Man option, what will the Meloni pension reform look like?

What are the plans of the next Meloni government on pensions. Giuliano Cazzola's analysis

Look'. The right wins the elections and elects Lorenzo Fontana to the presidency of the Chamber, known for his clerical and homophobic views, radically opposed to those new '' civil rights '' of which the left has become a staunch champion.

Yet it seems that the future Meloni government intends to apply gender identity (cornerstone of the Zan bill ) to pensions.

In essence, men will also be able to exercise the right to a pension through the “ woman option '' or by claiming 58 years of age and 35 in payments and submitting to the contribution calculation for the entire service activity, even for the periods regulated by the salary system. . The history of this outgoing flexibility is singular.

The woman option was introduced by the Maroni reform, in 2003, for a limited period of time in order to mitigate the impact of the increase in personal data requirements for women. The option remained unused for years, sometimes even ignored, due to the feared economic penalty deriving from the contribution calculation. But when the Fornero reform accelerated the alignment of the old age age of women to that required for men, in the context of a general increase in the retirement age, the Woman Option also became attractive, so much so that its application was extended from year to year. year up in all budget laws.

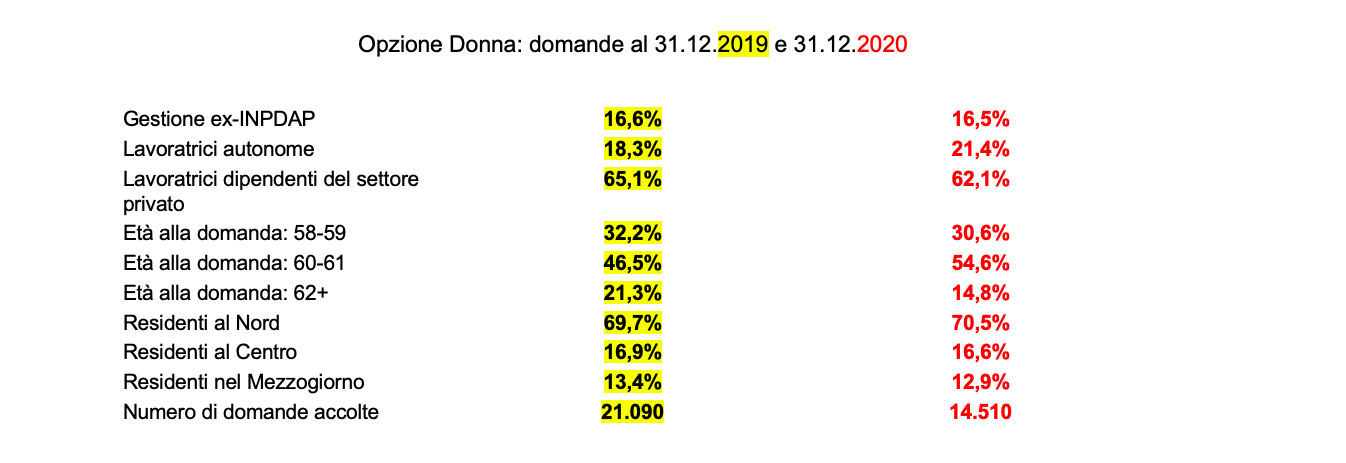

There was, however, a substantial limit to the exercise of this option: the requisites required quite high for the working conditions of women. In 2020, INPS received 19,970 applications for the Female Option, 17.6% less than in 2019. 14,510 applications were accepted, of which 16.5% from public sector workers, 21.4% from self-employed workers and the rest liquidated in private sector managements. Less than a third of the workers who have chosen the Female Option have an age close to the minimum age requirement.

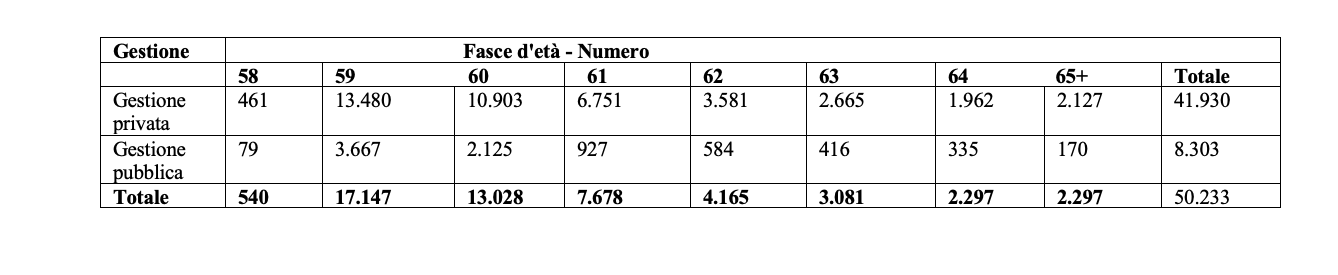

It is the same problem that emerged for quota 100: the two requisites, the personal and the contributory one, do not go hand in hand, so it happens that a 58-year-old woman has not yet reached 35 years of payments or vice versa. As can be seen from the table below, the highest stock concerns individuals between 59 and 60 years of age, but there are also many older ones.

BREAKDOWN OF APPLICATIONS ACCEPTED BETWEEN 1 JANUARY 2019 AND 31 JANUARY 2021 BY AGE AT THE DATE OF THE APPLICATION

Also interesting is the table relating to the applications presented (and those accepted) in the individual sectors, by age blocks and age distribution in the years 2019 and 2020. Note the preponderance of applications presented and accepted among people residing in the North, as has always been the case in all cases of early retirement.

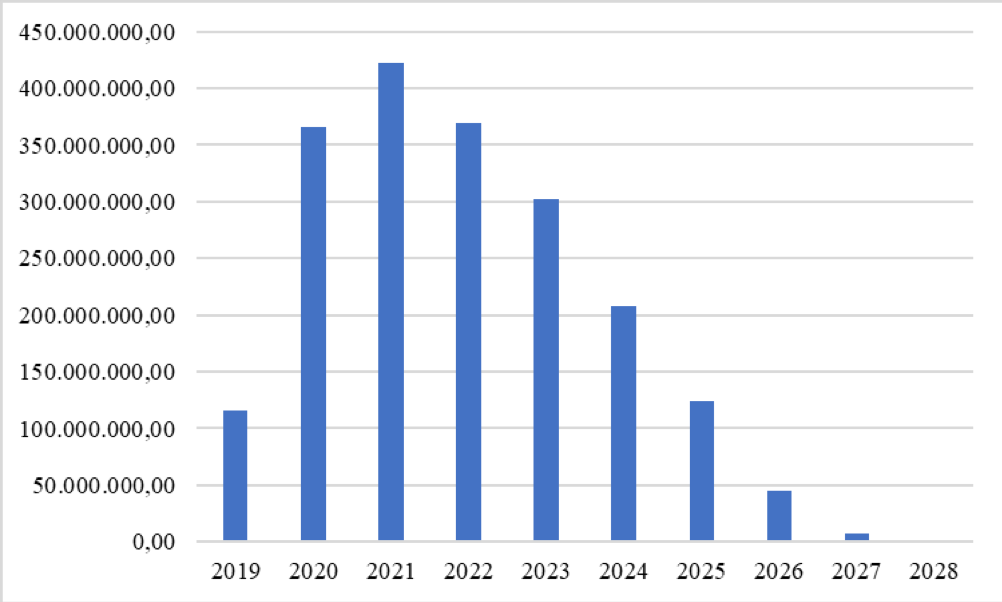

We have already mentioned that the Female Option is a poorly used way out for years, due to the bugbear of the full contribution calculation. In reality, not only (see the graph) tends to reduce the "penalty" that is encountered by exercising the option, but that it is an unjustified alarm it has been seen along the way since the start. In the technical reports (RT) prepared in recent years on the occasion of the extensions of the Woman Option, the average curtailment considered to assess the amount of the treatment has rapidly fallen.

As pointed out by the Court of Auditors in its reports on coordination of public finance, the RT referred to in Law 208/2015 discounted a cut of 27.5 percent for employees and 36 percent for self-employed women; the RT referred to in Legislative Decree 4/2019 discounted 14 percent for private employees, 19 percent for public employees and 23 percent for self-employed women; the RT of the 2020 Budget Law considered 8 percent for employees and 17 percent for self-employed.

Finally, the RT of the 2021 Budget Law estimated a reduction in the average pension amounts due to the contribution calculation on average equal to 7 per cent for employees and 15 per cent for self-employed women. Absolutely sustainable penalties if we consider the number of years in which the worker collects the pension in advance.

The Technical Report (RT) at legislative decree 4/2019, in evaluating the effects deriving from the extension of the possession of the requisites of the Woman Option as at 31 December 2018, had hypothesized an average amount of the contributory pension equal to 1,200 euros per month for private employees , 1,400 per month for public workers and 800 for the self-employed. The RT attached to the budget laws of subsequent years assessed average amounts slightly increasing, but substantially stable.

COST OF WOMEN'S OPTION – APPLICATIONS ACCEPTED FROM 2019 TO 31 JANUARY 2021 (source – Inps)

Having said all this, if the Woman Option has some sense in protecting female workers, who are largely destined to wait for the requirements of the old-age pension (67 years of age and at least 20 contributions) in order to stop working, from given that they encounter considerable difficulties, for many understandable reasons, in accumulating substantial periods of service, necessary for the various cases of advance, the same reasoning does not apply to a possible " man option ", because it would result in a new early exit, in added to all the others under the pretext of the so-called flexibility, for a consistent audience of interested parties, for the position that men (of the baby boom generations) have had in the labor market, where they entered early and remained for a long time, with stable and continuous that allowed to reach the threshold of early treatment in the age of elderly / young people.

Pensions, then, are the only monetary payments to which an automatic equalization system is applied (rightly) to the cost of living which, in the face of the recovery of inflation, will lead to a significant increase in social security expenditure. According to the Parliamentary Budget Office, assuming inflation two points higher than the 5.8% forecast in the Def for 2022, the revaluation of pensions against inflation will cost the State about 32 billion gross over the next three years (5, 7 billion in 2023, 11.2 in 2024, 15.2 in 2025) which will benefit over 16 million pensioners.

In the current situation of public finance it is problematic to find the corresponding resources to fulfill this disbursement already provided for by the law. Should we add new burdens by disguising men as women?

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/opzione-uomo-come-sara-la-riforma-meloni-delle-pensioni/ on Mon, 17 Oct 2022 08:06:50 +0000.