I’ll explain what Lagarde’s ECB will do

The ECB has opted to reduce purchases a little more markedly than expected, reiterating its intention not to raise rates in 2022 thanks to the fact that inflation will return from its peaks over a three-year time horizon. The comment by Antonio Cesarano, Intermonte's chief global strategist

PEPP (pandemic plan)

- Stop of the PEPP in March with a reduction in the related purchases in the first quarter '22 vs quarter '21, when they reached around 50/60 billion monthly

- Lengthening of the timing of PEPP reinvestments from the end of '23 to at least the end of '24

- The plan can be reactivated after March if necessary (by decision of the Council)

APP (canonical QE currently equal to € 20bn per month)

- For the second quarter of '22: € 40 billion net monthly

- For the third quarter of '22: € 30 billion net monthly

- From October '22: back to € 20 billion net per month

- APP expected to remain in place until shortly before raising rates

- Reinvestments expected to continue for an extended period of time beyond the time when the ECB begins to raise rates

TLTRO III

- Favorable conditions end in June '22

- Assessment of the two tier mechanism to prevent negative rates from interfering with banking lending

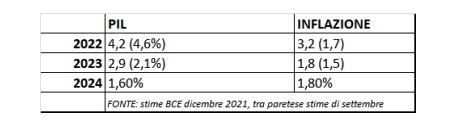

Here are the updated estimates on GDP and inflation:

It should be noted that in terms of core inflation ex food and energy, the estimates are also below 2% for the entire time horizon.

During the press conference, Lagarde then added:

Upside risks from inflation mainly based on wage negotiations. The energy component is very important, accounting for 2/3 of the increases in inflation estimates.

IN SUMMARY

The ECB's decision followed the unexpected hike in BOE rates (justified by the expectation of an inflation peak of 6% in April 2022 and with the clarification that the intention is to implement "modest" restrictive measures).

Also in the case of the ECB, the surprise was that of a more restrictive attitude compared to the consensus expectations that were placed on the hypothesis of partial translation of the PEPP into APP, with APP that would go from 20 to 40 billion € per month until at least September.

The ECB, on the other hand, has opted for a downward path, ie an average monthly € 40 billion in the second quarter, which then becomes € 30 billion in the third quarter. Furthermore, the possibility of extending the TLTROs whose favorable condi- tions end in June '22 was not contemplated, while some analysts hypothesized the extension until June '23.

However, the hypothesis of extending the TLTROs with the launch of a new round of operations could simply have been postponed to the February / March meetings, in order to assess the liquidity / macro conditions at that point in light of the impact of the pandemic.

In a nutshell, the ECB has opted to reduce purchases a little more markedly than expected, reiterating its intention of not wanting to raise rates in 2022 thanks to the fact that inflation will fall from the peaks over a time horizon of three years, as evidenced by the 2023 and 2024 inflation estimates

Furthermore, Lagarde stressed that inflation risks remain on the upside.

All this leads to lower monthly purchases starting from the first quarter, when the PEPP will decelerate compared to the 50/60 billion € per month experienced in the fourth quarter. The lower prospective purchases that have the flavor of a more hawkish ECB (after the surprise in this direction also by the Bank of England) resulted in a reaction of short rising rates and an increase in the curve slope, with a widening of the spread due to the greater impact on the countries that have previously benefited from QE the most.

IN PERSPECTIVE

A phase has in fact been inaugurated today in which central banks will increasingly face the dilemma of inflation versus growth.

In the first phase (ie the current one), the first factor to be managed is the inflation risk, which involves increased expectations of a Fed hike and some first reaction as in the case of the BOE.

Subsequently, between the first and second quarters, demand could bring out more evident signs of a slowdown under the blows of inflation, putting central banks in front of the dilemma of choosing inflation vs growth, which could in fact translate into a Solomonic decision. if anything, to make some increases, but stopping after a short time, so as not to damage the growth too much.

The first example of a “Solomonic decision” came today from the BOE in the name of the first rate hike with the clarification that it is only a “modest” tightening of monetary policy conditions. In other words, there are no bellicose intentions of large and constant rate hikes.

The ground is slippery and you need to know how to properly dose the brake and accelerator

Short-term rates are therefore likely to be more attentive to central bank rate expectations, while the long-term part is more likely to listen to the bells of slowing growth. The result could be a flattening trend of the curve and long-term rates on average decreasing, except for temporary phases of interruption.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-si-muovera-la-bce-di-lagarde/ on Fri, 17 Dec 2021 08:18:54 +0000.