I’ll explain what the ECB will do

ECB: inflation risks and possible rate hikes, but without haste, that is, not before completing QE. Lagarde's announcement analyzed by Antonio Cesarano, Intermonte's chief global strategist

Yesterday's speech by Lagarde took note of the higher than expected inflationary pressures, opening up to the hypothesis of interest rate movements, however, not before completing the QE.

Here are some main points.

The central point is where Lagarde said inflation risks are on the upside, especially in the short term, adding that the inflation target is now much closer.

Lagarde emphasized the importance of the meetings of 10 March and 9 June to assess the context on inflation in more detail, in particular if the three conditions of the new guidance are met in order to then consider the interest rate theme, namely:

until we see inflation reaching two per cent well ahead of the end of our projection horizon

reach two per cent not only well ahead of the end of the projection horizon but also "durably for the rest of the projection horizon"

progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilizing at two per cent over the medium term

Another important point is that any rate hike is conditioned by the sequence, i.e. first complete the QE and then move the rates afterwards.

The ECB currently plans to bring the purchase plan to 40 billion monthly in the second quarter, to 30 billion in the third and then continue with 20 billion monthly

IN SUMMARY

I try to summarize the picture outlined

Lagarde notes that inflation is longer than expected, also in light of the unexpected January data.

He admits that there are upside risks to inflation especially in the short term but at the same time tries not to take time to avoid hasty decisions.

In order to do this, it is linked to the need to follow the sequence, that is, first the end of QE and then a rate hike, which at present would mean imagining a first rate hike not before the last months of the year.

This eventuality would be preceded by inflation estimates above the target level of 2% over the entire three-year period of the forecasts that will be updated in March and then in June.

In fact, therefore, in this way the ECB would have time to be able to verify whether it really is necessary to set the rates at the end of the year based also on how the inflationary scenario will evolve, especially on the post-winter energy front.

If, on the other hand, he wanted to anticipate the times, he would also need to speed up the tapering, announcing it in the meeting in March or June.

At the time of writing, Bloomberg post meeting indiscretions are also emerging which I report:

ECB SAID TO CONSIDER END OF APP NET BUYING POSSIBLE IN 3Q

ECB IS SAID TO PREPARE FOR POTENTIAL MARCH POLICY RECALIBRATION

Consequently, the most likely scenario to take into account the prolongation of the high inflation phase could be to interrupt QE in September, announcing it in March (always maintaining flexibility based on the evolution of the scenario) and then check in June whether the inflation are positioned above 2% over the three-year period, in order to have the fourth quarter available in order to possibly act on rates

At that time (i.e. at the end of the year) it will then be clearer whether inflation has shown signs of retrenchment after the prolonged peak at the beginning of 2022 and therefore to be able to assess whether to actually implement a rate hike.

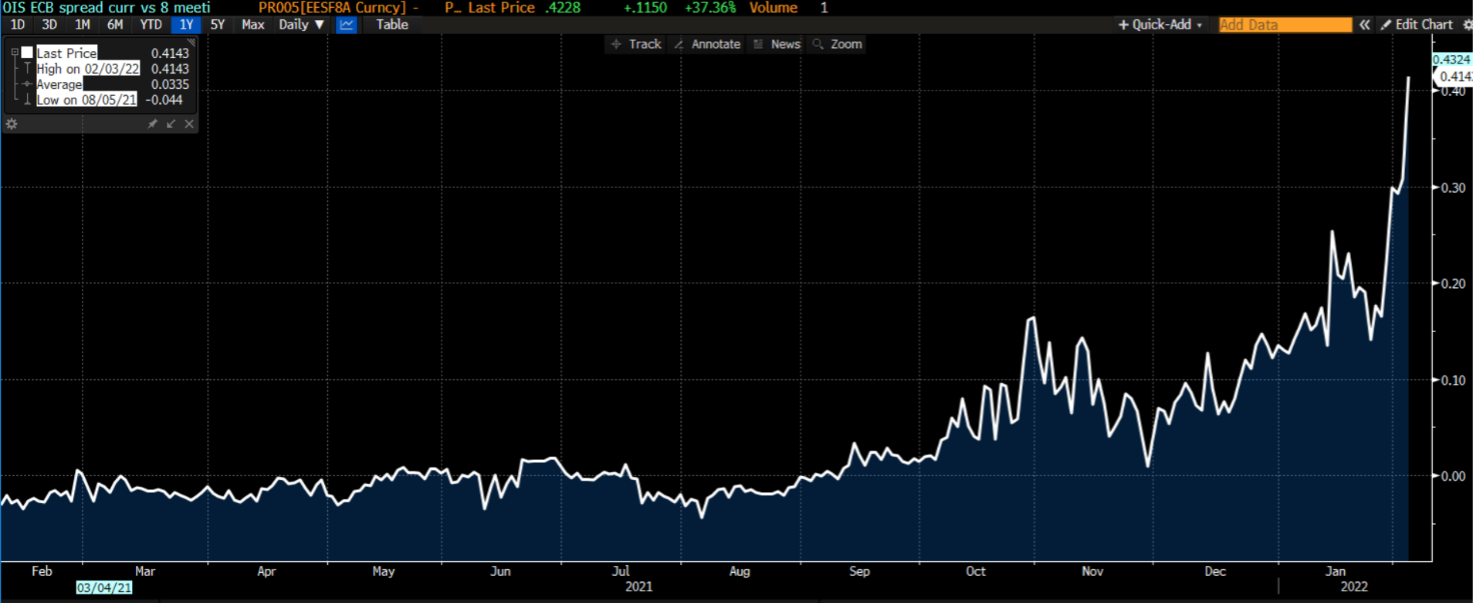

The markets, for their part, live off expectations and have corrected the game by assuming up to almost two rate hikes by the end of the year, as signaled by the spread on OIS contracts between the first and eighth ECB meetings, ie the one at the end of the year.

MARKET SCENARIO

On the interest rate front, the scenario remains on average an upward phase in market rates during this quarter and the first months of the second, in a single issue context focused on growth

During the second quarter, signs of a marked slowdown in growth and the first signs of a downsizing of inflation could emerge (in the sense of filing of the maximum peaks and not yet returning to the pre-pandemic phase) which could lead to an arrest of the phase of hike in market rates, especially on the long-term part of the curve

On the eur / usd front, the questioning of the ECB position (fixed rates for 2022) together with the possible drastic downsizing of US demand during the second quarter, at the moment confirm the possibility of reaching the 1.15 area for the eur / usd by June.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/vi-spiego-cosa-fara-la-bce/ on Fri, 04 Feb 2022 06:49:53 +0000.