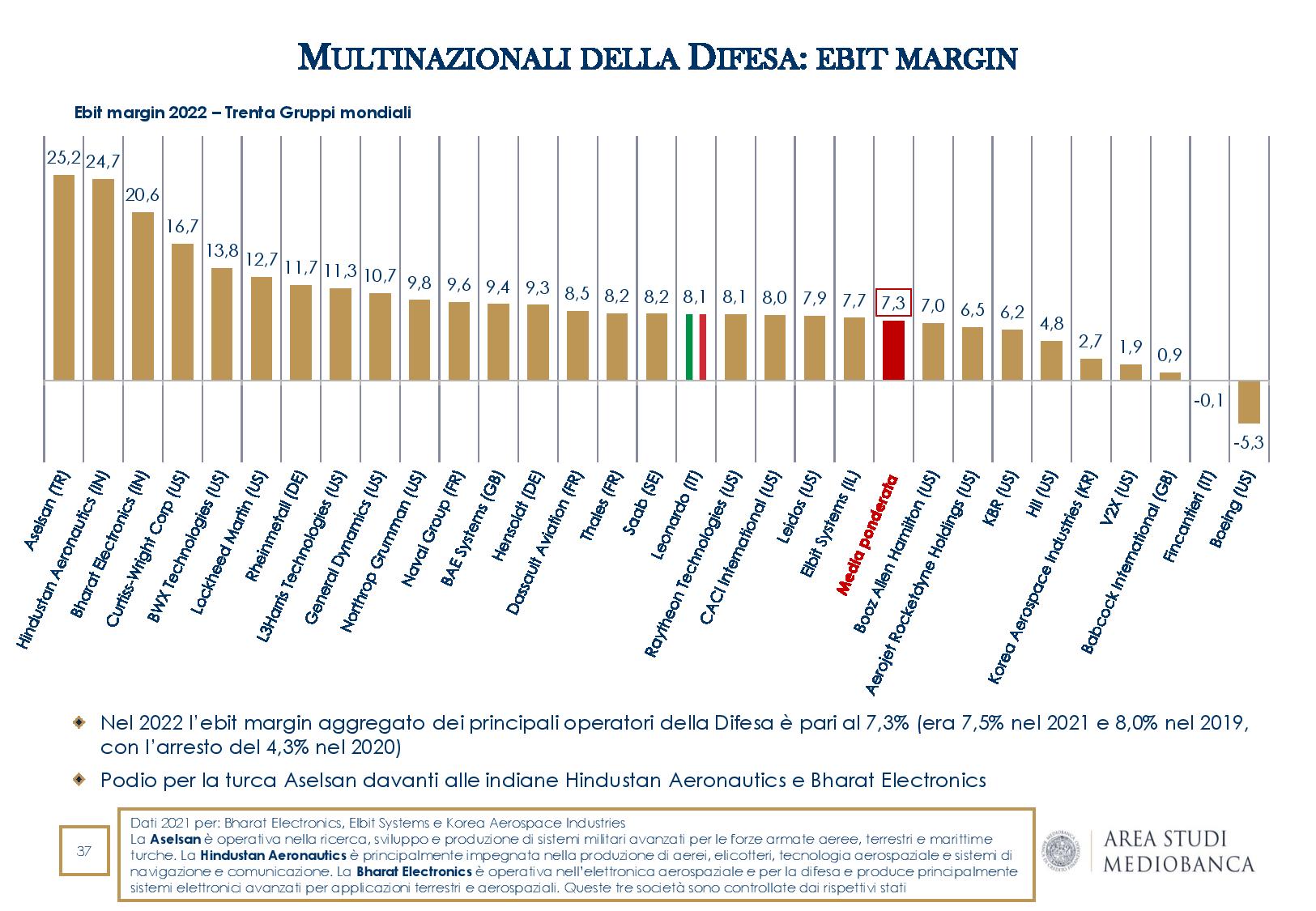

PROFITABILITY DOWN

Profitability appears to be declining: the average EBIT margin falls from 8.0% in 2019 to 7.3% in 2022. Three state-owned companies report the most satisfactory margins: the Turkish Aselsan (25.2%) and the Indian Hindustan Aeronautics (24.7%) and Bharat Electronics (20.6%).

ITALY ABOVE THE AVERAGE ALSO FOR INVESTMENTS

Investments are up by double digits, reaching a total of 12 billion euros (+13.2% on 2021) and rising to 2.7% of revenues (from 2.5% in 2021). The podium for investment intensity sees the American BWX Technologies in first position (8.9%), ahead of the Turkish Aselsan (6.7%) and the German Hensoldt (5.6%) and Rheinmetall (5.4%). The Italian groups are well positioned, confirming their industrial strength: sixth place for Fincantieri (4.0%) and 12th for Leonardo (3.3%).

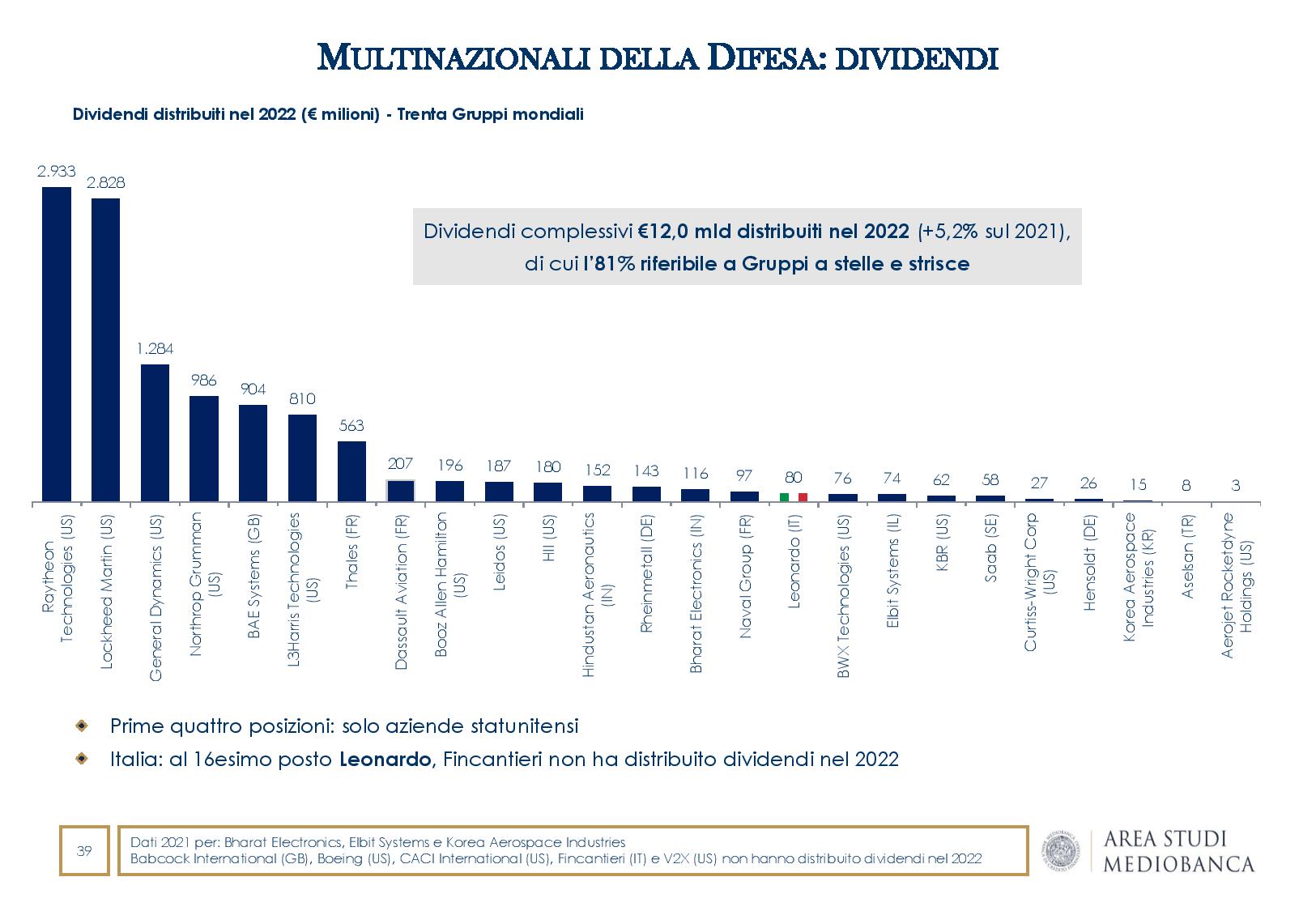

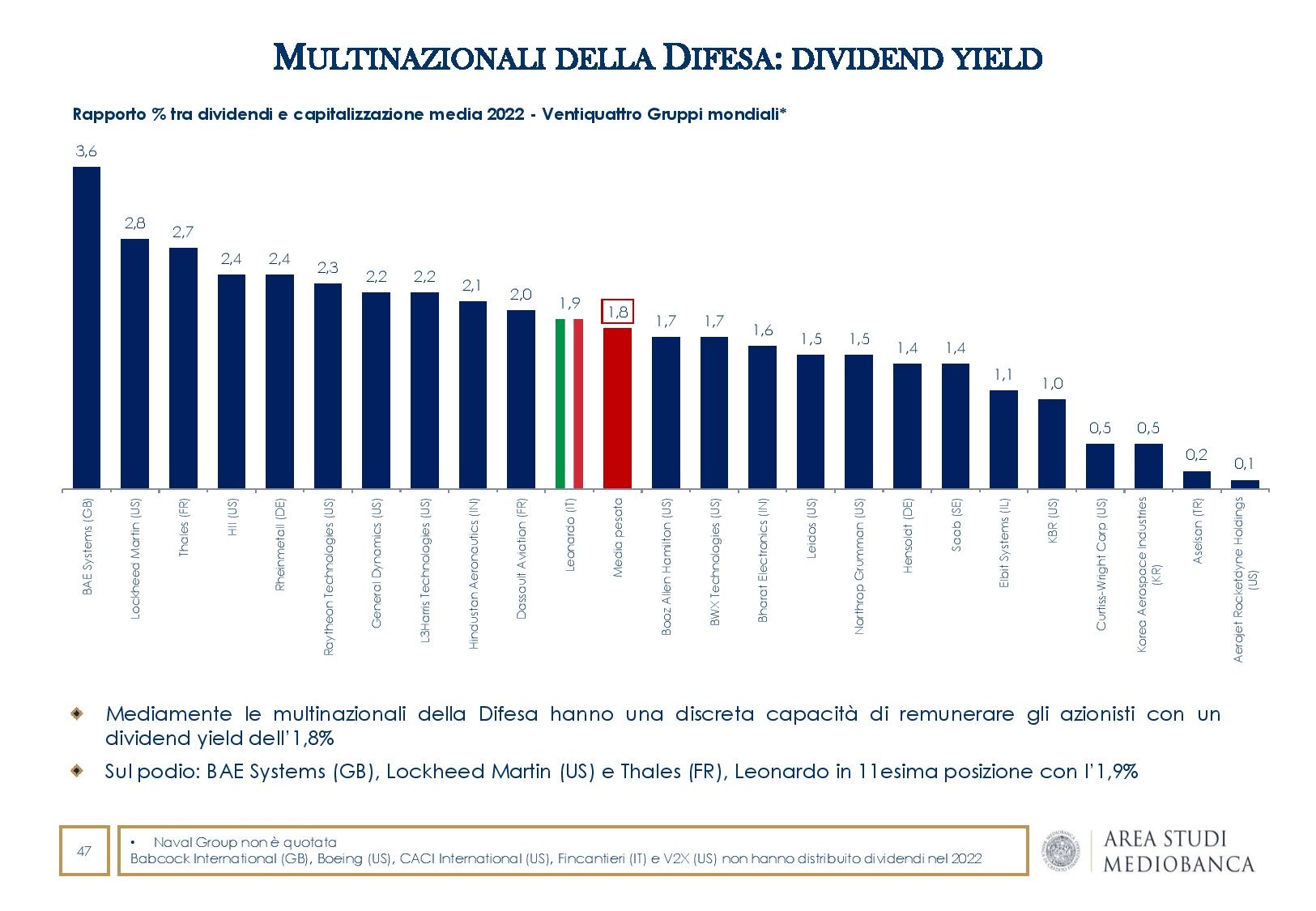

THE DISTRIBUTION OF DIVIDENDS GROWS

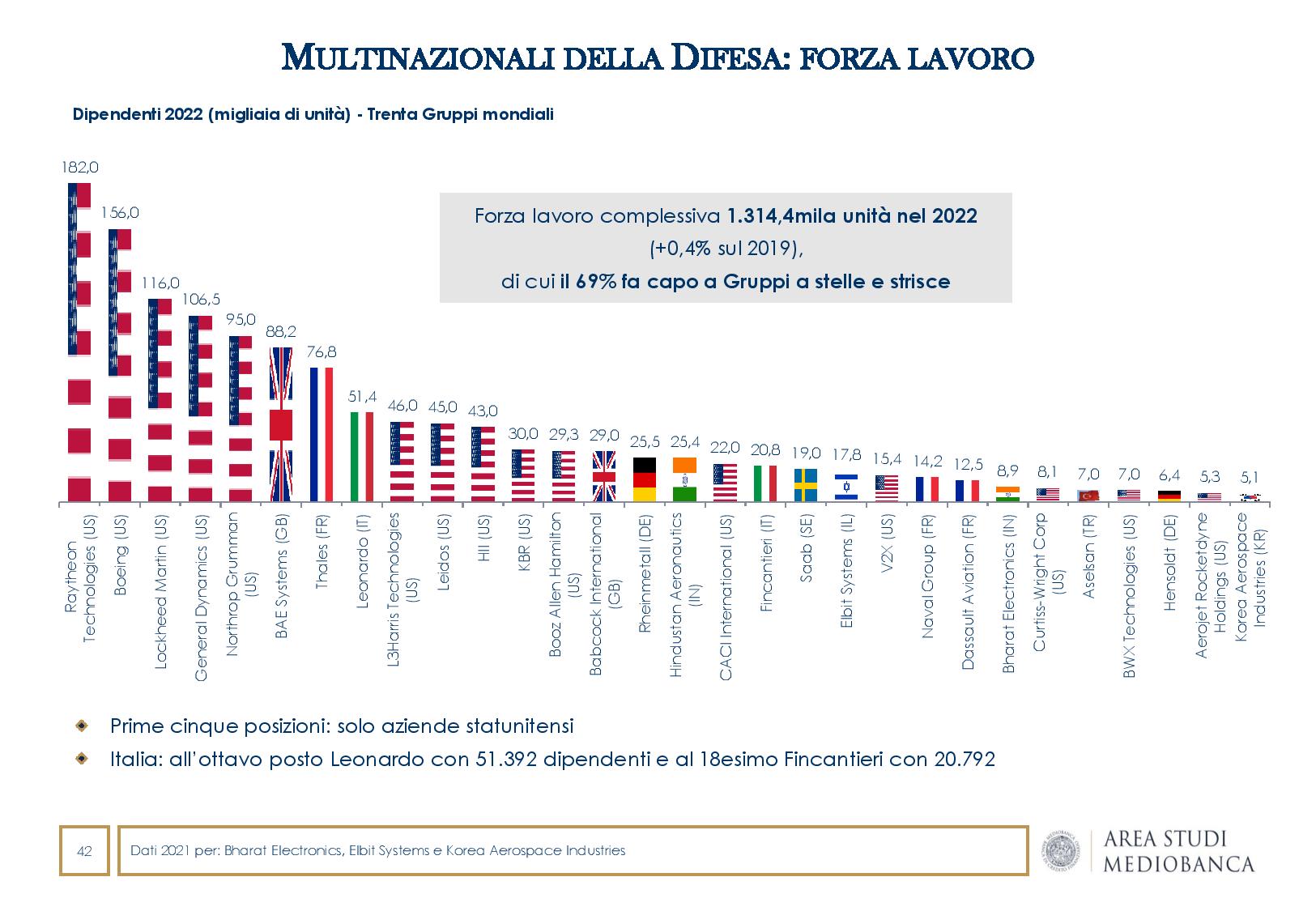

The distribution of dividends increased by 5.2% on 2021, with 81% of the total absorbed by the shareholders of the US groups. The thirty defense multinationals employed over 1.3 million people in 2022 (+0.4% on 2019), of which 69% belong to the stars and stripes groups.

THE ASSET SITUATION

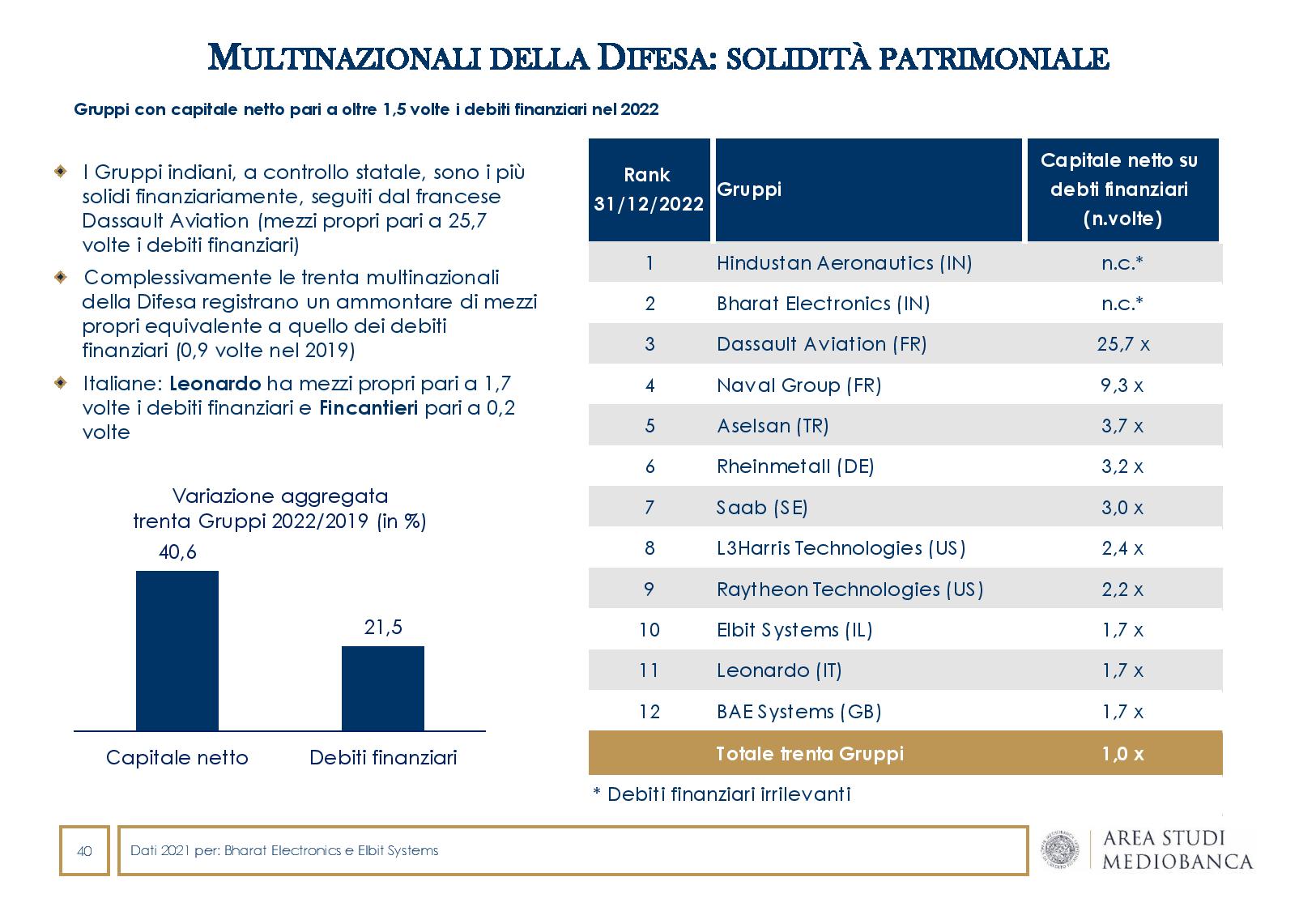

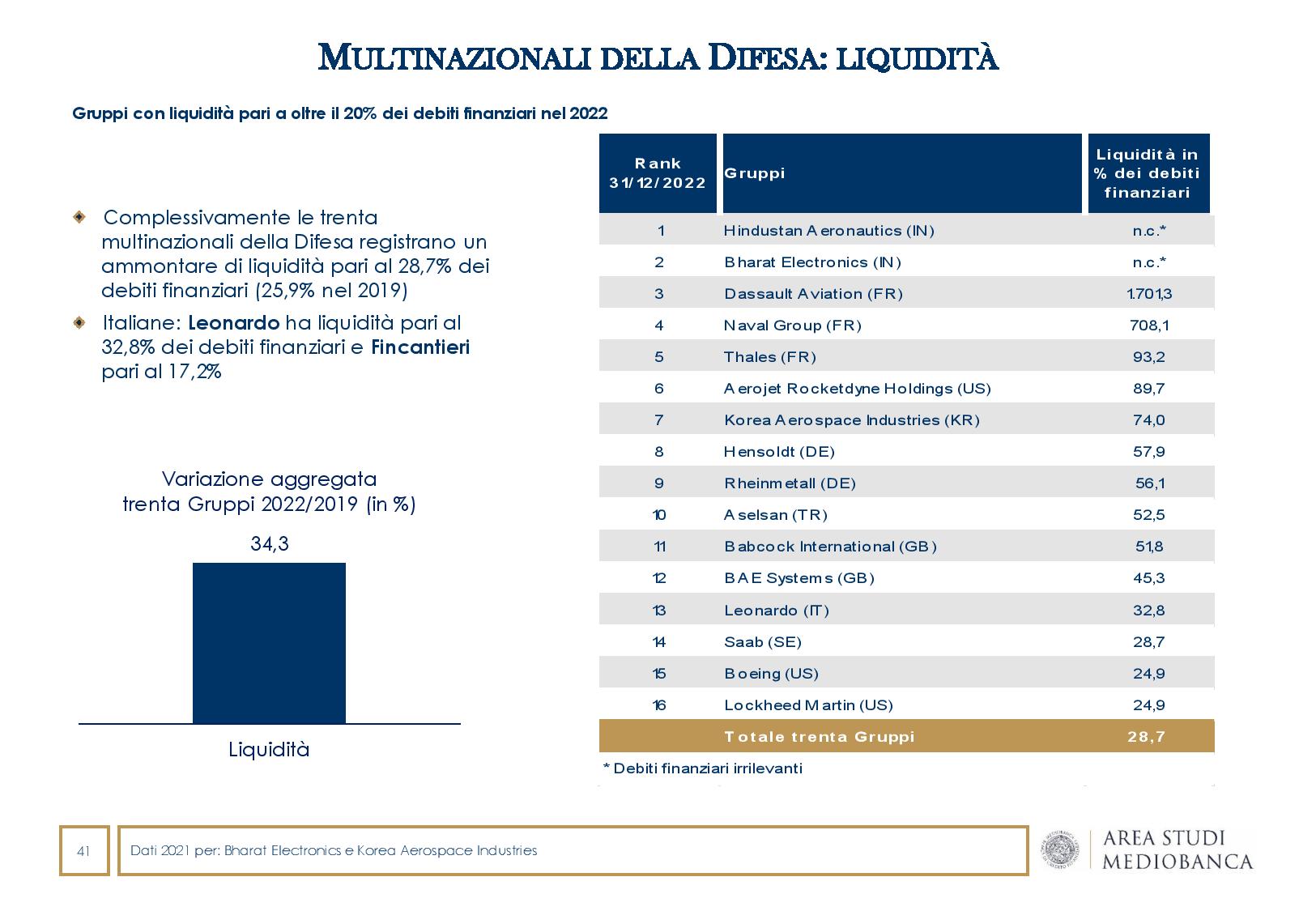

On the balance sheet front, the Defense companies recorded an amount of equity equivalent to that of financial debts at the end of 2022, with both Indian companies (Bharat Electronics and Hindustan Aeronautics), under state control, more capitalized, followed by the French Dassault Aviation (capital equal to 25.7 times the financial payables). Compared to 2019, own funds increased (+40.6%) more than those of third parties (+21.5%). Liquidity also increased (+34.3% on pre-pandemic levels), equal to 28.7% of financial debt at the end of 2022.

LEONARDO AND FINCANTIERI IN THE TOP 10 FOR WORKFORCE

SAAB, HENSOLDT AND RHEINMETALL ON THE PODIUM FOR SHARE RETURN

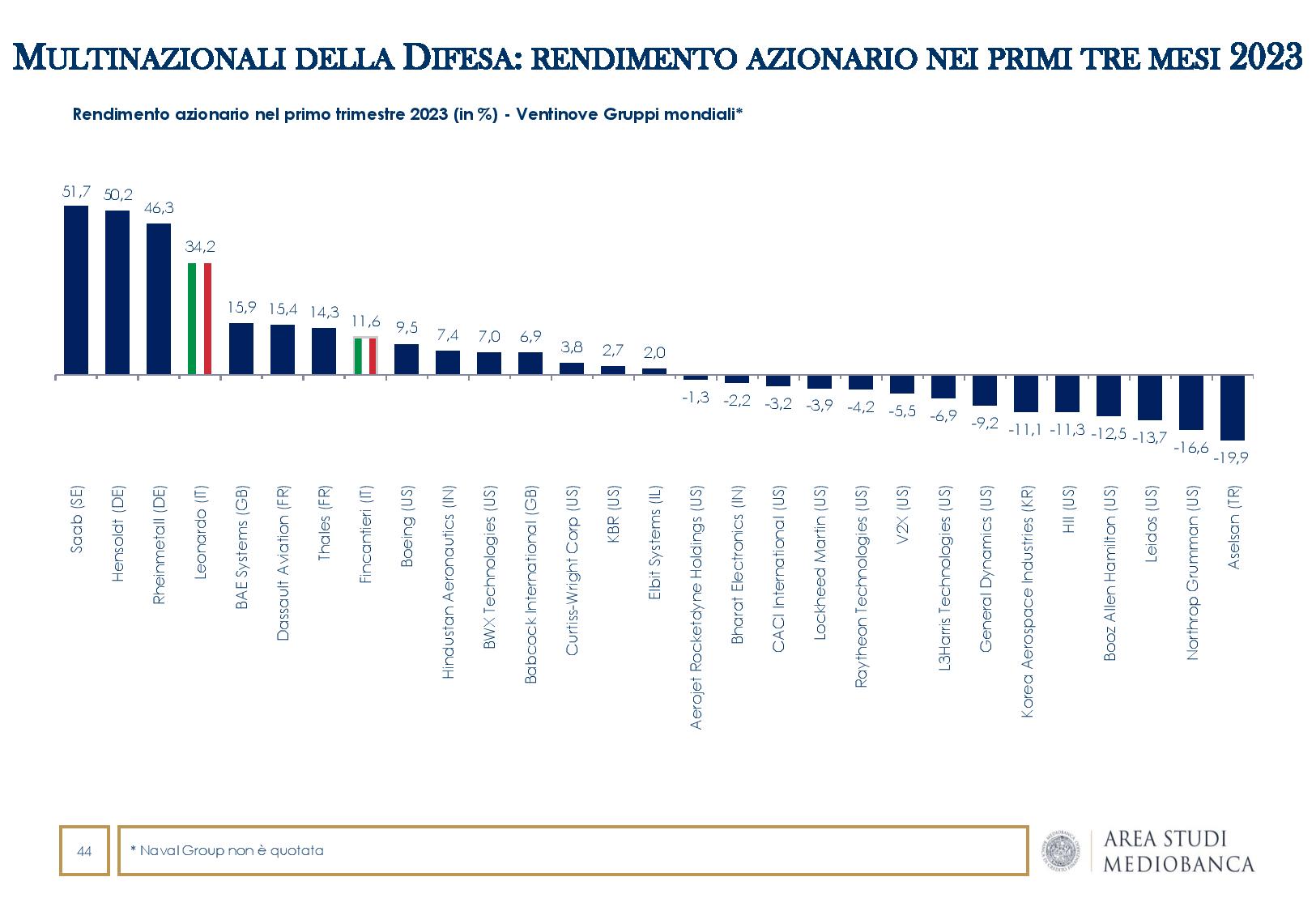

In 2022 the share yield of Defense players (dividends included) is equal to +34.6%, well above the -11.0% marked by the world stock index. In the first quarter of 2023, the aggregate value marks +0.2%, with the best performances recorded by the Swedish Saab (+51.7%) and the German Hensoldt (+50.2%) and Rheinmetall (+46.3%); fourth best performance for Leonardo (+34.2%) and eighth for Fincantieri (+11.6%).

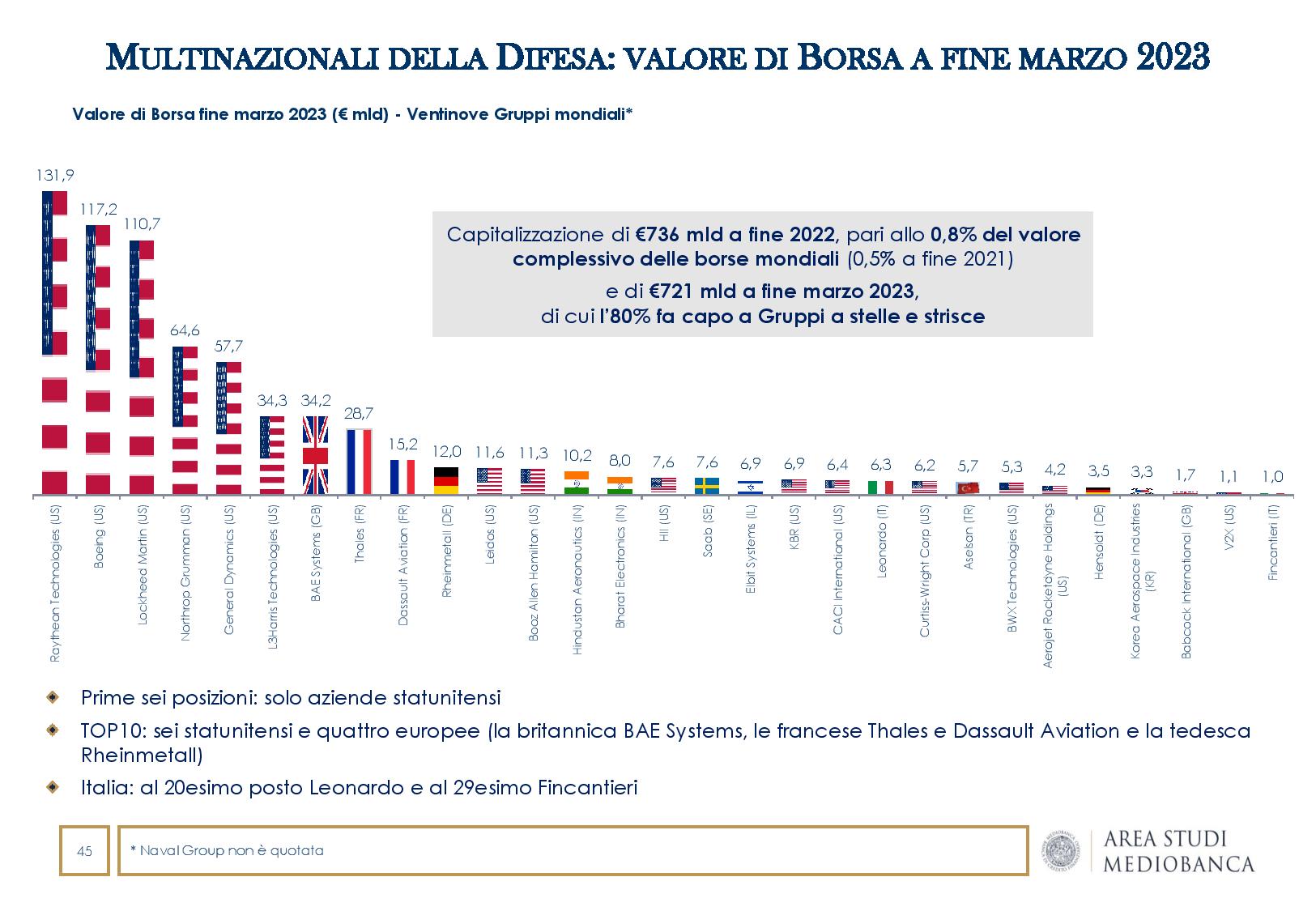

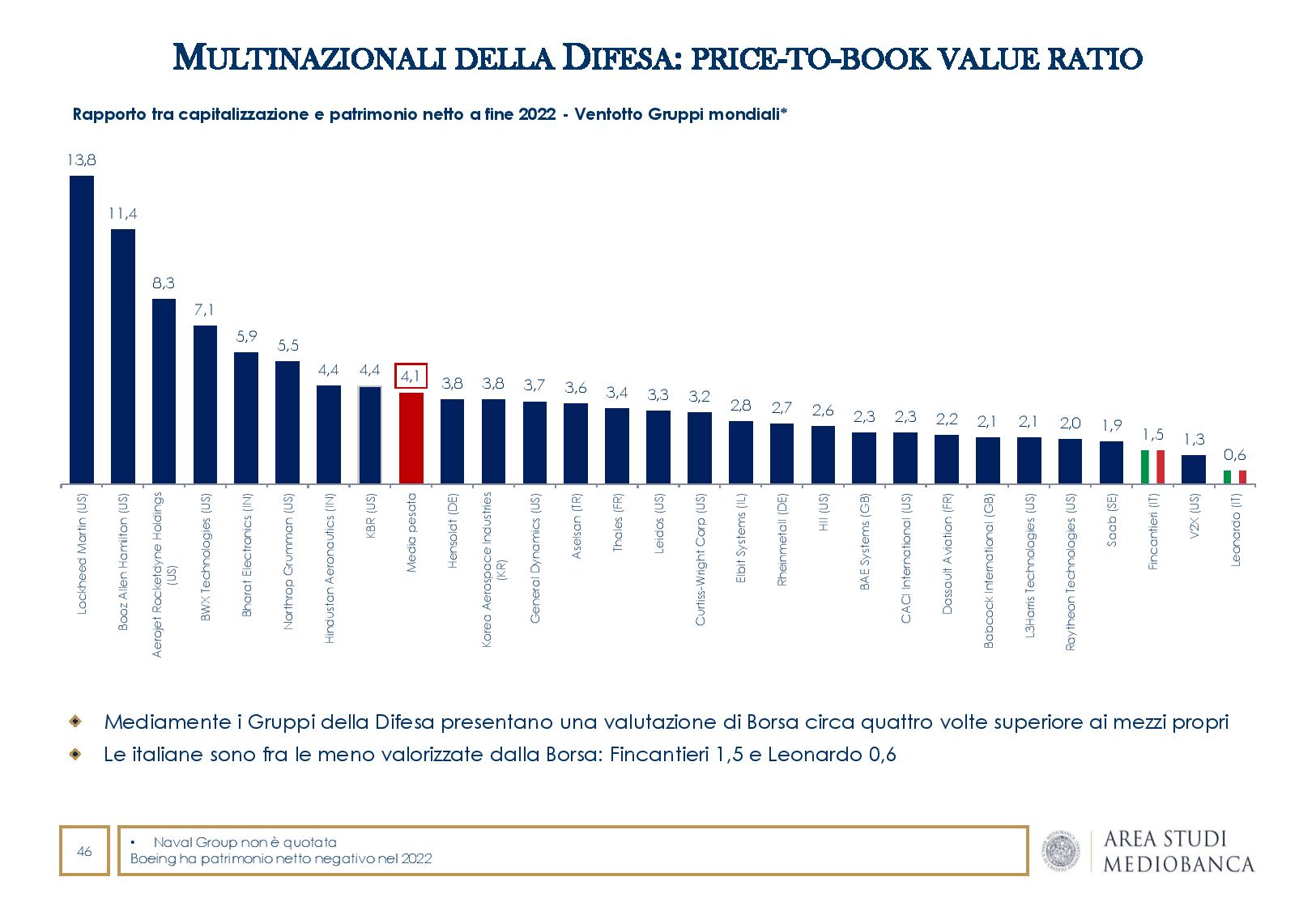

CAPITALIZATION OF DEFENSE MULTINATIONALS WORTH 0.8% OF WORLD EXCHANGES

As regards the capitalization of defense multinationals, this stood at 736 billion euros at the end of 2022, equal to 0.8% of the total value of the world stock exchanges (0.5% at the end of 2021). On average, capitalization is four times higher than equity, with the Italian companies among the least valued by the Stock Exchange: Fincantieri shares 1.5 times the equity and Leonardo 0.6 times. At the end of March 2023, the aggregate capitalization was 721 billion euros, of which 80% was held by the stars and stripes groups, with the stock podium occupied by the three US Raytheon Technologies (€131.9bn), Boeing (€117 ,2bn) and Lockheed Martin (€110.7bn). All other companies have a market capitalization of less than 65 billion euros.

So according to Mediobanca experts, the stock market and investors seem to have appreciated the renewed value of security. This happened despite the fact that defense companies suffer from a penalizing specialization in terms of ESG. However, the changed geopolitical context, the recognition of deterrence as an instrument for preserving peace and the need to protect democratic values have opened the debate on the reconsideration of the compatibility between sustainability and investment in the capital of defense companies.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-fioccano-gli-affari-delle-aziende-della-difesa-comprese-leonardo-e-fincantieri/ on Sun, 09 Apr 2023 05:52:00 +0000.