How the world economy will fare

The synergy between the solidity of the labor market and the easing of financial conditions represents a positive signal for the markets. Analysis by Jeffrey Cleveland, Chief Economist of Payden & Rygel

Last February 10, according to the Chinese calendar, the Year of the Dragon began, a mythological creature that in China symbolizes light, prosperity and good luck. However, its meaning is not unique everywhere and in the Western world the dragon is often associated with darkness and destruction: a dualism that is found in the financial markets at the beginning of each new year, often dominated by uncertainty. In the eyes of Western financial markets, the dragon would be the harbinger of recession, crisis in the labor market and businesses, with negative consequences for the riskiest asset classes such as shares and high yield bonds. Weakness of macro indicators, contraction of bank loans and high interest rates: since the beginning of 2022, the consensus on the markets has been unanimous in predicting the "dragon" of recession.

What the main economic indicators tell us

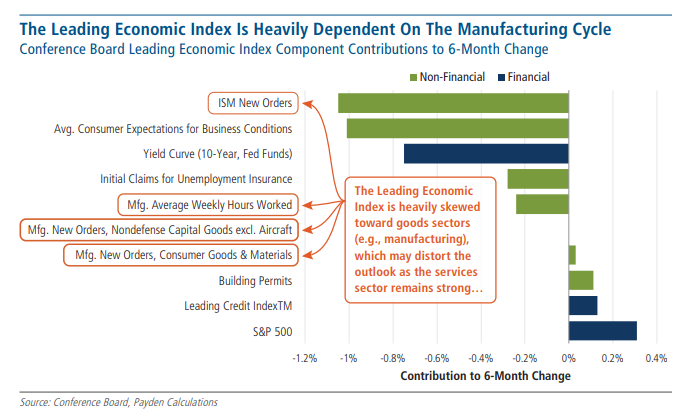

The LEI (Leading Economic Indicator) is an index that summarizes various parameters that typically anticipate changes in the economy: it includes both economic parameters, such as employment, trade and industrial production, and financial parameters, such as share prices and the performance of yield curve. Since 1990, the entry of the LEI into negative territory has always anticipated a recession within an average of 12 months, with peaks of 19 months in 2007 and 6 months in 2020. At the moment, however, although the LEI has been negative over the last 20 months, a recession has not yet occurred.

A possible explanation refers to the composition of the LEI, which is strongly skewed towards the manufacturing sector. In fact, as with every economic indicator, the composition of the LEI also changes over time, adapting to the economy and varying parameters and weights. However, accurately adjusting the models can be a complex operation, also because the comparison between current and past readings is not always straightforward. For example, today in the calculation of US GDP the services sector accounts for 80%, the manufacturing sector only accounts for 9%, compared to 30% 40 years ago. On the contrary, of the ten parameters that currently make up the LEI, four are related to the manufacturing sector, distancing the index from the snapshot of real economic production.

High interest rates

After decades of zero-cost money, the last four years have been characterized by a gradual rise in interest rates, especially in developed markets, where real and nominal rates have risen at rates not seen since the 1970s. As an example, 10-year US Treasury yields increased by nearly 400 basis points, from 0.58% in July 2020 to 4.31% on February 13, 2024, while over the same period, real 10-year yields years went from -1.03% to 2.02%. Such a record rise brings with it the fear that the situation could become unsustainable: the collapse of cryptocurrencies in 2022, the crisis of the US regional banking system in 2023 and that of the commercial real estate sector have raised several questions about the excessive aggressiveness of rates. The answer to these questions, however, is not unique but changes depending on the time horizon analyzed. Taking ten-year real rates in the United States as an example, from an average of 3.8% in the period 1990-2002, they went to an average of 0.9% in the period 2002-2023. Since the start of 2023, rates have returned to an average of 1.7%, currently hitting 2.02%. Therefore, although these are restrictive levels compared to the years 2000-2010, if contextualized in the long term the terms of the issue change.

The resilience of the US economy in the face of increases in real and nominal interest rates can be traced back to a series of factors: firstly, the reduction in the use of financial leverage by American families for over a decade (since the crisis global financial crisis of 2008 to the Covid emergency in 2020); secondly to the wave of refinancing to which the exceptional drop in rates between 2020 and 2021 led both businesses and families; finally to the long-term orientation of real estate loans. In conclusion, the growth of the US economy, to date, is driven by consumption and corporate profits, while families and businesses are less sensitive to the increase in interest rates compared to previous cycles.

A look ahead to 2024: favorable labor market and financial conditions

After a phase characterized by economic growth, fiscal stimuli, falling inflation and the balanced attitude of global Central Banks, in 2024 the markets appear to be looking for support on both the economic and financial fronts. In this regard, the combination of a solid labor market, especially if supported by stable wage growth, and favorable financial conditions, would support market performance, even in the face of a possible reawakening of the "Western dragon" of recession.

The global labor market has enjoyed excellent health for years, in the wake of reopenings and the surge in post-Covid demand. Today, conflicting signals are starting to emerge, particularly in developed markets: in Canada, for example, job vacancies and the unemployment rate (+0.8%) are approaching pre-Covid levels. In the USA, however, although the unemployment rate has increased slightly (from 3.5% to 3.7%), job vacancies remain above pre-Covid levels and requests for unemployment benefits remain limited.

Furthermore, analyzing the historical series of weekly requests for unemployment benefits in the United States since 1970, only in 10 cases did the weekly figure fall below 200,000 units and the average from 1 December 2023 to 2 February 2024 fell stood at 210,000 units, reaching 187,000 in one case, the second lowest figure in the last 50 years. Also noteworthy is the fact that in developed countries the growth of nominal wages remains high, while real wages are recording an increase coinciding with the decline in inflation: the result is an increase in the purchasing power of workers which should translate into a driving force for consumption. A trend that stands out especially in the United States, due to the huge fiscal stimulus and the reduction in the use of financial leverage by American families.

As for financial conditions, they are typically measured by real-time asset prices and other financial market metrics. For example, Goldman Sachs' Financial Conditions Index combines short-term and long-term interest rates, the trade-weighted performance of the US dollar, credit spreads or risk premiums and weighted average equity valuations, ultimately representing a useful real-time indicator of the trajectory of financial markets, including asset price volatility and economic consequences.

The measurement of financial conditions is also given by less extemporaneous systemic factors, such as monetary and fiscal policies, spending behavior, the level of indebtedness and the trajectory of the financial markets.

The latest readings of metrics such as the GS Financial Conditions Index remain below the thirty-year averages and argue in favor of an easing of monetary policy, despite the tightening carried out by the main Central Banks in the last three years. Second, November-December 2023 saw the largest easing in Goldman Sachs' Financial Conditions Index in decades. Furthermore, the shift in global monetary policy from a bullish phase to an easing phase should help mitigate concerns about growth and turbulence in the financial system. Lastly, global fiscal policies will continue to be accommodating, especially in developed countries, which are not inclined towards austerity.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-andra-leconomia-mondiale/ on Sun, 24 Mar 2024 06:38:50 +0000.