How are the 2022 accounts of Poste Italiane going, sector by sector

All the details on the 2022 quarterly report of Poste Italiane

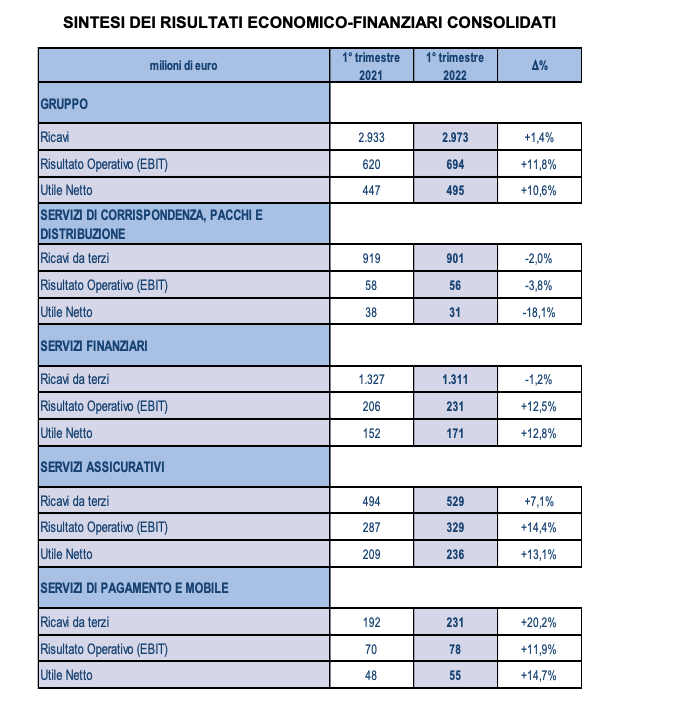

Poste Italiane closed the results for the first quarter of 2022 with a positive sign thanks to insurance and financial services.

The operating result is "in strong growth", notes the company, equal to 11.8%, amounting to 694 million, "with positive contributions from insurance services, financial services, payments and mobile and a resilient performance of the correspondence division, parcels and distribution ". The group reported net income up 10.6% to 495 million in the first quarter of 2022.

Revenues "in continuous growth", equal to 1.4% in the quarter, reaching 3 billion. Poste underlines the “solid financial performance in the first quarter of 2022 which paves the way for a successful 2022”.

"Our diversified business model continues to produce excellent financial results with net profit of 495 million and with operating profitability improving in all business segments", highlights the CEO of Poste Italiane Matteo Del Fante, presenting the first quarter results.

“We confirm our role as a strategic pillar for Italy, through our omnichannel distribution platform. We continue to meet the constantly evolving needs of our customers and confirm our ambition to support the development of our country, from now on ”underlines the CEO of Poste Italiane. “Less than two months after the update of the Group's Strategic Plan, these results represent the first cornerstone of a successful 2022”, added Del Fante. "Since 2020 – he notes – we have achieved a constant and improving quarter performance: after a strong recovery in 2021, in the first of the year we continue to grow solidly, paving the way for a successful 2022".

All the details on the numbers for the first quarter of 2022 by Poste Italiane.

HOW IS THE CORRESPONDENCE SECTOR GOING

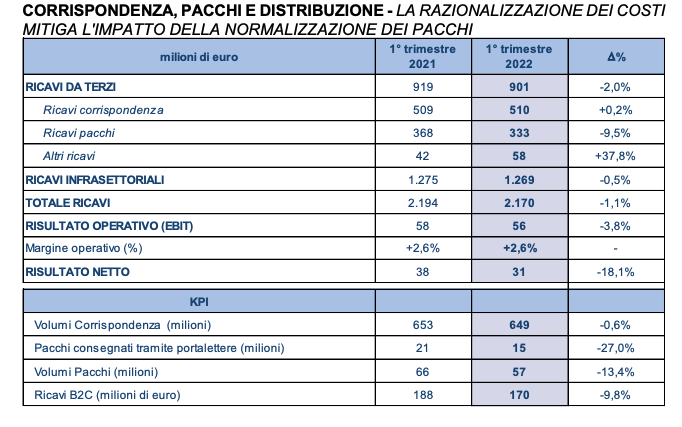

In the first quarter of 2022, revenues from the correspondence, parcel and distribution sector of Poste Italiane decreased by 2%, compared to the first quarter of 2021, to 901 million. Revenues from correspondence remained unchanged at € 510 million, “with volumes falling for products with lower margins, such as unregistered mail, and increasing for products with higher margins, such as integrated services”.

REVENUES FROM PACKAGES DECREASE

Parcel revenues, on the other hand, decreased by 9.5% year on year to 333 million "going through – the company notes – a phase of normalization, albeit structurally remaining above the pre-pandemic levels, due to profound changes in the customer behavior. In absolute terms, this quarter is in second place all time for volumes of packages delivered in the first quarter of each year ”.

In particular, in the quarter, parcel volumes decreased by 13% year-on-year to 57 million units: the comparison is with "a strong first quarter of 2021, from the e-commerce boom related to travel restrictions" for Covid measures. "In the first quarter of 2022, approximately 1 million packages were handled per day, with postmen delivering 15 million packages, recording a reduction of 27% compared to the first quarter of 2021".

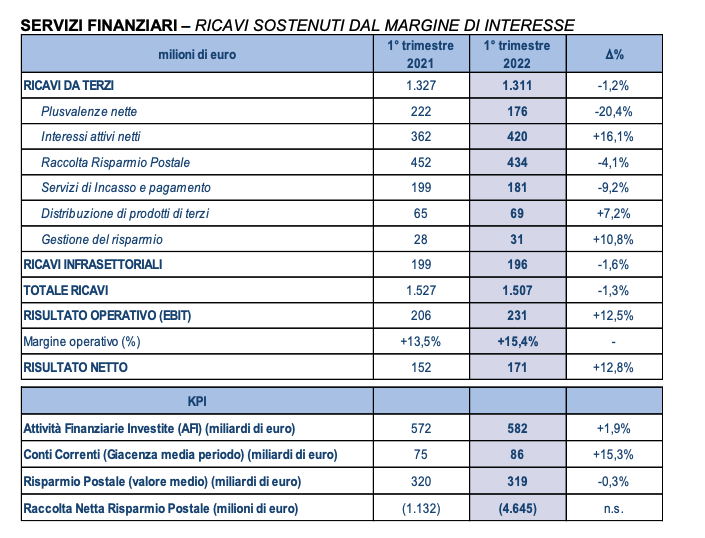

GOOD FINANCIAL SERVICES

“The insurance sector provides the greatest contribution to the profitability of the group, with a positive performance in both the Life and Non-Life sectors. The Ebit of Financial Services increased thanks to stable revenues and the contribution of lower costs ”.

In the Payments and Mobile sector – continues the CEO of Poste Italiane, highlighting the results for each business sector – the growth in the Ebit figure was determined by the ability to exploit the positive trends of the market, as evidenced by the 2 billion transactions managed in 2021 and over half a billion in the first quarter of the year ". Then, "the operating result in the Mail, Parcels and Distribution division was solid in the quarter, thanks to the rationalization of costs which offset the impact of the normalization of parcel volumes which are structurally above pre-pandemic levels, even following the exceptionally high results of last year, resulting from the lockdown measures implemented in the majority of Italian regions. Even in the face of a challenging context in the logistics sector, our proven experience in cost rationalization makes us particularly confident in maintaining full visibility on our 2022 EBIT target for the Mail, Parcels and Distribution division ".

(EXTRACT FROM THE PRESS RELEASE OF POSTE ITALIANE ON THE RESULTS OF THE FIRST QUARTER 2022)

HERE'S BELOW THE PERFORMANCE OF THE MAIN BUSINESS SECTORS OF POSTE ITALIANE IN 2022

CORRESPONDENCE, PARCELS AND DISTRIBUTION

In the first quarter of 2022, the revenues of the Mail, Parcels and Distribution sector decreased by 2.0%, compared to the first quarter of 2021, to € 901 million. Revenues from correspondence were unchanged in the first quarter and amounted to € 510 million, with volumes decreasing in products with lower margins, such as unregistered mail, and increasing in products with higher margins, such as integrated services. Mail rates remained virtually unchanged in the first quarter of 2022. Parcel revenues decreased by 9.5% year-on-year in the first quarter of 2022, reaching € 333 million, going through a phase of normalization, albeit remaining structurally at the above pre-pandemic levels, due to profound changes in customer behavior. The comparison with the first quarter of 2021 is made particularly challenging in the face of the record volumes reached in the first 3 months of 2021, when two thirds of the Italian regions were subject to strict restrictions on travel; in absolute terms this quarter is in 2nd place all time for volumes of packages delivered in the first quarter of each year. Other revenues increased in the first quarter of 2022 by 37.8% yoy to € 58 million.

In the first quarter of 2022, package volumes decreased 13% year-on-year to 57 million units, impacted by the comparison with a strong first quarter of 2021, supported by the e-commerce boom related to travel restrictions. Parcel rates have increased, with B2C posting a 7% improvement over the first quarter of 2021, thanks to a more favorable mix in the customer base. In the first quarter of 2022, approximately 1 million parcels were handled per day, with Postmen delivering 15 million parcels, recording a reduction of 27.0% compared to the first quarter of 2021. Distribution revenues remained essentially stable to € 1.3 billion. Operating income (EBIT) remained unchanged in the first quarter of 2022 at € 56 million from € 58 million in the first quarter of 2021, with the rationalization of costs which offset the effect of the normalization of parcel volumes.

FINANCIAL SERVICES

Financial Services revenues decreased in the first quarter of 2022, on an annual basis, by 1.2% to € 1.3 billion, with net interest income (NII) up 16.1% and operating income proactive investment portfolio down 20% due to a different time effect. In the first quarter, gross revenues (including intra-sector revenues) decreased by 1.3% year-over-year to € 1.5 billion impacted by lower commissions from the distribution of insurance products. In the first quarter, the interest margin increased year on year by 16.1% to € 420 million, driven by investments in tax credits and by a favorable market context in relation to interest rates; € 176 million in capital gains were recorded, while the full-year objective of proactive portfolio management has already been ensured with settlement dates in the second and third quarters. Postal savings distribution fees decreased 4.1% yoy in the first quarter of 2022 to € 434 million, due to greater outflows than expected.

Distribution fees on personal loans and mortgages grew 7.2% in the first quarter of 2022 year-over-year to € 69 million supported by higher volumes and better pricing. Revenue from collection and payment services decreased in the first quarter of 2022 by 9.2% year-over-year to € 181 million mainly due to an acceleration in the decline in bulletins and the transfer of revenue from debit cards to PostePay, together with the growth of bills directly managed by PostePay as a payment service provider. Managed savings fees increased in the first quarter of 2022 by 10.8% yoy to € 31 million, demonstrating resilience thanks to recurring management fees. Invested Financial Assets (AFI) reached € 582 billion in the first quarter of 2022 (down € 4 billion compared to December 2021), driven by € 2.0 billion in net inflows and a negative market effect on asset values. assets of € 6.0 billion, connected to the increase in interest rates. Net technical reserves fell by € 4.7 billion, reflecting the increase in interest rates, despite yet another solid performance in the quarter in terms of net inflows which reached € 2.6 billion. Net deposits from deposits amounted to € 3.9 billion, driven by the Public Administration. Operating profit (EBIT) grew, year on year, by 12.5% in the first quarter of 2022 and equal to € 231 million, mainly due to higher provisions for risks and charges in 2021 and lower intra-sector costs in first quarter of 2022

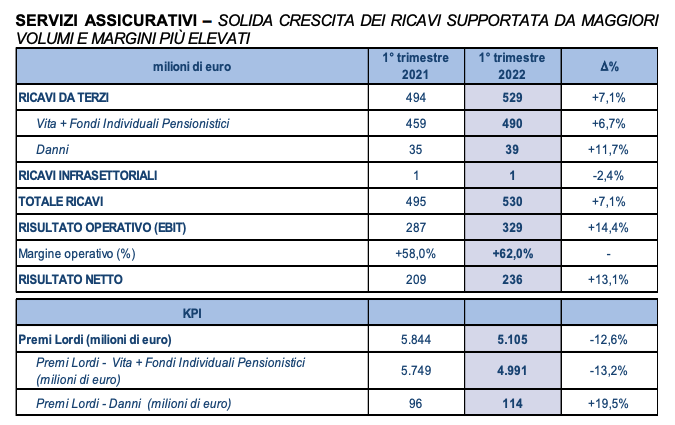

INSURANCE SERVICES

Revenues from the insurance sector increased, year on year, by 7.1% in the first quarter of 2022 and amounted to € 529 million. Life business revenues increased in the first quarter of 2022, on an annual basis, by 6.7% to € 490 million, driven by growing volumes and margins supported by sales of multi-branch products, which now represent 61% of total production . In the first quarter of 2022, the revenues of the Non-Life Division increased on an annual basis by 11.7% to € 39 million thanks to the modular offer and benefiting from both the Poste Italiane welfare offer and the recovery of CPI products, linked to the distribution on behalf of third parties of personal loans and mortgage loans. Net inflows in the Life insurance sector grew by 32% compared to the first quarter of 2021 and equal to € 2.6 billion in the first quarter of 2022. Gross premiums in the non-life insurance sector increased by 19.5% and equal to to € 114 million. The operating result (EBIT) for the first quarter of the year reached € 329 million, up 14.4% on an annual basis, reflecting the trend in revenues. At the end of March 2022, the Solvency II Ratio of the Poste Vita Insurance Group stood at 272% supported by a higher level of interest rates, with transitional measures providing a buffer of an additional 24 pp to address the volatility of the market.

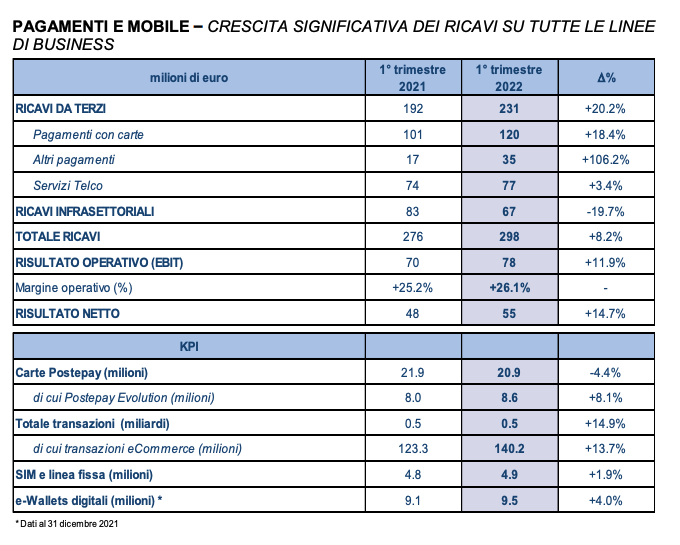

PAYMENTS AND MOBILE

The revenues of the Payments and Mobile segment continued to grow, year on year, by a solid 20.2% in the first quarter of 2022, well above the market average, and amounted to € 231 million, confirming the role played by PostePay as a leader in the rapidly growing and evolving market of digital payments in Italy. Card payments grew in the first quarter of 2022 by 18.4% year-over-year to € 120 million thanks to (i) increased transactions, both on the physical and digital channels, and (ii) the continuous shift towards Evolution cards showing higher recurring margins, with the total stock at the end of March equal to 8.6 million cards (+ 8.1% on an annual basis). E-commerce transactions continued on their growth path in the first three months of the year, reaching 140.2 million from 123.3 million, up 13.7% on an annual basis in the first quarter of 2022.

Other payments increased in the first quarter of 2022 by 106.2%, on an annual basis, to € 35 million, mainly thanks to the payment transactions managed directly by PostePay as a Payment Service Provider, thus mitigating the progressive reduction of bulletins. Telco service revenues increased 3.4% year-on-year to € 77 million in the first quarter of 2022, leveraging a loyal customer base of 4.9 million users, new fiber offering customers and a very low dropout rate. PosteID (Poste Italiane's national digital identity solution) has now been adopted in the first quarter of 2022 by 22.4 million customers (+ 5.7% compared to the level reached at the end of 2021). The operating result (EBIT) was up in the first quarter by 11.9% and equal to € 78 million, also benefiting from the new network supply contract for mobile telephony services, now up and running, and at the same time including charges of € 2 million relating to the start-up of the new energy business.

OUTLOOK 2022

Finally, Poste notes that “the year 2022 began in a general economic scenario strongly conditioned by some factors that are affecting future growth prospects and consequently on market sentiment. The geopolitical tensions due to the conflict in the Russian-Ukrainian territory, inflation, the increase in interest rates and the latest lockdowns imposed by the Chinese government due to the resurgence of infections from Covid-19 represent the main challenges to general economic growth that they are inducing the main world banks and institutions to revise their growth estimates for the current year downwards and which increase the general context of uncertainty and turbulence in the markets ”.

Therefore, “future forecasts are strictly correlated to the evolution of the reference scenario and in particular to the duration and extent of the Russian-Ukrainian conflict and the related repercussions on the prices of raw materials, on the limited availability of production factors and energy flows. The Italian government intervened to mitigate the effects of the increases in raw materials by introducing, respectively, specific obligations on the subject of purchase procedures subject to the Procurement Code or by acting directly on the components of energy and gas prices ".

The Poste Italiane Group has historically demonstrated resilience in times of financial turbulence, indeed establishing itself as a "safe haven" for savers, thanks to a financial offering portfolio characterized by products with low volatility that will continue to maintain Savings in the future as well. Postal at the heart of the development strategy. The Group's cost structure also includes limited exposure to sectors characterized by high price pressure. The Group procures and competes mainly in the domestic market, has no production units located in or neighboring countries affected by the conflict, and has limited commercial relations with these countries; therefore, it has no direct repercussions that could have significant impacts on the various businesses or significant repercussions on its profitability. The Group also benefits from actions taken at favorable market times, aimed at mitigating fluctuations in the price of production factors, such as hedging operations against the risk of fluctuations in fuel prices or the stipulation of supplies with "frozen" prices for throughout the current year and part of 2023.

To confirm this, the results achieved in the first quarter are solid, with revenues up compared to 2021 and the operating result benefiting from the management's continuous focus on cost rationalization and control. In line with the strategy outlined in the "24SI Plus" Business Plan, which provides for the differentiation of the offer into market segments with high growth prospects, in May 2022 the Group completed the acquisition of Plurima, a leading company in health logistics . The acquisition of the LIS company will also accelerate the implementation of the Group's omnichannel strategy, favoring the transition to digital payments and consolidating growth in the proximity payment business. The development of the insurance savings and postal savings segments will remain strategic, on which the commitment to digitize the offer and customers will continue, as well as the development of initiatives aimed at improving the customer experience on the physical channel. Investments are planned to support the growth of parcels, digital payments and protection, with offers aimed at reducing the country's underinsurance. In the transition path undertaken towards carbon neutrality by 2030, investments and strategic initiatives will continue, such as the renewal of the delivery fleet with low-emission vehicles, the installation of photovoltaic panels for energy supply and the efficiency of properties. Finally, the entry into the energy sector was confirmed during the year, with a 100% green offer based solely on renewable sources

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-vanno-i-conti-2022-di-poste-settore-per-settore/ on Thu, 12 May 2022 12:25:42 +0000.