Intesa Sanpaolo, Unicredit and more, all the numbers of the banks under Italian Guarantee. Sace report

The role of the major banks such as Intesa Sanpaolo and Unicredit in the Italian Guarantee and the industrial sectors that have most benefited from the instrument introduced by the 2020 Liquidity decree. This is what emerges from the Sace report

Guarantee Italy is an instrument, introduced by the Liquidity Decree of 8 April 2020, through which the state-owned company Sace supports Italian companies affected by the Covid-19 health emergency. The Liquidity Decree has given Sace, chaired by Rodolfo Error, the mandate to support, through the issue of financial guarantees , the liquidity needs of the economic activities impacted by Covid-19.

More than a year and a half after the initiative was born, what were the results of the program? This was explained by the managing director of Sace, Pierfrancesco Latini, during a hearing in the Chamber of Deputies, presenting the explanatory report by Ss on the operations of “Garanzia Italia”.

Guarantee Italy part of the European strategy for businesses

Guarantee Italy is part of the Temporary Framework approved on March 19, 2020 by the European Commission , which allows state aid to be granted to companies in liquidity crisis. In this context, the Liquidity Decree provided that Sace may grant counter-guaranteed guarantees by the State on loans intended to support the Italian economic activities damaged by Covid-19. The initial deadline was 31 December 2020, then moved to 31 December 2021, the current draft of the 2022 Budget law plans to extend the Italian Guarantee to 30 June 2022.

Plafond of 200 billion euros: less than 30 billion requested

The Liquidity Decree had allocated 200 billion euros , of which 30 billion for SMEs, to guarantee the loans granted, and exclusively for production activities based in Italy. The report presented by Latini on the results of the Italian Guarantee shows that Sace, from 20 April 2020 to 31 October 2021, received a total of 3,522 requests for guarantees for a total amount of approximately 30 billion euros .

The ordinary procedure and the simplified procedure

The Decree provides for two methods , distinguished according to the turnover, the size of the companies involved and the maximum amount of the loan: an ordinary procedure and a simplified procedure . The ordinary procedure is reserved for companies with a turnover greater than 1.5 billion euros or with a number of employees in Italy greater than 5,000 or for loans of an amount greater than or equal to 375 million euros . The simplified procedure, managed entirely through the online platform, is instead dedicated to companies with turnover up to 1.5 billion euros, number of employees in Italy up to 5,000 and amounts up to 375 million euros .

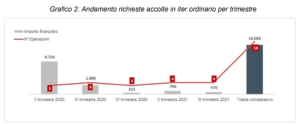

The numbers of the ordinary procedure

The requests for guarantees received and accepted by Sace that followed the ordinary procedure were 18 for a total amount of the request for a loan of 10 billion and 85 million euros . Of the 18 total requests, one is a factoring request (assignment of receivables in order to obtain liquidity) for a value of 300 million euros, the remaining 17 are requests for financing with a total value of 9,785 million euros. At 31 October 2021, 15 guarantees were issued for an amount of 9 billion and 915 million euros, 14 of these, corresponding to 9 billion and 875 million euros, have already been disbursed. The average loan rate applied is 1.85% and the average annual cost of the guarantee issued is 0.74%. The minimum duration of the guarantees accepted is 9 months, the maximum duration is 72 months.

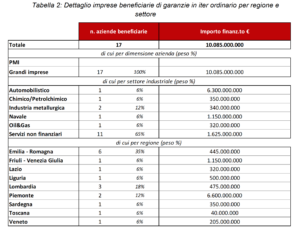

The companies benefiting from the ordinary procedure

The companies that have been able to access the ordinary procedure are large companies in the automotive, chemical, metallurgical, naval and energy sectors. These companies are mostly located in central and northern Italy, as can be seen from this Sace table.

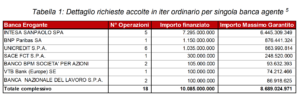

The financing banks of the ordinary procedures

As the CEO of the state-owned company said in his speech to the Commission, the banks involved in the initiative are the largest on the Italian scene: from Intesa Sanpaolo to Unicredit, passing through Bnl and Banco Bpm.

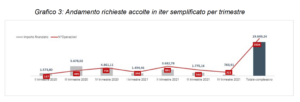

The numbers of the simplified procedure

There were 3,504 requests for guarantees in the simplified procedure for a total amount of the request for a loan of approximately 19 billion and 850 million . Of these, the guarantees already disbursed as of 31 October 2021 amounted to 3,287 for a total loan request amount of approximately 19 billion and 331 million euros and a guaranteed amount of approximately 19 billion 75 million euros. Sace received 48 requests for factoring, for 213.7 million euros , 3,397 requests for financing for 19 billion and 539 million euros , 46 leasing requests for 32.2 million euros and 13 requests for debt securities for 64 , 2 million euros . The average loan rate applied is 1.75% and the average annual cost of the guarantee issued is 1.01%. The minimum amount of the guarantee is around 24 thousand euros and the maximum of 365 million. The minimum duration of the guarantees accepted in the simplified procedure is 2 months, the maximum of 96 months.

Businesses benefiting from the simplified procedure

1899 companies have benefited from guarantees through the simplified procedure, of which 20% SMEs, 50% MID and 30%. These companies are active in the automotive, agri-food, chemical, metallurgical, textile, electrical, consumer goods, construction, mechanical, aeronautical, naval and energy sectors. The requests came from all over Italy but, reflecting the industrial presence in our country, a greater number of requests came from the northern regions , Lombardy and Emilia Romagna above all.

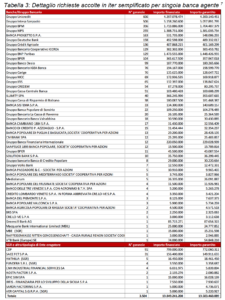

The financing banks of the simplified procedures

The financial intermediaries who can benefit from the Sace guarantee as part of the Italian Guarantee are banks, national and international financial institutions and other persons authorized to carry out credit in Italy registered in specific registers, sections and registers of the Bank of Italy.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/intesa-sanpaolo-unicredit-e-non-solo-tutti-i-numeri-delle-banche-in-garanzia-italia-report-sace/ on Mon, 13 Dec 2021 08:10:03 +0000.