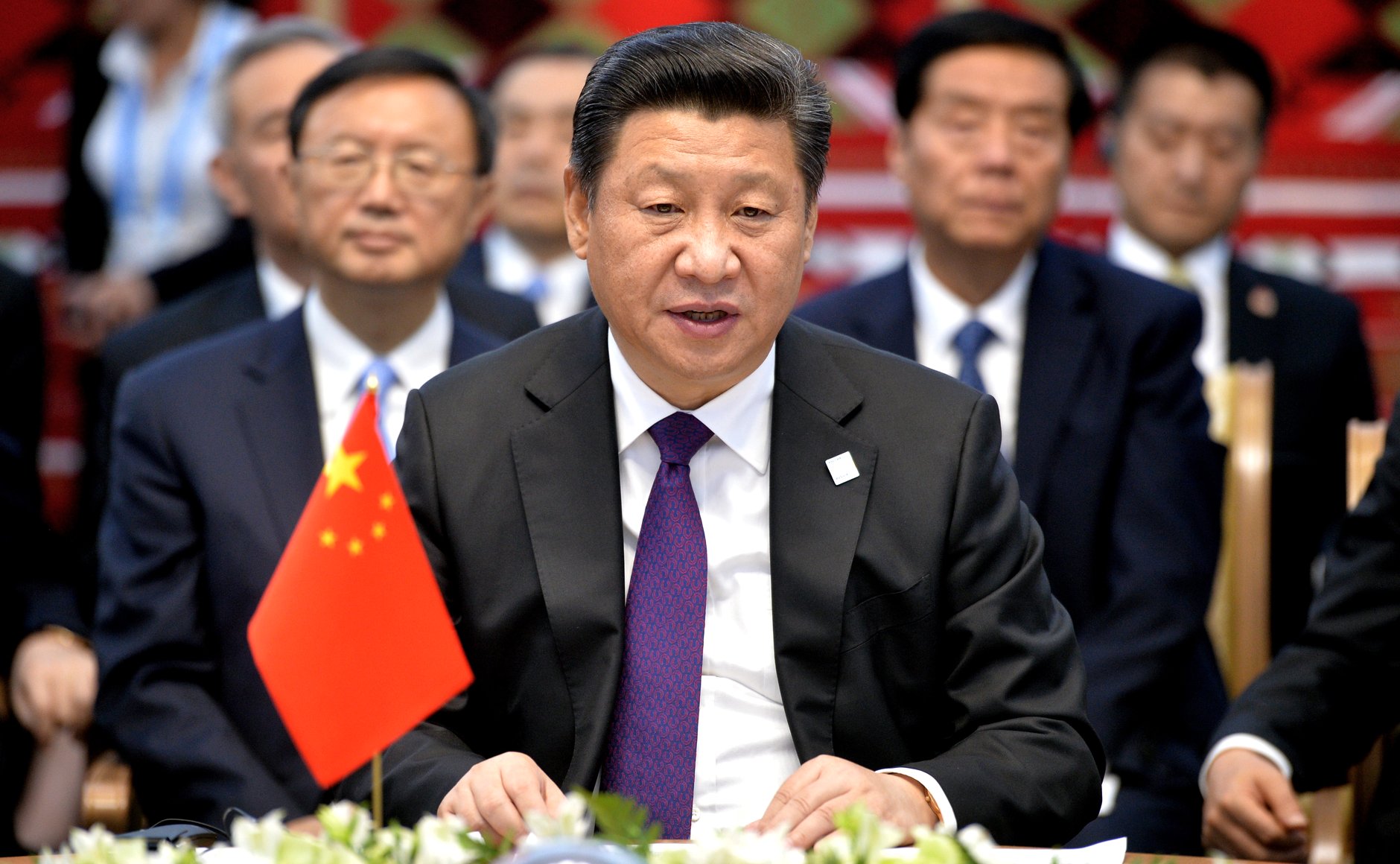

Is Xi Jinping’s ideology hurting China’s economy? Wsj report

Many economists predict lower economic growth for China, due in part to President Xi Jinping's authoritarianism. The deepening of the Wall Street Journal

Two years ago, Xi Jinping set out ambitious plans to expand China's wealth and double the size of the national economy by 2035.

According to estimates by officials involved in policymaking, the Chinese economy is expected to grow an average of nearly 5% per year for 15 years. Many economists, both inside and outside China, believe that 5% is not achievable, not just for this year, but also in the long term.

A major challenge is Xi's political agenda. Since coming to power in 2012, Xi has placed ideological righteousness, national security and Communist Party control at the center of his politics. And he insisted on greater state control over the economy, an approach that many economists say has come at the expense of the dynamic private sector that has driven China's extraordinary growth.

Private sector economists, the World Bank and other institutions expect China's growth to rebound to around 4.5% next year, after an estimate of 3% or so in 2022, assuming Beijing will eventually loosen your zero-Covid policy. Many economists predict that growth will remain weaker than before the pandemic, in part due to shrinking workforce and rising debt, the WSJ writes.

Much of the recent slowdown in Chinese GDP growth is attributable to the severe containment policies of Covid. Xi's insistence on closing companies even in the event of minor outbreaks has reinforced his belief that China's centralized control system is better than the West's and has kept the number of reported cases low. It has also kept businesses closed and increased youth unemployment.

Xi now appears to be intent on extending his tenure as the nation's leader for another five years during the Communist Party congress to be held this week, contravening the recent move to step aside after ten years. And it shows no signs of wanting to change course on its priorities. In the opening speech of the party congress, Xi defended his zero Covid policy, stating that it "protected people's lives and health to the fullest extent possible".

On Monday, China abruptly delayed the release of its third quarter gross domestic product data, originally scheduled for Tuesday, without giving any reasons.

A long-term economic concern is that Xi has prioritized state-owned enterprises by squeezing private companies – a major turnaround on China's trajectory since former leader Deng Xiaoping ushered in a period of "reform and opening up" in 1978.

He used the powers of the state to neutralize the powerful private sector tycoons. In a context of growing tensions with the United States, it has stepped up efforts to reduce China's dependence on foreign technology and has directed more capital into sectors that Beijing considers strategically important, such as semiconductors and artificial intelligence.

This shift is contributing to slowing productivity and wage growth, the weakness of China's financial markets, and the growing reluctance of Western companies to invest in the country.

A new study from the Atlantic Council's GeoEconomics Center, a Washington-based think tank, and the Rhodium Group, a New York-based economic research partnership, predict that China will struggle to maintain growth of more than 3% annually by mid-year. this decade, unless the government makes changes to overcome population shrinkage and productivity weakness.

"We have seen a gradual fading of enthusiasm for market-based economic reforms," said Helge Berger, International Monetary Fund Head of Mission for China. "China's growth potential may be substantially lower than what we are used to."

Some signs point to problems for the country's growth potential. An IMF analysis estimates that productivity growth averaged only 0.6% over most of the past decade under Xi's leadership. This is a sharp drop from the 3.5% average of the previous five years.

The IMF estimates that the productivity of state-owned enterprises is only about 80% of that of private enterprises, and they are usually less profitable. The state-owned PetroChina Co., which contributes to China's efforts to reduce energy dependence from abroad, has more than 400,000 employees, six times more than Exxon Mobil Corp.

Based on the return on assets, the Texan company is about three times more profitable than PetroChina, with more than double the income per full-time worker.

According to IMF projections, a strong push to renew the state sector, with measures aimed at ensuring a level playing field for private enterprises, could more than double China's annual productivity growth to around 1.4%.

Xi's political approach has angered some senior Chinese leaders who believe the country should continue to follow Deng's path, according to officials involved in policymaking. Xi's number two, Li Keqiang, in what should be his last year as premier, has at times seemed to pick up on concerns within the party's ranks about faltering growth.

Shortly after party leaders gathered in the seaside town of Beidaihe in August, Li took a trip to Shenzhen, the cradle of China's economic transformation. In a symbolic gesture, he placed a wreath of flowers near a large statue of Deng.

According to a video widely circulated on Chinese social media, Li told a cheering crowd: "Reform and openness must go on." Li compared the process of liberalizing the Chinese economy to "a trail of blood".

The video was later deleted by Beijing censorship.

Xi had signaled a different approach when he took office in 2012. Eager to raise living standards as part of his "Chinese Dream" for national rejuvenation, he called for state-owned companies to operate more as commercial enterprises than cities and towns. the provinces review their finances and that the government promotes entrepreneurship.

As time went on, Xi began to be wary of market forces and how they could threaten political stability, especially after the stock market turmoil in 2015, people who know his thinking say.

Xi has also become more alert to potential threats to Communist Party supremacy from private sector magnates like Jack Ma, co-founder of Alibaba Group Holding Ltd., and the US's increasingly tough stance towards China.

The market-oriented changes have given way to initiatives aimed at strengthening Party control and making China, in Xi's words, a "modern socialist power".

State policies aimed to reduce China's dependence on Western imports, transform the country into a leader in new technologies, cleanse the financial system of debt and redistribute wealth.

Beijing has given subsidies to favored industries and encouraged state-owned enterprises to merge to become more powerful. In 2018, the total assets of state-owned companies were valued at 194% of China's gross domestic product, a value higher than in the early 2000s and several orders of magnitude than any other country, according to the IMF.

Thanks to state support, Chinese state-owned enterprises have obtained loans at lower interest rates. According to the Rhodium-Atlantic Council report, they now account for over 90% of bond issues in China.

Efforts to contain housing speculation and prevent the housing bubble from escalating have led state-owned real estate developers to grab market share at the expense of private ones.

Beijing has also launched a near-total crackdown on private tech giants, seen as a challenge to Xi's authoritarian rule, especially in sectors venturing into the party's ideological domain, such as private lessons and entertainment.

An entrepreneur who holds a doctorate in education technology in the United States has spent more than a decade building an English language learning platform in China that serves more than 15 million students. He left the company last year after his customer base dropped 80% due to Beijing's crackdown on private education companies, which Xi feared cost his parents too much and became a de facto system of alternative education.

“It is as if I had raised a child for 15 years and all of a sudden he was gone,” said the entrepreneur. He has since begun doing research in a government-funded laboratory in the field of computational biology, a strategic priority for China. He is considering returning to the United States.

Another entrepreneur, Rock Sun, said he left China over the summer after the government banned cryptocurrency-related transactions. Beijing feared that decentralized and anonymous digital currencies could undermine state control over the financial system.

Sun, who has worked for years in tech and cryptocurrency companies in Beijing, said cryptocurrency investors had initially welcomed government guidance to help bring order to the industry. After Beijing's shares wiped him out, he left for Singapore, where cryptocurrencies are regulated but allowed.

China is now a world leader in some areas supported by Beijing, including electric vehicles. Companies that have benefited from state support, including Hangzhou Hikvision Digital Technology Co. and SenseTime Group Inc. are at the forefront of fields such as surveillance and artificial intelligence.

Venture capital investors invested $ 129 billion in Chinese startups in 2021, surpassing the previous high of about $ 115 billion in 2018, with most of the money going to party-approved priorities such as semiconductors and technology. 'information.

China's per capita national income reached $ 12,556 last year. This brings it closer to the $ 13,205 threshold that the World Bank classifies as the minimum for a "high-income" country, a goal that Beijing has been pursuing for some time. China's GDP per capita was 18% of that of the United States last year, up from 12% in 2012.

Scott Rozelle, an economist who heads Stanford University's rural education program and co-author of "Invisible China", said China could find itself in the "middle income trap" – where a country's growth stagnates before to get rich – unless you fundamentally change your priorities for investing in human capital.

The author found that in 2020 only 34% of the Chinese workforce will have a higher education, a lower rate than other middle-income countries such as Mexico, Argentina and Turkey. Among the world's leading market economies, the schooling rate averages 82%.

"China has failed to invest in its people," he said.

After Xi's efforts to make China less dependent on foreign technologies, the country is now able to produce about 26% of the semiconductors it needs, up from 13% in 2017, according to Handel Jones, the company's chief executive. International Business Strategies consultancy.

These are less complicated chips. Despite the billions of dollars invested over the past 10 years, China has failed to mass produce high-end chips, critical to modern economies and currently dominated by chip makers in Taiwan, South Korea and the United States.

A state-led push to develop China's first large commercial jet, the C919, has shown limited progress after a decade of investment. The plane recently overcame a number of regulatory hurdles to begin carrying passengers, but industry experts say it's still years away from commercial service.

Arthur Kroeber, founding partner of the research firm Gavekal Dragonomics, who has written extensively on the Chinese economy, said he was increasingly negative about China's prospects given the limited benefits of its technology-centric industrial policy.

“The stated strategy may boost some industries such as semiconductors and electric vehicles, but it is not enough to create economic productivity growth,” he said.

Increased regulatory controls on foreign investment, for national security reasons, have led to more multinationals leaving China or planning a divestment. Despite government data showing persistent strong flows of foreign investment into China, the Rhodium-Atlantic Council study finds that foreign direct investment as a share of China's GDP has steadily declined, dropping to 21% last year from nearly 30%. % of a decade earlier.

A survey published in August by the US-China Business Council of 117 American companies operating in China showed that business optimism reached an all-time low. According to the survey, around 8% of the companies surveyed moved parts of their supply chain from China to the United States, while another 16% moved some operations to other countries.

Xi has withdrawn some of his policies that have pulled China away from the market economy, including the "common prosperity" campaign that called on entrepreneurs to share their fortunes. Xi told officials the short-term goal is to "make the cake bigger" and then divide it more evenly, officials briefed on the remarks reported.

"Many people are not sure that economic development will continue to be the party's central task," said Mao Zhenhua, president and founder of the China Chengxin Credit Co rating agency, at an economic forum held in Beijing in June. according to a transcript. "A course correction is needed to get the economy back on track".

(Extract from the press review of eprcomunicazione)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/mondo/xi-ideologia-danni-economia-cina/ on Sun, 23 Oct 2022 05:53:30 +0000.