How’s Comau doing (which Stellantis will sell)

The Stellantis group has taken over the dossier for the sale of Comau, a Turin company specialized in industrial automation and robotics. Here are the accounts (at a loss) of Comau

Exor, the holding company of the Agnelli family, shareholder of the car company Stellantis, is warming up its engines for the sale of Comau.

According to what was reported today by Sole24Ore and Corriere della Sera , the Stellantis group is considering options for the future of Comau, the Turin-based robot company of the group. Among these, the main one is that which leads to a spin-off, which could be followed by a listing on the stock exchange, although the latter is difficult to achieve given the context prevailing on the financial markets.

“It would be easier instead to sell to some foreign group, especially large Asian conglomerates. It must be said that an operation of this type will in any case also have to pass the examination of the Government, given that Comau is part of a strategic sector of technology", underlines the Confindustria newspaper.

Even before the outbreak of the pandemic, in 2019, before the maxi merger between FCA and PSA, rumors had circulated about a possible sale of Comau.

“At the time of the first spinoff plans, Stellantis seemed intent on placing 70% of Comau on the market, distributing the remaining 30% among its shareholders. At the time, analysts had imagined a wide valuation range, between 300 million and one billion,” wrote Corriere della Sera . According to Il Sole 24 Ore , “there was talk of a valuation of around 2 billion euros. Then the operation was put on standby, subordinated by the pandemic and other priorities."

Here are the numbers and deals of the Grugliasco robot company in view of the spin-off projects from Stellantis which could actually come to fruition in 2024.

TRANSFER IN VIEW

So Stellantis restarted work on the spin-off of Comau. According to what has been reported by multiple financial sources, the automotive group controlled by the Exor holding has resumed contact with various investment banks to study how to enhance the value of the company specialized in industrial automation and robotics.

The investment banks are apparently studying alternatives and the hypothesis of a sale is being examined: also exploring the interest of private equity funds in the company. In the panorama there are not many international investors who could carry out an operation of this type, which has a series of industrial complexities, summarizes MF .

At the moment no path seems definitive, and according to rumors, the American investment bank Goldman Sachs, one of the historic consultants of the automotive group, is working on an exploratory assignment on the dossier.

CONFIRMATION FROM THE COMPANY

Meanwhile, “The plan for the spin-off of Comau is proceeding, as announced by both Stellantis and Comau,” a Comau spokesperson confirmed to the Sun and the Corriere . «At the moment – he continues – it is not possible to add further details. On this path the company, which celebrates 50 years in 2023, is consolidating its set objectives."

Recently, moreover, the CEO of Stellantis himself, Carlos Tavares, admitted: "We are evaluating the right timing" for the spin-off of Comau. “A decision could be made by the end of the year,” notes the Corriere .

THE BUSINESS

As Il Sole 24 Ore recalls, “Comau, a company with twelve production plants, with an international network of five innovation centers and five digital hubs, where almost 4 thousand people work in 13 countries, is a world leading company in the field of industrial automation for the automotive industry, for which it develops and supplies assembly and machining solutions for traditional and electric vehicles and robotic production systems, including wearable robotics solutions”.

“The demand for automation is growing by more than 10% per year, with even higher peaks in the new sectors that are opening up to these technologies. Leveraging its experience in 'traditional' Automotive, Comau is consolidating itself in the e-Mobility segment, which already today represents 25% of our business, which is constantly increasing", underlined the CEO of Comau, Pietro Gorlier on the occasion of the " meeting “Automation as a driver of growth and innovation: the role of Comau, for its 50 years” last May.

In fact, the company is continuing the process of diversifying its activities, entering sectors that are open to automation technologies, such as shipbuilding. Just last June, Comau and Fincantieri presented the first concrete result of their collaboration started in 2021: MR4WELD (Mobile Robot for Weld – mobile robot for welding) a unique mobile robotic welding solution.

THE EVALUATION

As already mentioned, when we started talking about a spin-off four years ago, analysts had imagined a wide valuation range, between 300 million and one billion. “The impression, however, is that Tavares aspires to go beyond this sum” specifies the Corriere . True also in 2018 Comau had closed the financial statements with a production value of 241 million euros with a profit of almost one million euros (932,205 euros).

COMAU'S NUMBERS

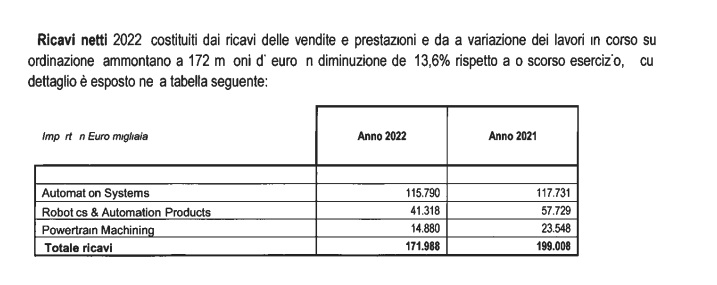

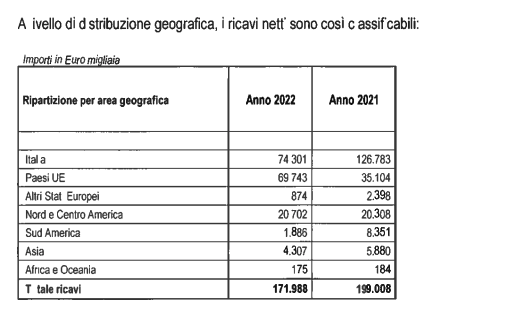

Looking at last year's balance sheet, the robot company closed 2022 with a production value of 208.5 million euros, down 7.7% compared to 225.8 million euros in 2021. Production costs stood at 236 million euros, down compared to 280 million the previous year. The operating result is negative with a loss of 60 million, although an improvement compared to the loss of 74.7 million in 2021.

COMMERCIAL TREND

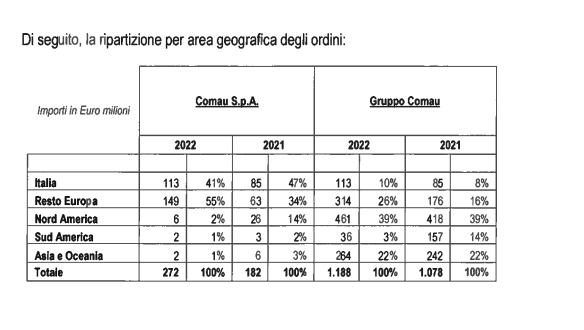

As stated in the financial report, in 2022 Comau acquired orders for 1,188 million euros, an increase of 10% compared to 2021. The increase mainly concerns activities in Europe. Specifically, 36% of orders and activities concern Europe, 39% North and Central America, while the remaining 25% concern South America and Asia.

As of December 31, 2022, the Comau group's order book amounted to 933 million euros, an increase of 31% compared to the previous year. As regards Comau Spa, 96% of orders were acquired in Europe (of which 41% in Italy) and 4% in the rest of the world.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-va-comau-che-stellantis-vendera/ on Thu, 14 Sep 2023 11:37:13 +0000.