How will Europe’s economy fare?

“The ECB's GDP growth forecasts are too optimistic”. Comment by Martin Wolburg, senior economist at Generali Investments

The euro area averted fears of another quarter of deadlock in activity and recorded a surprisingly strong increase in GDP of 0.3% in the second quarter. Information from countries suggests that foreign trade (see France) and stabilizing consumption (in Germany) were the key factors. However, looking ahead, it appears clear that a cooling of activity is underway. At the beginning of the third quarter, the main confidence indicators deteriorated in all sectors. The composite PMI (Purchasing Managers Index) fell to 48.9, a level consistent with the contraction in output, while the forward-looking components of various economic analyzes also weakened.

FORECAST FOR THE SECOND HALF OF 2023

Despite this, we believe that the second half of the year will be characterized by a slowdown in activity, but not a recession. A key stabilizing factor will be further reductions in inflation. In July, headline inflation fell to 5.3% annually. Falling energy and commodity prices and less pressure from pipelines will drive inflation below 3%y/y (yoy) by the end of the year. Improving real income growth and a sound labor market will be the main pillars of stabilisation.

WHEN WILL THE ECB'S PEAK RATES REACH?

The peak in ECB rates will be reached in September. At its July meeting, the ECB raised its (deposit) rate to 3.75%, as expected. However, while considering inflation still too high and for too long (core inflation stable at 5% yoy in July), the ECB no longer sees the need to raise rates further, instead adopting a truly interest-based stance data. Up-to-date inflation data and macro projections will therefore be key.

WHY THE ECB'S FORECASTS ARE TOO OPTIMISTIC

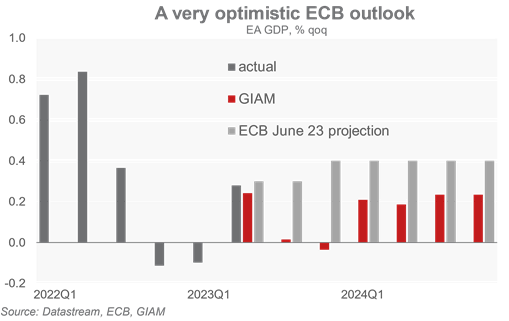

We believe the ECB's GDP growth forecasts are too optimistic (see chart). We doubt that the updated inflation forecasts are supportive enough to cap the swings. It has clearly emerged that the ECB continues to be concerned about the internal dynamics of inflation. We therefore remain firm on our scenario of a final 25 basis point hike to hit the 4.0% high, but recognize that this choice has become very much in the balance now. In any case, we believe that the maximum level of interest rates will be reached in the third quarter and maintained for about a year.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-andra-leconomia-delleuropa/ on Tue, 15 Aug 2023 05:06:00 +0000.