Like Tencent, Microsoft and Alphabet continue to evade taxes. Mediobanca report

The web giants have "saved" 50.7 billion in unpaid taxes in 4 years. This is what emerges from the annual survey of the Mediobanca research area on the websoft giants

In the last four years the web giants have evaded over 50 billion in taxes.

This is what emerges from the annual survey of the Mediobanca Research Area on the 25 largest international WebSoft (Software & Web Companies) by revenues in the three-year period 2019-2022 and in the first nine months of 2023.

Specifically, in Italy the branches of the WebSoft giants paid our Italian tax authorities 162 million euros in 2022, for an effective tax rate of 28.3%, an increase compared to the 150 million euros paid in 2021 . Also considering the provision for the payment of the Digital Service Tax, the tax rate would rise to 36.0%.

All the details.

THE “SAVED” TAXES OF THE WEB GIANTS ACCORDING TO MEDIOBANCA

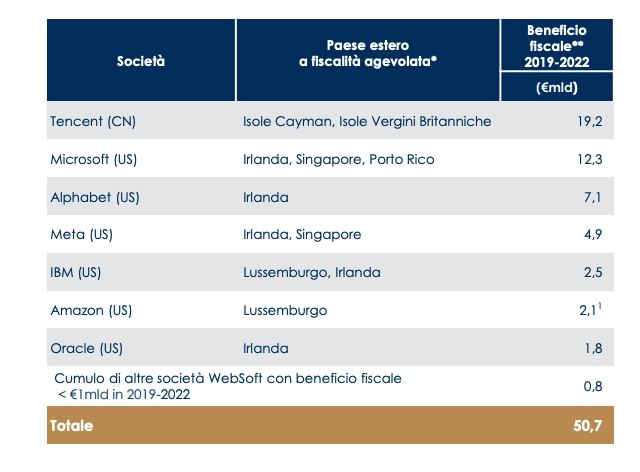

In 2022, approximately one third of the pre-tax profit of the world's largest WebSofts is taxed in low-tax countries, resulting in tax savings of 13.6 billion in 2022 and 50.7 billion cumulative in the four years 2019-2022. The average rate is equal to 15.1% in 2022, lower than the theoretical rate of 21.9%.

In the period 2019-2022, taxation in countries with preferential taxation resulted in tax savings of 19.2 billion euros, 12.3 billion euros and 7.1 billion euros respectively for the Chinese tech giant Tencent and the two big US companies Microsoft and Alphabet. billion euros. These top three companies account for more than 70% of the total tax benefit.

Furthermore, Mediobanca notes that Chinese groups, mainly active on the domestic market, have approximately 4.6 billion euros in 2022 in tax savings recognized by the People's Republic of China (PRC preferential tax rates and tax effect of the Super Deduction policy). Alibaba is in first place with 1.8 billion euros, followed by Tencent and PDD each with 600 million euros.

TOWARDS THE GLOBAL MINIMUM TAX

Therefore, as Mediobanca reminds us, to address the problem of "Base Erosion and Profit Shifting", the Organization for Economic Co-operation and Development (OECD) and the G20 launched the BEPS project on 12 February 2013.

The project reached a major milestone with the adoption by the OECD and G20 of a comprehensive package of explanatory statements in 2015 and the Inclusive Framework on BEPS, established in 2016 (BEPS 1.0).

Another "milestone" was recorded in 2019, following the initiative of the G20 leaders, with the public consultation on the new OECD project based on a two-pillar approach (BEPS 2.0). Subsequently, in October 2021 the Finance Ministers and Central Bank Governors of the G20 approved a package of measures (based on the "2 pillars") to define a comprehensive, coherent and coordinated reform of international tax rules, thus expressing unanimous support to the BEPS 2.0 Project.

The OECD/G20 “Inclusive Framework” included 140 members and of these only four countries did not join the declaration (Kenya, Nigeria, Pakistan and Sri Lanka). The EU approved and published in December 2022 Directive 2022/2523 which requires Member States to transpose the rules on minimum tax (second pillar) into national law by 31 December 2023. On 16 October 2023 the Council of Ministers of The Italian Republic has preliminarily implemented the EU directive (2022/2523).

WHAT DOES THE GLOBAL MINIMUM TAX PROVIDE

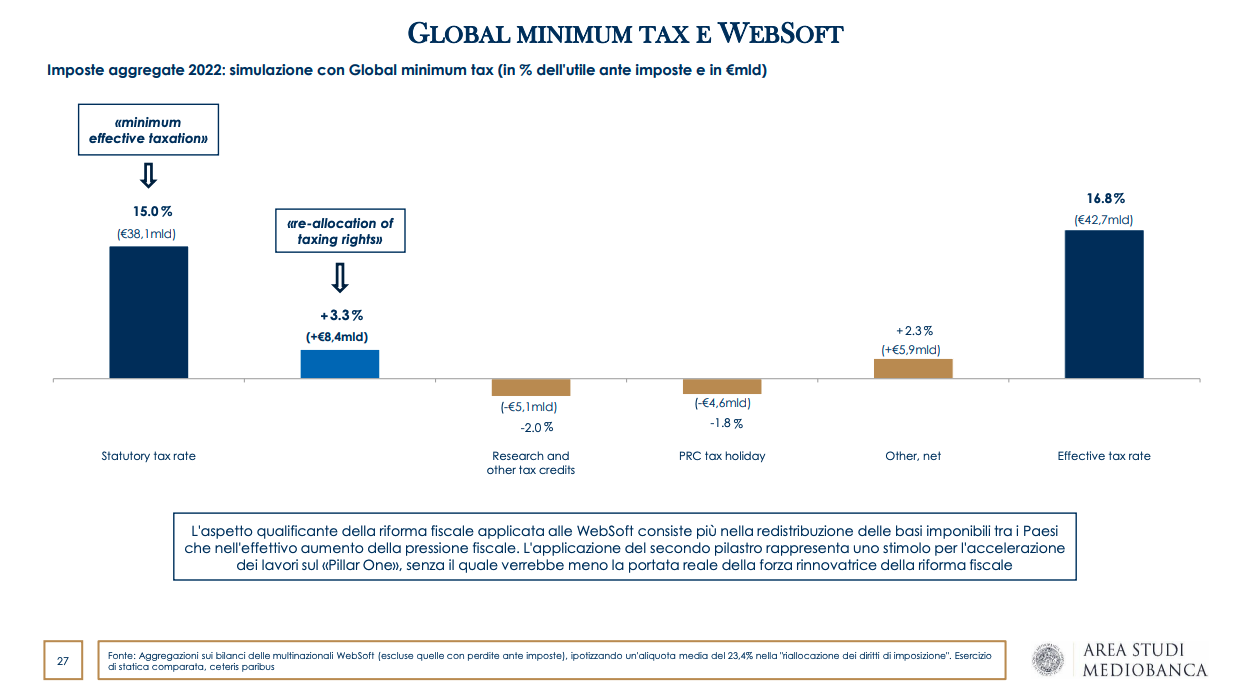

Finally, Mediobanca reconstructs the agreement on the taxation of multinationals (Global Minimum Tax). This is a project to reform the international corporate tax framework (MNE), regardless of the sector to which it belongs or the business model, based on the joint application of the «2 pillars»:

- Pillar One: re-allocation of taxing rights «will ensure a fairer distribution of profits and taxing rights among countries with respect to the largest MNEs». For multinationals with a turnover exceeding 20 billion euros and a pre-tax profit exceeding 10% of revenues, an additional tax is envisaged on a quarter of the pre-tax profit exceeding the aforementioned 10%, which will be redistributed in the countries concerned and taxed according to the reference tax rates

- Pillar Two: minimum effective taxation «seeks to put a floor on competition over corporate income tax». For multinationals with a turnover exceeding 750 million euros, a pre-tax tax of 15% is foreseen.

From 2024 the Global minimum tax should also become operational in Italy which will lead to the application of the 15% rate on the profits made by multinationals with an annual turnover exceeding 750 million.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/come-tencent-microsoft-e-alphabet-continuano-a-svicolare-dal-fisco-report-mediobanca/ on Sun, 17 Dec 2023 06:34:09 +0000.