Inflation, what should we expect from the Fed in September?

What the US inflation data say in July and what is expected for August. The analysis of Antonio Cesarano , Chief Global Strategist of Intermonte

Less pronounced rise than the consensus of general inflation (3.2% vs 3.3%) and continuation of the decline of the core part in line with expectations.

In details:

• Rise in gasoline less strong than consensus

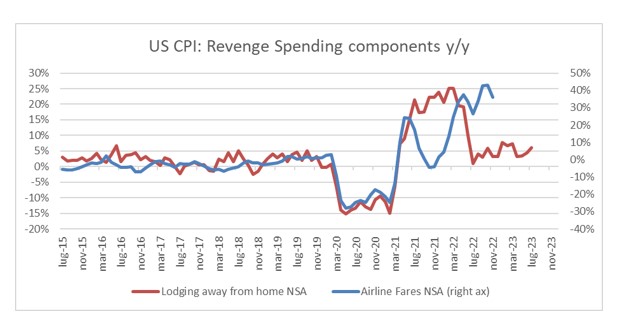

• Continuation of sharp decline in airfares (-8.3% m/m)

• Decline in used car prices (-1.3% m/m)

• Stabilization of the monthly increase in the rent component

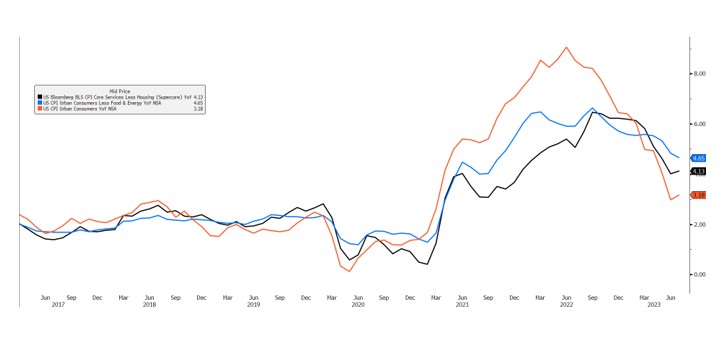

The figure is compatible with the hypothesis of a Fed pause in September and at the same time bears traces of the slowdown in the services sector (always the strongest part of the economy) as indicated by the drop in airfares. At the same time, the slight rise in the super core y/y (black line in the first graph below) due to a less favorable comparison effect, may lead Powell to underline that the pause is not necessarily to be understood as definitive and could already prefigure a setting of this type in the symposium at Jackson Hole on August 24/26.

Before the FOMC of 20 September there will be another data on inflation for August (to be published on 13 September): in this case the comparison effect is once again favorable, especially for the core index (+0.6% change core m/m of August 2022).

July inflation data passed the test of a month which did not benefit from a good favorable comparison effect with reference to the general index (July 2022 change m/m 0%). The overall figure shows a stabilization of the rental component (+0.4%) which, therefore, still leaves available a large margin of decline in the future, which could help reduce inflation.

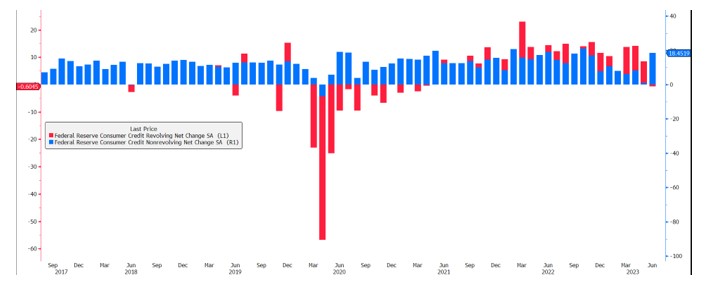

For the end of the year/beginning of 2024, a favorable comparison effect remains on average, both for the general index and above all for the core. Also considering the cushion of a potential further decline in the aforementioned rental component, the scenario of a progressive decline in inflation remains the central scenario, in a context in which signs of a slowdown are also increasing in the services sector (see the CPI components linked to travel/recreation), although it continues to be not only the most prevalent but also the strongest part of the economy. At the same time, indications of a slowdown are also arriving from consumer credit, as evidenced by the first monthly drop in the revolving component (above all credit cards) in June.

These indications confirm the central scenario for the end of the year:

- US ECONOMY : medium-sized slowdown/recession between the end of 2023 and the beginning of 2024 or alternatively a growing perception of recession at the beginning of 2024 during the end of 2023.

- RATES : drop in rates during the fourth quarter to take into account prospects for central bank easing in 2024 accompanied by curve steepening. Possible further volatility between August and September, to complete the metabolization of a context of higher Treasury issuance to deal with the growing deficit in conditions of declining tax revenues.

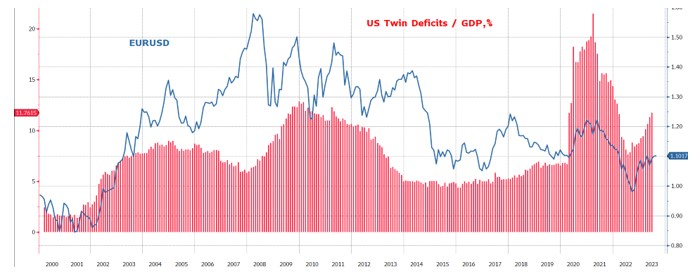

- EURUSD : by the end of the year the hypothesis of depreciation towards the 1.13 area has been confirmed, in line both with the perception of Fed softening even before that of the ECB, and with an increase in the twin US deficits (budget + current account), fueled above all by the increase in the budget deficit.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/inflazione-fed-settembre/ on Fri, 11 Aug 2023 05:40:19 +0000.