I’ll explain the ballets between NFT and cryptocurrencies

The analysis by Mads Eberhardt, Cryptocurrency Analyst for BG SAXO

Volatility in the equity and cryptocurrency markets was intense this first time of year. The two markets have moved somewhat in sync, to a much greater extent than last year.

But not only that: also pay attention to the NFT market, where the spotlights are focused on OpenSea and the New York Stock Exchange.

CRYPTO AND THE STOCK MARKET IN ARM

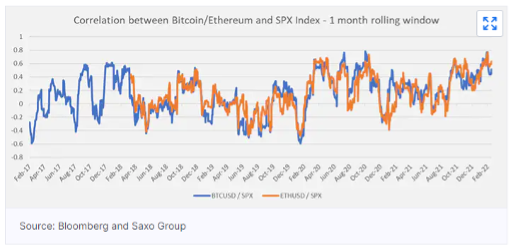

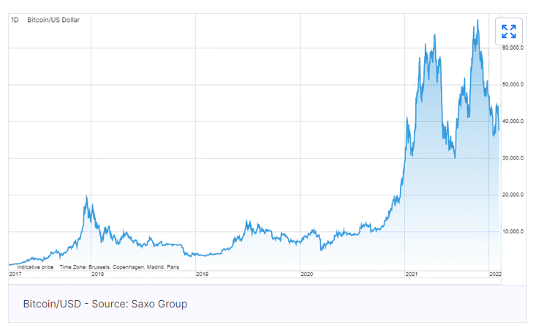

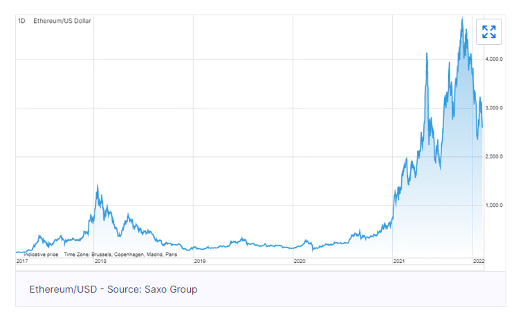

During these first two months of the year the cryptocurrency market has been highly correlated with the stock market as documented by research by Anders Nysteen , Senior Quantitative Analyst at Saxo Bank. In fact, starting from 2022, the correlation between the daily returns of the S&P 500 index and Bitcoin has been between 0.56 and 0.61, depending on the correlation measure and the source. In contrast, the correlation was only around 0.25 in 2021. It appears that the cryptocurrency market has been largely driven by the same factors as the equity markets, namely inflation concerns and Russia-Ukraine tension. This year, risk sentiment swept through equities, which was also severely tested by the slide in technology stocks. At the same time, the cryptocurrency market has been impacted by the fact that more traditional equity traders have expanded their investments to include cryptocurrencies as well: this means that their portfolio balances their risk between stocks and cryptocurrencies. As a result, cryptocurrencies may not provide the same degree of diversification as in the past.

FROM THE ALLEGED HACKING TO THE PHISHING OF OPENSEA USERS

A few days ago, news spread that the Ethereum contract of the largest non-fungible token market (NFT) OpenSea had been dried up and that, therefore, numerous users had seen their NFT stolen by alleged hackers.

Since OpenSea consumes most of the gas (transactions) on Ethereum, and is one of the most used use cases of blockchain, its value to the crypto community as a whole is vital. Due to this episode, in the following hours, the price of Ethereum slipped by around 4%.

It was later revealed that neither OpenSea nor their Ethereum contracts were actually affected. Instead, it was a phishing attack based on a malicious contract that the hackers somehow got several users to approve, which allowed the person in question to steal their NFTs.

OpenSea later revealed that 17 people had been affected by phishing.

This points out that the cryptocurrency market is highly sensitive to rumors about hacks, especially the largest and most frequently used protocols, which act as an industry lifeline.

THE NEW YORK STOCK EXCHANGE DEPOSITS THE BRAND TO EXCHANGE NFT

In terms of NFT, OpenSea is not expected to have a monopoly on the market together with Coinbase and Kraken (also in the process of launching their respective NFT markets.

In fact, competition from another company is on the way, namely the New York Stock Exchange owned by the Intercontinental Exchange, known as the NYSE. The NYSE filed a trademark application last week to register the NYSE name for various cryptocurrency-related products and services, such as virtual reality and NFT.

So, we could see the NYSE double in NFTs in addition to the six NFTs released by the company in April last year, each symbolizing early trading of Spotify, Snowflake, Unity, DoorDash, Roblox and Coupang on the stock exchange.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/vi-spiego-i-balletti-tra-nft-e-criptovalute/ on Sun, 27 Feb 2022 14:36:41 +0000.