Italian industry closes 2022 with growth

How is Italian industry doing? The comment by Paolo Mameli, senior economist of Intesa Sanpaolo's studies and research department, on the industrial production index.

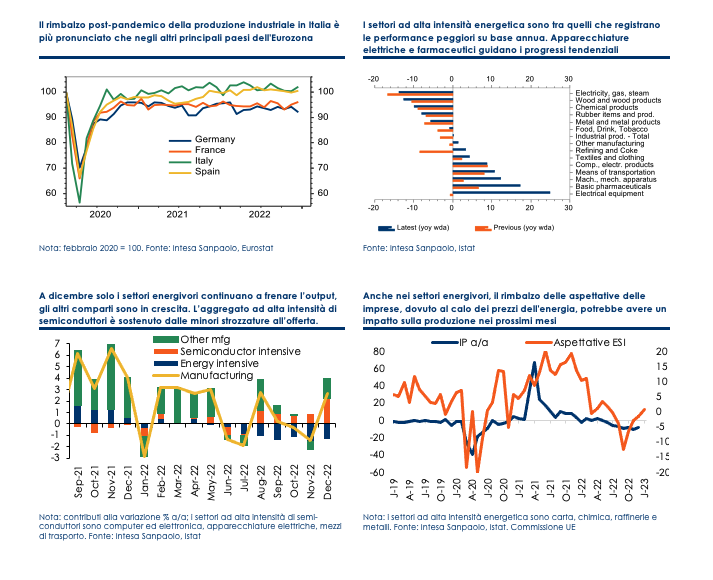

The 1.6% m/m jump in industrial production in December was much stronger than expected – the largest monthly increase since last August (August and December data are very volatile due to the holidays). The figure leaves output below the level prior to Russia's invasion of Ukraine (-0.6% vs February 2022) but significantly above pre-pandemic levels (+2% vs February 2020 ); in particular, the recovery compared to the pre-pandemic period is more pronounced than in the other large economies of the Eurozone (also thanks to some peculiar characteristics of our production system such as "short" production chains and more domestically integrated than in other countries, high diversification of exports by product and by target market, specialization in low energy intensity sectors).

In the 4th quarter, production fell by -0.9% q/q, which suggests that industry in the strict sense subtracted about two-tenths from value added in the final part of 2022 (therefore, the decline in GDP by -0.1% q/q reported by Istat for the last quarter is due to a positive contribution from services and construction). In 2022 as a whole, industrial production grew, albeit moderately (0.5%), after the large post-pandemic rebound of 2021 (12.2%).

Over the month, the recovery in output was generalised, with the sole exception of durable goods (-2.4% m/m): this could be the industrial sector most affected by interest rate hikes. The largest contribution came from the production of capital goods, which increased by 3.1% m/m (a sign that the investment cycle does not appear to have been interrupted by the energy crisis). In the manufacturing sector alone, growth in the month was 1.7%, mainly thanks to the double-digit jump recorded by electrical equipment (17.2% m/m) and pharmaceuticals (11.6% m/m ).

Production in the most energy-intensive sectors suffered a further decline, in particular in the chemical sector (-2%), base metals (-1.2%) and wood, paper and printing (-0.8 %m/m). This suggests that energy-intensive industries are still struggling despite the recent drop in natural gas prices. On an annual basis, energy-intensive sectors remain in largely negative territory (chemicals -11.6%, wood, paper and printing -15% y/y adjusted for calendar effects), while electrical appliances (27.4 % YoY) and pharmaceuticals (18.1% y/y) lead the progress trend.

In any case, against a persistent weakness in the energy-intensive sectors (our estimate: -0.7% m/m, -8.4% y/y), we note a resilience in the other production sectors. In particular, semi-conductor-intensive sectors (our estimate: +5.5% m/m, +14.4% y/y) are benefiting from reduced supply constraints thanks to the easing of supply bottlenecks in transport system and global value chains.

It should be noted that industrial production data for December are usually very volatile, as they depend on the distribution of holidays in the month, and are therefore often subject to revisions: we are very cautious about attributing excessive significance to this month's data. However, December's rebound could be a first sign that, after the broad weakness recorded in most of the second half of 2022, industrial production could return to moderate growth in the coming quarters, supported by the recent collapse in energy prices (whose effects are fully transmitted to the productive activity with a delay of some months).

Overall, our forecast for Italian GDP growth in 2023 (0.6%), which for almost the entire last year was significantly higher than the consensus, indeed now appears subject to upside risks, especially in the event where the prices of energy raw materials remain at current levels.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/industria-italiana-chiude-in-crescita-il-2022/ on Fri, 10 Feb 2023 12:46:25 +0000.