Is demand in America starting to slow down?

In the United States, inflation is declining, with signs of a deflation of “revenge spending”. The analysis by Antonio Cesarano, Intermonte's chief global strategist

The US inflation figure for August was below expectations both in the general component (8.5% from 9.1%) and in the core component (steady at 5.9%).

In the first case, the drop in the energy component had a significant impact, which more than balanced the persistence of strong inflationary pressures in the food component. The petrol component fell by 7.7% m / m compared to a 2% m / m drop in the transport component.

The core index remained unchanged at 5.9% y / y thanks mainly to a slowing monthly growth in the important rental component and, more generally, to a slowdown in the growth of the services sector.

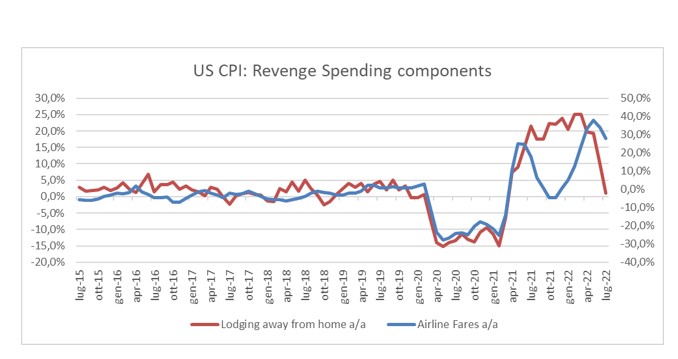

The items of expenditure more similar to the post-pandemic spending boom, to recover the time lost during the lockdown (so-called revenge spending), also marked significant downsizing in terms of y / y as in the following graph. An important clue to the deflating post-pandemic demand boom.

In a nutshell, the figure appears to be the sum of two components: on the one hand the decline in commodities (energy in the first place) and on the other hand the attenuation of the sharp rise in the services sector.

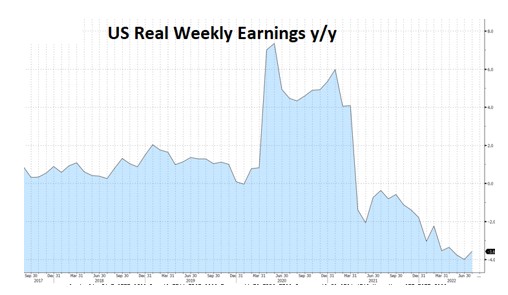

In both cases, the common factor could be represented by the first symptoms of a slowdown in demand that little by little is starting to become less explosive than in the phases immediately following the pandemic, partly under the blows of a continuous erosion of purchasing power. emblematically represented by the decline in real wages in progress for 16 consecutive months.

In terms of expectations on Fed Fund rates at the end of 2022, in fact, they remain overall anchored at around 3.5%. After the US job market, the expectation was for hikes of 75, 25 and 25bps in the September, November and December meetings which have now returned to 50, 25 and 25bps.

The most relevant aspect is that inherent instead the spasmodic search of the operators of the so-called “pivot” of the Fed, ie the timing of the monetary policy reversal point.

Further data will undoubtedly be needed to confirm. At the moment, the scenario that is emerging is that of a progressive reduction of US inflation towards lower levels, although historically still high, since it is inflation more linked to demand and therefore more sensitive to Fed maneuvers.

The generalized decline in commodities reflects in itself the current downsizing of global demand, which in turn translates into possible prospective moderation of US inflation which has both a favorable comparison effect and also less dependence on geopolitical factors such as Europe mainly due to Russian gas.

For the end of the year, therefore, the hypothesis of a progressive decline in long-term government rates remains confirmed (target area 2% of the 10y treasury) in view of a greater probability attributed to the hypothesis of the US 2023 recession and consequently also of a reversal of the Fed.

For equity markets, the potentially recessive scenario signaled by the inversion of the interest rate curve, could represent a factor of potential support for share prices between the end of 2022 and more likely in the course of 2023, in view of the passage of the Fed's monothematic focus on inflation. to also include the theme of growth.

Powell will be called upon to summarize all these factors at the Jackson Hole symposium on August 25/27.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/inflazione-stati-uniti-luglio-2022/ on Thu, 11 Aug 2022 05:04:19 +0000.