How the stock exchanges scrutinize the economy and politics

The markets between Brexit, Capitol Hill and Covid. The comment by Giuseppe Sersale, strategist of Anthilia Capital Partners Sgr

Resuming the comment in 2021, the impression is that, also thanks to the events of the last few days, we have put a lot of chores behind us.

Trump's self-centered and narcissistic post-election strategy has had the brilliant result of giving the Senate majority to the Democrats, and demolishing the Republican party. Barring surprises, the Dems have a 4-year majority in front of the 2 Chambers, and perhaps a reconfirmation in 2024 (but here we are really going too far). Of course, a majority of 1 vote (that of Vice President Harris) in the Senate does not allow for great things: there is the method of filibustering, to get around which 60 votes are needed. The Reconciliation, through which Congress can pass fiscal rules with a simple majority in the Senate, bypassing Filibustering, can only be used once a year. And in any case with 50 vs 50, an absence is enough, or a dissent between the Dems that goes into impasse. And even in the House we have a majority of just 11 seats.

On this basis, to think that Biden does good and bad times, is able to approve 3 trillion plans, taxes and stews of large corporations etc is perhaps a bit exaggerated. But eventually the market will tend to price it, until the knots come to a head.

According to the latest developments, yesterday's Capitol disaster produced, in addition to 4 victims and an unknown number of injuries and arrests, further rebellions by prominent Republicans. Pence, in addition to condemning the episode, has certified Biden's victory, and Trump seems willing, according to the latest statements, to allow a peaceful transition of powers, even if he will never admit to having been defeated.

We also got rid of Brexit, with an agreement in extremis. The deal avoids the imposition of duties and quotas on the trading of goods between the EU and the UK, which was the biggest problem. However, there will be more customs controls. It is on the services front that we have the greatest unknowns. Market access for UK companies has ended and many rules are yet to be established, particularly for financial services. So not beautiful, but at least the big uncertainty is over.

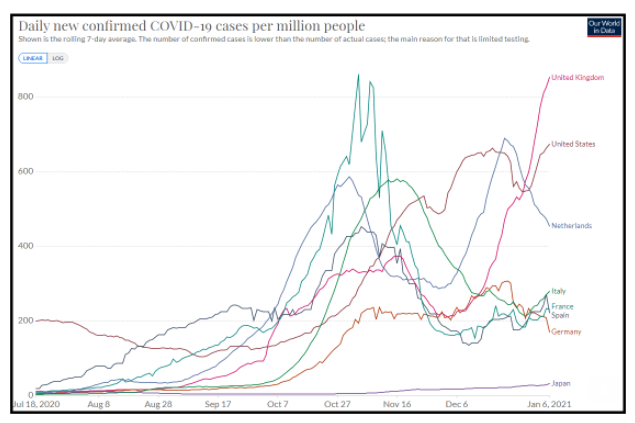

The story that we have not yet put behind us, however, is Covid. In the period since December 22, the UK mutation has caused cases to explode in Great Britain (62,000 cases yesterday), while in the US cases have started to rise again. Sure, the Christmas holidays will have caused some distortion in the data.

In Europe the picture is mixed, with Germany improving together with the Netherlands, and Italy accelerating slightly, while France and Spain are currently showing poorly defined trends. Japan has been making headlines recently for record cases, concentrated in Tokyo, but its curve, while increasing, remains very “Asian”. And in China we are having the first outbreak worthy of the name for some time now, with the lockdown of a city of "just 11 million inhabitants" near Beijing (link). In the UK and Germany, restrictions were tightened as early as last Tuesday.

It certainly cannot be said that this has upset the markets that much. Global equities continued to perform despite the numbers, and while some volatility was observed here and there, new relative or absolute highs were seen almost everywhere. On the other hand, it is now evident that economies have become a bit addicted to lockdowns, thanks to the huge amount of support measures that accompany them. In fact, the final December PMIs came out in recent days and beyond some single defaillance (See Italian Services ) The numbers are in line with the flash data and much better than expected for December, given the extent of the measures containment.

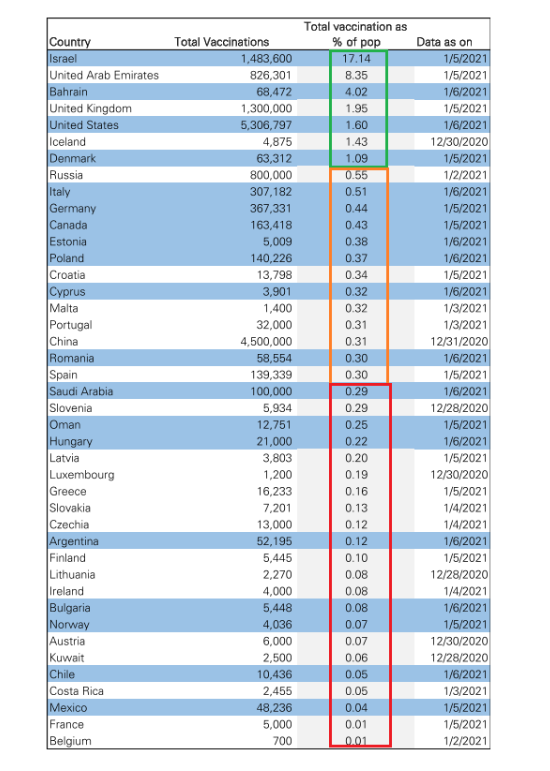

And then, now the focus is now firmly on vaccines, as also shown by the fact that Deutsche Bank has replaced, in its daily piece, the scheme that reported the 7-day moving averages of new cases, with a scheme that shows the progress of the various states in vaccinating the population. Among other things, the Moderna vaccine was approved yesterday in Europe, which should add 160 million doses, such is the amount booked by the Eurozone, to the vaccine mount .

Coming to the last 24 hours on the markets, yesterday the bonanza caused by the victory of the Dems in Georgia was somewhat attenuated in the final by the events of Capitol Hill, unheard of from the point of view of gravity for public order, but perhaps conclusive of a phase of uncertainty, in light of the latest news. The aforementioned "low quality blue sweep" weighed on the Nasdaq yesterday, the only index to close in negative. I generally found the reaction a bit exaggerated for 2 reasons. First, I don't think the Georgia ballot victory was so unexpected. I would say it was quite likely in light of the latest polls. Second, as noted above, I don't think it will be easy for the administration to pass regulations with these majorities. For this reason I am not surprised that Wall Street in general has risen, because it is a period in which any excuse is good to do so, and in any case in reality the S&P 500 was hovering at the levels of December and therefore the decline in uncertainty had to be factored. But the penalization of the Nasdaq has more the meaning of a pretext to rotate on more cyclical and less expensive or defensive sectors and markets, than that of fear of a Dem impact.

Same goes for the rise in yields. The blue sweep is an excuse to price a little more growth and inflation. On this second point, I note that the US 5, 10 and 30 year breakeven inflation all rose well above 2%. The 10-year is at 2.1%, the highest since October 2018, and the 5-year high is just 10 bps. The sub-indices of prices paid in the ISMs came out at 77.6 for the manufacturing sector and 64.8 for the services sector. Another sign that the amount of fiscal and monetary stimulus injected is not only impacting financial assets.

Finally, Bitcoin is by far the best performing asset of this early 2021. In fact, it started today's session with year-to-date gains of over 25%, and is currently adding another 10%. Its explosiveness seems to be the main representation of a situation in which an enormous amount of liquidity chases a finite set of assets. Perhaps it is worth remembering for the umpteenth time Farrell's fourth rule (“Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways”). The fact is that by now the wide range of tools for investing in cryptocurrencies has greatly expanded the investor base, while the offer remains fixed. Trying to understand where temporary saturation can occur is an exercise in style. I limited myself to observing that the last explosive movement saw Bitcoin go from around $ 2,000 in July 2017 to over $ 19,000 in December. This time in July, at the start of the parabolic movement, we were at 9,000, and a rudimentary target could be between 70 and 90,000. However, we must take into account that at the moment we are in the middle of an orgy of speculation on various assets. Not that 2017 was a phase of depression, however. As a caveat I observe that the performance at 3 days is close to 30%.

Tonight, the Asian session had a good tone overall with the major indices showing good gains. The exception is Hong Kong, which was sunk by a mixture of factors:

** With a final blow, the Trump administration could ban investments in Ali Baba and Tencent . It is unknown how credible a threat is given that there is talk of removing the outgoing President by appealing to the twenty-fifth amendment.

** The NYSE would have changed its mind again and would like to delist 3 Chinese telecom.

** Beijing took advantage of the cover offered by the Georgia ballots, and subsequent riots in Washington, to further crack down on opposition in Hong Kong, jailing 50 people . The spokesman for the Chinese foreign ministry also made fun of the alleged US double standards for repressions on Chinese territory compared to those on US territory.

The European morning saw indices factor the Wall Street drop yesterday, with nervous price action that caused the banks sub-index to go from gain to loss more than once. US news of a Trump with milder advice favored hedging on the Dollar, as “everyone and his dog” started the year short in dollars. We'll see how breathtaking these coatings are.

The main macro data today was in the US in the afternoon.

** Jobless claims surprised positively, decreasing moderately from the levels reached in December (787,000 from previous 790,000 and vs estimates for 800,000). Total subsidies disbursed are also down (5.07 million from prev 5.2 and vs expectations for 5.2), but there are another 12.8 million under the extraordinary subsidies PUA and PEUC. In general, at this stage the numbers can be distorted by seasonal changes and holidays.

** A trade deficit well above expectations (68.1 bln from previous 63.1 bln and vs estimates for 67.3 bln) due to a + 2.9% of imports in November did nothing to support the $.

** the December ISM services are spectacular (57.2 from prev 55.9 and vs estimates for 54.5). The details confirm the strength, with new orders + 1.3 at 58.5 and business activity + 1.4 at 59.4, but the employment sub-index – 3.3 at 48.2 indicating a drop in employment. There are two considerations here: 1) see above, even the activity in services seems to be expanding rapidly, despite Covid and lockdown. 2) however, the deterioration in the labor market reported in December by the claims and yesterday by the ADP survey is confirmed (- 123,000 from previous +304,000 and vs estimates for +75,000). It seems a further demonstration that the small company, a reservoir of US occupation, is suffering while the large one is filling up with orders.

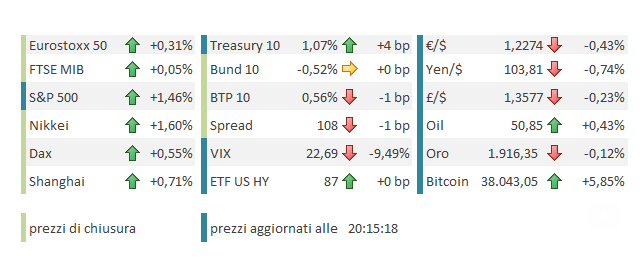

Of course, the markets especially liked the latest data. Wall Street accelerated to the upside, with the Nasdaq leading the move, having shaken off yesterday's dross. Yields rose, while the Dollar, which was already rebounding, did not react much. European stock exchanges took the opportunity to build on yesterday's gains, with the Eurostoxx 50 at new highs since February 2020. Core yields stable, peripherals slightly down. Among commodities, the strength of copper stands out, while precious metals continue to consolidate after the rise at the beginning of the year.

Bitcoin has halved its progress in the last hour, now it “only” rises by 5% after being in progress by 10%. It is still a bit too volatile to be stably large in institutional portfolios, in my opinion.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-le-borse-scrutano-leconomia-e-la-politica/ on Fri, 08 Jan 2021 09:00:48 +0000.