How the foreign debt grows in Evo Morales’ Bolivia

What happens to Evo Morales' Bolivia's foreign debt and why transport is a predominant sector. Riccardo Venturi's analysis

Former President Evo Morales was the symbol of an expansive season for Bolivia's economy. Of very humble origins, he managed to take charge of the claims of coca farmers and indigenous peoples and win the presidential elections in 2005.

He began his term in 2006 and ruled until 2019, when, despite a new victory in the elections, due to allegations of fraud and pressure from the armed forces he was forced into exile and the country was ruled by a right-wing interim government.

This exile lasted until 2020, as the new elections that were held in the country led to the victory, Luis Arce, formerly its minister for the economy, and this allowed his return to his homeland. Its action has been to combat poverty through subsidies, greater access to health care and the implementation of the transport sector, which is essential for developing the economy.

THE FOREIGN DEBT

The composition of Bolivia's external debt, from 2012 to 2019, shows how loans from 11 to 30 years prevail with an average of 64.6%, followed by those for more than 30 years (20.9%) and those from 0 at 10 years (13.5%). The percentage of those with no term, mainly disbursed by the International Monetary Fund from 2017 to 2019, never constituted more than 3.0% of the total.

Analyzing in more detail the financiers of Bolivian debt, it is noted that multilateral ones prevail over bilateral ones. The data are now divided into two periods, since those from 2006 to 2010 come from a summary summary, while the others have been drawn up year by year in the individual reports. Moreover, from 2011 onwards, new multilateral lenders not present in the previous period begin to be reported and there are significant variations in bilateral lenders.

For the period from 2006 to 2010, multilateral loans from international financial institutions predominate (average balance of US $ 1,727.4 million) compared to bilateral loans (average of 549.0 million).

In this phase, the Comunidad Andina de Fomento – CAF (967.0 million on average) has always been used, while both the governments preceding Morales and the first one chaired by him in his early years had taken steps to reduce the debt with Banco Mundial – BM (from a balance of 1,571.4 million in 2003, reaching a peak of 1,748.8 million in 2004, followed a slight decline to 1,666.8 million in 2005 and a sudden low of 233.4 in 2006 , to then rise to 355.1 in 2010, with an average of 289.0 from 2006 to 2010) and Banco Interamericano de Desarrollo – BID (1,621.2 million in 2006, which fell sharply in 2007 to 459.3, to 629.4 in 2010, with an average of 738.0).

These data show that despite the ideological mistrust of institutions that are heavily affected by US influence, Morales has pragmatically started quickly to borrow from them.

THE FINANCING COUNTRIES

The most significant bilateral loans from 2006 to 2010 were those from Brazil (an average annual balance of 114.1 million), a significant presence since before Morales and which continued to provide loans even under his presidency, and Venezuela, with the whose now defunct President Chávez Morales was in ideological harmony. In fact, from a balance of 5.9 million in 2005 it reached 32.6 already in 2006 to arrive, always increasing, at 309.5 in 2010, with an average of 191.54 for the period 2006-2010. As regards the disbursement of loans by Spain, the former colonial motherland, there was a reduction in the balance: from 106.5 million in 2008 to 19.3 in 2009, with an average balance of 78.2 for the period 2006-2010.

China, starting from 2007, therefore precisely during Morales' first mandate, began to intensify its participation, which in the following years has indeed become absolutely predominant, in fact the balance of loans provided by it in 2003 was 16.3 million, 14.0 in 2004, 24.4 in 2005, then increased from 38.6 in 2006 and 75.4 in 2007, to reach 82.2 in 2010, with an average of 71.0 for the period 2006-2010. Germany is not overwhelming but constant, with an average balance of 53.3 million. France, Italy and Argentina, on the other hand, are minorities.

There was a collapse of the Japanese shareholding (in 2003 a balance of 567.6 million, in 2004 of 71.6, in 2005 of 63.0 and of 0.0 in subsequent years). The portion consisting of the sum of other countries not mentioned above is of little importance. The absence of the United States stands out, but this is in line with its economic and political disengagement in the South American area of the last few decades.

DATA AND DIFFERENCES

In the data of the period 2011-2019 it is possible to find similarities and differences compared to that of 2006-2010. The prevalence of multilateral loans from international financial institutions over bilateral ones remains, with an average balance of 4,814.0 million dollars for the former and 913.9 million for the latter, but there are variations in creditors.

As regards the average balances of multilateral creditors, in this period, although for significantly lower average balance amounts than CAF (1,959.0 million), BID (1,892.3 million) and BM (662.6 million), Bolivia has also begun to borrow figures worthy of mention from Fondo Internacional de Desarrollo Agrícola – FIDA (57.5 million), Fondo Nórdico para el Desarrollo – FND (34.3 million), Fondo Financiero para el Desarrollo de los Países de la Cuenca del Plata – FONPLATA (120.3 million), Organización de Países Exportadores de Petróleo – OPEP (57.7 million) and Banco Europeo de Inversiones – EIB (30.4 million).

In this second phase, the prominence of China stands out unequivocally, confirming the role assumed by the Asian country in financing the government projects of developing countries: from a balance of 170.8 million in 2011 to one of 1,045 , 0 million in 2019, with an average balance of 497.9.

As regards Venezuela and Brazil, in this second period there has been a reduction in their participation. There was an inevitable decline in Caracas funding, with a balance of 416.9 million in 2011, 159.8 in 2012, 154.5 in 2013, 125.3 in 2014, after which from 2015 to 2019 it was no longer reached. the figure of 1.0 million, with an average balance of 95.5.

This is due to the economic and social crisis that the Bolivarian republic has been experiencing for years. The decline in loans from Brazil could be seen as due to the ideologically hostile presidencies in Morales of central Temer (2016) and that of the right of Bolsonaro (2019), however it is possible to observe a gradual but continuous decrease in credit as early as 2012. , which started right under the presidency of Rousseff's pink wave: the balance was 172.0 million in 2011, fell to 93.0 in 2012, finally reaching 21.6 in 2019, with 65.0 million on average . Constant attendance in this second phase was Germany (55.6 million average balance), South Korea (35.2 million) and Spain (13.1 million).

In recent years, there has been a notable increase in the commitment of French capital: a balance of 8.8 million in 2011, which fell 3.3 in 2016, and then jumped to 122.7 in 2017, then rose to 145.1 in 2018. and finally with a new surge in 2019 they reached 297.1, with an average balance therefore of 66.8. Absolutely minorities by participation are Japan, Italy and Argentina. The absence from the reports of the role of the United States is confirmed also in this second period.

Starting from 2015, three new items are found in the reports with the following average balances for the period 2015-2019: debt securities (average balance of 1,600 million), IMF (227.2 million) and money and deposits (43.8 million ).

Lastly, private loans are mentioned, the balance of which was 500.0 million in 2012, 1,000.0 million in 2013 and 2014, then for several years they were no longer reported, to reach 33.4 in 2019.

THE TRANSPORT SECTOR AND OTHERS

From 2012 to 2019 the transport sector predominated by allocation, intercepting on average 42.6% of the amounts from foreign debt; in second place was the basic sanitation sector, on average at 7.1%; other sectors worthy of mention are institutional strengthening (5.4% on average) and agro-livestock (4.06% on average).

The hydrocarbon sector, fundamental for the Bolivian economy, on the other hand was a small item, as it was largely self-financed thanks to the increase in royalties wanted by Morales and the increased price of hydrocarbons starting from the mid-2000s.

In addition to the aforementioned hydrocarbon sector (mainly natural gas), Bolivia's leading productions are those from mining: silver, boron, antimony, aluminum, tungsten, zinc, lead. The huge reserves of lithium, an indispensable material for rechargeable batteries, and therefore destined to increase its importance, should also be noted.

In an economy that relies so much on the extractive sector, investing in a more efficient transport system means increasing the speed of placing on the market what comes from mines and fields, as well as bringing benefits for all other sectors thanks to the reduction of costs to move a commodity from one part of the country to another.

RELATIONS WITH ABROAD

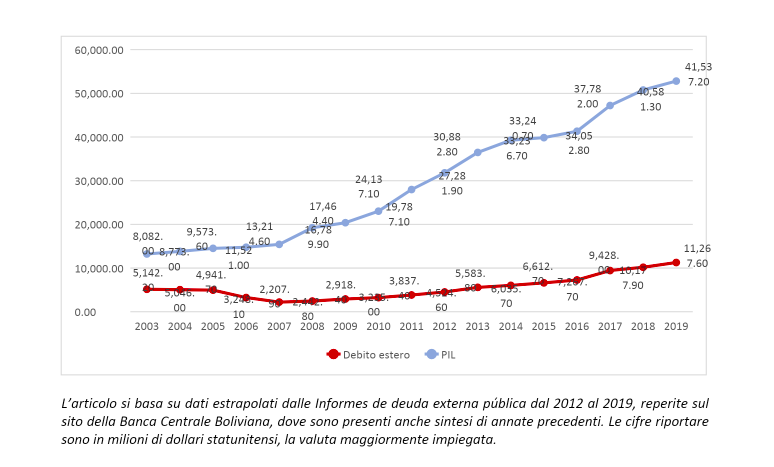

The increase in foreign debt, offset by a significant and continuous growth in GDP, was mainly aimed at supporting the economic development of the country and to ensure a substantial improvement in the conditions of the poorest.

In the next few years we will see the results, over which the shadows of some unknowns loom: will the sums borrowed for the transport sector lead to growth capable of compensating for interest expenses? Will the foreign debt, especially the one with China, bring limitations to the concrete sovereignty of the country? Will the trend in the cost of raw materials of which Bolivia produces support GDP growth and therefore debt sustainability? Finally, what impact will Covid-19 have on the Bolivian economy?

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/mondo/come-cresce-il-debito-estero-nella-bolivia-di-evo-morales/ on Sat, 09 Oct 2021 05:06:24 +0000.