I’ll explain the ECB’s pandemic program

The analysis by Chiara Manenti, Intesa Sanpaolo fixed income strategist, on the pandemic program of the ECB

The pandemic program has always been presented by the ECB as an exceptional and flexible tool. We believe that the risk for the market of seeing reduced support from the central bank is very limited in the short term, while this element could play a more significant role on yield dynamics in the second half of the year if the recovery evolves into in line with forecasts.

The January ECB meeting has become an event for the bond market due to the new sentence inserted in the paragraph regarding the Pandemic Program in which it is made clear that: "If favorable financing conditions can be maintained through asset purchase flows that do not exhaust the endowment in the horizon of the net purchases of the Pepp , it will not be necessary to fully use the endowment. " The paragraph also goes on to underline that, in the opposite case, the ECB would also be willing to recalibrate the program by expanding it, but the market obviously focused on the first sentence.

It must be remembered that already in the minutes of the December meeting, in which the enlargement of the program amount by 500 billion euros was decided, twice it was highlighted that the intrinsic flexibility of Pepp also implied the possibility that it would not be used. in full within the deadline: "An important shift in implementing the Pepp was to be highlighted and it should be underlined that if favorable financing conditions could be maintained with asset purchase flows that did not exhaust the full amount available under the Pepp, the envelope need not be used in full. "

The Pandemic Program has also always been presented by the ECB as an "exceptional instrument for exceptional times": as specified on several occasions by ECB representatives, the PEPP has the dual function of ensuring the stability of the markets in order to guarantee financing conditions favorable to all and to counter the impact of the pandemic on inflation trends.

C. Lagarde declared, in fact, before the European Parliament that "As a result of that, it (cfr. Pepp) is very specific and it was intended to be targeted, to be temporary, to be exceptional, which is really causing it to have a dual function: first of all, making sure that stability is returned to markets so that financing can be can be made available, and second, it has a monetary-stance function as well. "

The pandemic program also has threefold flexibility: 1) in terms of assets that are purchased, since the possibility of purchasing commercial paper has also been introduced with respect to the APP; 2) in terms of time, the ECB had to carry out a sort of front-loading of purchases to intervene in the initial stages of the pandemic and restore stability to the market; 3) in terms of jurisdictions, because to restore stability on the markets, the capital quotas were not respected on the Pepp, just think that about 30 billion more were purchased in Italy in 2020 than the official quota. This triple flexibility was widely used in the initial stages of the program, but subsequently the use of flexibility was reduced, thanks to the good results obtained on both government and corporate yields and spreads, also thanks to the support intervention given by fiscal policy.

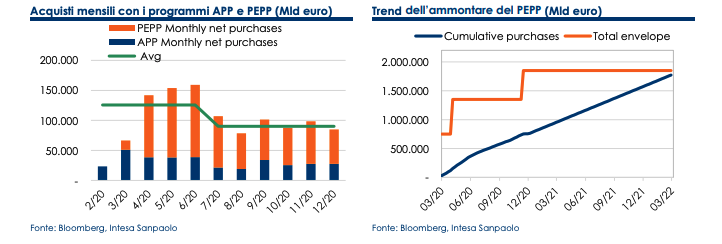

To understand what the perspectives are on the use of Pepp, let's analyze in detail how the purchasing program has been managed so far. The temporal flexibility is demonstrated by the graph below: monthly purchases under the two programs APP and Pepp, after a peak of over 150 billion in June 2020, have fallen and stabilized since last summer around an average of 90 billion monthly, corresponding to a weekly average of purchases under the Pepp of about 16 billion euros. If the ECB kept the pace of purchases at this level, the Pepp availability would be practically used in full by the end of March 2022, the current expiry date of the program (graph below).

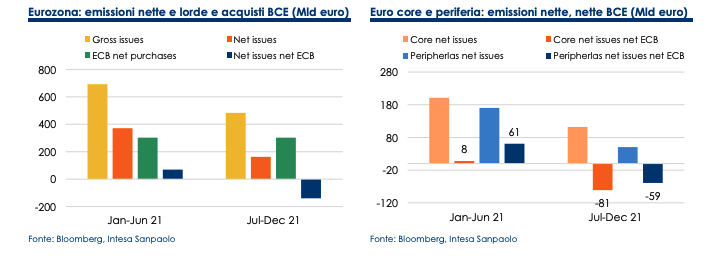

On the government market segment, a positive correlation can be observed between official purchases and issues, confirmed by the fact that the ECB has always reduced its presence on the market in the months of August and December, when supply is seasonally reduced. From the graph below, which shows the series of monthly government purchases compared to the monthly target declared by the ECB, it is clear that the calibration of purchases by the ECB follows the dynamics of gross issues rather than that of net issues. Even analyzing the annual data at the Eurozone level, it appears that the percentage of government bonds purchased out of total gross issues "follows" the inflation profile, which leads us to believe our forecast for this year, which sees purchases of government bonds under the two programs rise to approximately 620 billion nominal euros out of a total expected gross issues of 1,200 billion euros, corresponding to net issues net of negative ECB purchases of about 60 billion euros from 137 billion in 2020. our estimate assumes that, to the overall 240 billion of purchases with the APP, there must be added about 800 billion of purchases with the Pepp, whose residual availability would remain equal to approximately 280 billion at the end of this year.

Having said this, it is however possible that the purchases of the ECB support the seasonality of the offer during the year, in particular the substantial decrease in the offer in net terms between the first and second half of the year: according to our estimates, if purchases proceeded at a constant pace during the year, in the second half of the year the net supply after the ECB purchases would be negative for about 140 billion euros compared to +70 billion in the first half. This trend is also confirmed by analyzing the offer divided between core and peripheral countries (graph). It is therefore not unlikely that the ECB will decide to overweight its acquisitions in the coming months and then slow them down, if market conditions remain stable, in the final part of the year.

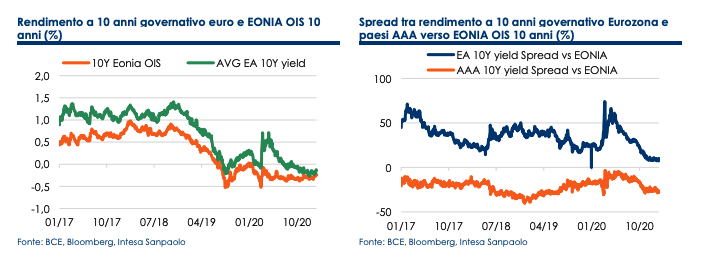

Market conditions are in fact, as mentioned previously, one of the determining factors in the evolution of the purchase program. At the present time, the ECB may believe that its action has been effective in restoring stability on the government market by almost making a sort of target on returns. One of the indicators of market conditions, often cited by chief economist Lane , is in fact the differential between the 10-year yield on Eurozone government bonds and the 10-year EUR OIS rate, which represents a sort of risk free for the zone. EUR.

As can be seen in the graphs above, the differential between the two yields, which in the initial phase of the pandemic had returned to the levels of 2017 at around 70bps, narrowed after the introduction of the Pepp, but the strong push to close this differential is came from the prospect of an enlargement and extension of the pandemic program, which gave strong support to the market at the same time as the positive news on the availability of vaccines. In conclusion, we believe that in the short and medium term the risk for the government market of seeing the support from the ECB reduce is very limited, an element that could instead play a more significant role on the dynamics of yields in the second half of the year, if the recovery will evolve in line with forecasts.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/vi-spiego-il-programma-pandemico-della-bce/ on Tue, 02 Feb 2021 06:05:23 +0000.