How to regulate cryptocurrencies

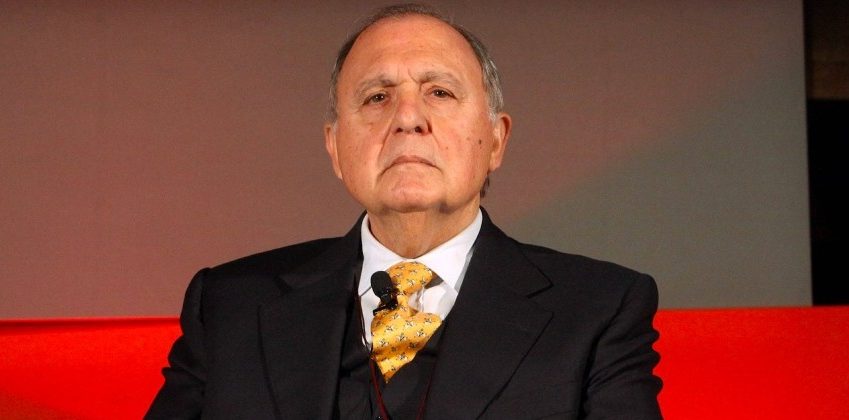

Cryptocurrencies: the full speech of the economist Paolo Savona, Consob president, at the Festival of Economics in Trento

At the current stage of the debate, the condition in which the cryptocurrency market finds itself is that of its "substantial self-governance of quantities through prices, which requires its regulation to guarantee financial stability". Thus the president of Consob, Paolo Savona, during a conference on cryptocurrencies as part of the Festival of Economics in Trento. “This condition – he adds – could perhaps be reached after November 2022, when the 18 + 8 American institutions involved with the ordinance signed by the President of the United States will answer the questions posed by him; they invest a wide spectrum of issues raised by the birth and circulation of cryptocurrencies and their hybridization of traditional instruments, going so far as to consider the geopolitical and geostrategic implications of their development ".

THE INTEGRAL INTERVENTION BY PAOLO SAVONA

The expansion of the quantities and the different forms of the so-called cryptocurrencies (further on CC) has been such that the integration of this new market reality into the existing legislation is essential; in order for it to be done on a rational basis, it is necessary that the operation of the set of these virtual instruments be placed in known economic theory. This is not an intellectual habit, but a necessity which, for any monetary and financial phenomenon, has historically required the development of an explanatory theory of how the relative market works. To avoid the uncertain meaning of the Italian term "economy", which indicates both theory and economic reality, we will use the English term economics, followed by with cryptocurrency, but for the sake of brevity we will use CC-economics [1].

The definition embraces a field that has become quite broad of virtual instruments of a movable nature and accounting methods in encrypted and decentralized form, with particular attention to the “blockchain” one. On the subject, we are witnessing a proliferation of definitions coined to capture the ongoing evolution of this new market reality. For instruments, an elementary division between cryptocurrency and cryptoasset is used to distinguish their monetary or financial use; for accounting methods the more general term DLT-Distributed Ledger Technology. In a broader context, reference is made to DeFi-Decentralized Finance, which embraces the universe of decentralized accounting operations of all kinds, or to FinTech, which considers the operations and operators that accept or propose technological innovations in financial matters.

I will avoid going into the complexities of this new market area so as not to burden the exhibition, in the belief that the audience will understand what we are talking about at a first level of abstraction from reality.

The use of CCs has affected the functioning of the money and financial market on a global level and has led the authorities of many countries to study and propose an integration of current legislation. We are well aware of the market's ability to find ways to circumvent existing rules and, in this case, to rapidly exploit the benefits of the absence of public regulation; private operators have taken the lead in CCs, first developing them in quantities and forms, then hybridizing them with "traditional" activities (credit concessions in mixed form or CC only, derivative contracts with collateral only in CC or mixed with traditional instruments , insurance contracts with CC or other contractual combinations).

Interest in all forms of CC has increased as a result of the close connection created between traditional money and finance to face the global financial crisis of 2008 and has increased following the greater use of computers induced by the lockdown for health reasons. However, the real thrust came from the earnings expectations that the CCs showed they had or just promised, with Bitcoin playing the role of the “chariot fly” of the well-known La Fontaine fable.

Some aspects of this new economics have already been highlighted, but not framed in an overall vision of the national and global monetary and financial markets; it was mainly discussed whether CCs are in the nature of money or financial instruments, without reaching a common conclusion, either privately or officially. Their monetary use is rather modest, but they act as a unit of measurement (numerary) for all the trades in which they are present; that is, they perform a traditional function of money, together with that of a store of value, even if outside the theoretical context defined in centuries of crisis and corrective experiments. In fact, given their price variability and the absence of regulation, they are peculiar reserves of value, but they are not real units of measurement, because their expression refers mainly to the US dollar, which remains the dominant numerary even at the global. Furthermore, they are not a legal means of exchange or debt release, as they do not have legal tender. In this regard, the warnings of the supervisory authorities, replacing the necessary regulatory provisions, have proved to be of little effect, as evidenced by the recent events of falls in the values of the CC. Massive sales of stablecoins (further on SC) backed by Bitcoin (further on BC), by other CCs or by shares of industry or traditional companies, whose market values are falling and making stability guarantees obsolete, have created difficulties for some intermediaries in the sector, who reacted by warning customers that if they caused their collapse by accelerating sales, they would lose their savings. I don't think we can be clearer than that about the consequences of the absence of regulated legal protection in this market. On the theoretical level, the effect is similar to that which occurs on bank deposits in the event of their escape, if there is no lender of last resort or an institution that performs a similar function.

In choosing, even alternatively, the monetary or financial use of CCs, whoever owns them does not refer to the existing legislation, but to the conventions established between the members of the virtual circuit, to which they attribute a practical value higher than the legal one. In fact, the absence of legislation represents one of the main risks of operating in this market area, which reverberates in the traditional area hybridized by the CCs. What matters for operators in virtual instruments is the interchangeability (or liquidability) between their different forms and with traditional instruments of the money, financial and real market.

Having clarified this aspect, the theoretical framework of CCs in a new economics requires that the elaboration be placed within one of the main traditional monetary schools of thought:

(i) that which claims to entrust to the market the creation and self-government of the quantities of money and interest rates (which sees the ideas of Friedrich Hayek among the most cited by his supporters, although not perfectly in line with those of he expressed);

(ii) that of assigning to monetary authorities the independent exercise of creating and controlling the quantities of money and / or interest rates (whose supporters refer to John Richard Hicks, to name only an important teacher, given that the his ideas are common to many other economists);

(iii) the one that suggests setting golden rules, rigid rules of monetary creation, leaving the market to set interest rates (with Milton Friedman considered school head).

These schools of thought are considered part of classical, Keynesian and neoclassical theories. The choice between these options can only be made by assuming that the economy works in one way rather than another. On the subject, economists have produced rivers of "evidence", which are not such because an empirical verification that everyone agrees has not been reached, but only to a set of logical arguments in favor of one or the other interpretative hypothesis. The only conclusion that can be drawn from this vast scientific production is that from time to time, from country to country, economies function as if one of the three schools had practical validity, but only contingent.

The first theory assumes that the markets, left free to operate, have an intrinsic capacity to self-regulate, where prices are the prevailing reference of operators and full employment is always guaranteed, being contained in the concept that it consists of the level that should be used.

The second, that markets pay attention mainly to quantities and do not have the ability to use all available labor and capital resources, requiring public intervention to achieve cyclical stability of the economy and full physical employment of resources, especially of work.

The third recognizes the usefulness of recourse to private market initiative and state intervention for infrastructural purposes, but suggests a rigorous, if not strictly rigid, monetary policy and a public budget parameterized to economic trends, structurally in tie.

At the present stage of the debate, the condition in which the CC market finds itself is that of its substantial self-governance of quantities through prices (close to the classic version), which requires its regulation to guarantee financial stability; this condition could perhaps be reached after November 2022, when the 18 + 8 American institutions involved with the ordinance signed by the President of the United States will answer the questions posed by him; they involve a wide spectrum of issues raised by the birth and circulation of CCs and their hybridization of traditional instruments, going so far as to consider the geopolitical and geostrategic implications of their development [2].

Considering that the creation of CC, which does not have reserves of traditional instruments in whole or in part, alters the distribution of income and wealth, because it creates purchasing power out of nothing, albeit on a conventional basis, the three explanatory models indicated must be also integrated by evaluating the effects they have on the distributive variable and, consequently, on the social equilibrium or on the imbalances that occur on the market as a whole.

However, the definition of a more complete economic theory will require more time, since it depends, we repeat, on the knowledge of the morphology that the monetary and banking system will assume, to decide what to do on an overall rational basis. However, this ideal world is rare to find and, therefore, decisions can only be taken in conditions of uncertainty, like every fact of economic life.

Faced with such a broad and complex scenario, attention has so far been devoted to examining Gresham's law, answering the question of what the bad money could be capable of driving out the good one. The usual disagreements have arisen as to whether the official currency, such as the dollar or the euro, will prevail over the private one (the CC) or whether the opposite will happen, as argued by many scholars whose ideas are shared here. The only doubt is linked to the persistence with which private individuals will continue to consider on a conventional basis that CCs find a guarantee against the risks of the absence of legislation and the wide volatility of their prices in the high earnings expectations they place in them. However, it is not a practical answer that must be sought, but an arrangement that is as stable as possible in theory, jointly assessed in the light of a monetary policy that proceeds in a manner consistent with the principles that inspired it up to the most recent decisions to assign a greater weight on financial stability and real growth than rigorous inflation control.

For some years it has been debated whether the solution to the problem that has arisen with the developments of the CCs can and should come with their replacement, it is not yet clear whether total or partial, with a "digital" public currency, called CBDM-Central Bank Digital Money ( CBDC is also used replacing M-Money with C-Currency); however, even this solution raises problems of an institutional and technological nature. In fact, if digitization consisted in the expansion and improvement of this form already widely used in current payments to create a cashless society, a company without physical currency, only the problem would arise of indicating which DLT accounting will be used and of drawing up a regulatory transition program. -technological towards the new monetary regime. If, on the other hand, the CBDM were a currency that competes with the CCs, the main problem would consist in guaranteeing the authorities access (called a "node") to the information accounted for on the Blockchain, distinguishing the case of Bitcoins, closed to external participants to the holders. (at least at the current state of the known techniques), from that of the other CCs (Ethereum, Ripple XRP, Litecoin, etc.), potentially open, with decentralized methods to be able to exercise their supervisory activity.

If the CBDM completely replaced the CCs, problems would arise in the reorganization of the current banking system, as the deposits would exit the monetary circuit. This change would confine the activity of banks to the financial circuit, that of the mere management of savings and payments, raising problems of defining common governance rules:

a) the creation and circulation of digital currency within countries and in international exchanges, establishing a new exchange rate regime along the lines decided with the 1944 Bretton Woods Agreement, valid until 1971, within which the possibility of proposing the creation of a digital bancor of Keynesian memory [3];

b) the domestic and international securities market, embracing all traditional and virtual instruments, establishing the characteristics of the technologies to be used for decentralized accounting.

In the context, central banks would maintain direct financing relationships with banks and, where permitted by their statutes, with the states and the economy (businesses and households), in a position of monopoly of monetary creation. Today's monetary base would disappear and the CBDM would take the form of fiduciary money, similar to that once created by banks alone, with a much stronger public guarantee for holders than current bank deposits have.

Gresham's Law would find a practical answer as bad money would disappear, not under the pressure of the market, but by the will of the authorities; if, however, they, as their statements seem, were willing to recognize the legitimacy of stablecoins also for those created by banks, the problem would remain unsolved. It is true that the SC would be subjected to an authorization process to maintain control over the government of the overall quantity of money, but this choice would in any case complicate the conduct of a monetary policy aimed at financial stability if the management of the reserves necessary to guarantee the stability of these peculiar CCs were partial and not total, as well as composed of different forms of the CBDM. If that were the case, as we hear repeatedly, we would lose the advantages of the distinction – repeatedly invoked by Irving Fisher and the Chicago Plan of 1939 to get out of the Great Recession and taken up with greater analytical precision by Hyman Minsky to put an end to the banks ". two bosses ”- the stability of the currency for the part in the form of deposits and a greater use of savings aimed at growth.

If the CBDM coexisted with the CCs and, even more so with the SCs, the definition of an interconnection between the digitized, centralized open and closed accounting bases would be indispensable, regulating the technologies in order not to lose the information necessary for economic policy choices. . In any case, a preliminary examination of how a two-tier market works, a market where two forms of the same good coexist (private money and official money), would be necessary; the negative effects of this form are known since fiduciary coinage was implemented by several private sources, especially banks, at the turn of the nineteenth and twentieth centuries, with a last experience made to avoid the collapse of the Bretton Woods monetary regime, when he decided to isolate gold trading on the official market from those on the private market, which lasted only a few months before the collapse of the dollar's gold convertibility at fixed prices already mentioned. The coexistence between a currency whose quantities would be controlled by the authorities and one controlled by private individuals can be considered difficult to implement, if not really impracticable, especially if the private one was of international origin and penetrated national systems.

Having ascertained that the redefinition of a CC-economics requires strictly connected decisions on an institutional and technological level, it is possible to trace its main components to arrive at a collective work agenda. The task is so large and burdensome that it requires the repetition of the experiences made in the early 1960s with the MIT-PENN-FED econometric model under the guidance of Franco Modigliani, Albert Ando and Frank De Leeuw, who saw the Bank of Italy by Guido Carli follow with equal speed and no less intelligence to fine-tune his M1BI. These models are now obsolete, not only due to the lack of consideration of the universe of CCs, but because they fail in their predictive use of a probabilistic matrix, which requires continuous changes in the results, undermining their very function of helping to make choices. This is all the more true, in a world that has become rather complex due to the innumerable interconnections between thousands of variables that need to be treated using artificial intelligence methods, with a paradigm shift from the deductive method, typical of econometric models, to the inductive one. , however, on new scientific bases, as correctly argued by Rainer Masera in the text already cited [4].

At this point of knowledge of the CC problem, the research path of a CC-economics should be contained in a three-phase work agenda.

The first, which consists in the re-examination of the existing econometric models, introducing the quantities of CCs created or existing and, alternatively, their prices in order to:

to. redefine the known functions on the behavior of real investments and savings to changes in quantities and prices;

b. assess the quantity and price effects of CCs on exports and imports;

c. identify the transmission mechanisms of the effects on prices and portfolio balances (distinguishing inflation on real goods and inflation on financial goods);

d. decide on the use of tools for economic, monetary and fiscal policy choices, elaborated over centuries of reflections.

A second, certainly more demanding, which aims to identify the probable corrections to the economic theories as known today, overcoming the vision so far limited to single aspects (such as Gresham's law and the two-tier market mentioned above), hypothesizing :

the. the existence or not of a private currency, the CC, accepted on a conventional basis by the parties, but without public recognition;

ii. the existence or otherwise of a condition of free convertibility between public and private currencies and free circulation of finance, in the presence of a market that registers trade even in an unofficial way;

iii. the presence or absence of a WTO to regulate global trade.

To reach a third phase, the one that elaborates new models based on the application of artificial intelligence methods that involve the exit from the deductive logic based on objective (or subjective) probabilities, to enter an inductive logic based on the elaboration of thousands of data available to derive more satisfactory forecasts. The most reasonable expectations are that changing the model from that used by econometric models would provide a better understanding of the effects, but not the causes that determine them. We should therefore be content with predicting better, giving up, at least initially, to pursue the aims of knowing the causes of the economic phenomena typical of the economic research pursued up to now.

These profound changes concerning the ways in which all markets already move and, even more so, will move also involve a re-examination of the tasks assigned to existing institutions and of the organizations that they will have to give to carry them out. This will depend on the solution that will be decided for the architecture and forms of money, for similar decisions regarding intermediaries and market supervision, as well as corporate governance. These are all decisions that must be taken to assign to the competent units the objective of pursuing the financing of productive growth and limiting the area of finance for finance, which represent the most effective ways to protect savings, understood as an indispensable basis for stability. social necessary for an orderly development.

Raising problems without indicating solutions rightly leaves those who wonder what the future of their savings is unsatisfied. The cognitive premises to give an answer have so far been indicated. Since they have not yet been clarified at the European and, even less so, global level, at this stage of knowledge it is still possible to proceed, as is done, according to the lines of supervision and application of regulations established for traditional instruments, which encounter , however, legal and practical obstacles to their application. However, the current regulation represents the basis for welcoming the proper functioning of the market for any type of activity in which cryptocurrencies are present, which is supervised by specialized bodies capable of guaranteeing compliance with the legislation that will be decided, the transparency of the operations that are carried out on the market, the rapid execution of authorization processes and sanction mechanisms, all activities to be examined in the new technological context.

[1] I put forward this proposal in a Lectio magistralis held at the University of Cagliari on 1 October 2021, the text of which was published in Bancaria ("Theoretical and practical features of an economy with cryptocurrencies", n. 10, 2021, pp. 2-11); a summary in English is being published in the journal Economia Internazionale.

[2] I examined this ordinance issued on 9 March 2022 in my speech to the Banca di Piacenza on 2 April 2022 entitled "Some reflections on scientific and technological progress at the service of finance".

[3] I draw this reference in a wide-ranging paper on the topics covered in these reflections edited by Rainer Masera on February 6, 2022 entitled "New risks and regulation of cryptocurrencies".

[4] I examined the evolution of the method for scientific research in my last work for the types of Rubbettino (Soveria Mannelli 2022) entitled Does the progress of science improve the destiny of humanity? A review of the changes in scientific research methodology from Roger and Francis Bacon to the present day.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-regolare-le-criptovalute/ on Fri, 03 Jun 2022 07:50:45 +0000.