Mps, all the unknowns of the industrial plan

Will the objectives of the Mps industrial plan be achieved? Here is what it foresees and the possible evolutions. The analysis by Antonio Amendola, manager of the AcomeA PMItalia ESG fund of AcomeA SGR

The new industrial plan of Mps provides for a capital increase of 2.5 billion euros: of these, 0.8 billion cover 4 thousand voluntary exits, while the rest, together with the profits generated over the entire period of the plan, serves to bring CET1 (Common Equity Tier 1, i.e. the primary component of the bank's capital) in 2024 at a stable level above 14%, or 530bps (basis points) above the SREP, and at 15.2% in 2026.

To achieve the goal of having a stable and profitable bank, three directives will be followed:

- simplification of the company structure

- cost rationalization, starting from voluntary exits

- boost of the business mix towards commercial revenues by focusing on Bancassurance (Axa) and Asset Management (Anima).

Thanks to these actions, management expects to reach a ROTE (return on tangible equity) of 8% in 2024 and 8.7% in 2026 (starting from 4.6% in 2021).

Profits are expected to be € 1 billion in 2024 and a return to dividend, with a payout of 30%, in 2025.

Furthermore, the plan is based on a series of fairly conservative assumptions: 3-month Euribor held at 66bps fixed until 2026 compared to estimates that see it above 200bps. Mps will also place a strong focus on Widiba, but all the positive results expected from this division are not in the numbers of the plan.

Legal Risks

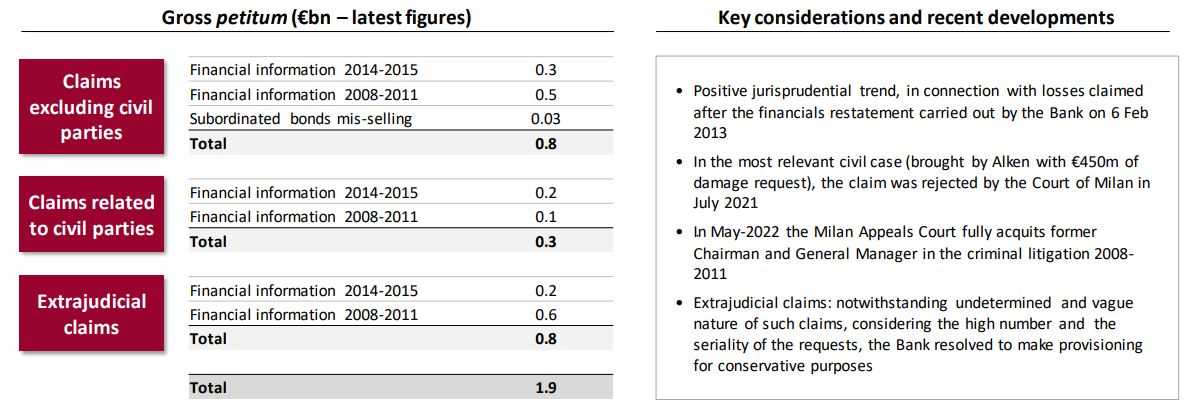

To date, Mps has € 1.9bn of gross legal risks, of which € 0.8bn are linked to the Mussari / Vigni, Viola / Profumo cases, with a good chance of being won.

As regards the hedges, the bank has not provided disclosure but considers itself "abundantly satisfied" with these levels of provisions.

Below is the detail of the slide contained in the business plan:

These legal risks have more than enough coverage. Mps was recently acquitted for Mussari and Vigni and soon there should be the second degree for Viola and Profumo. Considering the first as the most delicate, the chances of confirming the second degree sentence for Profumo are not high.

At the NPE level (the percentage of non-performing loans on the total credit risk) the bank goes from a NET NPE of 2.6% in 2021 to 1.9% in 2024 and 1.4% in 2026.

Pre-Underwriting and MAC clause

Net of an interest already shown by possible relevant investors such as AXA and Anima, the investment banks have signed a Pre-Underwriting agreement on the capital increase, a positive sign as it certifies that the operation is feasible.

Pre-Underwriting, in fact, presupposes that one undertakes to subscribe the unexercised at a price defined at the time the capital increase is launched. All protected by a standard clause called Market Adverse Clause (MAC). This clause is very generic: it provides that it is possible to withdraw from the commitment both for extreme events such as wars or geopolitical upheavals, and in the event that there are no market conditions to proceed with the capital increase.

The latter hypothesis can occur in the event that, between discussions with investors, it is realized that there is no appetite or that in any case it would reach a level of unexercised too high, which the banks would not be willing to bear.

How do you bear the risk of unexercised?

To date, the four Global Coordinators (Mediobanca, Citygroup, Credit Suisse and Bank of America) have been appointed. For the sake of simplicity, suppose that the part to be made on the market / unexercised is € 800m (it is approximately € 900m) and we assume that the remuneration for this operation is 8%. An unexercised amount of 800m means that each bank would have to pay 200mn. At this point, other banks participating in the final consortium come into play: each Global Coordinator can appoint a series of Joint Coordinators and pass the risk onto them (in exchange for a part of the remuneration) and so to cascade down and down.

Let's take one of the four banks: BofA has an unexercised risk of € 200m. At this point, based on how much risk he wants to take, he appoints a series of other banks – let's suppose Santander and Stifel – on which he tip € 50m per risk head. We now have BofA with € 100m of unexercised risk, Santander and Stifel with € 50m each for part of the compensation. At this point, in turn, Stifel and Santander can transfer part of the unexercised risk to other banks in exchange for part of the fees, and so on. Obviously, the more likely it is that the operation will go through, the less the Global Coordinators are willing to divide the risk and the reward.

Catalyst timeline

- The EU Commission must confirm the extension for the stay in the capital at the MEF, which means an exit from the state. At the moment the MEF is negotiating an extension with an exit in the near future, but with undisclosed terms.

- The ECB must approve the business plan within a technical timeframe of 90 days.

Many short investors, who therefore focus on the fall in the stock, argue that the ECB cannot approve this plan as € 2.5bn is not enough to restore and relaunch the bank. At the same time, MPS called the assembly for approval in mid-August and expects a positive response, on the strength of the fact that the plan may reflect what the Authority expected.

- Once the two authorizations have been obtained, the consortium that will lead the operation will be defined.

At this point the crucial issue is the window for the capital increase: it is true that there are banks that guarantee the unexercised, but if there are adverse market conditions, the capital increase could not start and therefore there would be a risk. of having to recapitalize. The capital increase does not start if the placement banks realize that there is no interest, in order not to take on all the risk on the unopted. In this case they would invoke the MAC clause and cancel the operation. In 2016 it happened that for the capital increase of 7 billion entirely, there was no appetite on the market and since the banks did not want to take the total risk, the state entered. Today, however, the situation is quite different: the State is already a shareholder and subscribes to 64% of the increase, therefore, if no one is interested, the banks should share a risk of unexercised € 900m.

The real final stumbling block is therefore the launch of the capital increase, which will be guaranteed by the consortium that signed the underwriting.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/mps-tutte-le-incognite-del-piano-industriale/ on Sun, 03 Jul 2022 15:06:29 +0000.