I reveal to you the ECB’s ultravisions on inflation

What is the ECB up to? The comment of the economist Ugo Arrigo

After a long series of ten consecutive increases in just 14 months, the ECB, at the monthly board meeting held in the city of Athens, was finally convinced to leave its interest rates unchanged at least for the moment . In fact, the rate on main refinancing remains for the moment stuck at 4.50% at which it was set last month, that on deposits at 4%, and that on marginal loans at 4.75%. At the end of the meeting the Central Bank announced that the decision had been taken unanimously.

WHAT THE ECB STATEMENT SAYS…

Could this, finally, be the culmination of an abundant year characterized by a policy of increasing monetary restriction? The answer is not clear-cut but gives a glimpse of a positive outcome, in fact according to the ECB press release the current rates are at such a level that, if "maintained for a sufficiently long duration" they will be able to make "an important contribution" to attenuating inflation until to achieving the Bank's legendary objective of 2% in the medium term.

Therefore, at the moment the ECB does not seem to deem it necessary to further press the brake on the monetary supply but nevertheless considers it essential to keep it pressed as now for a rather long time, if we consider that in last month's meeting the chief economist Lane had explained that the macroeconomic models used would indicate a full manifestation of the effects of the current monetary policy over a two-year period, and therefore by 2025.

…AND WHAT LAGARDE DOESN'T SAY

President Lagarde did not want to confirm that the current level of rates represents the peak of this bullish phase, on which to stop for more or less long before starting the descent, nor did she specify what exactly is meant when we talk about duration " long enough” of high rates. In any case, it cannot be ruled out that a decline could begin in the short term, so much so that the hypothesis of being able to begin a process of reducing the cost of credit was not even taken into consideration.

In essence, the ECB, its president and its board continue to fear the inflationary phenomenon, the origins and development of which they do not seem to have fully understood, and do not in fact exclude that the ongoing downward trend in the speed of growth of prices could encounter obstacles and stop, if not change direction. As a result they continue to wait, monthly meeting after meeting, like vigilant “Desert of the Tartars” style soldiers for the possible enemy of inflation in their Frankfurt tower. In the meantime, the real economies of the Eurozone countries are languishing and the cost of public and private debt in peripheral Euro countries such as Italy is soaring.

IS INFLATION AN ONGOING AND WORRYING PHENOMENON?

Indeed, how is it possible to believe that price pressures remain strong, as emerged from the discussion, and that the current statistical decline, evident in all countries, does not represent an actual deceleration but some form of statistical illusion? Is inflation really still an ongoing and worrying phenomenon? It doesn't seem like it to us but before explaining the reasons it is worth making some considerations. The rise in prices can in fact be evaluated in three ways, always using the consumer price index:

1. Through its cyclical rate of change, therefore the percentage increase in the index compared to the previous month, which can possibly be considered at an annualized rate. But this indicator is strongly affected by seasonality as well as non-regular components, such as the presence of administered prices.

2. Through its trend rate of change, therefore the percentage increase in the index compared to the same month of the previous year. This indicator has the advantage of protecting against the effects of seasonality, however it alone does not tell us in which months of the last twelve the price increase was actually concentrated or whether it was uniform. Okay, it may be that compared to a year ago prices are now 6% higher (hypothetical example) but what was their actual path? Was the price growth regular during the year or was it concentrated in the first few months and then disappeared (or even changed direction), or was it concentrated in the last few months and is probably still ongoing? It is clear that the two cases are far from equivalent.

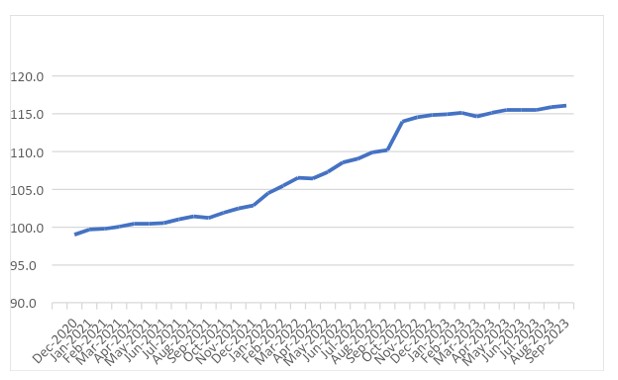

3. At this point, if we do not want to be misled by how we measure price growth, all we have to do is look directly at the trend of the consumer price index number which, represented in a graph, provides us with the exact snapshot of the path that prices are going.

The Graph. 1 fulfills this task in the Italian case of consumer prices measured by the NIC index for the entire national community, however the considerations that can be drawn from it are exactly the same as in any other Eurozone country that we would like to consider instead of 'Italy or the sum of all countries.

The following emerges from it:

– Consumer prices were stable in the first half of 2021, in fact between January and July they only rose by 1.4%, which corresponds to 2.3% on an annual basis, almost identical to the ECB's mythical 2% target.

– They start to grow in the second half of 2021 and accelerate in the first half of 2022, coinciding with the start of the Russian invasion of Ukraine.

– This growth phase ends with the last significant economic increase in October one year ago; between July 2021 and October 2022 prices increase by 12.8% in 15 months, corresponding to 10.1% on an annual basis.

– Exactly twelve months have passed since then and, in the eleven for which we have data, prices have returned to a clearer stability than they had in the first half of 2021, before any inflationary trend manifested itself; in fact, in these eleven months Italian consumer prices have risen by only 1.9%, corresponding to exactly 2.0% over twelve months, which is, to the decimal point, precisely the objective pursued by the ECB.

So what inflation is observed by the ECB leaders? Who is the Frankfurt optician from whom they buy the glasses (or telescopes, in the 'Tatar Desert' hypothesis) with which they watch inflation?

It is a real shame that Lord Keynes cannot see this era and these choices because, as he already wrote in the 1920s of the last century in the pamphlet "The economic consequences of Mr. Churchill", in the 1920s of this century he would not hesitate to write “The economic consequences of Madame Lagarde”.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/bce-inflazione-commento-arrigo/ on Sun, 29 Oct 2023 06:11:41 +0000.