How will we replace Russian gas? Scenarios

Putin's war against Ukraine will have consequences on gas supplies, including to our country. Here's what awaits us. The article by Marzio Galeotti and Alessandro Lanza for lavoce.info

The war that Putin's Russia has waged against Ukraine has drawn attention to the European energy situation and in particular to the gas market.

As regards our country, the Prime Minister, Mario Draghi, clearly illustrated some central elements in Parliament. The first is that Italy is among the European countries most closely linked to Moscow in terms of natural gas supplies.

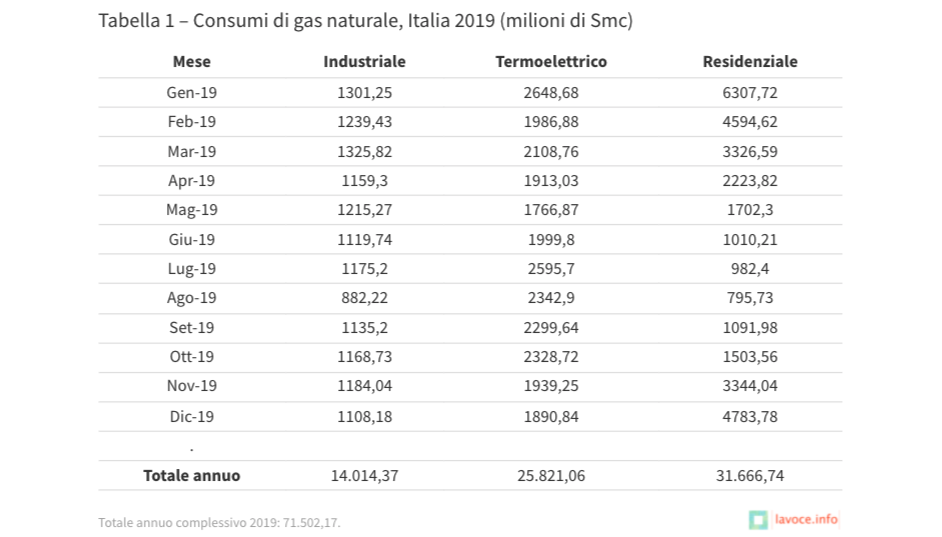

Table 1 reports the data published by the Ministry of Ecological Transition referring to 2019, to avoid the effect caused by the coronavirus. In Italy, the total consumption of natural gas amounts to 71.5 billion Smc (standard cubic meters); the residential sector absorbs most of the available gas, with a percentage equal to 44 per cent of total consumption, followed by the thermoelectric sector (36 per cent) and the industrial sector (20 per cent).

About 5 per cent of the demand for natural gas is met by national production and the remainder by imports. In 2019, a total of 71 billion cubic meters of gas were imported, used in part to satisfy consumption and the rest set aside in storage sites. 13 per cent of total imports come from liquefied natural gas (LNG).

The main gas exporters to Italy are (in brackets the percentage of total imports):

- Russia: 33.4 billion scm (equal to 46 per cent)

- Algeria: 13.4 billion Scm (equal to 18.8 per cent)

- Qatar: 6.5 billion scm (equal to 9.2 per cent)

- Norway: 6.1 Scm (equal to 8.7 per cent)

- Libya: 5.7 billion Scm (equal to 8 per cent)

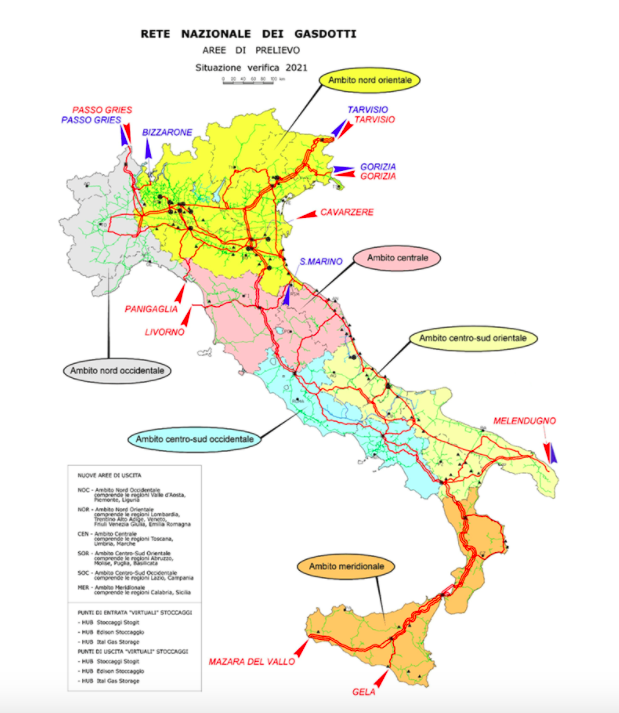

In 2021, the trans-Adriatic gas pipeline (Tap) came into operation to transport gas from Turkey through Greece and Albania to Italy with a landing in Melendugno (Puglia). The plant currently supplies 8 billion cubic meters of gas a year, with the forecast of reaching 10 billion cubic meters in the summer of 2022 and reaching a maximum supply capacity of 20 billion cubic meters in the future.

The position of Brussels

In these hours, the positions of Italy and the EU with respect to the offer coming from Russia are taking shape. The offices of the European Commission are very carefully evaluating a possible emergency plan to deal with any blocking of supplies; it seems clear that the European inventory system should in any case stand up to an interruption. At that point, the solidarity mechanism recalled by Mario Draghi in Parliament would take effect. Ultimately , the Commission does not seem to be too pessimistic about energy risks for the winter: "We are not in a situation where we could suddenly find ourselves without gas and in any case the level of stocks is at 30 per cent of capacity", was explained.

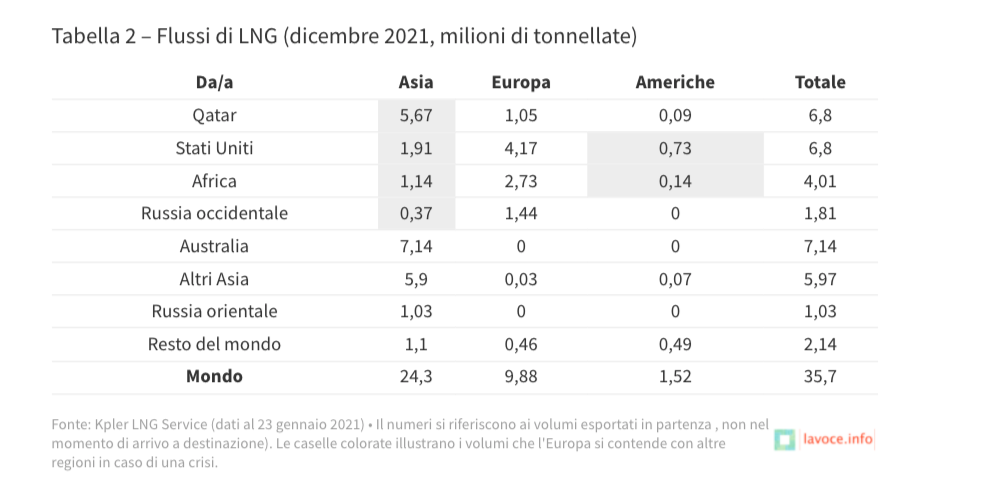

Brussels appears optimistic, or at least shows it is, also about the results of ongoing contacts with gas suppliers other than Russia. In January there was a record supply of liquefied natural gas with 10 billion standard cubic meters supplied in an extraordinary way thanks to the “diversion” of sea transport from the original destination. The EU assessment is in line with the consensus one, even if it is a fact that the levels of European stocks, although decreased less than originally expected, are at their lowest in the last ten years. It is no coincidence that Brussels has decided to invite member states to guarantee an adequate minimum level by the end of September each year. It should be noted, however, that according to Qatar, one of the major world exporters of gas, on which Italy insists so much, "quickly replacing Russian supplies is almost impossible". Today is the news that Japan will supply Europe with part of its LNG imports, due to the difficulties that the Old Continent faces due to the Ukrainian crisis. And in addition to Qatar, talks are underway with Egypt, Azerbaijan and Nigeria.

Table 2 shows that Europe has already absorbed a lot of LNG from the United States, even if some of it still goes to Asia. American supplies would not have an economic merit: from the mere point of view of costs, in fact, the hypothetical competition between a US ship and the gas coming from Russia would in any case be to the advantage of the latter. But obviously the security of supplies has an economic value and value.

At this stage, however, it is not yet possible to understand how Russia's reduction in supply could be achieved. Moscow could decide to cut supplies as it did a few years ago during the first Ukrainian crisis. However, according to recent statements by Gazprom leaders, the hypothesis seems unlikely at the moment.

Given the concern of some European governments, including the Italian one, the latest version of the financial sanctions would provide for a blocking of the "selective" Swift, which only allows transactions that refer to payments for gas supplies. In its extreme version, the Swift blockade would result in the impossibility of importing gas from Russia because in fact it would not be possible to pay for supplies. This would entail costs where take or pay contracts are in force which provide that the gas not withdrawn must still be paid for.

The cubic meters to find

Before even worrying about the higher costs – which certainly will exist and which will represent the price of Europe's firmness in the face of the violation of international law – we can ask ourselves how our country could cover the possible gap in the lack of supply of 33 billion. of Russian smc. The government has resolved to increase national production, which should reach 6.5 billion cubic meters and which would benefit energy-intensive companies and small and medium-sized enterprises. This would reduce the residual needs of the industry, according to Table 1, to 7.5 billion.

The other chapter on which to intervene is electricity generation. Although it is difficult to make predictions, or better still conjectures, the government has made it clear that it is ready to reactivate the coal plants that are being decommissioned (should be completed by 2025). Preliminary simulations carried out by the researchers of the Eni Enrico Mattei Foundation indicate a significant change in the electricity mix, with the reduction of the gas share by 10 percentage points offset by an increase of both coal by 2 points and renewable sources by 7 percentage points.

It also remains to cover the consumption of the residential sector, for which voluntary or compulsory energy saving measures could help to reduce the volumes to be satisfied through greater imports from other geographical origins and from LNG.

Naturally, these are speculations that do not consider the time factor. On the one hand, the greater national production cannot be activated in a short time and the same is true for the expansion of renewables, even if the government is working to speed up the bureaucratic procedures for authorizing new plants. On the other hand, however, the withdrawals should decrease as we leave the winter, even if in the summer we proceed to storage.

Basically, first let's worry about the quantities, then we will think about the costs. For the moment, the uncertainty is still strong.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/come-sostituiremo-il-gas-russo-scenari/ on Sun, 06 Mar 2022 06:24:29 +0000.