I’ll explain the three card game in the PNRR

What (not) goes into the Pnrr. Giuseppe Liturri's analysis

The editorial published on Saturday in the newspaper "Domani" by Stefano Feltri ("The priority of the PNRR is debt rather than growth"), offers us the opportunity to return to issues that we have repeatedly analyzed in detail on this site , concluding that those investments could very well have been financed by issuing national debt, given the current interest rate situation and the umbrella provided by the ECB and, above all, we could have decided the investment guidelines ourselves.

But Feltri only partially grasps the point and completely misses the most important target.

In fact, it is true that, as he says, the expenses financed with the PNRR are expenses that we would have incurred in any case and the European funds are reimbursed every six months, which only reduce the cost of debt but have little impact on growth. But there are three basic distinctions to make:

- The more than 100 billion allocated with the 2021 budget law, for the years 2021, 2022, 2023, only formally cover all the investments of the PNRR but only because in December 2020, the Next Generation EU did not yet formally exist (regulation 241 which governs the RRF, a device for recovery and resilience, was only approved in February 2021) and there was a need to cover expenses that would start immediately (such as the tax credit for industry 4.0). It is doubtful that, if the RRF had not been in an advanced stage of gestation, the government would have embarked on an investment plan of over 100 billion, relying only on access to the market for the issuance of securities. Therefore, if Feltri's thesis is based only on this formal aspect, it appears to us to be unfounded.

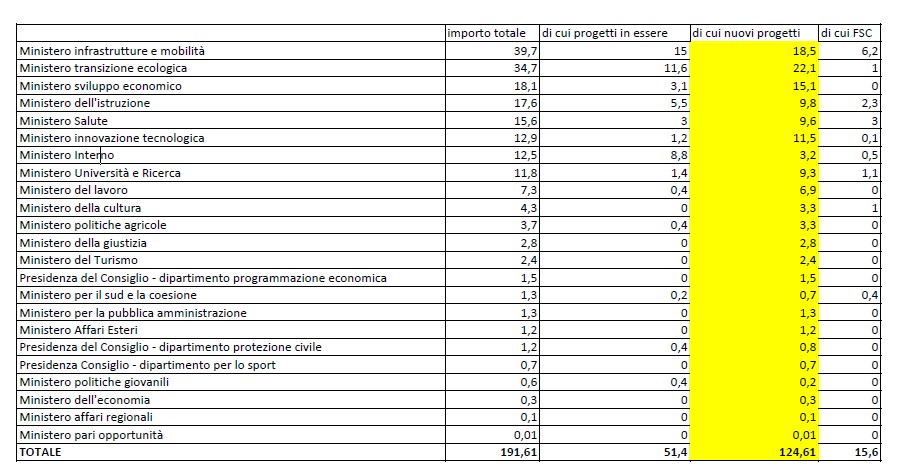

- Analyzing the figures, it emerges instead that the “real” additional investments, therefore not previously planned, are 124 billion out of 191 (see table, prepared by the ministerial decree of 6 August). The difference, equal to 67 billion, concerns 52 billion of investments already allocated, for which only the lender actually changes, but whose impact on growth was already in the trend, and another 15 billion withdrawn from the Cohesion Fund which is in any case a fund funded regularly for years and therefore, also in this case, these are investments already financed, for which only the source of funding changes. So Feltri hits the mark only partially: for 2/3 the investments are actually additional and therefore lead to growth, for 1/3 they are substitutes and already in the trend and therefore he is right in saying that "we pay back expenses".

- Where Feltri breaks through an open door – already broken by the numerous analyzes we have published on Startmagazine in recent months – but avoids drawing the necessary consequences is on the subject of the nature of the investments we will make in the coming years. He argues that European funds “ should be used to cover the costs of the transition to a new set-up. To evolve, instead of paying back expenses ”. The expenses that the country would need, according to him, are those to create a " buffer " to face the tax or pension reform. But here it is sorry to point out that he has misdirected his criticisms. Those who have decided what the country needs to grow is not in Rome, but in Brussels. And there they decided, for all 27 Member States, that the investments to be financed are those for digital, for the environmental transition and other "their" priorities. The package has arrived in Rome: take it or leave it. A very rigid straitjacket that totally disregards the real needs of each beneficiary country, which forced us to shape the projects by adhering to its forms, on pain of losing funding. This is the reality that Feltri fails to consider and it is also the answer to his well-founded perplexities. But in this case the appetites of the parties to which he refers have little to do with it, it is the "Mandarins" of Brussels who have decided everything.

In conclusion, if Feltri believes that those investments do not bring growth but only (modest) reduction in the cost of debt, he hits the mark but must remember that his criticism concerns only 1/3 of the investments of the PNRR and that where to spend the other 2 / 3 was decided by the Commission.

Try the intercom in Brussels and ask why.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/pnrr-feltri-stefano-domani/ on Mon, 27 Sep 2021 07:05:12 +0000.