Leonardo, how Helicopters, Electronics, Aeronautics and Space are doing

What emerges from Leonardo's six-monthly report on the performance of the main business sectors (Helicopters, Electronics, Aeronautics and Space)

Helicopters and defense electronics drive Leonardo's commercial trend.

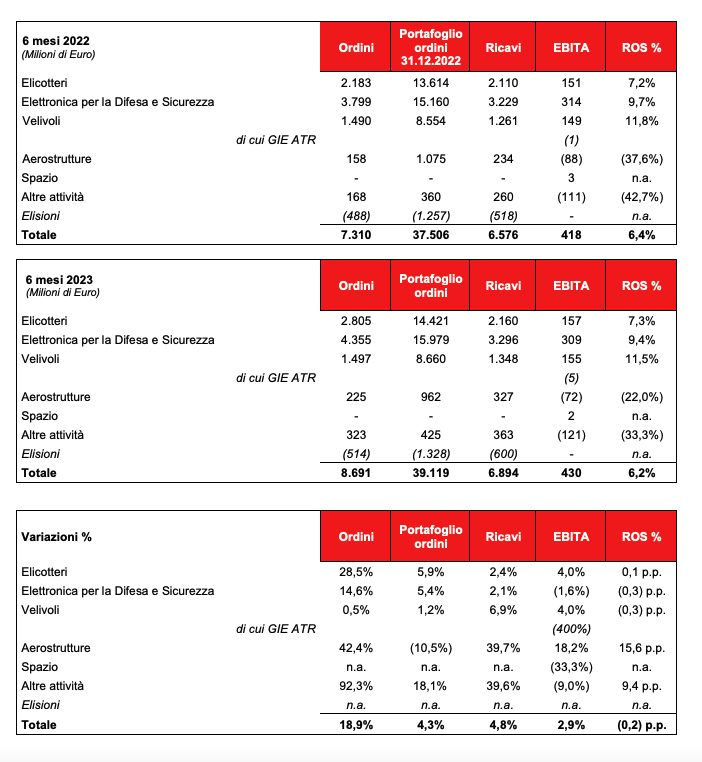

The Italian defense and aerospace group closed the first half of 2023 with revenues up by 4.8% (6.4% compared to the adjusted figure) to 6.9 billion, in particular in the aeronautics business, thanks also to the significant recovery of Aerostructures (+40% compared to the first half of 2022). Ebita rose by 2.9% to 430 million euro, while net profit fell to 208 million euro (-22.1%).

In consideration of the results obtained as at 30 June 2023 and the expectations for the subsequent ones, the company headed by Roberto Cingolani confirms the guidance for the full year formulated when preparing the financial statements as at 31 December 2022.

“We are in the preparation phase of the new Industrial Plan which will see the light at the beginning of next year. The pillars are the consolidation of the Core Business with a particular focus on defense products and the expansion to new initiatives, with the strengthening of the fastest growing sectors, such as Space and Cybersecurity” declared the CEO Cingolani.

In the call with analysts, in addition to strengthening the defense core business, Leonardo's number one explained that the group will also switch to "cutting-edge and disruptive technologies" and will compete with the big data industries, expanding its use of artificial intelligence (AI), Reuters reports. In addition, the CEO spoke of making the company more efficient by optimizing its product portfolio, expanding its international presence and better focusing its research and development (R&D) activities. “We have to do a few things very well, rather than many things mediocre,” Cingolani specified.

Below are the details on the performance of the individual segments as shown in Leonardo's press release and half-yearly report.

HOW IS LEONARDO'S HELICOPTER INDUSTRY

In the first half of 2023, the Helicopters sector continues to show an excellent commercial performance, showing an increase of around 29% in Orders compared to the same period of 2022, due to more acquisitions in both the government and commercial fields, indicates the note from the company in Piazza Monte Grappa. Revenues are growing slightly, with profitability substantially in line. During the period, deliveries of n. 82 new helicopters compared to the n. 50 registered in the first half of 2022.

The main acquisitions of the period include: the contract, deriving from the Italy-Austria Government-to-Government (G2G) Agreement signed last December 2022, for the supply of a further no. 18 AW169M LUH (Light Utility Helicopter) helicopters for the Austrian Ministry of Defence; the contracts relating to 3 AW159 helicopters, n. 10 AW109 Trekker and AW101 helicopters including Mid-Life Update (MLU) for export customers; the contract with Boeing for the supply of 13 helicopters relating to the start of the production phase of the MH-139 program for the US Air Force; the order for no. 6 AW139 helicopters to be used in offshore transport missions by the operator Abu Dhabi Aviation (ADA) and other various orders for helicopters in the Commercial sector.

As far as revenues are concerned, they show a slight increase due to increases in dual use helicopter lines as well as CS&T, mitigated by the lower contribution from the NH90 Qatar programme. Ebita is increasing correlated to higher revenues.

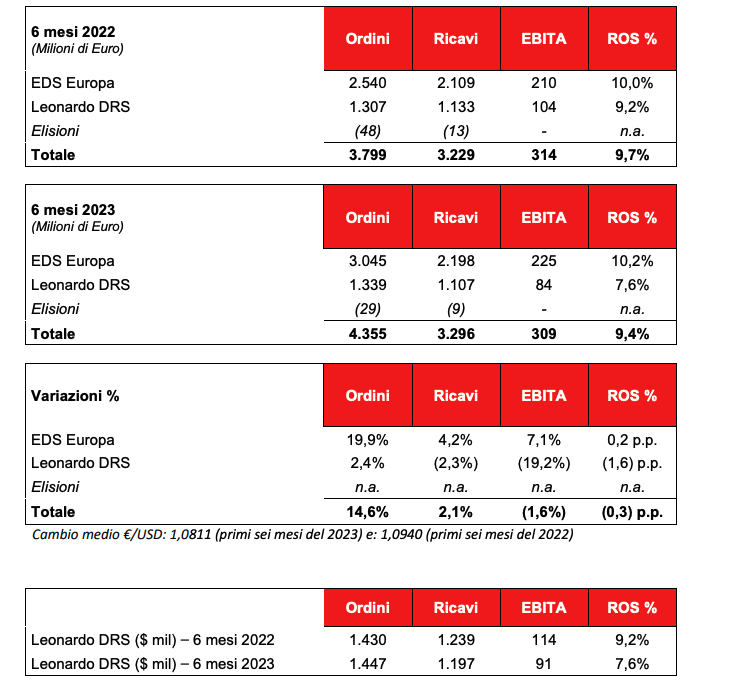

ELECTRONICS FOR DEFENSE AND SECURITY

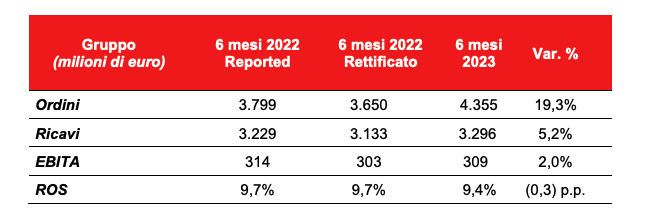

The results for the first half confirm the growth trend and are characterized by a remarkable commercial performance in all business areas (+14.6% on the Reported figure, +19.3% on the Adjusted figure), with volumes and profitability in increase mainly in the European component, explains the note from the group. Leonardo DRS recorded a decline in profitability in the period compared to the first half of 2022, which had benefited from a particularly favorable mix of activities:

As noted previously, H1 2022 data includes the contribution from the GES business and does not include Hensoldt's second quarter results. The sector indicators, adjusted for the comparative period, are therefore shown below:

Orders are growing in all business areas, despite the mentioned different reference perimeter.

With regard to revenues, volumes grew (+2.1% on the Reported figure, +5.2% on the Adjusted figure), especially in the European component. Leonardo DRS volumes are down slightly, mainly due to the different reference perimeter following the aforementioned exit of the GES business which took place in August 2022. Excluding this effect, the subsidiary's volumes are up compared to the same period of the previous year ( +6.8% on the figure Adjusted in Euro), specifies Leonardo's note.

Moving on to Ebita, increasing in the main business areas of the EDS Europe component. In DRS, there was a decline in profitability compared to the same period of 2022, which had benefited in particular from a favorable business mix and the lower absorption of fixed costs in the period.

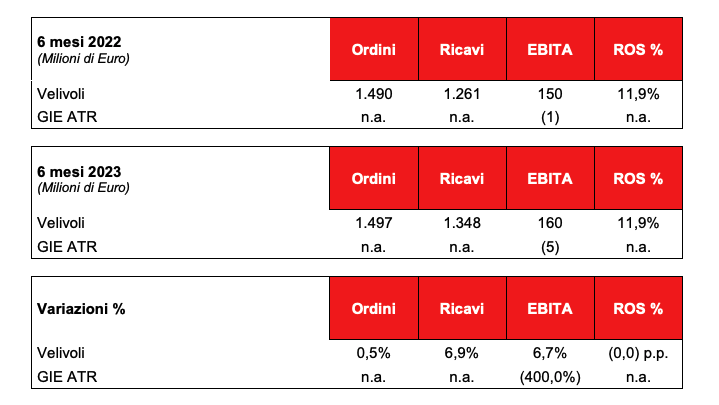

AIRCRAFT WITH GROWING VOLUMES THANKS TO MILITARY BUSINESS

The Aircraft Sector recorded a growth in volumes, confirming the high profitability of the military business and a recovery in deliveries by the GIE-ATR consortium.

From a production point of view: for the military programs of the Aircraft Division, 21 wings and 5 final assemblies were delivered to Lockheed Martin for the F-35 program (22 wings and 6 final assemblies delivered in the first half of 2022). Furthermore, the group's note highlights three deliveries of Typhoon aircraft to Kuwait, higher than the 2 recorded in the same period of 2022. For the EIG programme, there are 12 deliveries compared to 6 in the previous period, testifying to the recovery in volume growth.

Orders are in line with the same period of 2022, with the acquisition of an important export order for no. 2 C-27J aircraft, increased orders for the logistics component of the Eurofighter programme, for two ATR export aircraft in a special version and the anticipation of some orders for the JSF programme.

Revenues are growing thanks to the start of activities on the Euromale program (acquired in 2022) and higher production volumes on the JSF programme. With regard to Ebita, the group's note signals growth with the contribution of the Aircraft Division. In particular: for the Aircraft Division, the benefit of higher volumes was recorded, confirming the high level of profitability, mainly supported by the international Typhoon programmes; the GIE-ATR consortium, despite the doubled deliveries compared to 2022, recorded a decrease due to the different mix of deliveries made and above all to the one-off phenomena recorded in 2022 for the finalization of important contractual redeterminations.

THE AEROSTRUCTURES IMPROVE

As regards the Aerostructures sector, this confirms the expected improvement trend, in line with the recovery expectations of the OEMs and the effectiveness of the industrial actions implemented. The saturation of industrial sites is gradually improving thanks to the progressive increase in production volumes.

From an industrial point of view, 18 fuselage sections and 16 stabilizers were delivered for the Boeing 787 program (compared to 4 fuselages and 5 stabilizers delivered in 2022) and 13 fuselages for the ATR program (7 in 2022).

Furthermore, the sector recorded an increase in the commercial trend compared to last year, benefiting from the restart of the OEM demand; in particular of ATR and Boeing for the B-787 program. Orders from Airbus decreased slightly due to the customer's difficulties in ramping up the production of new aircraft. From the point of view of revenues, there is an increase of 40% compared to the first half of 2022, benefiting from the greater activities towards the GIE ATR consortium and the resumption of deliveries of the B-787 programme. Turning to Ebita, the recovery in production volumes of the various programs leads to an improvement in the saturation of industrial assets and the workforce with a consequent recovery in profitability.

SPACE

Finally, for the space sector, the first half of 2023 records a result substantially in line with the same period of the previous year, reports the group's note.

The satellite services segment, confirming the positive trend, recorded a growing operating result which offsets the impact of the charges associated with the signing of the early retirement agreement pursuant to art. 4 of the so-called Fornero Law. The manufacturing segment records significant development costs on the telecommunications component. Nonetheless, the economic result is in line with the first half of 2022 which saw the recognition of non-recurring costs linked to the write-down of the exposure to the countries involved in the Russia-Ukraine conflict, concludes Leonardo's note.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/leonardo-come-vanno-elicotteri-elettronica-aeronautica-e-spazio-3/ on Sun, 20 Aug 2023 13:05:20 +0000.