How will the economy of Japan go?

Japan's central bank lowers its growth forecast for fiscal year 2021, but raises it for the next. The microchip crisis and the weakening of the yen weigh on the national economy. Numbers, estimates and scenarios

In its latest quarterly assessment, Japan's central bank (the Bank of Japan) estimates that the country's economic growth for the fiscal year ending March 2022 will be 3.4 percent. It is a lower assessment than the one communicated last July, of +3.8 percent.

THE CAUSES

The reason for the lowering of the central bank's forecast is linked to the coronavirus pandemic which, with its disruptions to industrial activity and the procurement of components, has forced Japanese carmakers to cut their production levels in the impossibility of access. to semiconductors (or microchips) for vehicles.

The increase in infections in countries such as Malaysia and Vietnam had negative repercussions on the semiconductor chain, in turn causing a 30-40 percent decline in the output of the Japanese automotive sector in the period September-October. However, the situation is expected to improve in November.

INFLATION

The announcement that most surprised the markets was the inflation one: the central bank said it expects consumer inflation of 0.0 per cent; the July estimate was 0.6. "This," writes Nikkei Asia , "could fuel expectations that the Bank of Japan will maintain its monetary stimulus, unlike central banks such as the US Federal Reserve and the European Central Bank."

HOW IS THE ECONOMY OF JAPAN

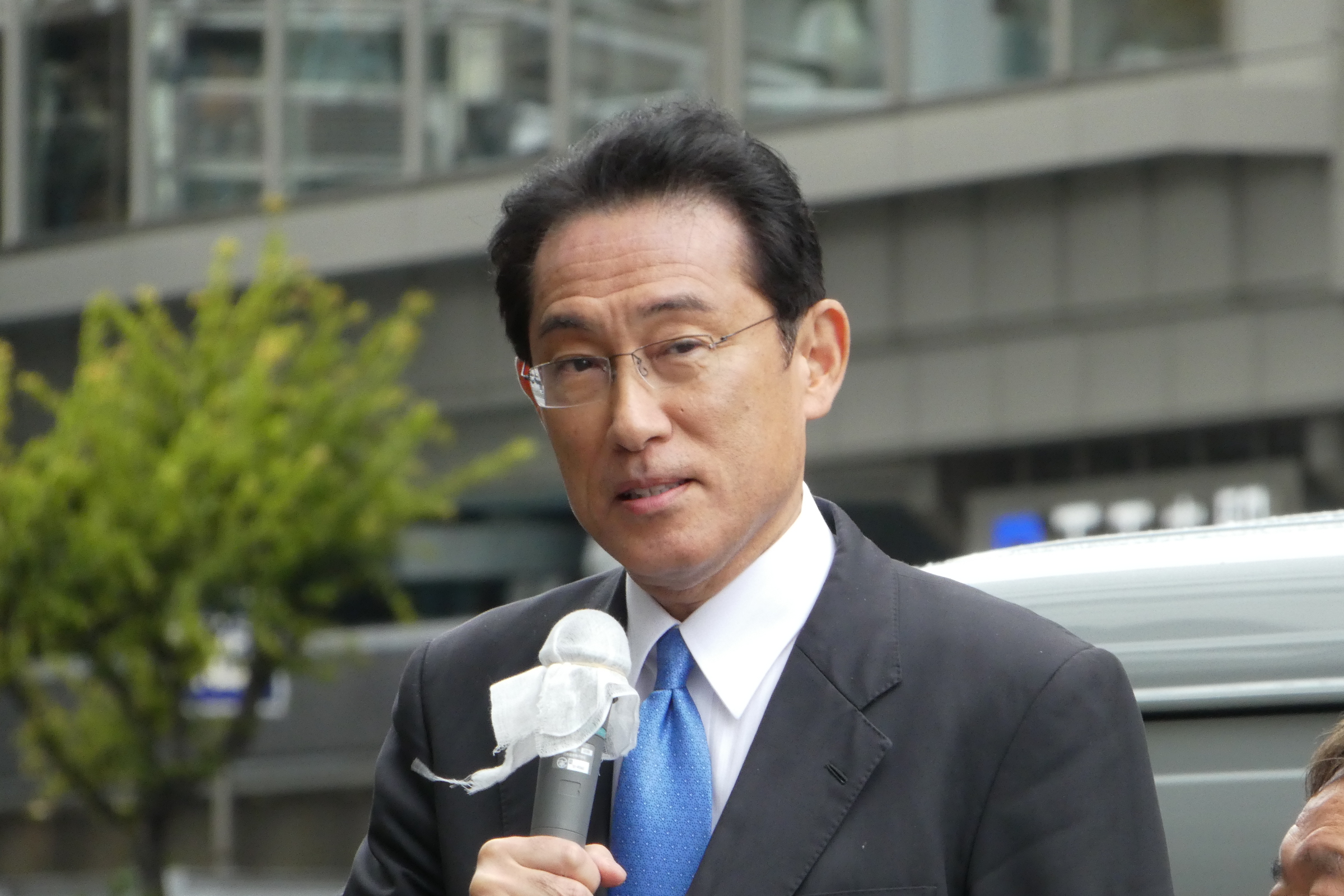

Japan's economy is showing several positive signs. For example, consumption is picking up after last month's decline in coronavirus infections, which led to the end of the state of emergency on October 1, for the first time in six months. Furthermore, since 4 October the country has a new prime minister: Fumio Kishida , of the Liberal Democratic Party (center-right): he has promised a "new capitalism" more attentive to redistribution, as well as an expansive spending policy.

For the fiscal year that will start in April 2022, the Bank of Japan expects growth of 2.9 per cent, higher than that announced in July (2.7); consumer inflation remains unchanged at 0.9 per cent.

THE CENTRAL BANK LINE

The central bank has decided not to change its monetary instruments. Short-term interest rates are at minus 0.1 percent, while long-term rates are around zero. The line of credit – introduced in March 2020, in response to the pandemic – on the purchase of corporate bonds, and also the offer of zero-interest loans for one year to banks that help companies affected by the coronavirus crisis will continue.

It is also keeping intact the COVID line of credit introduced in March 2000 to take measures such as the purchase of corporate bonds and commercial paper, as well as offering one-year interest-free loans to banks that support coronavirus-affected businesses.

Around the world, however, many central banks are beginning to tighten their monetary policies in response to rising inflation caused by the shortage of supply of a variety of products. For example, the US Federal Reserve should raise rates next year, sooner than initially expected (2023); close to Japan, South Korea's central bank has already raised rates from 0.5 to 0.75 percent.

The decision comes as central banks around the world begin tightening monetary policy in response to rising consumer inflation triggered by global supply shortages. South Korea's central bank raised rates to 0.75% from 0.5%, while New Zealand raised rates to 0.5% from 0.25%.

HOW IS THE YEN GOING

The yen, the Japanese currency, is in a moment of strong depreciation against the US dollar: in early October it touched a three-year low of 114 yen for one dollar. The divergence of the outlook on interest rates between the two countries has something to do with it.

As the Nikkei Asia notes, the weakening of the yen could translate into an increase in the cost of imported goods and production costs, complicating the national economic recovery and the monetary policies of the central bank.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/giappone-economia-crescita-inflazione/ on Thu, 28 Oct 2021 09:21:32 +0000.