More semiconductors, fewer houses: China’s new economic plan. Report Nyt

Chinese leaders no longer want to stimulate the heavily indebted real estate sector: rather, they are investing in factories and semiconductors to develop the local economy. The New York Times article

China's political leaders, under pressure to support the country's fragile recovery, are slowly steering the economy onto a new course. No longer able to rely on real estate and local debt to drive growth, they are instead investing more in manufacturing and increasing central government borrowing. The NYT writes.

For the first time since 2005, when comparable filings began in China, state-controlled banks have started to make sustained reductions in real estate lending, according to data released last week. Huge sums were instead channeled to manufacturers, particularly in fast-growing sectors such as electric cars and semiconductors.

FROM CONSTRUCTION TO FACTORIES

The approach presents risks. China has a chronic glut of factories, far more than it needs for its domestic market. A greater emphasis on manufacturing will likely lead to more exports, an increase that could antagonize China's trading partners. China's extra lending also poses a challenge to the West, which is trying to promote further investment in some of the same sectors through laws such as the Biden administration's Inflation Reduction Act.

The shift to loans for the manufacturing sector underlines Beijing's reluctance to bail out China's debt-ridden property market. Construction and housing account for about a quarter of the economy and are now suffering from sharp declines in prices, sales and investment.

China's investment push could spur growth in the coming months, partly offsetting problems in the real estate sector. But increasing central government borrowing to replace local borrowing will do little to defuse the long-term drag on growth caused by debt accumulation.

“I don't think there is a problem for short-term development, but we need to worry about medium- and long-term development,” said Ding Shuang, chief China economist at Standard Chartered, at a recent forum of Chinese economists and finance experts in Guangzhou. “It's fair to say that real estate is not at a rock bottom.”

WHERE THE REAL ESTATE CRISIS COMES FROM

China's real estate crisis has its roots in four decades of debt-fueled speculation that has driven prices to levels far higher than those normally justified by rents or household incomes. Chinese policymakers triggered the sector's recent decline by starting to reduce lending several years ago, and are now reluctant to bail out the sector by kickstarting another wave of real estate lending.

The government believed China's economy would restart in 2023, after the country's leaders lifted most of the "zero Covid" restrictions that had shuttered the economy last year. But after an initial burst of activity, growth slowed in the spring and summer. Vulnerabilities remain: Manufacturing activity suffered a new setback last month, after posting growth in August and September.

Last week, at a conference chaired by Xi Jinping, China's top leader, Communist Party and government officials met privately to discuss financial policy. According to an official statement, the conference ordered to allocate more financial resources to advanced manufacturing industries and to provide assistance to local governments.

CHINA WANTS MORE FACTORIES

While the real estate market is struggling, state-funded factory construction is in full swing.

China has already built enough solar panel factories to meet global needs. It has built enough car factories to produce all the cars sold in China, Europe and the United States. By the end of 2024, China will have built as many petrochemical factories in just five years as all those currently operating in Europe, Japan and South Korea.

Economists at the recent meeting in Guangzhou, organized by the International Finance Forum, a Chinese think tank, acknowledged that the country is facing challenges not seen since the years immediately following Mao's death in 1976. But they predicted that large investments in new production technologies will bear fruit.

“Today we have difficulties comparable to those in 1978, so the question is: what will be the future of innovation-led growth?” said Zhang Yansheng, a former senior official at the central government's economic planning agency, now at the China Center for International Economic Exchanges.

The Chinese banking system's shift from real estate lending to manufacturing began several years ago, Bert Hofman, director of the East Asian Institute at the National University of Singapore, said at the Guangzhou event.

Before the pandemic, Chinese banks were increasing lending to the real estate sector by more than $700 billion a year. In the 12 months to September, total outstanding loans to the property sector fell slightly. Banks granted fewer loans to builders and families paid off old mortgages by taking out new ones.

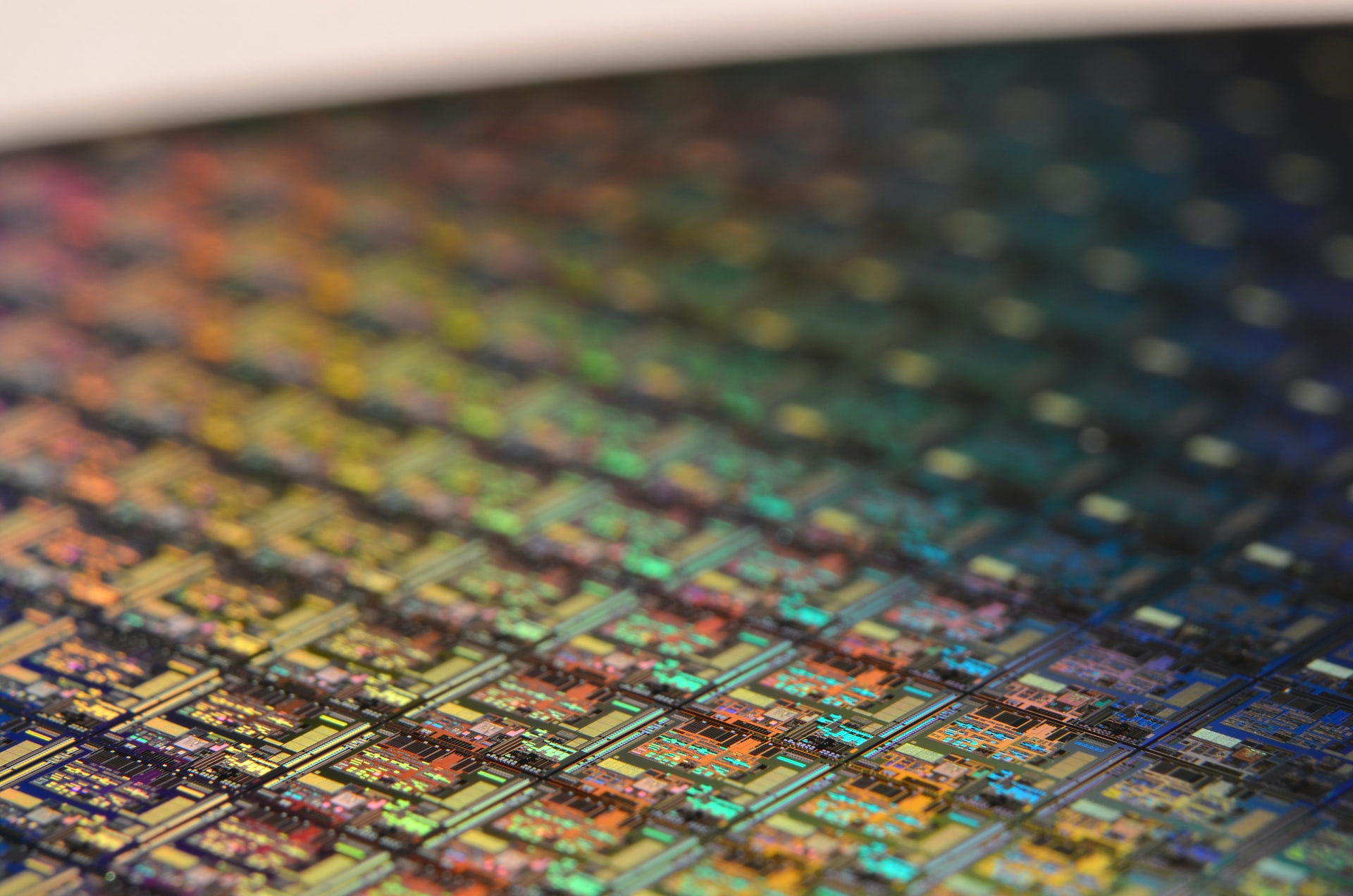

THE DEVELOPMENT OF SEMICONDUCTORS

By comparison, net lending to industrial businesses rose from $63 billion in the first nine months of 2019 to $680 billion in the first nine months of this year. This money has been earmarked in part for building a semiconductor industry that could allow China to free itself from imports and bypass American export controls, as well as categories such as electric car manufacturing and shipbuilding.

Many economists have expressed fear that increasing funding for the manufacturing industry will not be able to solve the problem of the economy in general. The real estate sector is still in decline and is so large that it will not be easy to compensate for its problems with the growth of industries such as the automotive sector, which represents 6-7% of economic production.

Increased factory construction threatens to antagonize other countries: Much of the additional production will likely be exported because many Chinese families have cut back on spending.

But the United States and the European Union have become less willing to accept further increases in their trade deficits with China. The European Union is already investigating the use of government subsidies by China's electric vehicle industry, opening a new trade rift between Brussels and Beijing.

Aware of these risks, China is courting developing countries. These countries still have sizeable, but often aging, manufacturing sectors, which offer an export opportunity from newly built, highly efficient Chinese factories. Many developing countries are struggling to renegotiate huge debts owed to Beijing for infrastructure projects, putting them in a weak position to raise tariffs on Chinese goods.

Chinese factories have gained dominance for decades. According to data from the United Nations Industrial Development Organization, since 2000 the country's share of the global manufacturing sector has grown almost fivefold, reaching 31%. The United States' share fell to 16%, while that of developing countries, excluding China, remained unchanged at 19%.

GROWTH THROUGH PUBLIC LOANS

Of course, one thing isn't changing in China's approach: its reliance on borrowing to fuel growth.

Officials have tried repeatedly for years to tame the debt addiction. Liu He, a vice premier, promised in a 2018 speech that this would happen within three years.

Instead, local government debt has increased since 2020, reaching nearly $8 trillion last year, and local governments' semi-independent lending units have amassed another trillion dollars in loans. China's overall debt has grown to be considerably larger, relative to the country's economic output, than the debt of the United States and many other developed countries.

Yao Yang, director of Peking University's National School of Development, said in September that debt control efforts have been unsuccessful.

“Between 2014 and 2018, which was supposed to be a window to defuse debt, debt skyrocketed; the situation has worsened after 2020,” he said in a speech. “This indicates that previous debt relief measures have been ineffective and, in some cases, counterproductive.”

(Extract from the eprcommunication press review)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/mondo/nuovo-piano-economico-cina-fabbriche-semiconduttori/ on Sun, 12 Nov 2023 06:17:44 +0000.