Leonardo, Rwm, Iveco Defense and Avio. Who exports the most weapons?

What emerges from the government's annual report to Parliament "on the operations authorized and carried out to control the export, import and transit of military materials"

Italian military exports continue to grow.

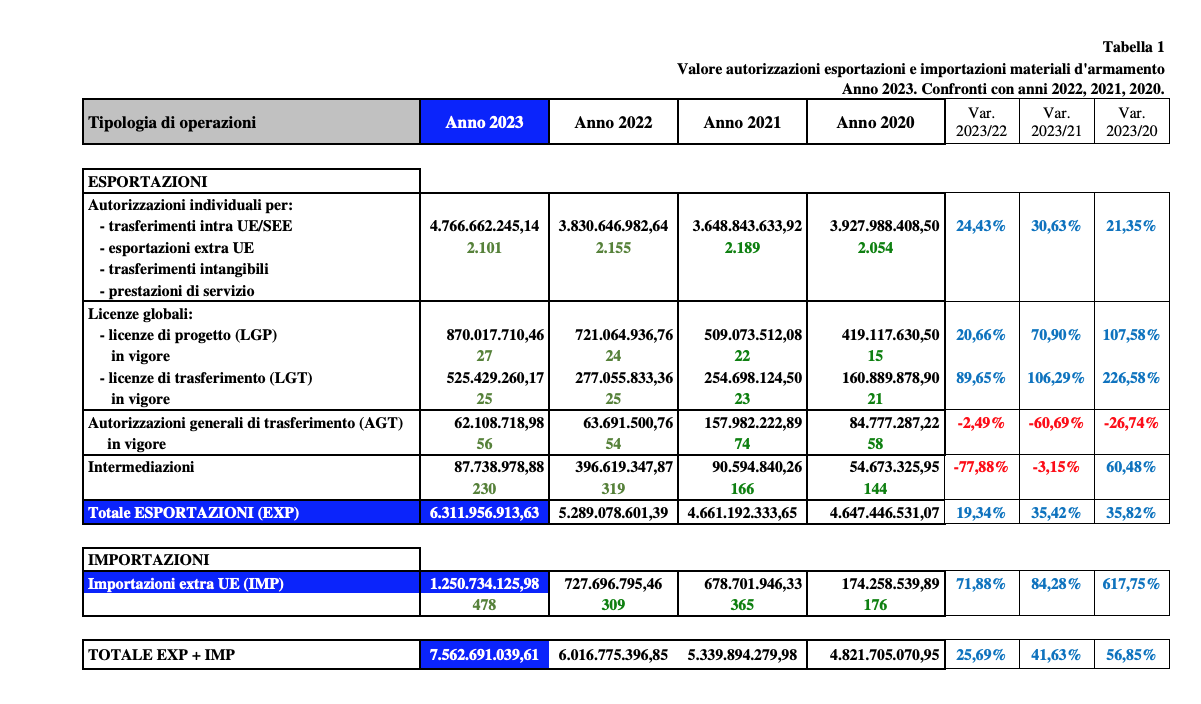

In 2023, authorizations for arms sales abroad in 2023 amount to 6 billion 312 million euros, one billion and 23 million more than in 2022 (+19.3%).

This is what emerges from the government's annual report to Parliament "on the operations authorized and carried out for the control of the export, import and transit of military materials", presented by the undersecretary to the Prime Minister, Alfredo Mantovano.

The document is required by law 9 July 1990, n. 185 which regulates the legislation on the export of armaments of the national defense industry. At the moment the Chamber is examining the government-initiated bill which dictates new rules for export control, already approved by the Senate . Among the various changes, the text contains the repeal of the obligation that the report to Parliament contains "a chapter on the activity of credit institutions operating in Italian territory concerning the operations governed by this law", based on the data transmitted by the Mef .

All the details.

ITALIAN MILITARY EXPORTS GROW

In 2023, the overall value of authorizations for the movement of military materials was 7.5 billion euros, of which 6.3 outgoing from Italy and 1.2 billion incoming.

Over the two-year period, there was an increase of 24.43% in the value of individual export authorizations, the total amount of which in 2023 was 4.766 billion euros compared to

to 3.83 billion in 2022, against a slight decrease in the number of measures issued. Global licenses confirm the growth trend of these types of authorizations, which represent a simplification tool, we read in the government report. In 2023, their cumulative value was around 1.5 billion euros.

On an overall level, there was an increase in the value of outgoing authorizations, which went from 5.2 billion the previous year to 6.3 billion.

THE RECIPIENT COUNTRIES

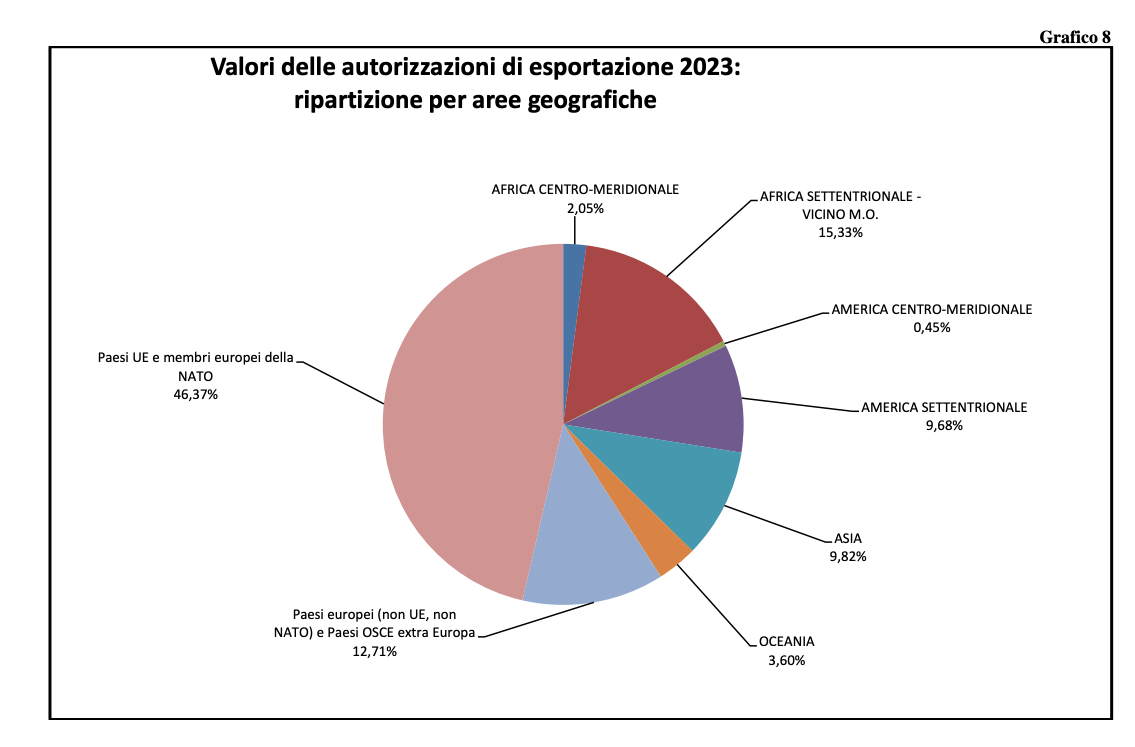

The number of countries receiving export authorizations was 83. The number of authorizations was 2,101, in line with the last three years.

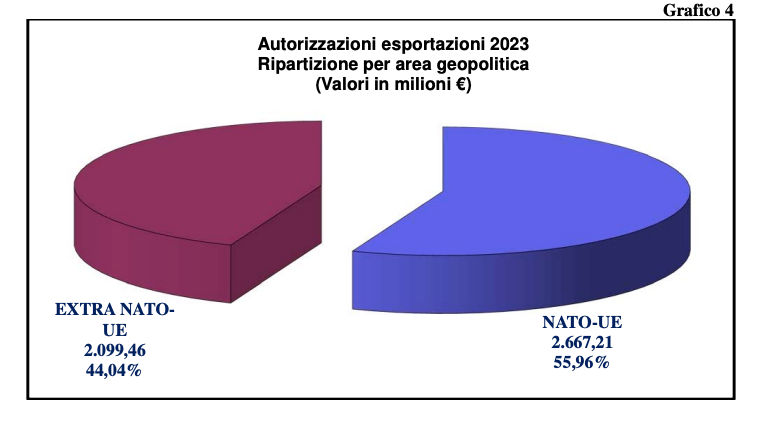

Specifically, the value of intra-community transfers and exports to NATO countries amounts to 55.96% of the total (1516 authorizations), the remaining 44.04% to non-NATO countries

EU/NATO (585 authorizations). The trend towards EU and NATO countries confirms, also for 2023, the growth recorded in previous years, in particular with regard to the value of

exports, the report specifies.

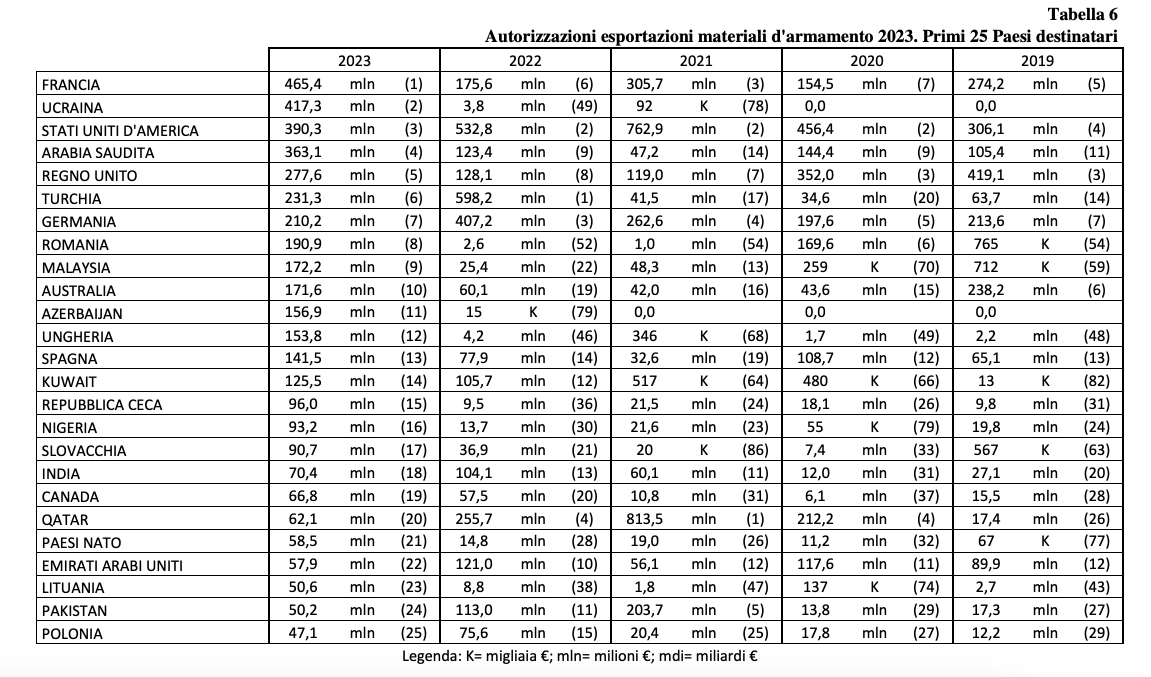

As regards individual countries, France rises from sixth to first position with 465.4 million, while Ukraine stands in second place (it was 49th in 2022) with 417.3 million, compared to 3.8 million in 2022 (even zero in the years prior to 2020).

The United States, in third place, remains among the main recipient countries albeit with a slight decline compared to 2022 (from 532.8 to 390.3 million), followed by Saudi Arabia (increasing from 123.4 to 363, 1 million) and fifth is the United Kingdom (277.6 million). In Europe, Romania (from 52nd to 8th place) and Hungary (from 46th to 12th place) rose.

THE UKRAINIAN DATA

As far as Kiev is concerned, the data relating to Ukraine highlights how "the ongoing conflict, after the first phase in which military assistance to Kiev is managed almost entirely at state level, through supplies organised, in the Italian case, by the Ministry of Defense (which do not require a Uama license and therefore do not appear in our data), in 2023 involved the production capabilities of the entire country system more widely, with an ever-increasing contribution from the private sector", highlights the government report.

FOCUS ISRAEL

As regards another country involved in a conflict, namely Israel, in 2023, the value of authorized exports to Tel Aviv (9.9 million) remained stable compared to the previous year, while that of imports achieved significant growth, reaching 31.5 million (seventh place among the countries of origin). “As is known, the characteristics of the Israeli action on Gaza in reaction to the criminal assault conducted by Hamas, after 7 October 2023, have led us to evaluate the granting of new authorizations towards Israel with particular caution” explains the report, recalling that the granting of new authorizations for the export of armaments”. Imports are another issue. “Italy's purchases of weapons from Tel Aviv have tripled: imports have gone from 9.81 to 31.54 million” highlights Il Sole 24 Ore .

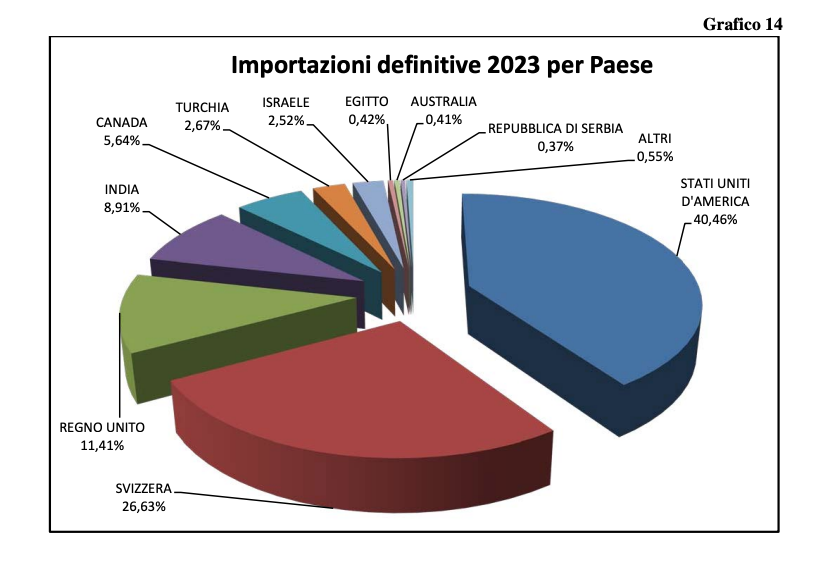

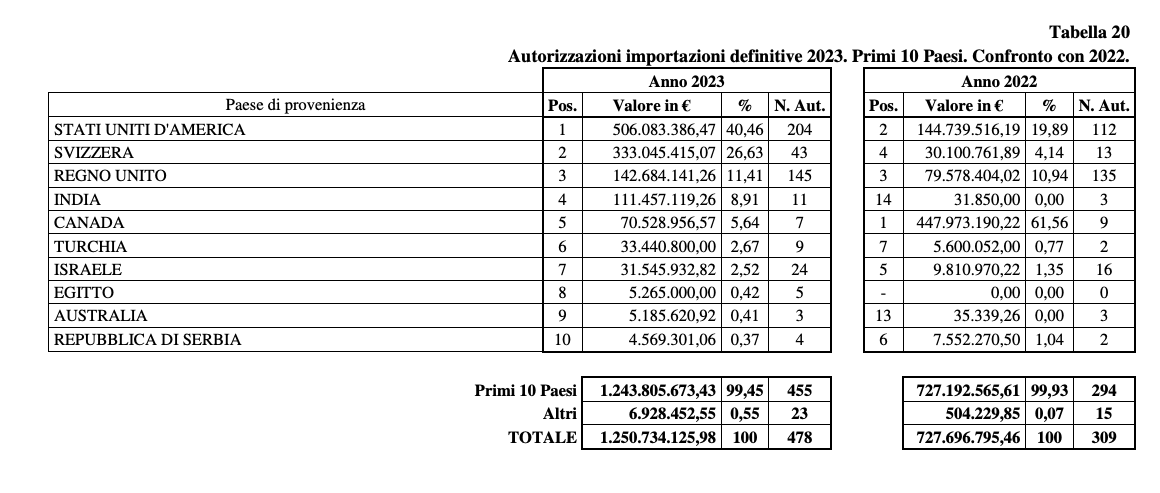

THE IMPORT DATA

In 2023 the value of the 478 individual import authorizations amounted to 1.25 billion euros, thus recording a growth of 71.88% compared to 2022 (in which 309 authorizations were granted, for a value of 727 million euros), of 84.28% compared to 2021 (in which 365 authorizations were granted, for a value of 678 million euros) and 617.75% compared to 2020 (in which 176 authorizations were granted, for a value of 174 million) .

Again with regard to definitive imports for 2023, it emerges that 40.46% (approximately 506 million euros) comes from the United States of America, while 26.63 (approximately 333 million) from Switzerland, 11.41 % from the United Kingdom (approximately 143 million), 8.91% (~111 million) from India and 5.64% from Canada (approximately 71 million).

LEONARDO, RWM, IVECO AND AVIO THE MAIN EXPORTING COMPANIES

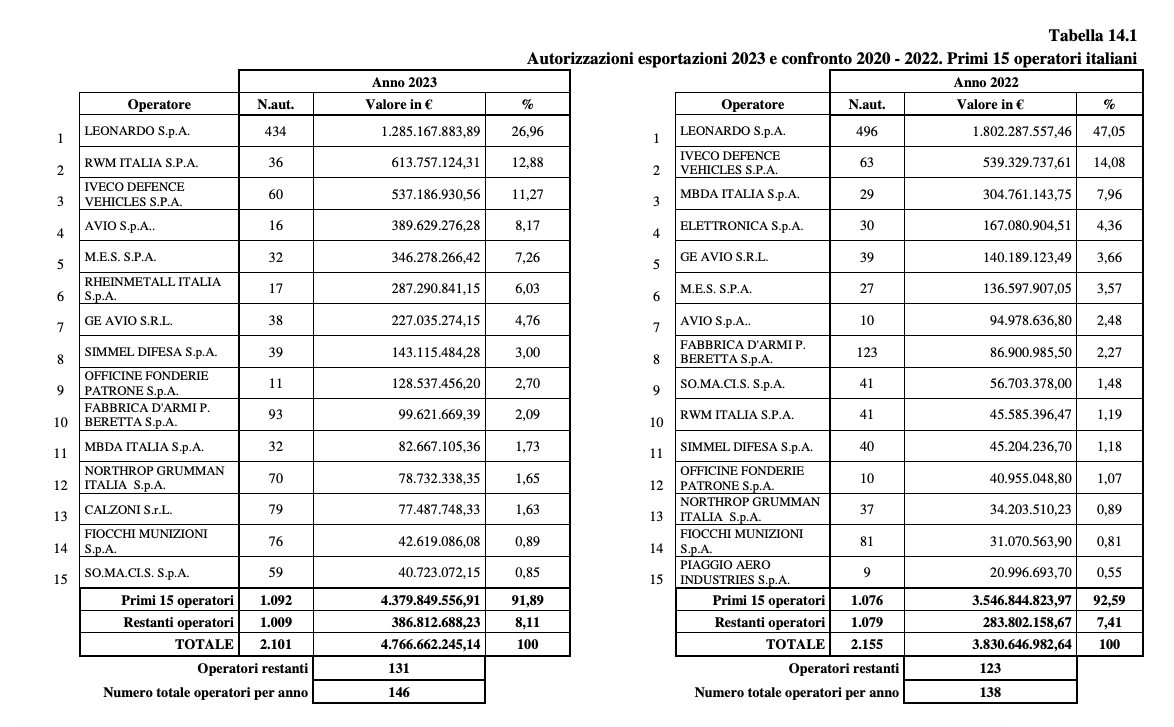

Moving on instead to the main arms exporting companies (they have a financial weight of 91.89% on the total value of authorizations), Leonardo dominates the ranking (26.96%), followed by Rwm Italia (12.88%), third Iveco Defense Vehicles (11.27%), fourth Avio Spa (8.17%). All four represent approximately 59% of the overall value.

In particular, the defense and aerospace giant led by Roberto Cingolani is the recipient of approximately 21% of the total authorizations (434 out of 2,101), confirming itself as a leading company with 1.2 billion (1.8 billion in 2022, 1.58 billion in 2021, 1.24 billion in 2020). Rwm Italia rose to second place with 614 million (45 million in 2022, it was ninth in 2021) while Iveco Defense Vehicles placed itself in third place with 537 million (539 million in 2022, it was second with 856 million in 2021, third in 2020 with 340 million). This is followed by Mes Spa (Mechanics for electronics and servomechanisms) with 32 authorizations for 346.3 million euros, Rheinmetall Italia with 17 authorizations for 287.3 million and Ge Avio with 38 authorizations for a total value of 227 million.

INFORMATION ON THE “ARMED BANKS”

Finally, in the year 2023, 69% of transactions for income attributable to definitive exports were negotiated by three credit institutions (Unicredit, Deutsche Bank, Intesa Sanpaolo). In 2022 dictates

percentage was 76%. As regards the overall amount of guarantees and financing granted or renewed in 2023, 86% is negotiated by three credit institutions (Unicredit, BNP Paribas Succursale Italia, Intesa Sanpaolo). As mentioned at the beginning and as Avvenire reminds us, this latter information would no longer be available if the reform on the export of armaments (dll amending law 185 of 1990) came into force.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/leonardo-rwm-iveco-defence-e-avio-tutti-i-dettagli-sulla-relazione-al-parlamento-export-militare/ on Tue, 16 Apr 2024 13:32:23 +0000.