Like Google, Meta and Amazon dominate the online advertising market in Italy

What emerges from the annual report of the Communications Regulatory Authority (Agcom) on the advertising sector, in particular online advertising

Digital platforms dominate the online advertising market.

The analysis of the overall advertising revenues of all means of communication (radio, TV, publishing and online) confirms a trend that has already been underway for several years: ever-increasing investments in online advertising, according to the authority's report. This assumes particular relevance if one considers that revenues from advertising, in 2022, come to represent 59% of the total economic value realized through the means of communication (traditional and online), including the resources obtained from the user's side for the 'purchase of content and revenue of a public nature (fee, conventions and public funds).

All the details.

THE DISTRIBUTION OF REVENUES IN THE ADVERTISING SECTOR

First of all, by limiting the analysis to advertising revenues, the growth trend dynamics of the sector are confirmed, even in 2022, albeit slowed down due to the health crisis of 2020, underlines Agcom.

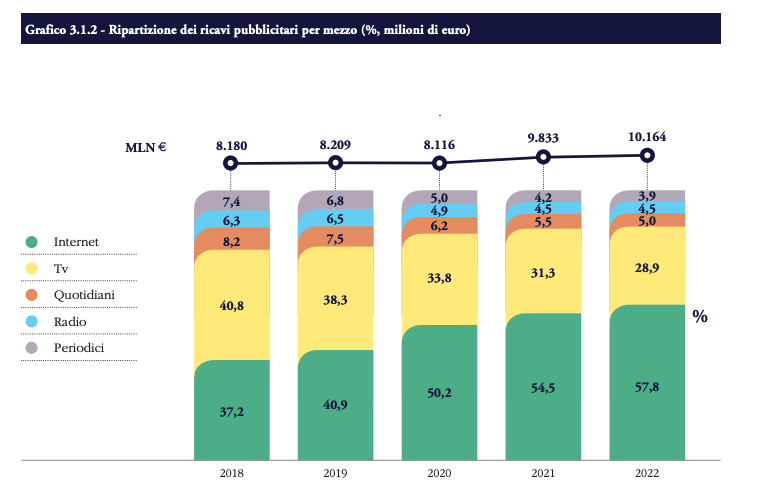

The positive trend of the gross domestic product deriving from the recovery of economic and productive activities in the last year, although fluctuating over the various quarters, has increased the propensity on the part of companies to invest in advertising, thus allowing the sector to recover the losses suffered and to settle on values decidedly higher than in 2018 (Chart 3.1.2).

GROWTH OF ONLINE ADVERTISING

The trend of the sector should be analyzed considering the different contribution of its components. If, on the one hand, there is sustained growth in online advertising, which does not seem to have been affected by the economic problems deriving from the health emergency and the conflict in Ukraine, on the other hand, advertising through traditional media shows a less linear evolution as it is more correlated to the phases of the economic cycle. Specifically, the progressive rise of online advertising (and in particular of intermediation platforms active on an international level) has led, for several years already, to a gradual reduction in the weight of traditional media on the overall value of advertising revenues.

In 2022, the gap between online advertising and other industries' collection has widened further.

PROGRESSIVE CONCENTRATION OF ADVERTISING RESOURCES MANAGED BY THE PLATFORMS

Specifically, the Authority notes that revenues from advertisements on the Internet, which already exceed 40% of total revenues starting from 2019, undermining the historic primacy of television, have recorded further growth in the last year and reach 58 % of total ad revenue.

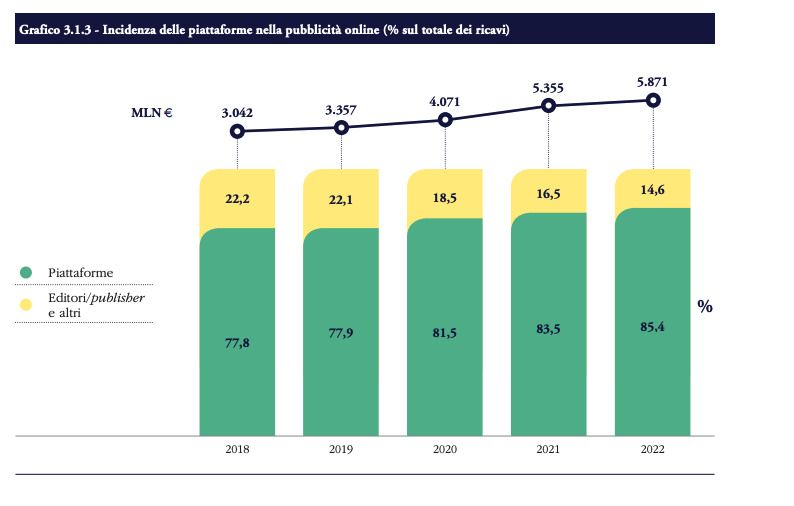

Therefore, the analysis of the composition of online advertising (Chart 3.1.3) shows a progressive concentration of the advertising resources managed by the platforms. More precisely, the impact of the platforms on overall gross revenues – i.e. on advertising revenues managed and brokered for the purpose of buying and selling spaces, both on their own sites and applications and on those of third parties gross of the portion retroceded – grows progressively until it reaches , in the estimates for 2022, a value above 85%. This evolution, which contrasts with the gradual erosion of advertising volumes intermediated by traditional publishers and concessionaires, confirms the difficulty of these players in maintaining adequate levels of competitiveness with respect to international platforms.

WHY INTERNATIONAL PLATFORMS DOMINATE

The reasons for the dominance of international platforms are determined, according to the Agcom report, both by the economic characteristics of the sector (presence of direct, indirect and cross network externalities, increasing returns to scale, obstacles to multi-homing, switching costs and sunk cost), and by the vertical integration and horizontal differentiation strategies adopted over the years. This has made it possible to obtain prominent positions both upstream and downstream of the value chain, and economic advantages that are difficult to replicate by its competitors.

HOW ADV SALES WORK

In detail, by virtue of these strategies, the platforms are currently able to offer numerous services in the various stages of the production chain and, therefore, to attract increasingly large audience shares through their sites and applications. Added to this is the extraordinary ability of the large international players to efficiently arrange, collect, store and aggregate a large amount of individual data on users, as well as to use sophisticated big data analysis techniques to obtain accurate user profiling, which makes the advertising brokerage services offered by these parties particularly attractive to investors.

Over the past ten years, the online advertising space negotiation system has become increasingly characterized by the presence of automatic models for buying and selling advertisements in which direct contact between advertiser and publisher has gradually been replaced by the use of technological platforms. These sales models have increased the dependence of the advertising system (and its players) on technological intermediaries (ad networks, affiliate networks, search engines, social networks). The platforms, in addition to achieving the majority share of revenues at all stages of the online advertising value chain, make minimal use of the intermediation services of third-party operators. On the other hand, traditional publishers and concessionaires are present with lower shares in the supply chain and use the intermediation services of the platforms consistently.

GOOGLE, META AND AMAZON ON THE REVENUES PODIUM IN THE NATIONAL ONLINE ADVERTISING SECTOR

Finally, it follows that, similarly to what has been observed on a global level, high levels of concentration are consolidating in the national sector of online advertising.

The distribution of revenues by operator confirms the presence of a limited number of international players, with significant and growing revenue shares, compared to a high number of other economic players (long tail theory), which achieve decidedly lower revenues and tend to increasingly distant from those obtained by the first operators. In fact, considering the gross revenues from online advertising, the relevance of the subjects placed in the first three positions is confirmed, which represent over 70% of the total estimated value of the market, explains the Authority chaired by Lasorella.

Alphabet/ Google and Meta/Facebook maintain the primacy of online advertising resources, with revenues growing both with reference to gross advertising revenues (deriving, as mentioned, from revenues from advertisements on their sites and applications, as well as from advertising carried out for third-party operators gross of the portion retroceded to the latter), and considering the net revenues (obtained from the sale of own spaces or those of third-party operators, net of the portion retroceded to the owners of the sites or applications). In third place, the presence of Amazon is confirmed with advertising revenues rising sharply also in 2022, Agcom concludes.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/come-google-meta-e-amazon-dominano-il-mercato-pubblicitario-online-in-italia/ on Wed, 23 Aug 2023 08:54:39 +0000.