I’ll explain how media terrorism on Italian public accounts arises

What is said and what is babbled about the state of Italy's public finances. Comment by Giuseppe Liturri

Since the outgoing governor of Bank of Italy Ignazio Visco – enlisted on Sunday by the Financial Times in the "fear" operation on our public debt – was not enough – the fear of the feared judgment of the rating companies was raised throughout the week. In a few weeks, starting from October 20th, Standard & Poor's, Fitch and Moody's will issue their report cards on the reliability of Italian debt and the importance of this assessment on the choices of some investors, especially institutional ones, is undeniable. But what seems frankly exaggerated to us – and we leave the choice between malice and negligence to the reader – is the overestimation of these report cards by some Italian newspapers, which have emphasized the possibility that the descent, even by just one step on the scale of assessment by the agencies, could cause problems for the prices of government bonds.

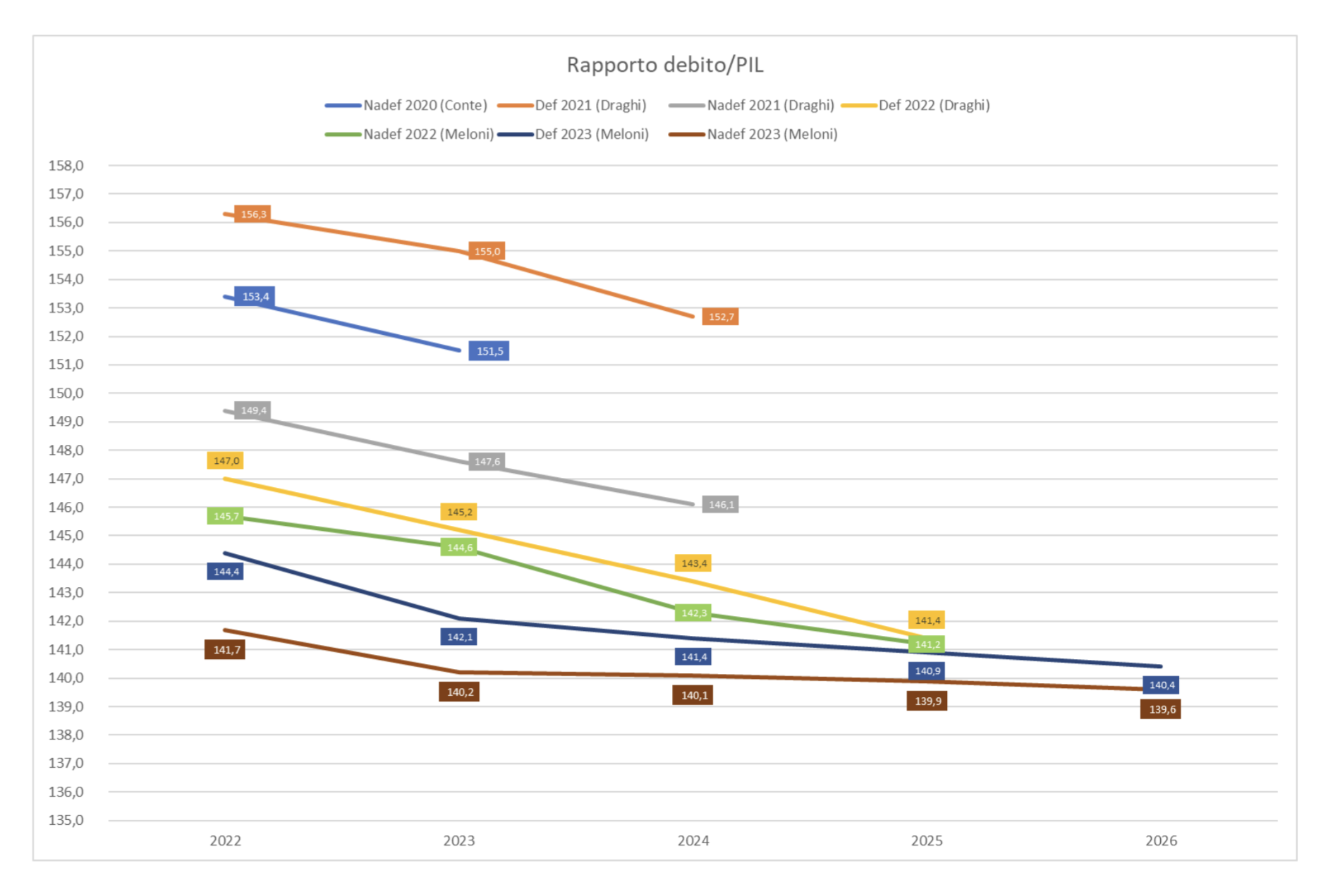

But many people overlook the fact that the debt/GDP ratio figures that the rating companies will have before them are much lower than those that did not raise objections just a few months ago. A few examples taken from the graph (at the bottom) with the complete data extracted from Def and Nadef for recent years are enough: for 2023 the Draghi government, just 18 months ago, had 145.2% as its programmatic objective; the Meloni government should close at 140.2%. For 2024, “Il Migliore” had committed to achieving 143.4%; Meloni, despite the poisonous legacy of the Superbonus but benefiting from an upward revision of the GDP, has the objective of 140.1%.

It is true that the slope of the debt/GDP reduction path, proposed by Minister Giancarlo Giorgetti to the Chambers with the Nadef , is lower than that of previous governments. But one cannot fail to see that we still arrived at around 140%, when the Draghi government in its first Def of 2021 even estimated 155% for 2023 and 152.7% for 2024. It is quite intuitive that the speed return depends on the starting level. It's one thing to go down from 155%, it's quite another to go down from 145% and it's absurd to ask for the same speed. Furthermore, it is the level that matters for the sustainability of the debt mass.

It is not clear why rating companies should not take note that, for 2024, 140.1% is objectively lower than the 142.3% of the first Nadef of the Meloni government, which has also been praised for months for the prudence adopted . Rating companies should be well aware that – for the sole fact that nominal GDP growth (5.3%, 4.1% and 3.6%, respectively for 2023, 2024, 2025) is significantly higher than the average cost of debt – at least the stability of the debt/GDP ratio is arithmetically guaranteed, even in the presence of primary deficits.

Instead we had to read all sorts of things. We have seen the chief economist of the International Monetary Fund, Olivier Gourinchas, pulled by the jacket, making it clear that the beam is made up of the US origin of the tensions on government bond rates and the excessive US deficit, but the emphasis is went to waste, because the hope for " more ambition in Italy's budget plans " was pulled out of his mouth. What did you expect an IMF economist, raised on the mantra of primary surpluses, to answer? However, he did not hesitate to indicate " medium-term growth " as the true objective of budget policy. And, in this sense, the only criticism that can be made of the budget maneuver is that it is not sufficiently expansionary. The fiscal impulse will be neutral, at best, if not downright recessive.

The opposition's findings therefore also become contradictory. Among many, we highlight the speech this week by Democratic Party senator Antonio Misiani, according to whom the maneuver is " in the name of austerity and financed in deficit" . In short, the IMF claims that there is too little austerity, the PD and the unions claim that there is too much of it. Maybe Misiani and Gourinchas should talk to each other.

The spotlight is also on the latest IMF forecasts for growth in 2024, reduced to +0.7% from +0.9% in the previous forecast in July. But no one has noticed that that IMF projection is " under current legislation ", that is, it does not take into account – because it was closed before – the approximately 15 billion greater deficit announced with the Nadef (from 3.7% trend to 4, 3% programmatic). Those extra 15 billion put into the pockets of Italians will also be worth 0.2-0.3 points of greater growth, or not? After all, it is an implicit multiplier (ratio between additional GDP and additional deficit) that does not even reach 0.5.

Every word uttered in the parliamentary hearings held before the vote on Nadef was scrutinized to support the preconceived theory of the alarm over the accounts. We even went so far as to quote Professor Liliana Cavallari of the PBO who only recalled what the Commission has written regularly since 2021 in its report on the deficit and excessive debt published in May, namely that the following spring Italy could be at risk of infringement procedure. Non-news. A bit like the famous "remember that you have to die" addressed to Massimo Troisi. And we, like him, note that the infringement procedure has always been there for at least 2 years.

The real problem for our country – in addition to the threats coming from the USA and the international situation – is that part of the debt on which the alarm is concentrated are EU loans for the Next Generation EU which are struggling to translate into investments and therefore into GDP growth. The cumbersomeness of the rules imposed by Brussels, a public administration first reduced to the bare bones and then overloaded beyond belief, are slowing everything down. It's not enough to collect the installments, you have to spend them. And then those installments will have to be repaid, at a rate that does not depend on the markets but on the EU's debt choices. Speaking of which , the Financial Times also discovered that the real spread is that of the EU , not that of Italy, as we have been writing to you for about 2 years. The Commission, again on Wednesday, issued bonds with yields higher than those of Germany and France (80 and 20 points respectively), despite enjoying a triple A rating higher than that of France. Investors are asking for a premium, not for the risk of default which, even in the event of the dissolution of the euro, is non-existent, thanks to the guarantees of all member states, which are worth 0.6% of each state's GDP and which would allow the repayment of loans even relying only on Germany's share.

As the London newspaper explains well, that risk premium requested by investors is justified by the price risk which is the effect of a relatively illiquid market and which promises to become increasingly illiquid because everything will end in 2026. Furthermore, the securities are not included in the stock market indices and there is no derivative for hedging. All inefficiencies – predictable from the start, because one cannot improvise as a large issuer of government bonds in a few months – which the Commission pays to the market and which it will pass on to the debtors, Italy in the lead.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/il-terrorismo-mediatico-sui-conti-pubblici-italiani/ on Mon, 16 Oct 2023 09:20:35 +0000.