Insurance, how are the accounts of Generali, Allianz, Unipol, Axa and more

What emerges from the Fisac Cgil report on the accounts of the major insurance companies, primarily Allianz, Axa, Generali and Unipol

Profit boom and solidity confirmed for Allianz, Axa, Generali and Unipol in the first six months of the year. From the Fisac Cgil report, based on the half-yearly reports of the four main European companies, "a positive picture emerges for the sector, both in terms of resilience and strong profitability, in an extremely complex macroeconomic context" highlights Susy Esposito, general secretary of the category. These are "data – he adds – which must be the basis for the development of bargaining, now and in the future, at all levels, national, corporate and group". For Esposito "with these results it is time to take steps forward on the bargaining front, expanding it to the entire insurance chain, starting with the renewal of the Anapa and Anagina contracts".

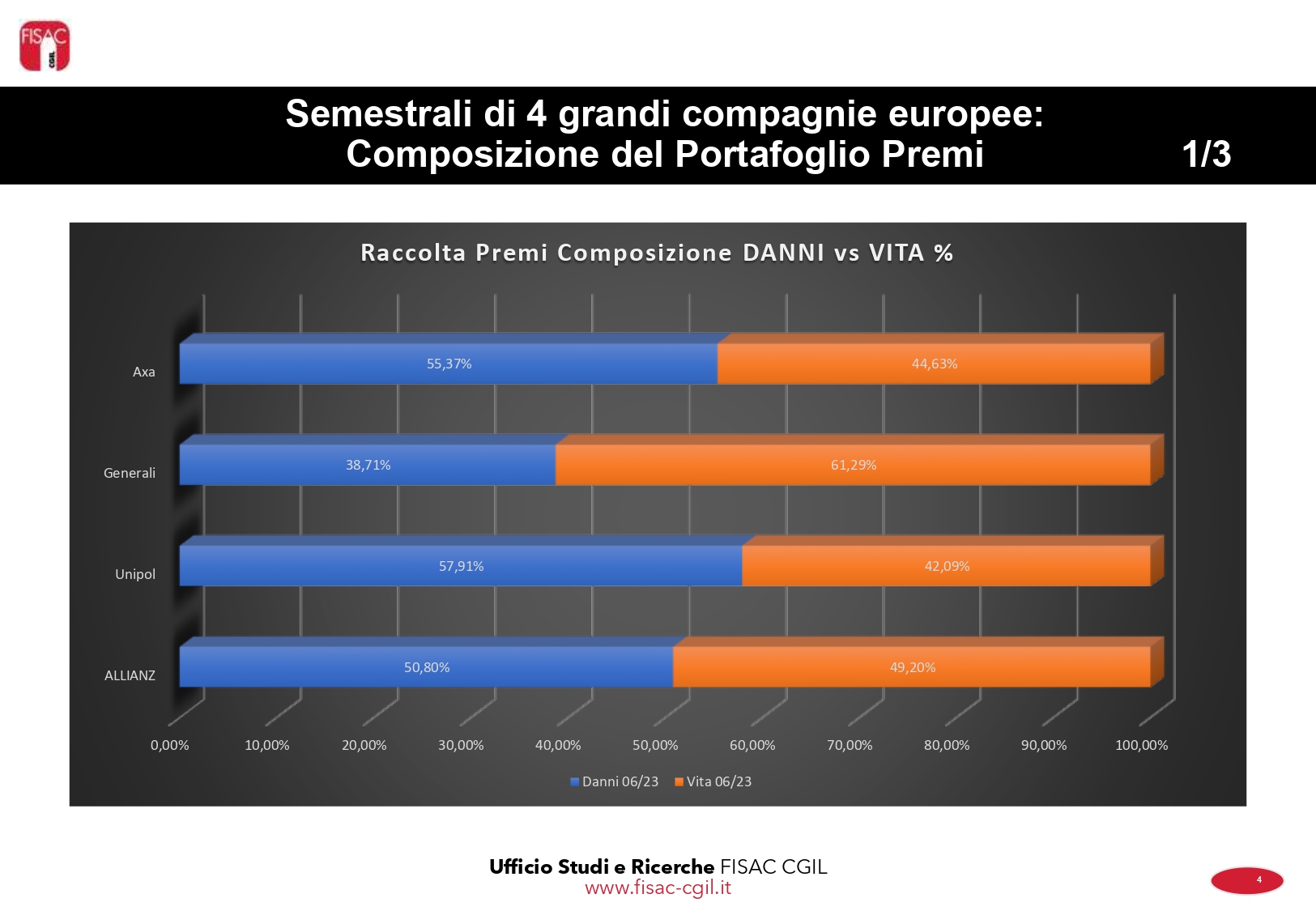

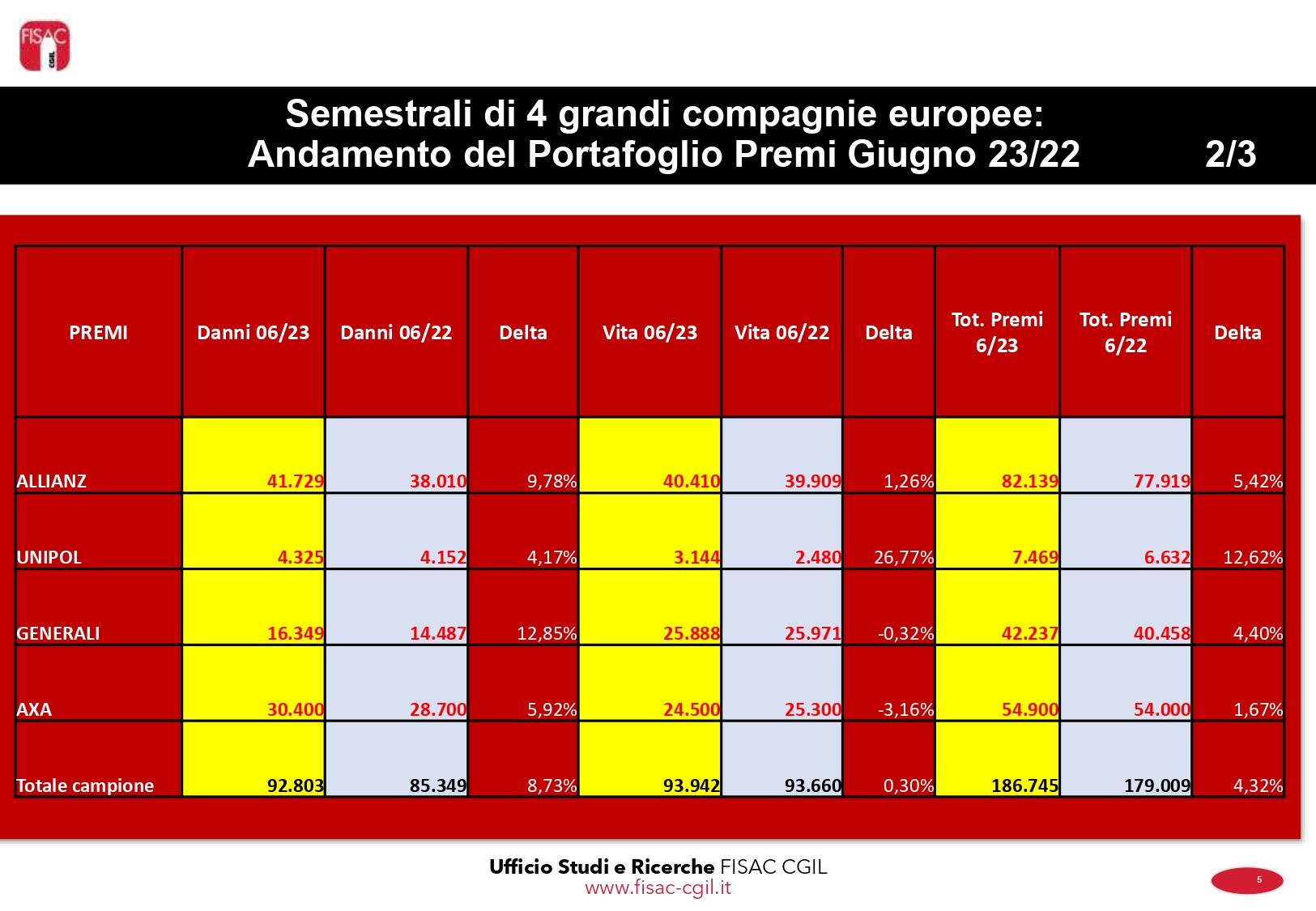

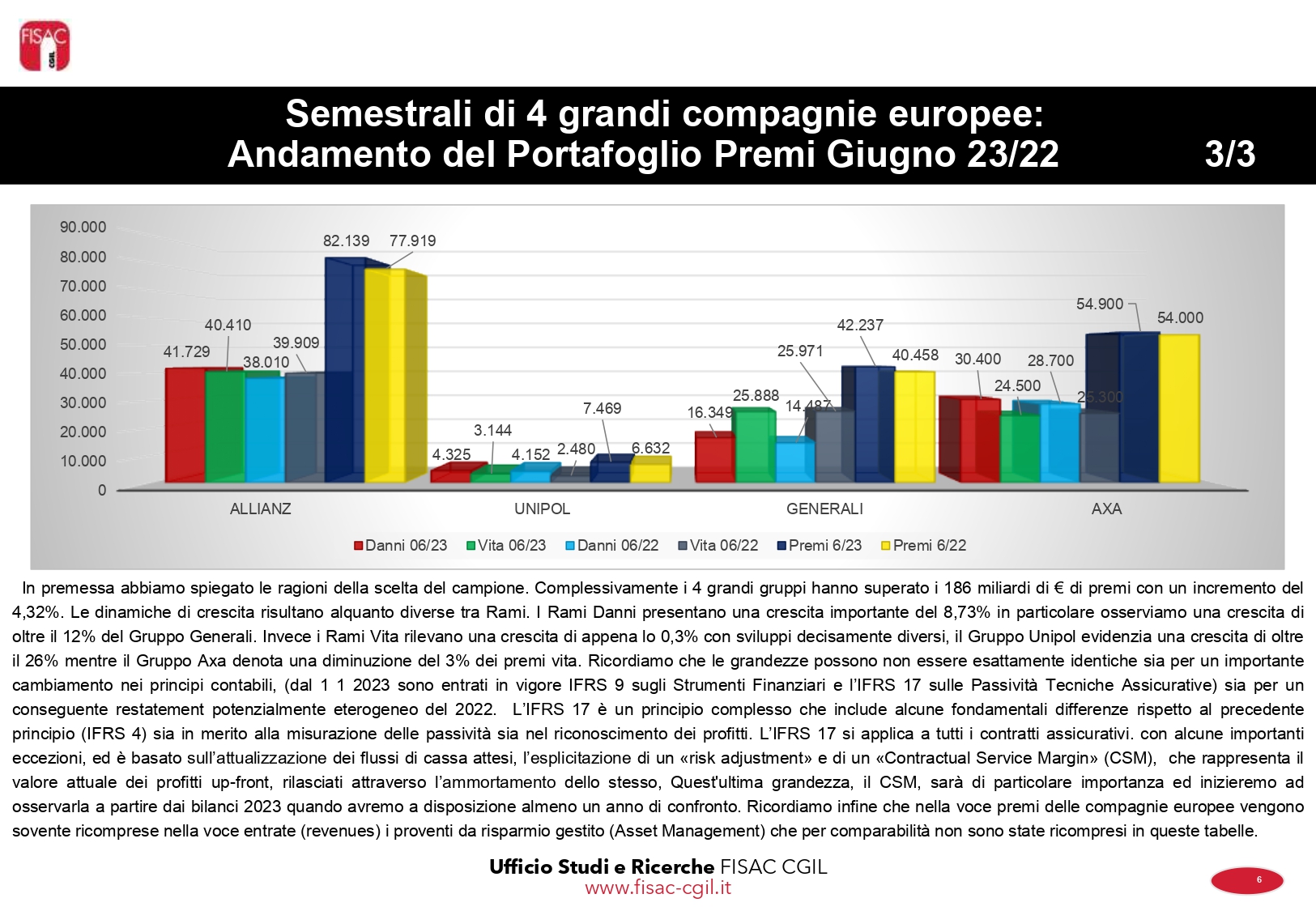

REWARDS OVER 186 BILLION

Last June the four groups scored premiums for a total of 186.7 billion of which almost 93 billion in the non-life sector (+8.73%) and almost 94 in the life sector (+0.30%). In particular, for Axa, 55.37% pertains to non-life with 30.4 billion (+5.92% on year) and the remainder to life with 24.5 billion (-3.16%). Unipol is in line (57.91% non-life) but with very different figures: respectively premiums of 4.3 billion (+4.17%) and over 3.1 billion (+26.77%). The best performance was achieved by Allianz with a division more or less in half: 41.7 billion (+9.78%) from the non-life sector and 40.4 billion from the life sector (+1.26%). Finally, Generali reverses the proportion given that 38.71% of premiums are collected in the life sector (almost 26 billion, -0.32%) and over 16.3 billion (+12.85%) in the non-life sector.

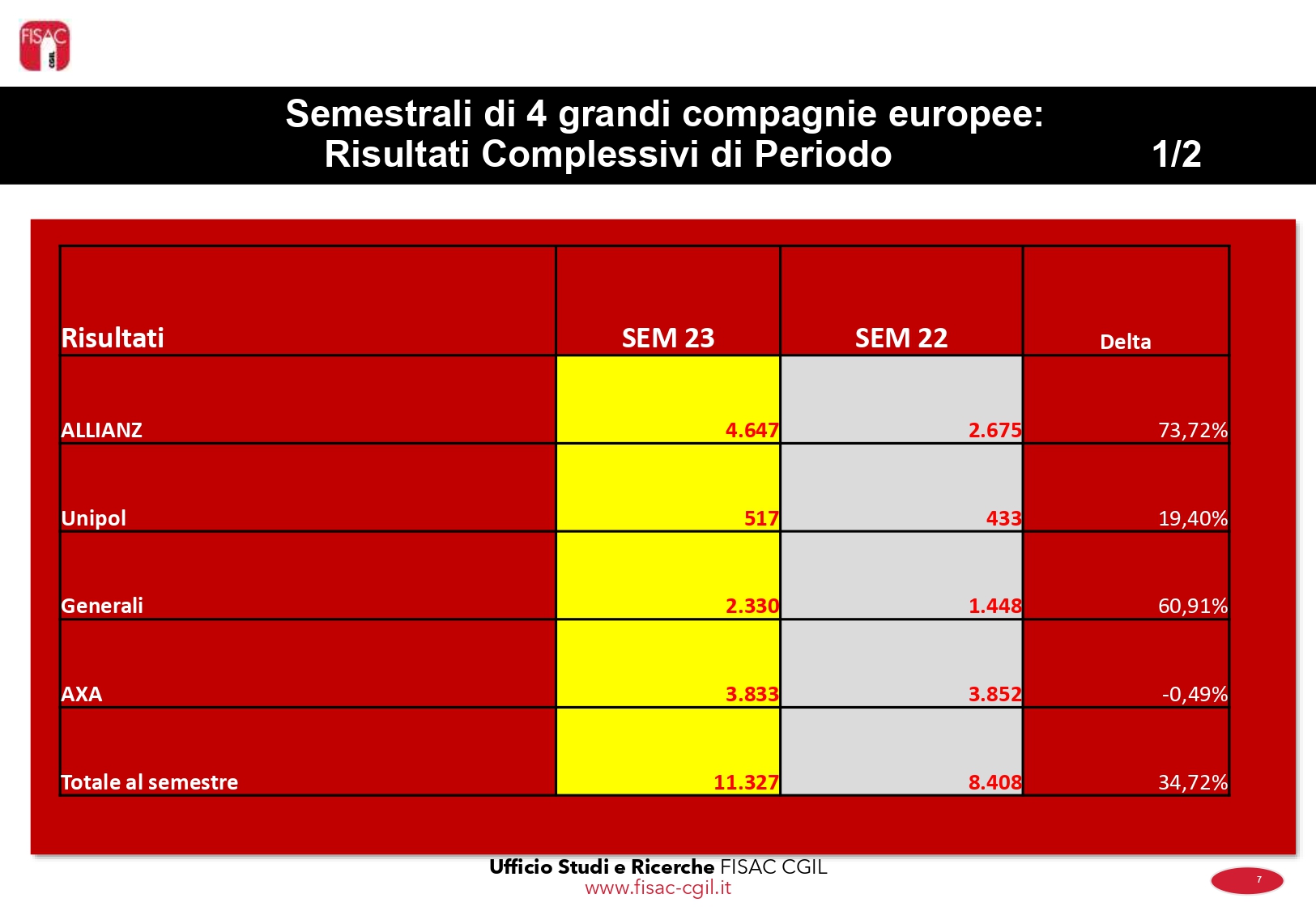

PROFITS GROWING BY 34.7%

On the earnings front, up by 34.72% compared to the first half of 2022

for over 11.3 billion, Allianz has the highest revenue with 4.6 billion (+73.72%), followed by Axa 3.83 billion (-0.49%), Generali 2.33 billion ( +60.91%) and from Unipol 517 million (+19.40%). “The sector has shown, in the selected sample, an important resilience – we read in the report – and also with regard to the Italian sample made up of the Generali group and the Unipol group there was an important increase. Finally, overall, there was a significant increase for Allianz while Axa essentially confirmed the profit for the 2022 half-year".

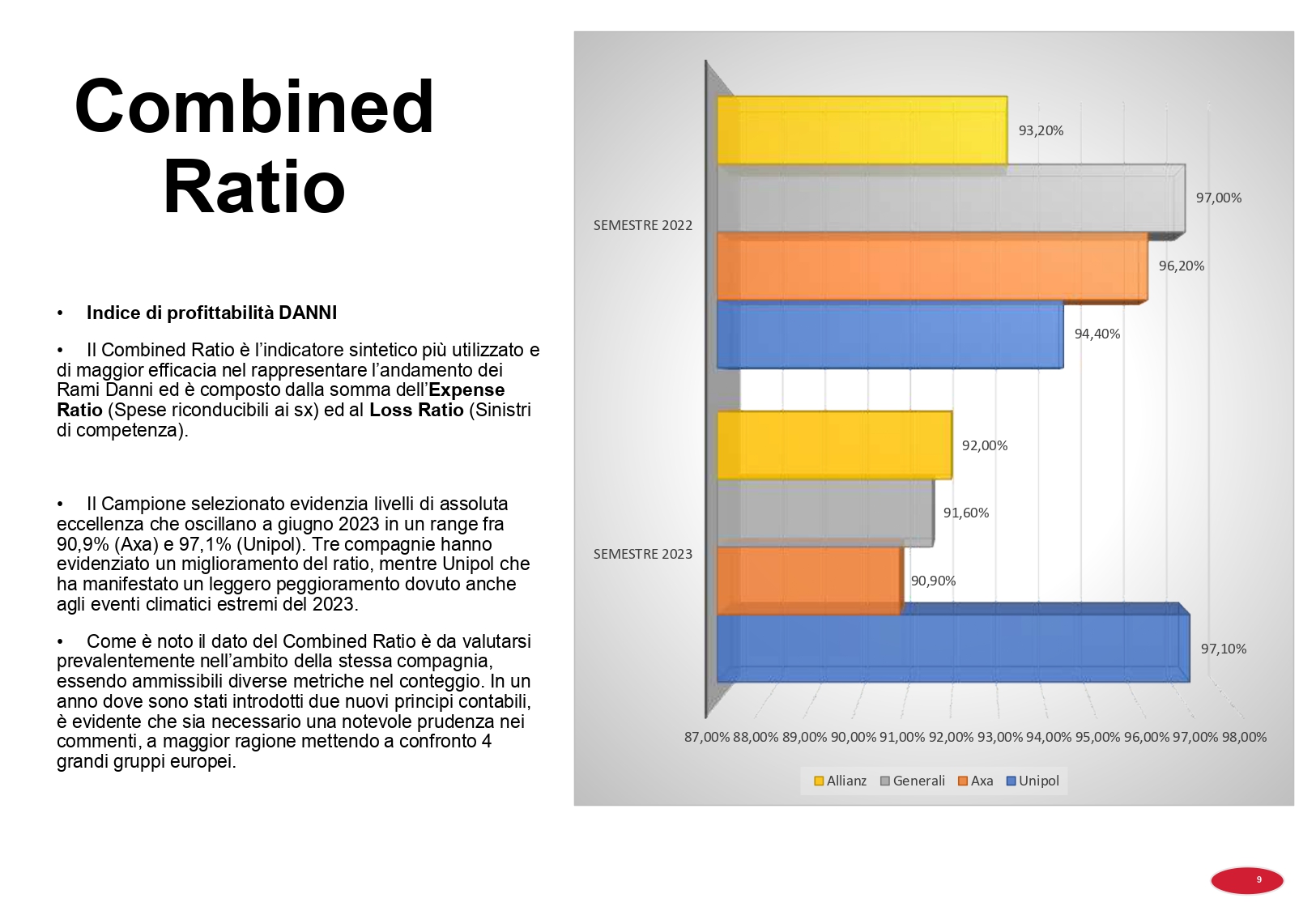

COMBINED RATIO BETWEEN 90.9% AND 97.1%

The Fisac report also examines the combined ratio of the companies and notes "levels of absolute excellence which fluctuate in June 2023 in a range between 90.9% (Axa) and 97.1% (Unipol)" passing through 91.6 % of Generali and 92% of Allianz. Further underlining: Allianz, Axa and Generali show an improvement in the ratio while Unipol a slight worsening also due to the extreme climatic events of 2023, starting from the flood in Emilia Romagna.

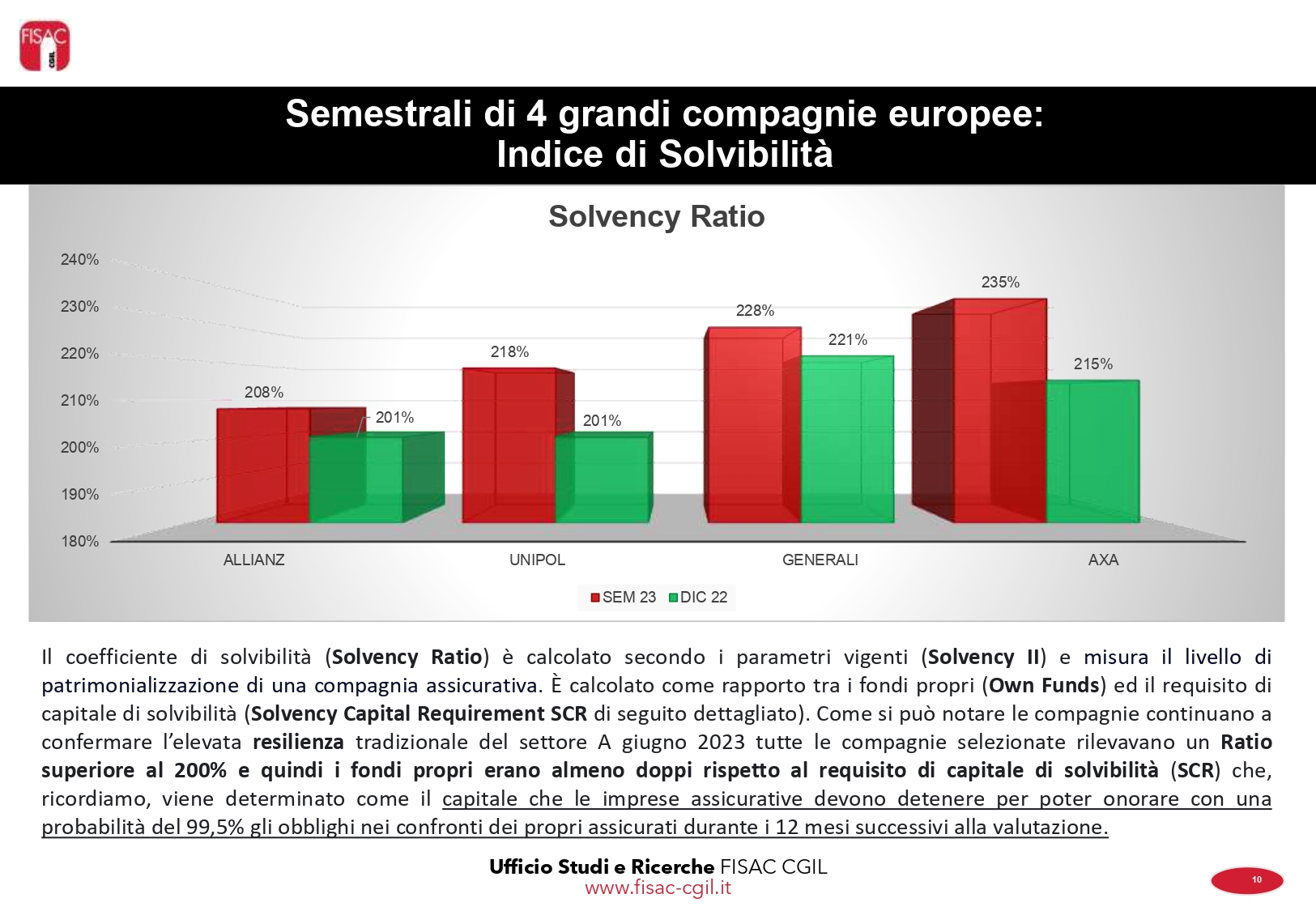

SOLVENCY II RATIO ABOVE 200%

The insurance sector, as finally observed in the Fisac Cgil report, remains very solid overall and also shows solvency indices (Solvency Capital Requirement II – SCR Ratio) in sharp increase. The groups examined, in fact, all have ratios already above 200% in December 2022, therefore "with own funds more than double compared to the SCR solvency capital requirement (i.e. the capital that insurance companies must hold in order to be able to honor a probability of 9.5% the obligations towards its insured during the 12 months following the evaluation), which went from an average of 210% in December 2022 to an average of 222% in June 2023", reaching 208% of Allianz, 218% of Unipol, 228% of Generali and, finally, 235% of Axa.

THE FISAC-CGIL REPORT

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/report-fisac-cgil-conti-compagnie-assicurative/ on Tue, 12 Sep 2023 05:19:51 +0000.