How will the American markets fare

In 2023, a contraction of the US economy is expected, worse than the tech and telecommunications bubble of the early 2000s, but not as severe as the financial crisis of 2008-2009. However, five investment themes can be identified. Commentary by Jared Franz, economist at Capital Group

The US economy, while stronger than most other developed countries, appears to be heading straight for recession, burdened by high inflation and rising interest rates.

In 2023, we expect the US economy to contract by 2%. It would be worse than the tech and telecommunications bubble of the early 2000s, but not as bad as the 2008-2009 financial crisis. The important thing to remember is that recessions are inevitable and necessary to eliminate market excesses; moreover, they have always laid the foundations for future growth.

Here are five investment themes to consider this new year.

1. Stocks will likely return to growth before the economy

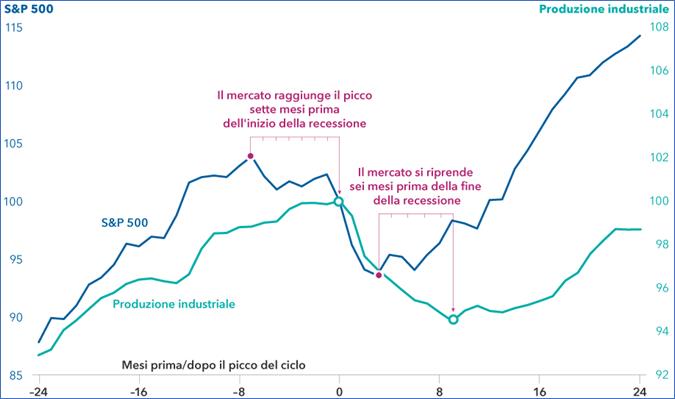

Every recession is painful in its own way, but on the relatively positive side, they haven't historically lasted very long. Our analysis of 11 US cycles since 1950 shows that recessions have lasted anywhere from two to 18 months, with the average lasting about 10 months.

Furthermore, equity markets generally tend to recover before the end of the recession. In this cycle, stocks have already dragged the economy down. But as history teaches, they could rebound about six months ahead of the broader economy.

Historically, stocks have been a clear indicator of economic performance

Stocks have always tended to anticipate a brighter future before it's evident in the data. In other words, investors would be better off holding their equity allocations than trying to guess the timing of a recovery. The advantages for those who manage to fully grasp the relaunch of the market can be considerable.

2. Dividends matter again

With rates rising and the economy slowing, we're seeing plenty of investment opportunities in companies that pay solid dividends. And dividends are starting to account for a larger and larger share of total returns, as they have historically.

When single-digit growth is expected, dividends can offer an edge. And they can also be a source of downside protection when volatility increases, but understanding their sustainability is essential.

Companies that tend to pay higher than the market average, constant dividends operate in a variety of industries, including financials, energy, materials, and healthcare. UnitedHealth Group, the leading provider of health benefits to employers in the United States, held its dividend steady despite rising interest rates.

3. A new market leadership

Often at the end of a down cycle, new market leadership emerges. With the cost of capital skyrocketing, companies with strong and reliable cash flows are uniquely positioned to lead the next recovery.

Think of the healthcare sector, which includes innovative pharmaceutical companies that are well capitalized and have good pricing power. Some drugmakers may use short-term profitability to fund acquisitions and other expansion strategies.

Recent investments in drug discovery are opening the door to new ways to tackle important problems like obesity. By 2030 it is estimated that in addition to suffering from this disorder there will be more than a billion people worldwide, resulting in cardiovascular disease, diabetes and kidney failure. Companies like Eli Lilly have invested heavily in therapies that could potentially reduce a patient's body weight by 20% to 25%.

4. Investments for growth also depend on earnings

Today the growth style has undergone a repricing due to the higher cost of capital. The success of an investment in growth-oriented stocks may depend less on multiple expansion and more on earnings growth.

Established tech behemoths, with visible cash flows, such as from legacy software offerings, coupled with an ever-expanding offering, such as a cloud platform, could dominate the market in the next bull cycle. Looking forward, however, investors will focus more on profitability and be less tolerant of companies that grow rapidly but have little or no earnings growth.

5. Prepare for a potential industrial renaissance

In addition to the healthcare and technology sectors, unexpected segments, such as capital equipment companies, could also be driving the new growth. A capital investment supercycle is expected to spark an industrial renaissance as supply chain reshoring, grid modernization and renewable energy investment stimulate demand for capital equipment spending.

We think the result of the Inflation Reduction Act, which allocates billions of dollars for investments in renewable energy infrastructure, could be a resurgence of traditional industrial companies that supply the renewable sector.

These billion-dollar spending also reflects revenue growth potential for capital equipment leaders such as Rockwell Automation, energy battery and storage developers such as Lockheed Martin and Tesla, and equipment suppliers to the energy and energy industries. mining such as Caterpillar and Baker Hughes.

This investment cycle may have broader benefits for US manufacturing, as significantly lower energy costs in the long run can give US manufacturers a competitive advantage. 'Made in the USA' will once again be synonymous with growth.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-andranno-i-mercati-americani/ on Sun, 29 Jan 2023 06:11:43 +0000.